| __timestamp | ON Semiconductor Corporation | Super Micro Computer, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2076900000 | 1241657000 |

| Thursday, January 1, 2015 | 2302600000 | 1670924000 |

| Friday, January 1, 2016 | 2610000000 | 1884048000 |

| Sunday, January 1, 2017 | 3509300000 | 2171349000 |

| Monday, January 1, 2018 | 3639600000 | 2930498000 |

| Tuesday, January 1, 2019 | 3544300000 | 3004838000 |

| Wednesday, January 1, 2020 | 3539200000 | 2813071000 |

| Friday, January 1, 2021 | 4025500000 | 3022884000 |

| Saturday, January 1, 2022 | 4249000000 | 4396098000 |

| Sunday, January 1, 2023 | 4369500000 | 5840470000 |

| Monday, January 1, 2024 | 3866200000 | 12831125000 |

In pursuit of knowledge

In the ever-evolving landscape of technology, cost efficiency remains a pivotal factor for companies striving for market leadership. This analysis delves into the cost of revenue trends for ON Semiconductor Corporation and Super Micro Computer, Inc. from 2014 to 2023. Over this period, ON Semiconductor's cost of revenue increased by approximately 110%, reflecting a strategic expansion in operations. Meanwhile, Super Micro Computer, Inc. exhibited a staggering 370% rise, indicating aggressive growth and scaling efforts.

By 2023, Super Micro Computer, Inc. surpassed ON Semiconductor in cost of revenue, highlighting its rapid market penetration. However, the data for 2024 is incomplete, suggesting potential shifts in strategy or market conditions. This comparison underscores the dynamic nature of cost management in the tech industry, where companies must balance growth with operational efficiency to maintain competitive advantage.

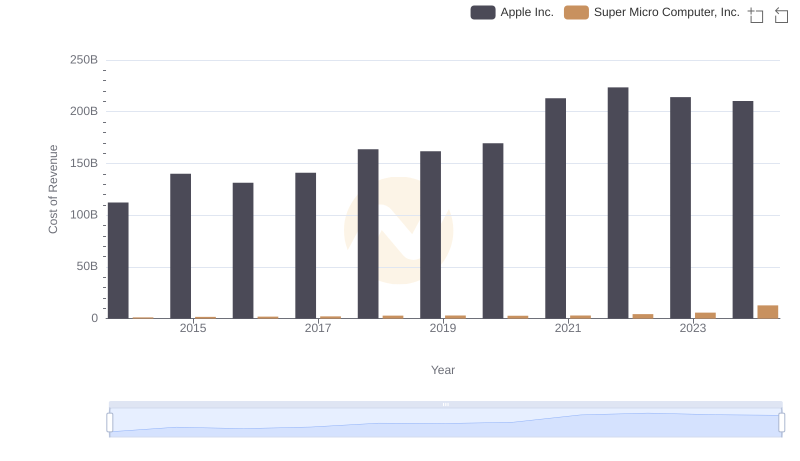

Apple Inc. vs Super Micro Computer, Inc.: Efficiency in Cost of Revenue Explored

NVIDIA Corporation vs ON Semiconductor Corporation: Efficiency in Cost of Revenue Explored

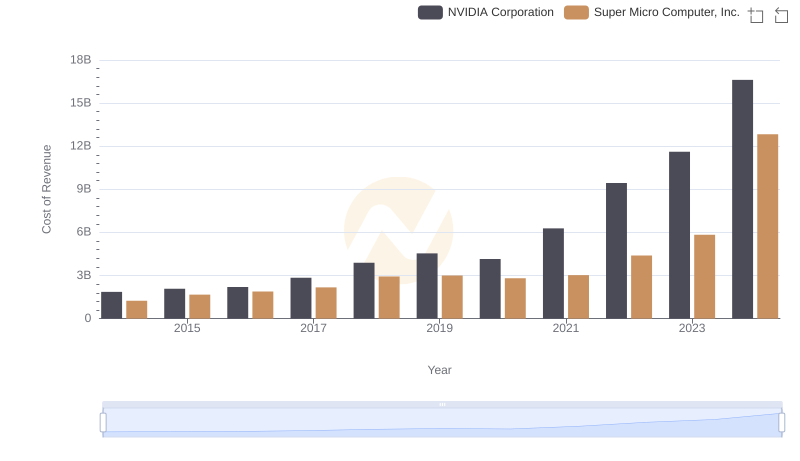

Cost of Revenue: Key Insights for NVIDIA Corporation and Super Micro Computer, Inc.

Cost Insights: Breaking Down Taiwan Semiconductor Manufacturing Company Limited and ON Semiconductor Corporation's Expenses

Cost Insights: Breaking Down Taiwan Semiconductor Manufacturing Company Limited and Super Micro Computer, Inc.'s Expenses

Cost of Revenue Comparison: Broadcom Inc. vs ON Semiconductor Corporation

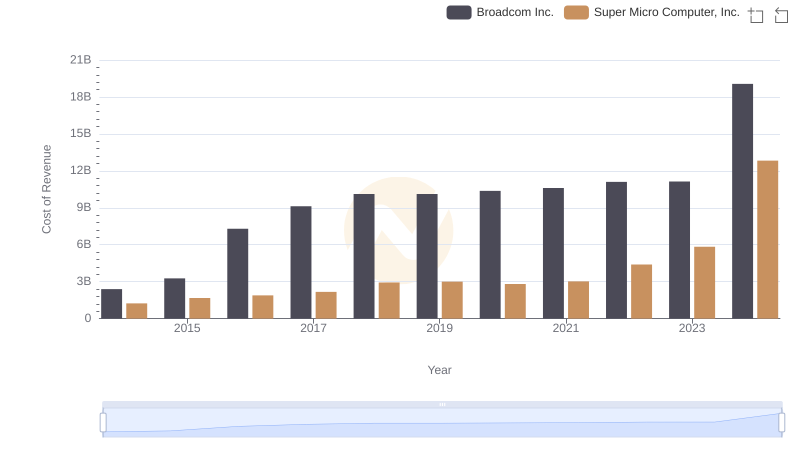

Cost of Revenue Comparison: Broadcom Inc. vs Super Micro Computer, Inc.

Revenue Showdown: ON Semiconductor Corporation vs Super Micro Computer, Inc.

Gross Profit Analysis: Comparing ON Semiconductor Corporation and Super Micro Computer, Inc.

Research and Development Investment: ON Semiconductor Corporation vs Super Micro Computer, Inc.

Comparing SG&A Expenses: ON Semiconductor Corporation vs Super Micro Computer, Inc. Trends and Insights

Professional EBITDA Benchmarking: ON Semiconductor Corporation vs Super Micro Computer, Inc.