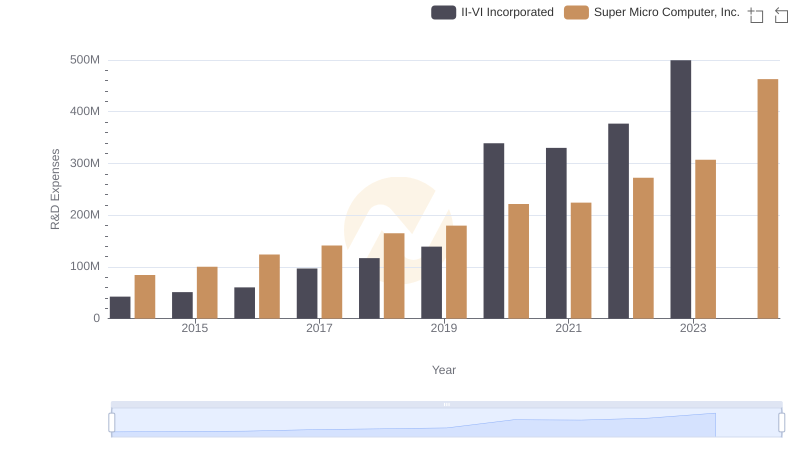

| __timestamp | II-VI Incorporated | Super Micro Computer, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 226716000 | 225545000 |

| Thursday, January 1, 2015 | 271598000 | 320231000 |

| Friday, January 1, 2016 | 312813000 | 331525000 |

| Sunday, January 1, 2017 | 388353000 | 358566000 |

| Monday, January 1, 2018 | 462203000 | 429994000 |

| Tuesday, January 1, 2019 | 521349000 | 495522000 |

| Wednesday, January 1, 2020 | 819550000 | 526210000 |

| Friday, January 1, 2021 | 1216213000 | 534538000 |

| Saturday, January 1, 2022 | 1265496000 | 800001000 |

| Sunday, January 1, 2023 | 1618283000 | 1283012000 |

| Monday, January 1, 2024 | 1455964000 | 2111729000 |

Unleashing the power of data

In the ever-evolving landscape of technology, financial performance is a key indicator of a company's resilience and growth. This analysis compares the gross profit trends of II-VI Incorporated and Super Micro Computer, Inc. over the past decade. From 2014 to 2023, both companies have shown remarkable growth, with II-VI Incorporated's gross profit increasing by over 600% and Super Micro Computer, Inc. by nearly 470%.

II-VI Incorporated has demonstrated a consistent upward trajectory, with a notable surge in 2020, where its gross profit jumped by 57% compared to the previous year. By 2023, the company reached a peak, with profits soaring to 1.6 billion, marking a 28% increase from 2022.

Super Micro Computer, Inc. experienced a steady rise, with a significant leap in 2023, where profits nearly doubled from the previous year. This growth trajectory highlights the company's strategic positioning in the tech industry.

While both companies have shown impressive growth, the data for 2024 is incomplete, leaving room for speculation on future trends. As these tech giants continue to innovate, their financial performance will be a key metric to watch.

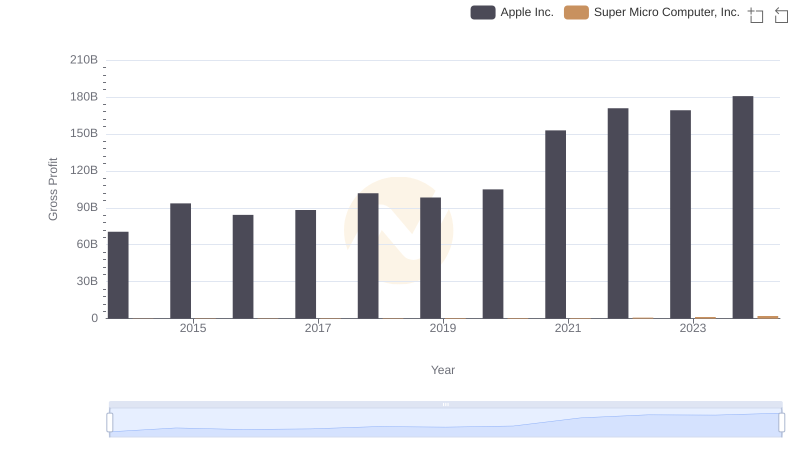

Who Generates Higher Gross Profit? Apple Inc. or Super Micro Computer, Inc.

