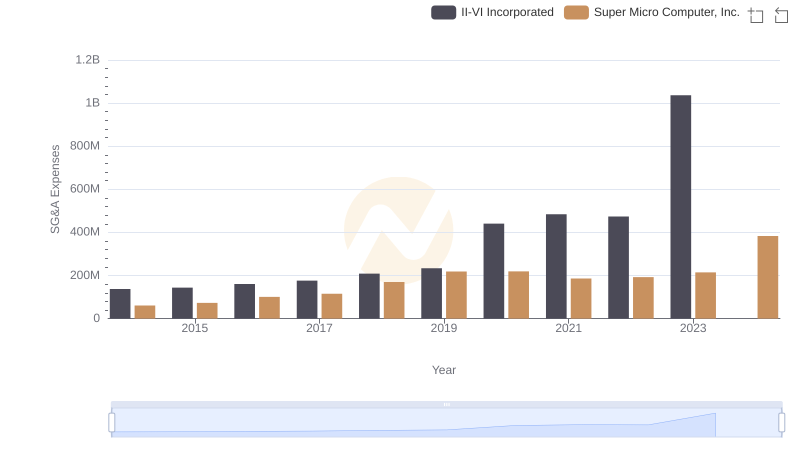

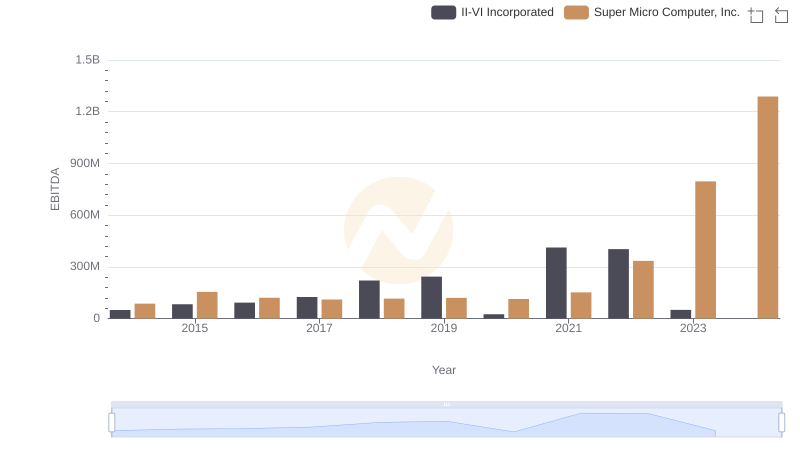

| __timestamp | II-VI Incorporated | Super Micro Computer, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 42523000 | 84257000 |

| Thursday, January 1, 2015 | 51260000 | 100257000 |

| Friday, January 1, 2016 | 60354000 | 123994000 |

| Sunday, January 1, 2017 | 96810000 | 141358000 |

| Monday, January 1, 2018 | 116875000 | 165104000 |

| Tuesday, January 1, 2019 | 139163000 | 179907000 |

| Wednesday, January 1, 2020 | 339073000 | 221478000 |

| Friday, January 1, 2021 | 330105000 | 224369000 |

| Saturday, January 1, 2022 | 377106000 | 272273000 |

| Sunday, January 1, 2023 | 499603000 | 307260000 |

| Monday, January 1, 2024 | 478788000 | 462926000 |

Data in motion

In the ever-evolving landscape of technology, research and development (R&D) investments are pivotal for companies striving to maintain a competitive edge. Over the past decade, II-VI Incorporated and Super Micro Computer, Inc. have demonstrated significant commitment to innovation through their R&D expenditures.

From 2014 to 2023, II-VI Incorporated's R&D spending surged by over 1,000%, reflecting its strategic focus on advancing materials and optoelectronic components. Notably, the company saw a dramatic increase in 2023, with investments peaking at nearly 500 million USD, underscoring its dedication to pioneering new technologies.

Super Micro Computer, Inc. also showcased robust growth, with R&D expenses rising by approximately 265% over the same period. The company's investment trajectory highlights its commitment to enhancing server and storage solutions, with a remarkable spike in 2024, despite some data gaps.

These trends underscore the critical role of R&D in driving technological advancements and maintaining industry leadership.

