| __timestamp | ON Semiconductor Corporation | Super Micro Computer, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 564800000 | 86715000 |

| Thursday, January 1, 2015 | 631800000 | 154994000 |

| Friday, January 1, 2016 | 727800000 | 120773000 |

| Sunday, January 1, 2017 | 1196700000 | 111232000 |

| Monday, January 1, 2018 | 1366800000 | 115787000 |

| Tuesday, January 1, 2019 | 1210600000 | 120415000 |

| Wednesday, January 1, 2020 | 1043400000 | 114126000 |

| Friday, January 1, 2021 | 1981800000 | 152132000 |

| Saturday, January 1, 2022 | 3338900000 | 335167000 |

| Sunday, January 1, 2023 | 3220100000 | 796046000 |

| Monday, January 1, 2024 | 1767700000 | 1288409000 |

Infusing magic into the data realm

In the ever-evolving landscape of the semiconductor and computing industries, ON Semiconductor Corporation and Super Micro Computer, Inc. have emerged as key players. Over the past decade, ON Semiconductor has demonstrated a robust growth trajectory, with its EBITDA increasing by nearly 470% from 2014 to 2023. This growth underscores its strategic positioning and operational efficiency in the semiconductor market.

Conversely, Super Micro Computer, Inc. has shown a more modest yet steady growth, with its EBITDA rising by approximately 1,385% over the same period. This remarkable increase highlights its expanding footprint in the computing solutions sector.

While ON Semiconductor's EBITDA peaked in 2022, Super Micro Computer, Inc. reached its highest in 2024, indicating a potential shift in market dynamics. The data reveals a compelling narrative of growth, competition, and market adaptation, offering valuable insights for investors and industry analysts alike.

Apple Inc. and ON Semiconductor Corporation: A Detailed Examination of EBITDA Performance

Professional EBITDA Benchmarking: NVIDIA Corporation vs ON Semiconductor Corporation

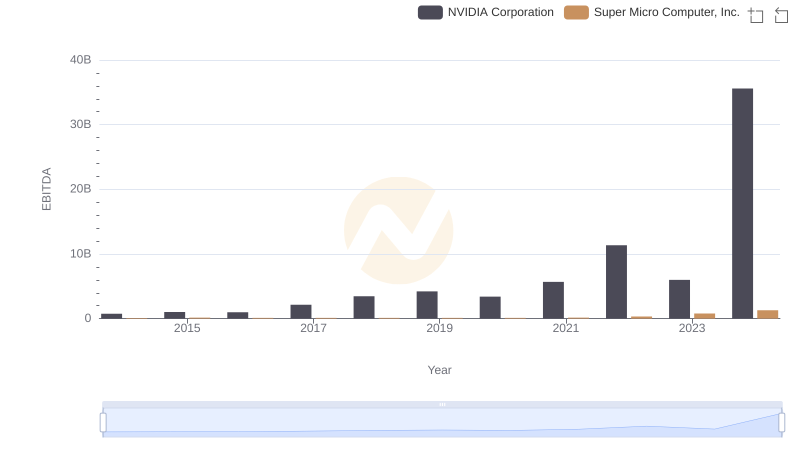

A Professional Review of EBITDA: NVIDIA Corporation Compared to Super Micro Computer, Inc.

Professional EBITDA Benchmarking: Taiwan Semiconductor Manufacturing Company Limited vs ON Semiconductor Corporation

EBITDA Performance Review: Taiwan Semiconductor Manufacturing Company Limited vs Super Micro Computer, Inc.

Professional EBITDA Benchmarking: Broadcom Inc. vs ON Semiconductor Corporation

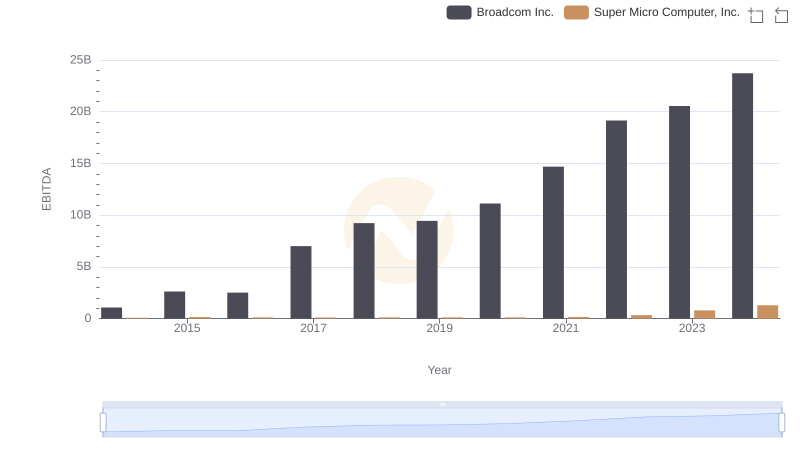

A Side-by-Side Analysis of EBITDA: Broadcom Inc. and Super Micro Computer, Inc.

Revenue Showdown: ON Semiconductor Corporation vs Super Micro Computer, Inc.

ON Semiconductor Corporation vs Super Micro Computer, Inc.: Efficiency in Cost of Revenue Explored

Gross Profit Analysis: Comparing ON Semiconductor Corporation and Super Micro Computer, Inc.

Research and Development Investment: ON Semiconductor Corporation vs Super Micro Computer, Inc.

Comparing SG&A Expenses: ON Semiconductor Corporation vs Super Micro Computer, Inc. Trends and Insights