| __timestamp | Dover Corporation | Ingersoll Rand Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 118411000 | 26000000 |

| Thursday, January 1, 2015 | 115037000 | 26000000 |

| Friday, January 1, 2016 | 104479000 | 22000000 |

| Sunday, January 1, 2017 | 130536000 | 26000000 |

| Monday, January 1, 2018 | 143033000 | 24000000 |

| Tuesday, January 1, 2019 | 140957000 | 25000000 |

| Wednesday, January 1, 2020 | 142101000 | 58000000 |

| Friday, January 1, 2021 | 157826000 | 74000000 |

| Saturday, January 1, 2022 | 163300000 | 91000000 |

| Sunday, January 1, 2023 | 153111000 | 108000000 |

| Monday, January 1, 2024 | 0 | 0 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of industrial innovation, research and development (R&D) spending is a critical indicator of a company's commitment to future growth. Over the past decade, Dover Corporation and Ingersoll Rand Inc. have demonstrated distinct strategies in their R&D allocations.

From 2014 to 2023, Dover Corporation consistently invested in R&D, with a notable increase of approximately 38% over the period. This steady growth underscores Dover's dedication to maintaining its competitive edge. In contrast, Ingersoll Rand Inc. exhibited a more dynamic approach, with R&D expenses surging by over 300% from 2014 to 2023. This dramatic rise highlights Ingersoll Rand's aggressive push towards innovation, particularly in recent years.

These trends reflect broader industry shifts, where companies are increasingly prioritizing R&D to drive technological advancements and secure market leadership. As we look to the future, these investments will likely play a pivotal role in shaping the industrial landscape.

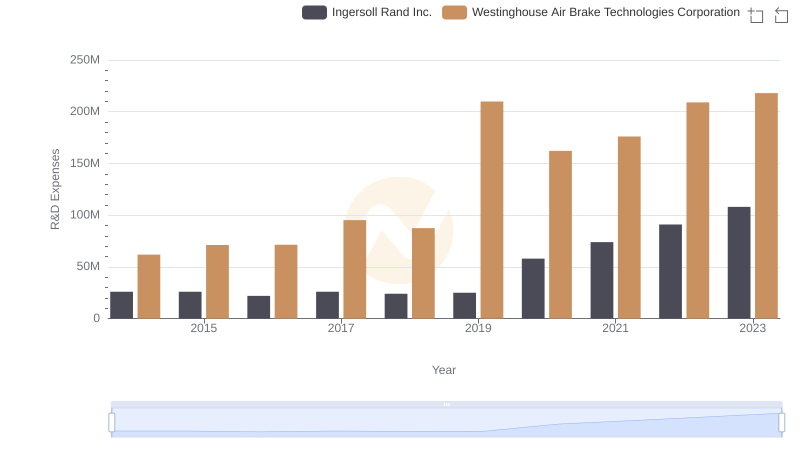

Research and Development Expenses Breakdown: Ingersoll Rand Inc. vs Westinghouse Air Brake Technologies Corporation

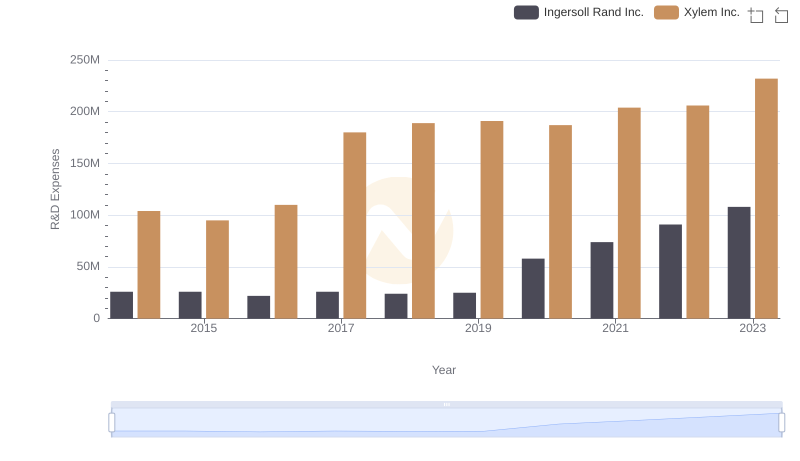

Research and Development Investment: Ingersoll Rand Inc. vs Xylem Inc.

