| __timestamp | Eaton Corporation plc | ZTO Express (Cayman) Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3810000000 | 534537000 |

| Thursday, January 1, 2015 | 3596000000 | 591738000 |

| Friday, January 1, 2016 | 3505000000 | 705995000 |

| Sunday, January 1, 2017 | 3565000000 | 780517000 |

| Monday, January 1, 2018 | 3548000000 | 1210717000 |

| Tuesday, January 1, 2019 | 3583000000 | 1546227000 |

| Wednesday, January 1, 2020 | 3075000000 | 1663712000 |

| Friday, January 1, 2021 | 3256000000 | 1875869000 |

| Saturday, January 1, 2022 | 3227000000 | 2077372000 |

| Sunday, January 1, 2023 | 3795000000 | 2425253000 |

| Monday, January 1, 2024 | 4077000000 |

Infusing magic into the data realm

In the ever-evolving landscape of global business, understanding the financial health of companies is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of Eaton Corporation plc and ZTO Express (Cayman) Inc. from 2014 to 2023. Eaton, a leader in power management, consistently maintained higher SG&A expenses, peaking in 2014 and 2023. Despite a dip in 2020, Eaton's expenses rebounded by 24% by 2023. Meanwhile, ZTO Express, a major player in logistics, showcased a remarkable upward trend, with SG&A expenses growing by over 350% from 2014 to 2023. This growth reflects ZTO's aggressive expansion strategy in the logistics sector. The contrasting trends highlight Eaton's stable yet fluctuating expenses against ZTO's rapid growth, offering insights into their strategic priorities and market dynamics.

Who Generates More Revenue? Eaton Corporation plc or ZTO Express (Cayman) Inc.

Key Insights on Gross Profit: Eaton Corporation plc vs ZTO Express (Cayman) Inc.

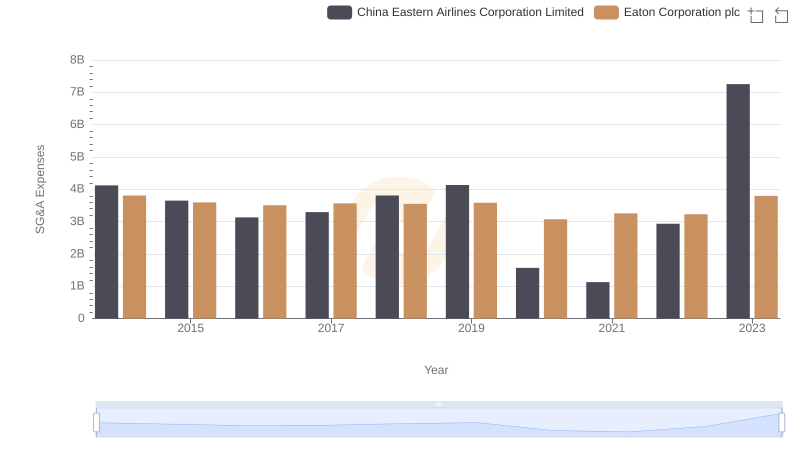

Eaton Corporation plc vs China Eastern Airlines Corporation Limited: SG&A Expense Trends

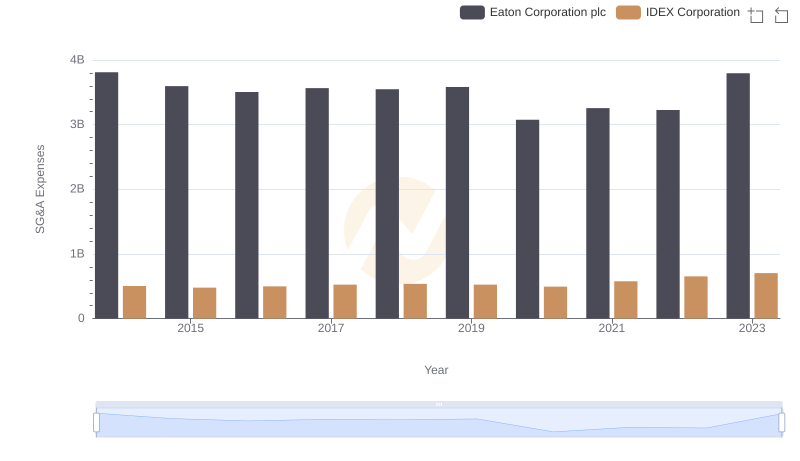

Selling, General, and Administrative Costs: Eaton Corporation plc vs IDEX Corporation

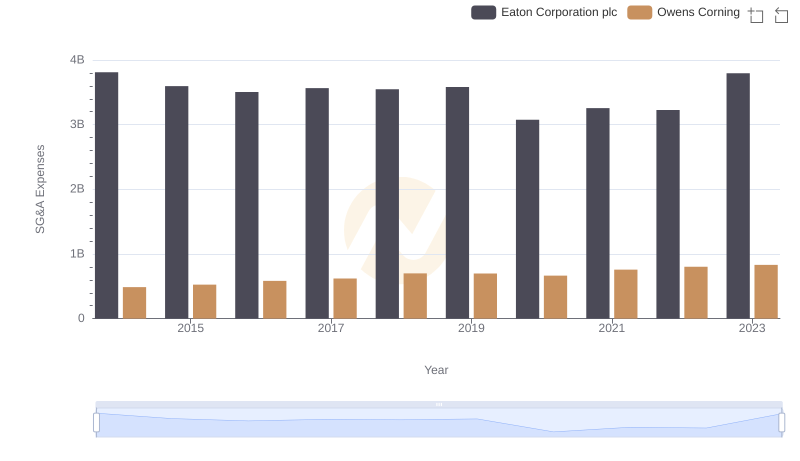

Eaton Corporation plc and Owens Corning: SG&A Spending Patterns Compared

Selling, General, and Administrative Costs: Eaton Corporation plc vs Textron Inc.