| __timestamp | ON Semiconductor Corporation | Super Micro Computer, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 366600000 | 84257000 |

| Thursday, January 1, 2015 | 396700000 | 100257000 |

| Friday, January 1, 2016 | 452300000 | 123994000 |

| Sunday, January 1, 2017 | 594400000 | 141358000 |

| Monday, January 1, 2018 | 650700000 | 165104000 |

| Tuesday, January 1, 2019 | 640900000 | 179907000 |

| Wednesday, January 1, 2020 | 642900000 | 221478000 |

| Friday, January 1, 2021 | 655000000 | 224369000 |

| Saturday, January 1, 2022 | 600200000 | 272273000 |

| Sunday, January 1, 2023 | 577300000 | 307260000 |

| Monday, January 1, 2024 | 612700000 | 462926000 |

Cracking the code

In the ever-evolving landscape of technology, research and development (R&D) investments are pivotal for companies striving to maintain a competitive edge. Over the past decade, ON Semiconductor Corporation and Super Micro Computer, Inc. have demonstrated contrasting strategies in their R&D expenditures.

From 2014 to 2023, ON Semiconductor consistently allocated a significant portion of its resources to R&D, peaking in 2021 with a 79% increase from 2014. However, a slight decline was observed in 2023, indicating potential strategic shifts or market challenges. In contrast, Super Micro Computer, Inc. exhibited a remarkable upward trajectory, with R&D spending surging by over 260% from 2014 to 2023. This growth underscores their commitment to innovation in the competitive computing sector.

As we look to the future, these investments will likely shape the technological advancements and market positions of these industry leaders.

Research and Development Expenses Breakdown: Apple Inc. vs ON Semiconductor Corporation

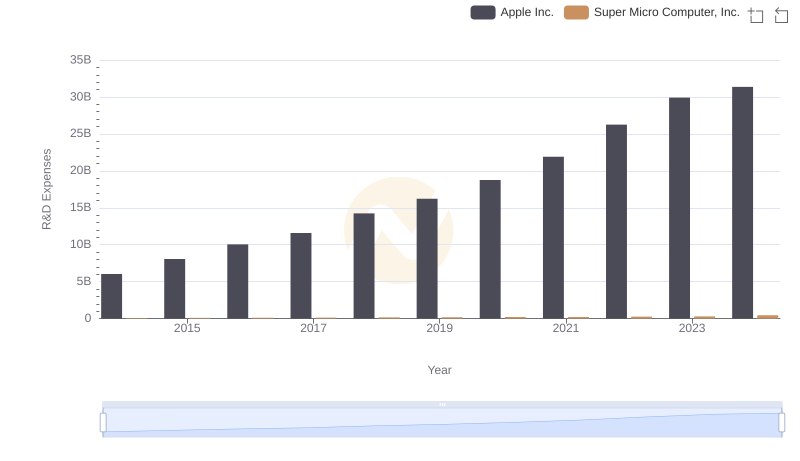

Analyzing R&D Budgets: Apple Inc. vs Super Micro Computer, Inc.

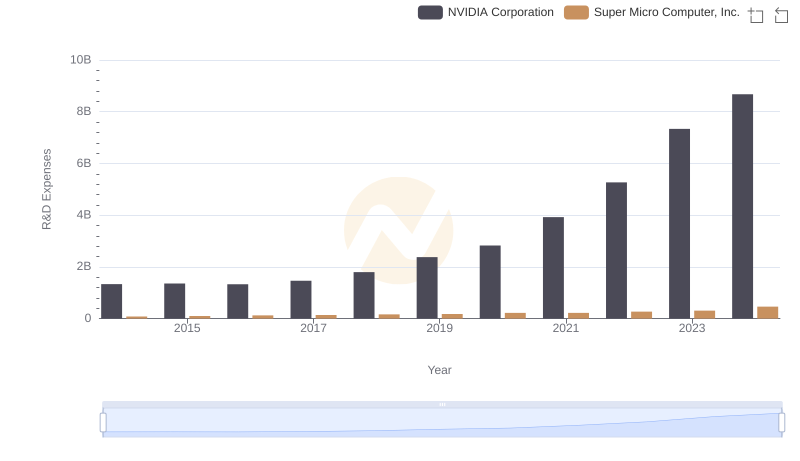

NVIDIA Corporation or Super Micro Computer, Inc.: Who Invests More in Innovation?

Who Prioritizes Innovation? R&D Spending Compared for Taiwan Semiconductor Manufacturing Company Limited and ON Semiconductor Corporation

Research and Development Investment: Taiwan Semiconductor Manufacturing Company Limited vs Super Micro Computer, Inc.

R&D Insights: How Broadcom Inc. and ON Semiconductor Corporation Allocate Funds

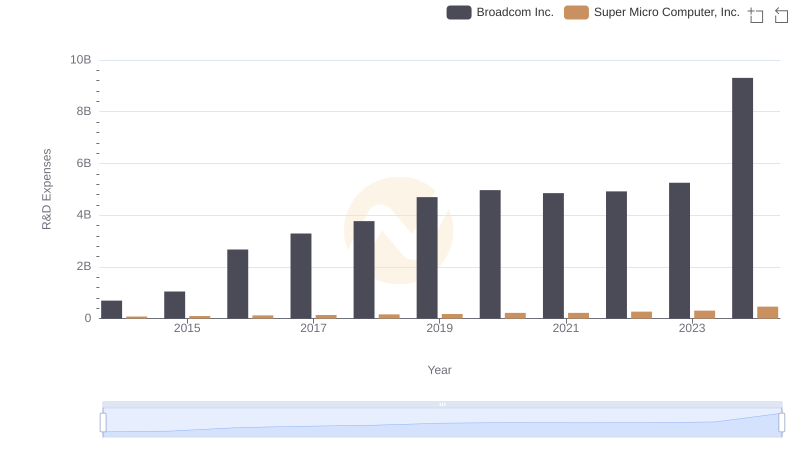

Research and Development Expenses Breakdown: Broadcom Inc. vs Super Micro Computer, Inc.

Revenue Showdown: ON Semiconductor Corporation vs Super Micro Computer, Inc.

ON Semiconductor Corporation vs Super Micro Computer, Inc.: Efficiency in Cost of Revenue Explored

Gross Profit Analysis: Comparing ON Semiconductor Corporation and Super Micro Computer, Inc.

Comparing SG&A Expenses: ON Semiconductor Corporation vs Super Micro Computer, Inc. Trends and Insights

Professional EBITDA Benchmarking: ON Semiconductor Corporation vs Super Micro Computer, Inc.