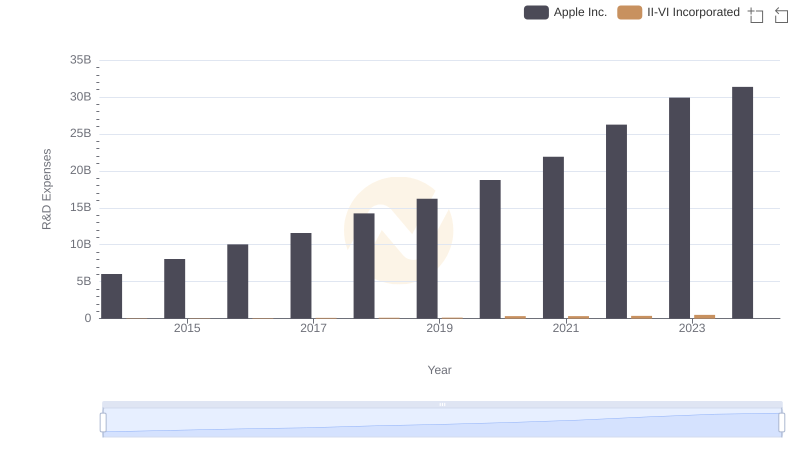

Research and Development Investment: Apple Inc. vs II-VI Incorporated

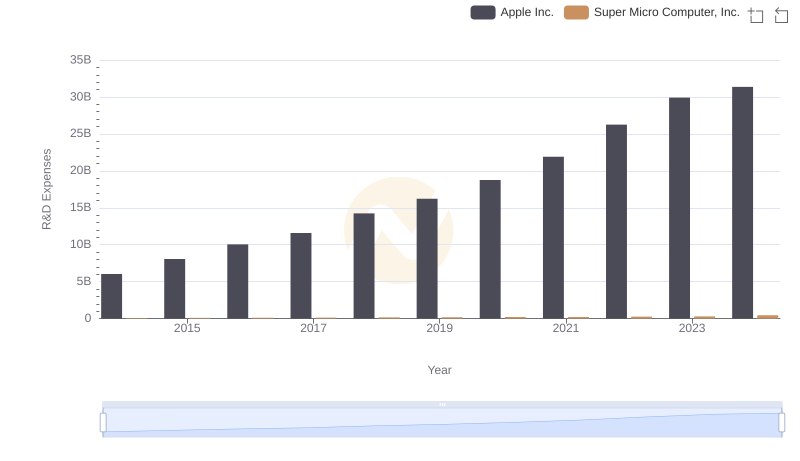

Analyzing R&D Budgets: Apple Inc. vs Super Micro Computer, Inc.

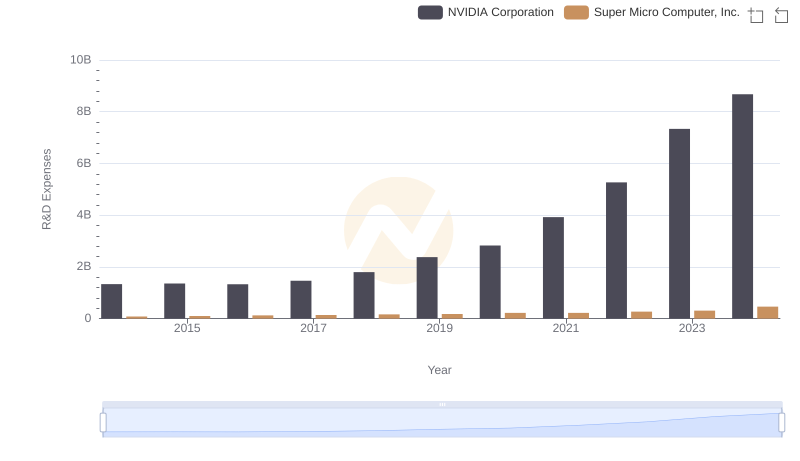

NVIDIA Corporation or Super Micro Computer, Inc.: Who Invests More in Innovation?

Research and Development Expenses Breakdown: Taiwan Semiconductor Manufacturing Company Limited vs II-VI Incorporated

Research and Development Investment: Taiwan Semiconductor Manufacturing Company Limited vs Super Micro Computer, Inc.