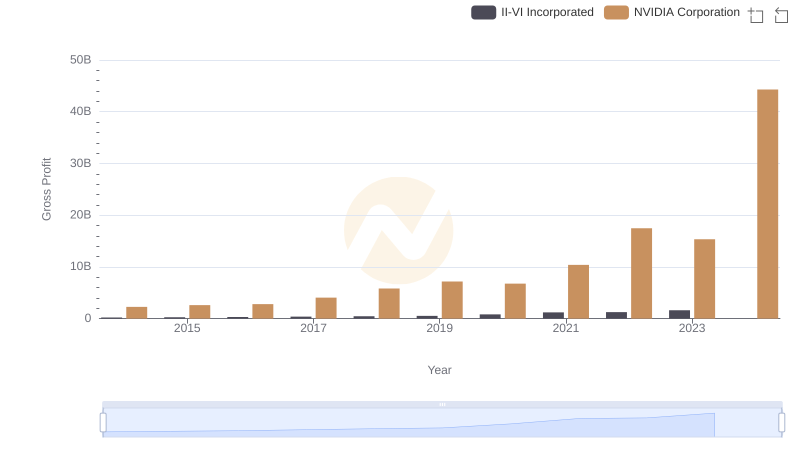

NVIDIA Corporation and II-VI Incorporated: A Detailed Gross Profit Analysis

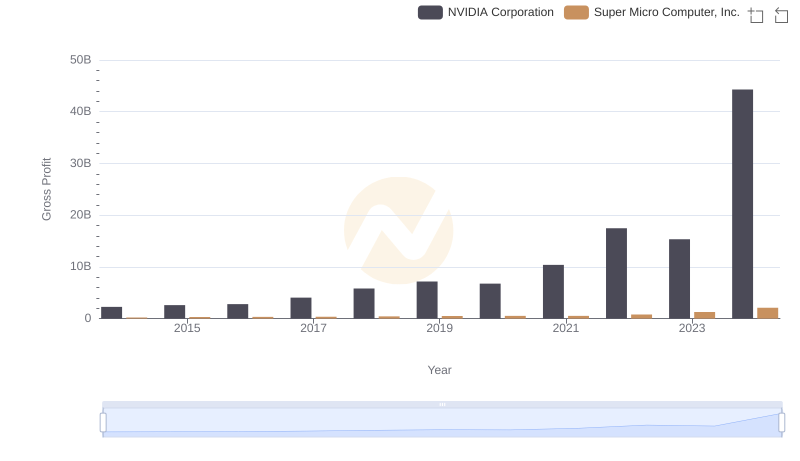

Gross Profit Comparison: NVIDIA Corporation and Super Micro Computer, Inc. Trends

Gross Profit Analysis: Comparing Taiwan Semiconductor Manufacturing Company Limited and II-VI Incorporated

Key Insights on Gross Profit: Taiwan Semiconductor Manufacturing Company Limited vs Super Micro Computer, Inc.