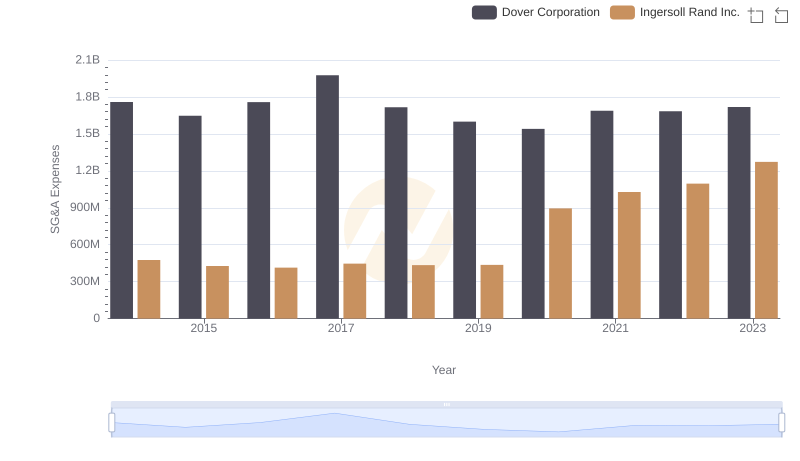

SG&A Efficiency Analysis: Comparing Ingersoll Rand Inc. and Dover Corporation

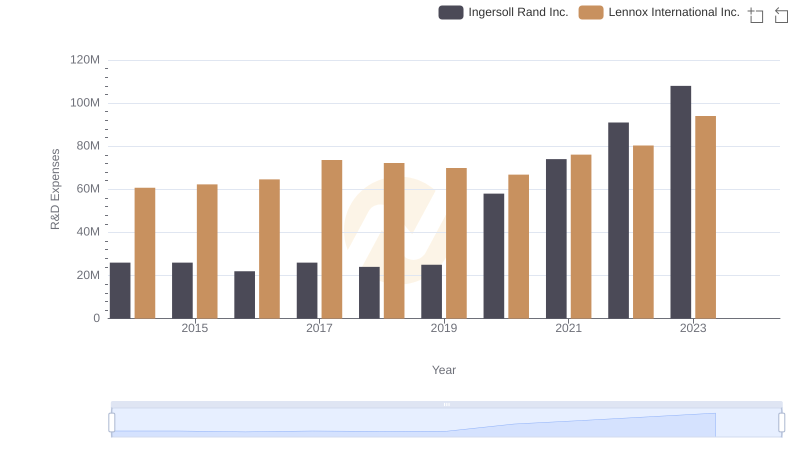

Ingersoll Rand Inc. or Lennox International Inc.: Who Invests More in Innovation?

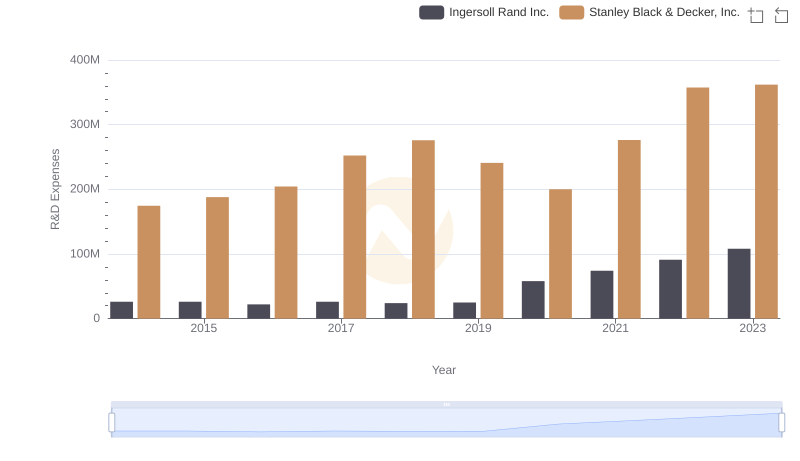

Ingersoll Rand Inc. or Stanley Black & Decker, Inc.: Who Invests More in Innovation?

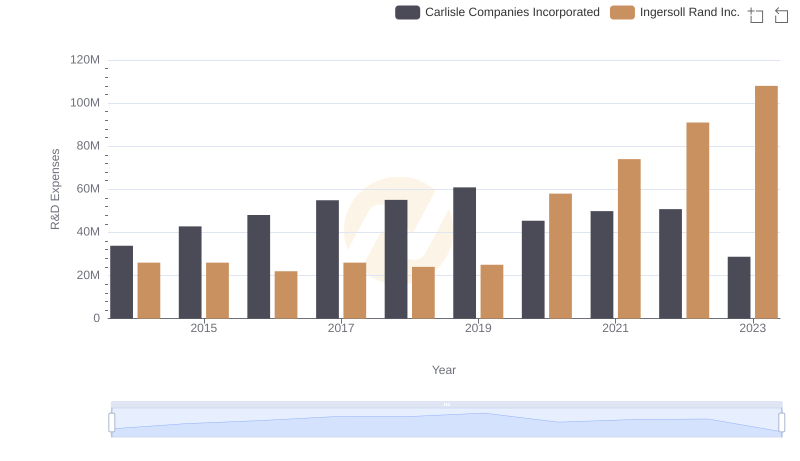

Research and Development: Comparing Key Metrics for Ingersoll Rand Inc. and Carlisle Companies Incorporated

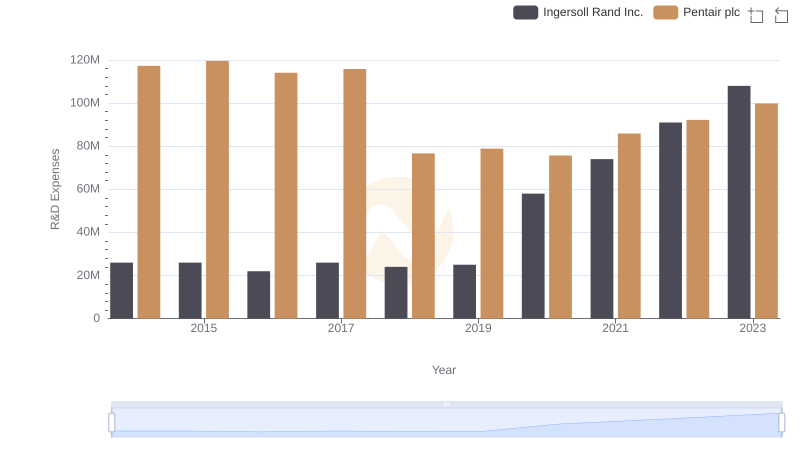

Comparing Innovation Spending: Ingersoll Rand Inc. and Pentair plc