| __timestamp | ON Semiconductor Corporation | Super Micro Computer, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1084900000 | 225545000 |

| Thursday, January 1, 2015 | 1193200000 | 320231000 |

| Friday, January 1, 2016 | 1296900000 | 331525000 |

| Sunday, January 1, 2017 | 2033800000 | 358566000 |

| Monday, January 1, 2018 | 2238700000 | 429994000 |

| Tuesday, January 1, 2019 | 1973600000 | 495522000 |

| Wednesday, January 1, 2020 | 1715800000 | 526210000 |

| Friday, January 1, 2021 | 2714300000 | 534538000 |

| Saturday, January 1, 2022 | 4077200000 | 800001000 |

| Sunday, January 1, 2023 | 3883500000 | 1283012000 |

| Monday, January 1, 2024 | 3216100000 | 2111729000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of the semiconductor and computer industries, understanding financial performance is crucial. From 2014 to 2023, ON Semiconductor Corporation and Super Micro Computer, Inc. have shown distinct trajectories in their gross profit margins. ON Semiconductor's gross profit surged by approximately 258% from 2014 to 2022, peaking in 2022. However, 2023 saw a slight dip, indicating potential market challenges or strategic shifts. In contrast, Super Micro Computer, Inc. demonstrated a steady growth, with a remarkable 468% increase over the same period, culminating in a record high in 2023. This divergence highlights the dynamic nature of these industries, where strategic decisions and market conditions can significantly impact financial outcomes. Missing data for ON Semiconductor in 2024 suggests a need for further analysis to understand future trends. Stay tuned as we delve deeper into these financial narratives, offering insights into the competitive landscape of tech giants.

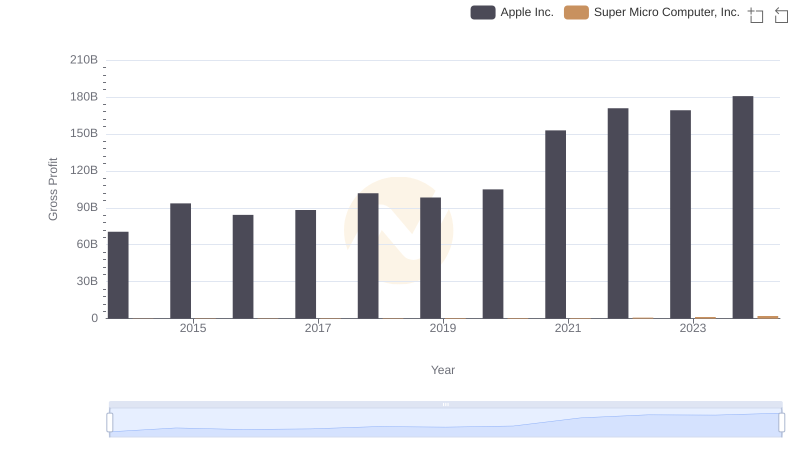

Who Generates Higher Gross Profit? Apple Inc. or Super Micro Computer, Inc.

Key Insights on Gross Profit: NVIDIA Corporation vs ON Semiconductor Corporation

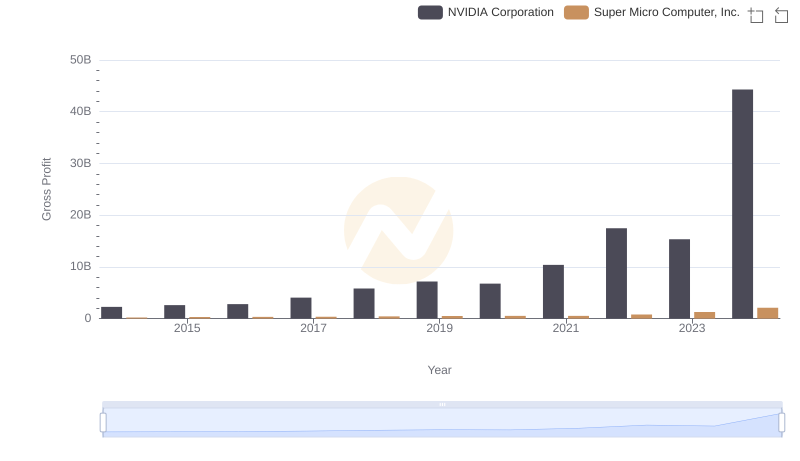

Gross Profit Comparison: NVIDIA Corporation and Super Micro Computer, Inc. Trends

Gross Profit Trends Compared: Taiwan Semiconductor Manufacturing Company Limited vs ON Semiconductor Corporation

Key Insights on Gross Profit: Taiwan Semiconductor Manufacturing Company Limited vs Super Micro Computer, Inc.

Broadcom Inc. vs ON Semiconductor Corporation: A Gross Profit Performance Breakdown

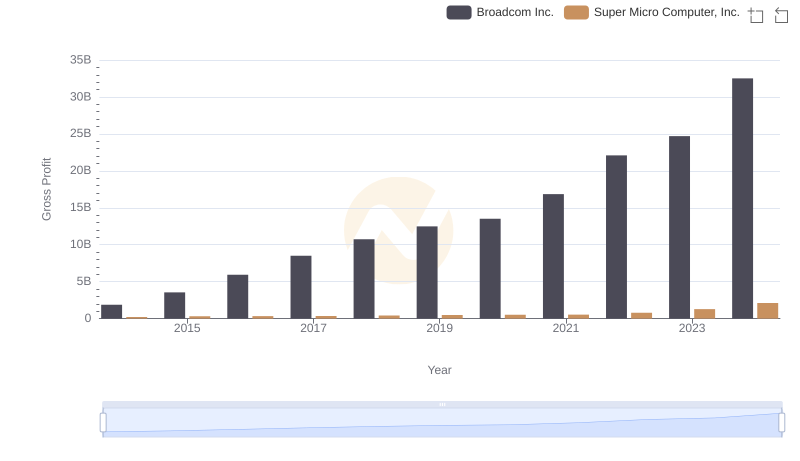

Gross Profit Analysis: Comparing Broadcom Inc. and Super Micro Computer, Inc.

Revenue Showdown: ON Semiconductor Corporation vs Super Micro Computer, Inc.

ON Semiconductor Corporation vs Super Micro Computer, Inc.: Efficiency in Cost of Revenue Explored

Research and Development Investment: ON Semiconductor Corporation vs Super Micro Computer, Inc.

Comparing SG&A Expenses: ON Semiconductor Corporation vs Super Micro Computer, Inc. Trends and Insights

Professional EBITDA Benchmarking: ON Semiconductor Corporation vs Super Micro Computer, Inc.