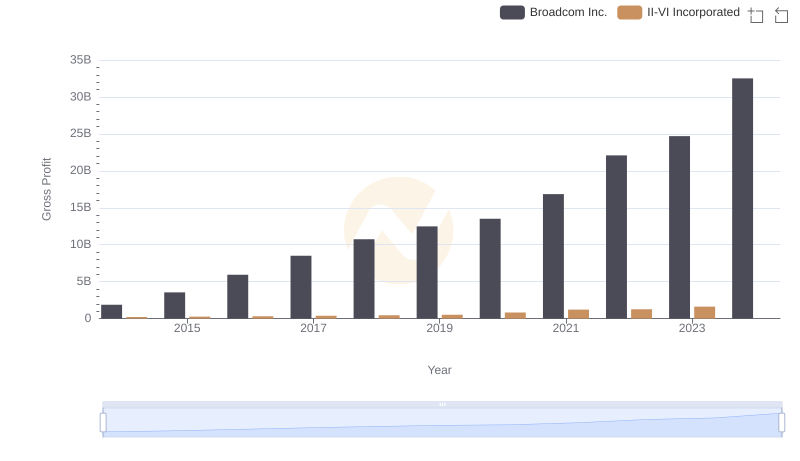

Broadcom Inc. and II-VI Incorporated: A Detailed Gross Profit Analysis

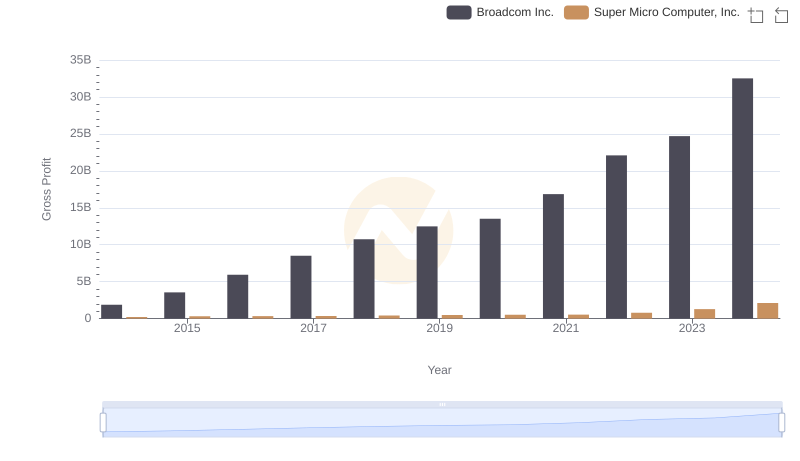

Gross Profit Analysis: Comparing Broadcom Inc. and Super Micro Computer, Inc.

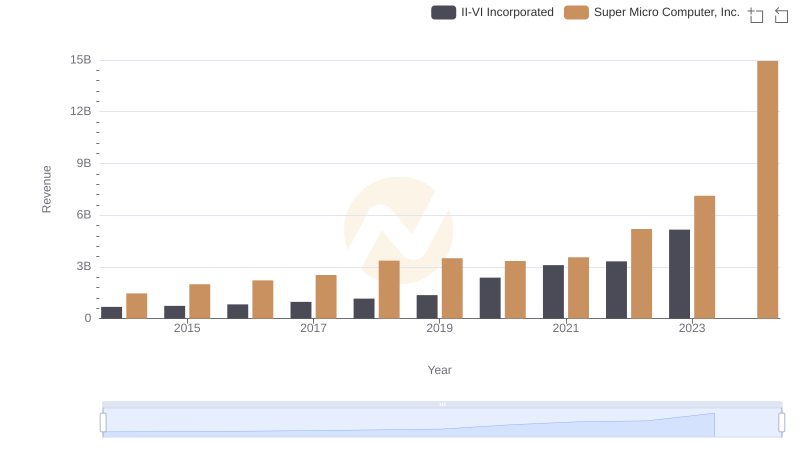

Annual Revenue Comparison: II-VI Incorporated vs Super Micro Computer, Inc.