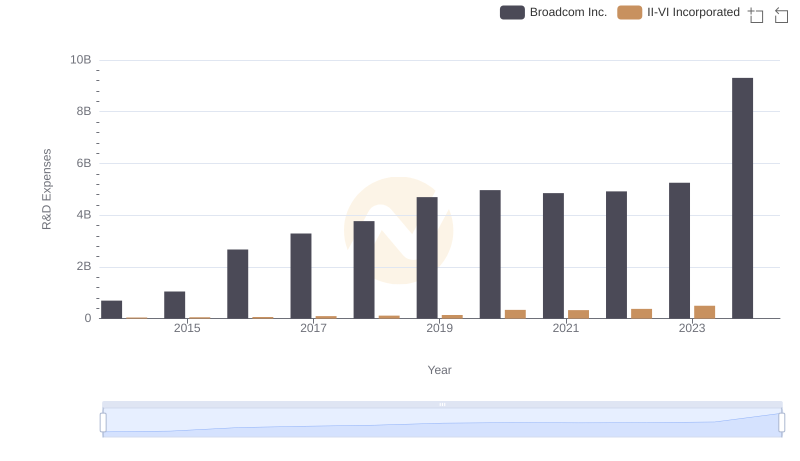

Broadcom Inc. vs II-VI Incorporated: Strategic Focus on R&D Spending

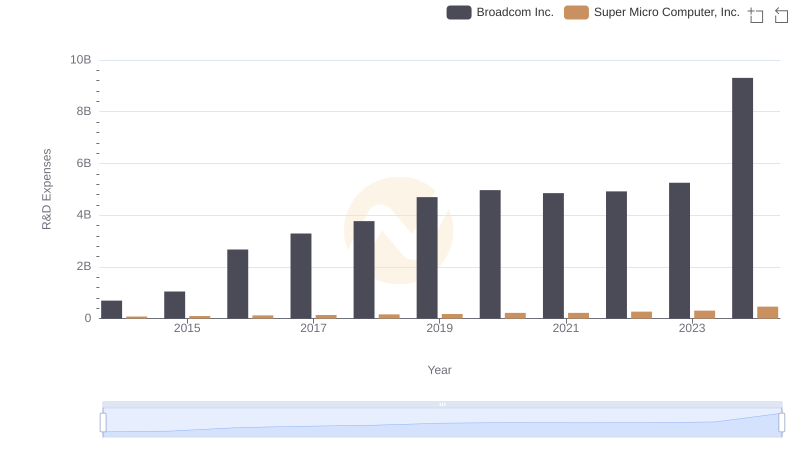

Research and Development Expenses Breakdown: Broadcom Inc. vs Super Micro Computer, Inc.

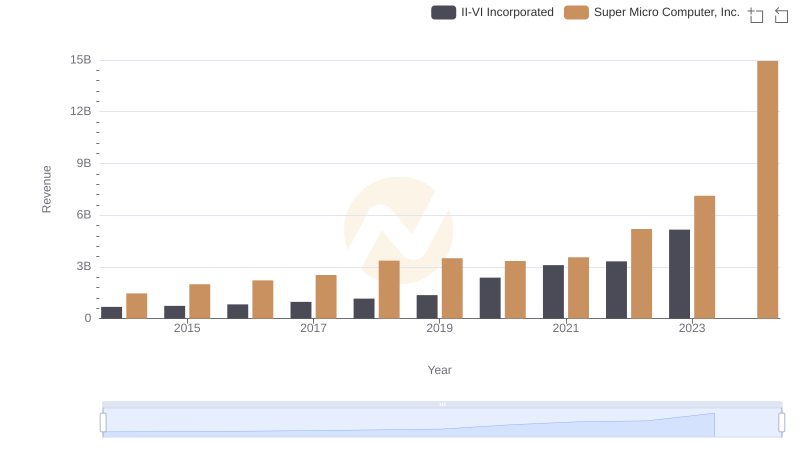

Annual Revenue Comparison: II-VI Incorporated vs Super Micro Computer, Inc.

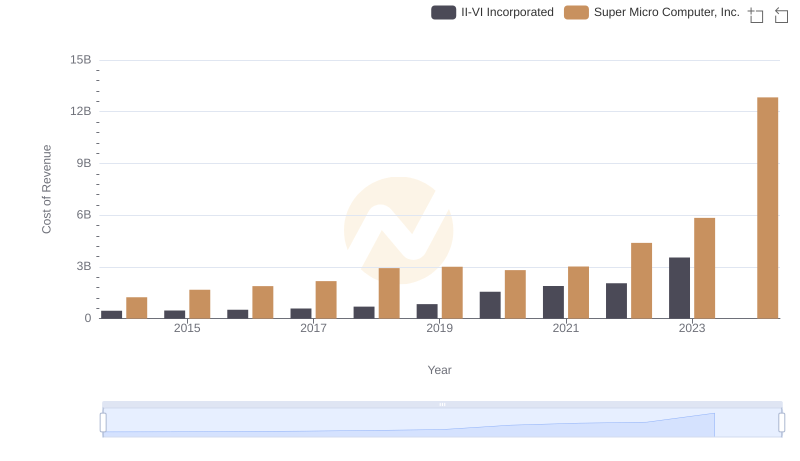

Cost of Revenue Comparison: II-VI Incorporated vs Super Micro Computer, Inc.

Gross Profit Trends Compared: II-VI Incorporated vs Super Micro Computer, Inc.

II-VI Incorporated and Super Micro Computer, Inc.: SG&A Spending Patterns Compared

A Side-by-Side Analysis of EBITDA: II-VI Incorporated and Super Micro Computer, Inc.