| __timestamp | Eaton Corporation plc | The Boeing Company |

|---|---|---|

| Wednesday, January 1, 2014 | 3810000000 | 3767000000 |

| Thursday, January 1, 2015 | 3596000000 | 3525000000 |

| Friday, January 1, 2016 | 3505000000 | 3616000000 |

| Sunday, January 1, 2017 | 3565000000 | 4094000000 |

| Monday, January 1, 2018 | 3548000000 | 4567000000 |

| Tuesday, January 1, 2019 | 3583000000 | 3909000000 |

| Wednesday, January 1, 2020 | 3075000000 | 4817000000 |

| Friday, January 1, 2021 | 3256000000 | 4157000000 |

| Saturday, January 1, 2022 | 3227000000 | 4187000000 |

| Sunday, January 1, 2023 | 3795000000 | 5168000000 |

| Monday, January 1, 2024 | 4077000000 | 5021000000 |

Cracking the code

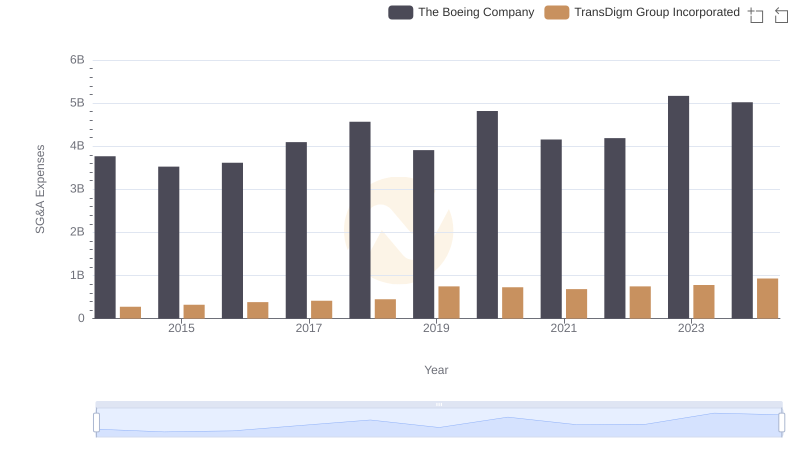

In the competitive landscape of aerospace and industrial manufacturing, understanding the financial dynamics of major players like The Boeing Company and Eaton Corporation plc is crucial. Over the past decade, from 2014 to 2023, these two giants have shown distinct trends in their Selling, General, and Administrative (SG&A) expenses.

Boeing, a leader in aerospace, has seen its SG&A costs rise by approximately 37% from 2014 to 2023, peaking in 2023. This increase reflects Boeing's strategic investments and operational expansions. In contrast, Eaton, a diversified power management company, experienced a more stable SG&A trajectory, with a slight dip in 2020, likely due to global economic challenges, but rebounding by 2023.

Interestingly, while Boeing's SG&A expenses consistently surpassed Eaton's, the gap widened significantly in recent years, highlighting Boeing's aggressive market strategies. However, Eaton's steady approach underscores its resilience and efficiency in managing operational costs.

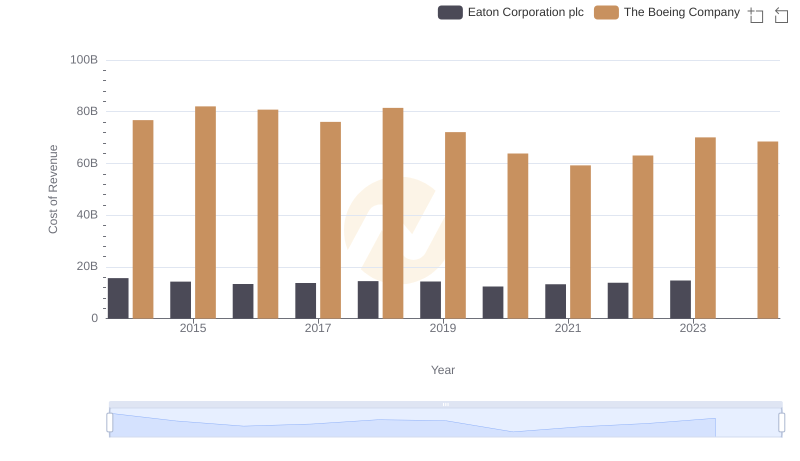

Cost Insights: Breaking Down The Boeing Company and Eaton Corporation plc's Expenses