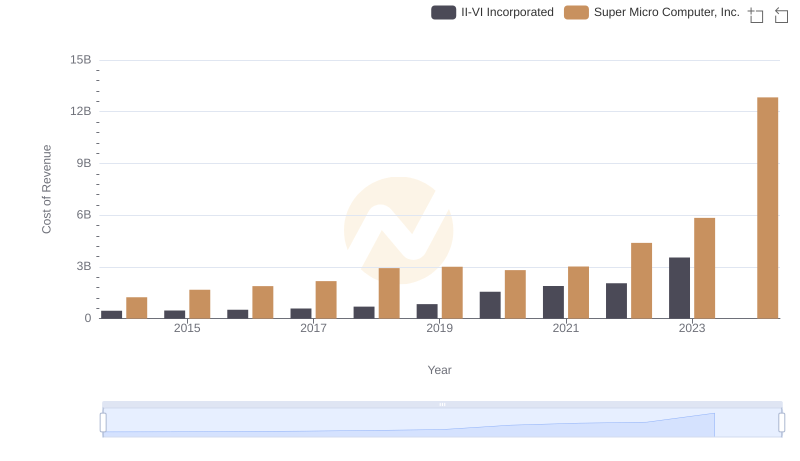

Cost of Revenue Comparison: II-VI Incorporated vs Super Micro Computer, Inc.

Research and Development Investment: II-VI Incorporated vs Super Micro Computer, Inc.

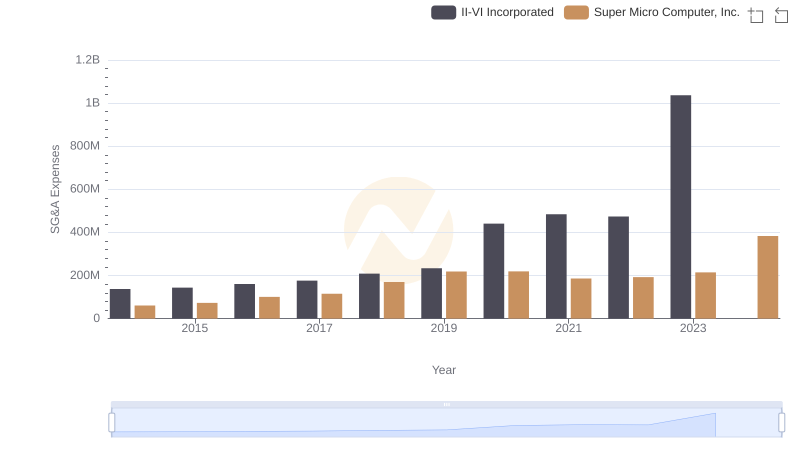

II-VI Incorporated and Super Micro Computer, Inc.: SG&A Spending Patterns Compared

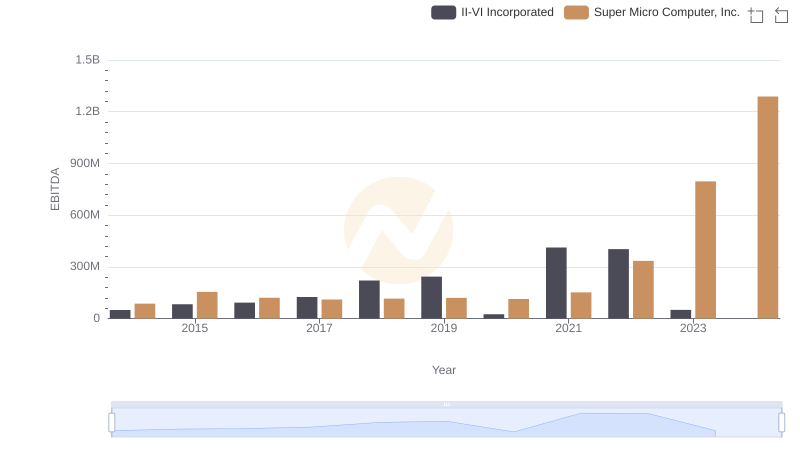

A Side-by-Side Analysis of EBITDA: II-VI Incorporated and Super Micro Computer, Inc.