| __timestamp | ON Semiconductor Corporation | Super Micro Computer, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 380900000 | 61029000 |

| Thursday, January 1, 2015 | 386600000 | 73228000 |

| Friday, January 1, 2016 | 468300000 | 100681000 |

| Sunday, January 1, 2017 | 600800000 | 115331000 |

| Monday, January 1, 2018 | 618000000 | 170176000 |

| Tuesday, January 1, 2019 | 585000000 | 218382000 |

| Wednesday, January 1, 2020 | 537400000 | 219078000 |

| Friday, January 1, 2021 | 598400000 | 186222000 |

| Saturday, January 1, 2022 | 631100000 | 192561000 |

| Sunday, January 1, 2023 | 641500000 | 214610000 |

| Monday, January 1, 2024 | 649800000 | 383111000 |

Cracking the code

In the ever-evolving landscape of the semiconductor and computer industries, understanding financial trends is crucial. Over the past decade, ON Semiconductor Corporation and Super Micro Computer, Inc. have shown distinct trajectories in their Selling, General, and Administrative (SG&A) expenses. From 2014 to 2023, ON Semiconductor's SG&A expenses grew by approximately 68%, peaking in 2023. In contrast, Super Micro Computer's expenses surged by over 250% during the same period, reflecting its aggressive expansion strategy.

While ON Semiconductor maintained a steady increase, Super Micro Computer's expenses saw a dramatic rise, especially notable in 2024, where data indicates a significant jump. This divergence highlights differing strategic priorities: ON Semiconductor's focus on steady growth versus Super Micro's rapid scaling. These insights provide a window into the financial health and strategic direction of these tech giants, offering valuable lessons for investors and industry analysts alike.

Operational Costs Compared: SG&A Analysis of Apple Inc. and ON Semiconductor Corporation

NVIDIA Corporation vs ON Semiconductor Corporation: SG&A Expense Trends

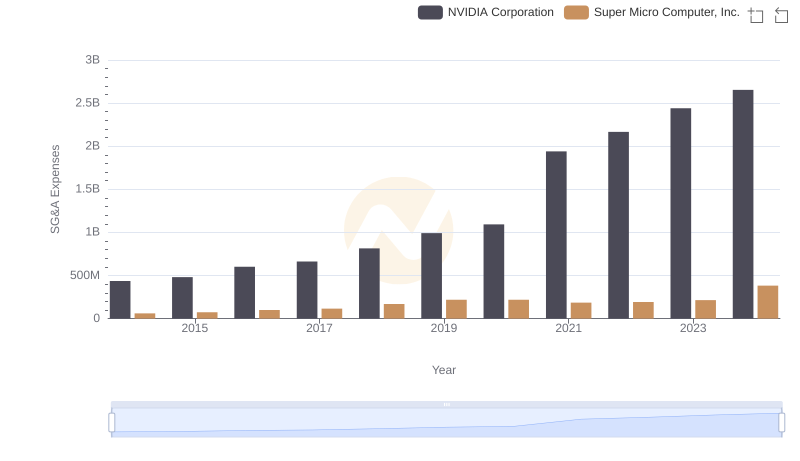

Breaking Down SG&A Expenses: NVIDIA Corporation vs Super Micro Computer, Inc.

Who Optimizes SG&A Costs Better? Taiwan Semiconductor Manufacturing Company Limited or ON Semiconductor Corporation

Selling, General, and Administrative Costs: Taiwan Semiconductor Manufacturing Company Limited vs Super Micro Computer, Inc.

SG&A Efficiency Analysis: Comparing Broadcom Inc. and ON Semiconductor Corporation

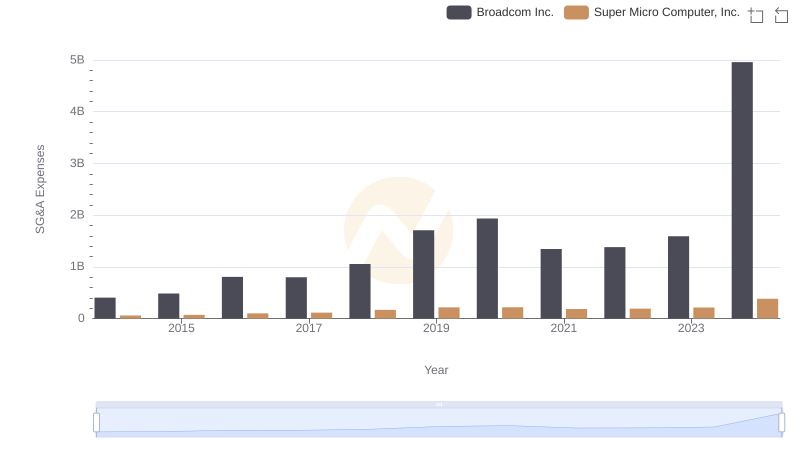

SG&A Efficiency Analysis: Comparing Broadcom Inc. and Super Micro Computer, Inc.

Revenue Showdown: ON Semiconductor Corporation vs Super Micro Computer, Inc.

ON Semiconductor Corporation vs Super Micro Computer, Inc.: Efficiency in Cost of Revenue Explored

Gross Profit Analysis: Comparing ON Semiconductor Corporation and Super Micro Computer, Inc.

Research and Development Investment: ON Semiconductor Corporation vs Super Micro Computer, Inc.

Professional EBITDA Benchmarking: ON Semiconductor Corporation vs Super Micro Computer, Inc.