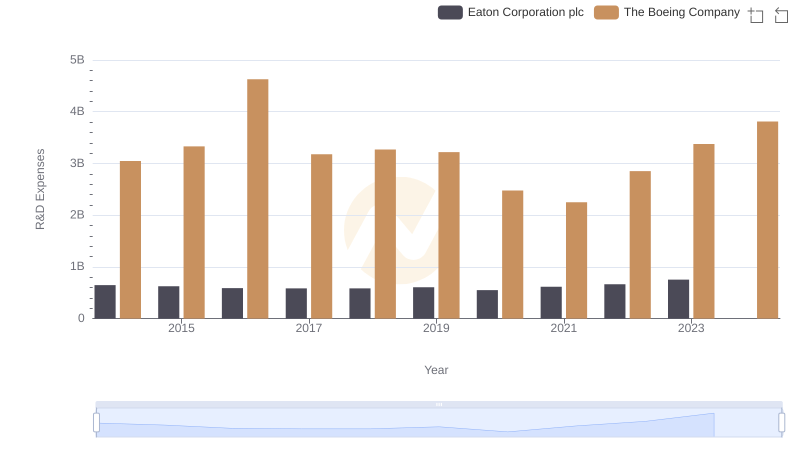

The Boeing Company vs Eaton Corporation plc: Strategic Focus on R&D Spending

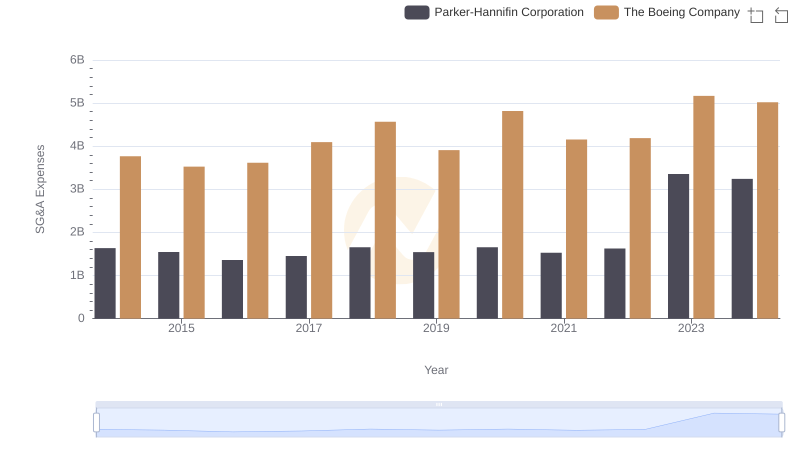

The Boeing Company and Parker-Hannifin Corporation: SG&A Spending Patterns Compared

The Boeing Company and TransDigm Group Incorporated: SG&A Spending Patterns Compared

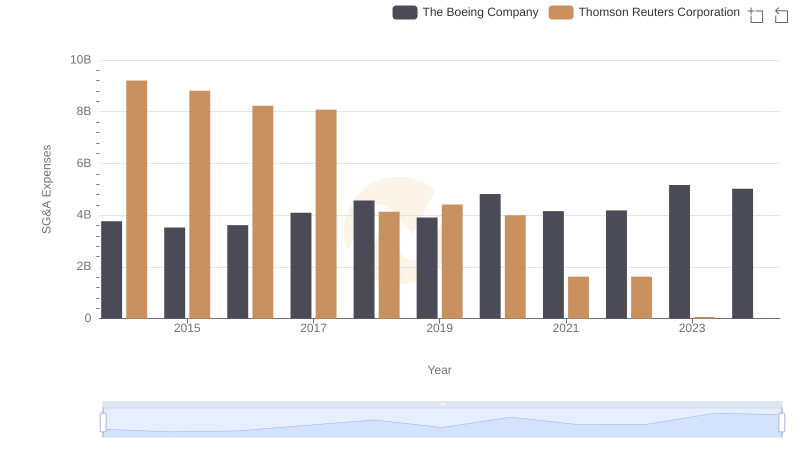

Selling, General, and Administrative Costs: The Boeing Company vs Thomson Reuters Corporation