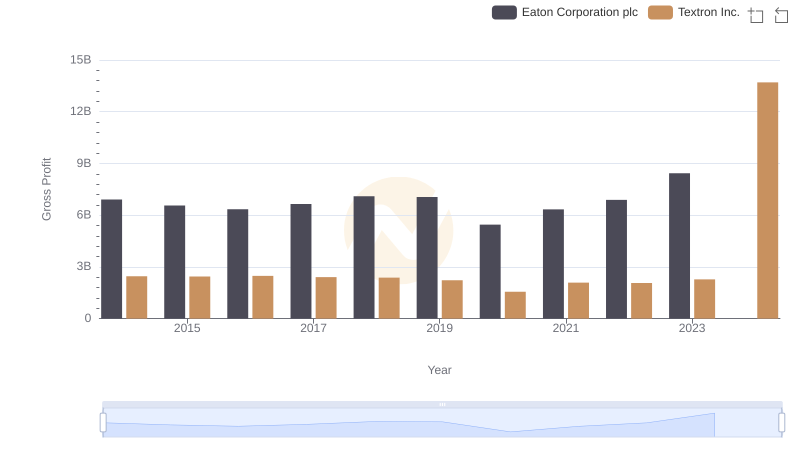

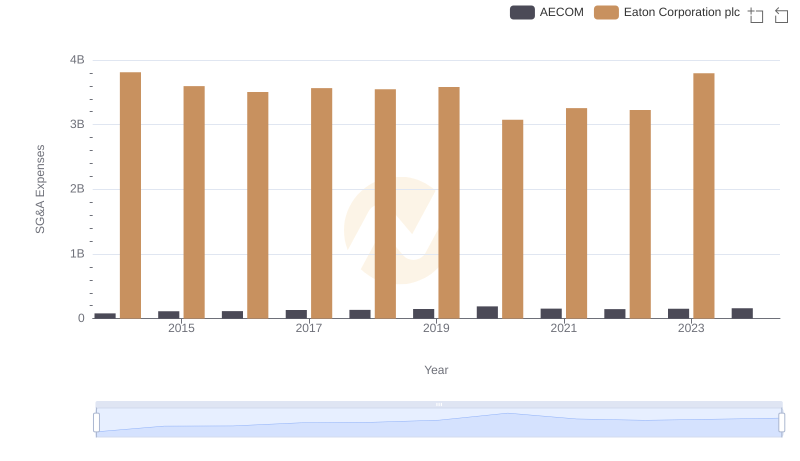

| __timestamp | Eaton Corporation plc | Textron Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3810000000 | 1361000000 |

| Thursday, January 1, 2015 | 3596000000 | 1304000000 |

| Friday, January 1, 2016 | 3505000000 | 1304000000 |

| Sunday, January 1, 2017 | 3565000000 | 1337000000 |

| Monday, January 1, 2018 | 3548000000 | 1275000000 |

| Tuesday, January 1, 2019 | 3583000000 | 1152000000 |

| Wednesday, January 1, 2020 | 3075000000 | 1045000000 |

| Friday, January 1, 2021 | 3256000000 | 1221000000 |

| Saturday, January 1, 2022 | 3227000000 | 1186000000 |

| Sunday, January 1, 2023 | 3795000000 | 1225000000 |

| Monday, January 1, 2024 | 4077000000 | 1156000000 |

In pursuit of knowledge

In the competitive landscape of industrial giants, understanding the financial dynamics of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, Eaton Corporation plc and Textron Inc. have showcased distinct financial strategies. From 2014 to 2023, Eaton's SG&A expenses fluctuated, peaking in 2014 and 2023, with a notable dip in 2020, reflecting a 19% decrease from its 2014 high. Meanwhile, Textron maintained a more stable trajectory, with expenses hovering around 1.3 billion USD annually, except for a significant spike in 2024. This spike, a staggering tenfold increase, suggests a strategic shift or anomaly worth further investigation. The data highlights Eaton's resilience and adaptability in cost management, while Textron's recent surge invites questions about future financial strategies. As we move forward, these insights provide a window into the evolving fiscal strategies of these industrial leaders.

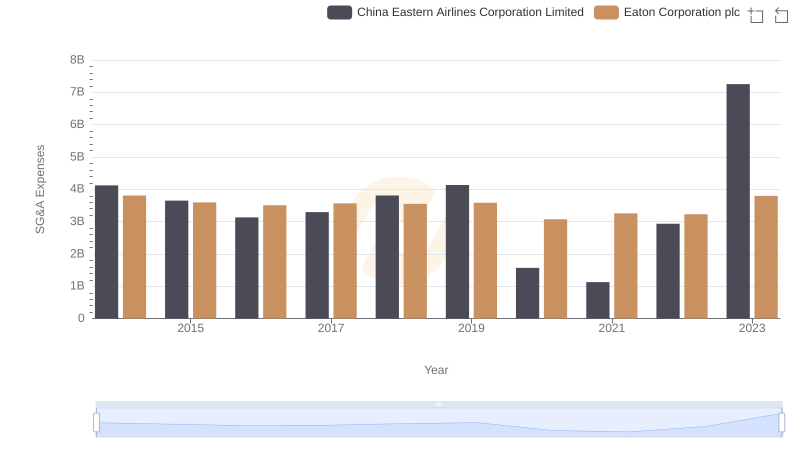

Eaton Corporation plc vs China Eastern Airlines Corporation Limited: SG&A Expense Trends

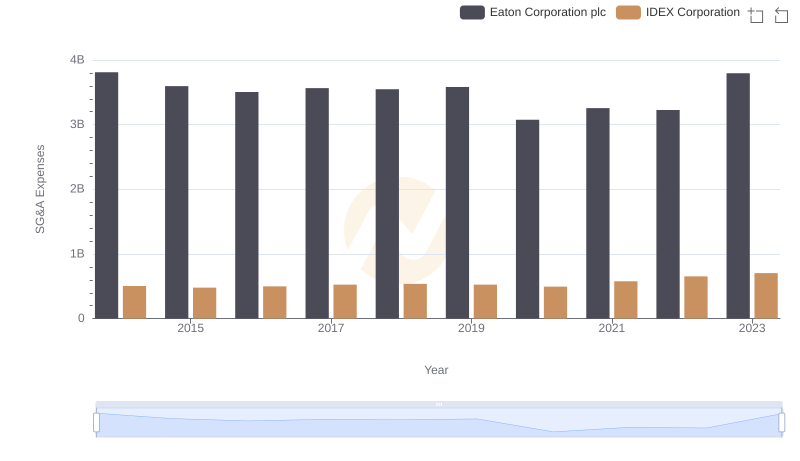

Selling, General, and Administrative Costs: Eaton Corporation plc vs IDEX Corporation

Who Generates Higher Gross Profit? Eaton Corporation plc or Textron Inc.

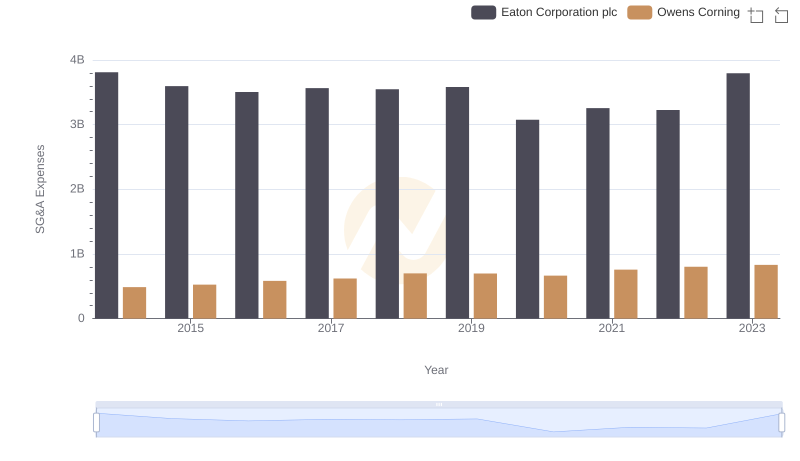

Eaton Corporation plc and Owens Corning: SG&A Spending Patterns Compared

Eaton Corporation plc vs ZTO Express (Cayman) Inc.: SG&A Expense Trends

Eaton Corporation plc vs Textron Inc.: In-Depth EBITDA Performance Comparison

Breaking Down SG&A Expenses: Eaton Corporation plc vs AECOM