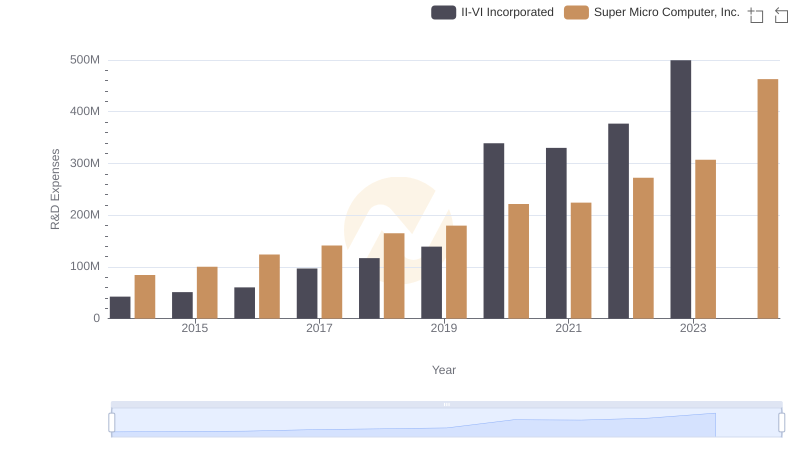

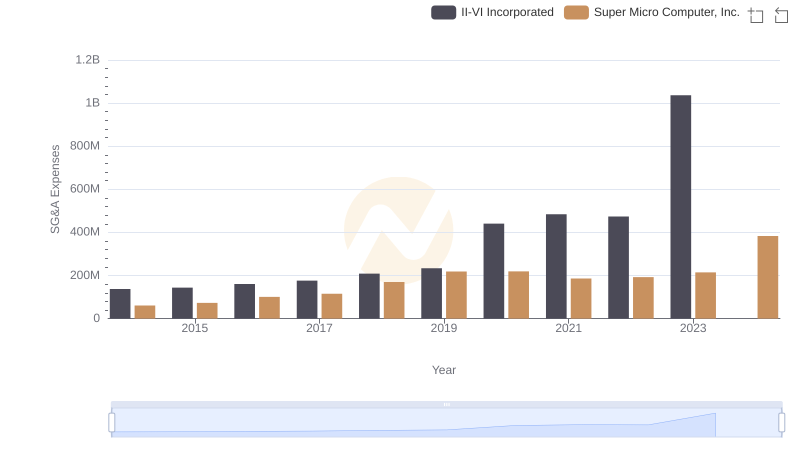

| __timestamp | II-VI Incorporated | Super Micro Computer, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 103218000 | 86715000 |

| Thursday, January 1, 2015 | 136058000 | 154994000 |

| Friday, January 1, 2016 | 149699000 | 120773000 |

| Sunday, January 1, 2017 | 189234000 | 111232000 |

| Monday, January 1, 2018 | 221316000 | 115787000 |

| Tuesday, January 1, 2019 | 243595000 | 120415000 |

| Wednesday, January 1, 2020 | 246363000 | 114126000 |

| Friday, January 1, 2021 | 682558000 | 152132000 |

| Saturday, January 1, 2022 | 689840000 | 335167000 |

| Sunday, January 1, 2023 | 613001000 | 796046000 |

| Monday, January 1, 2024 | 682936000 | 1288409000 |

Cracking the code

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) is a critical financial metric used to evaluate a company's operating performance. It provides a clear view of profitability by stripping away non-operational expenses, allowing investors and analysts to assess the core earnings potential of a business. In today's competitive landscape, understanding EBITDA trends can offer valuable insights into a company's financial health and operational efficiency.

This analysis focuses on the EBITDA performance of two prominent companies in the technology sector: II-VI Incorporated and Super Micro Computer, Inc. Over the past decade, both companies have demonstrated significant growth trajectories, albeit with varying degrees of volatility and consistency.

From 2014 to 2023, II-VI Incorporated's EBITDA has shown a remarkable increase, particularly peaking in 2021 with an impressive EBITDA of approximately $412 million. This represents a staggering growth of over 700% from its 2014 figures, where it recorded about $50 million. This upward trend indicates that II-VI has effectively capitalized on market opportunities, enhancing its operational efficiencies and expanding its product offerings.

Conversely, Super Micro Computer, Inc. has also exhibited robust growth, with its EBITDA soaring to around $796 million by 2023. This growth marks an increase of nearly 800% since 2014, where it started with approximately $87 million. Super Micro's consistent performance, particularly in the last few years, underscores its strategic positioning within the server and storage solutions market, catering to the rising demand for data center infrastructure.

When comparing the two companies, a few key observations emerge:

As we move into 2024, both companies are poised for continued growth, although II-VI’s data for 2024 is currently unavailable. Super Micro's projected EBITDA of approximately $1.29 billion indicates a strong market position and a promising outlook. Investors and stakeholders should keep a close watch on these trends as they reflect not only the companies' operational successes but also broader market dynamics within the technology sector.

In conclusion, the EBITDA performance of II-VI Incorporated and Super Micro Computer, Inc. illustrates the competitive landscape of the technology industry. By analyzing these trends, investors can gain valuable insights into the operational efficiencies and market strategies that drive success in this rapidly evolving sector.

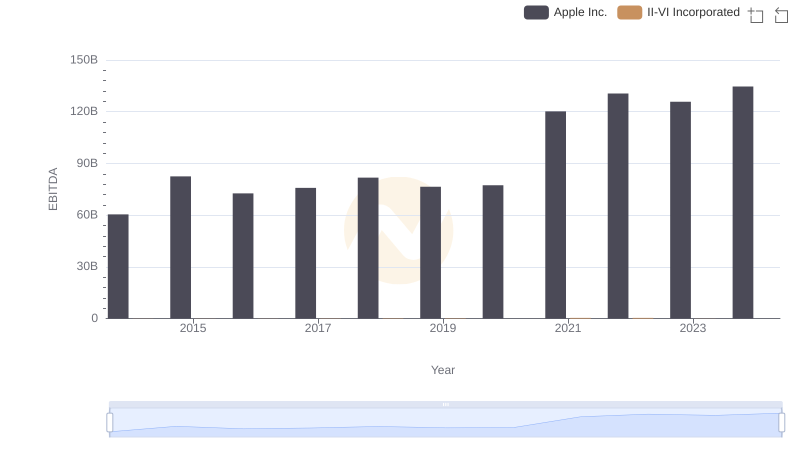

EBITDA Metrics Evaluated: Apple Inc. vs II-VI Incorporated

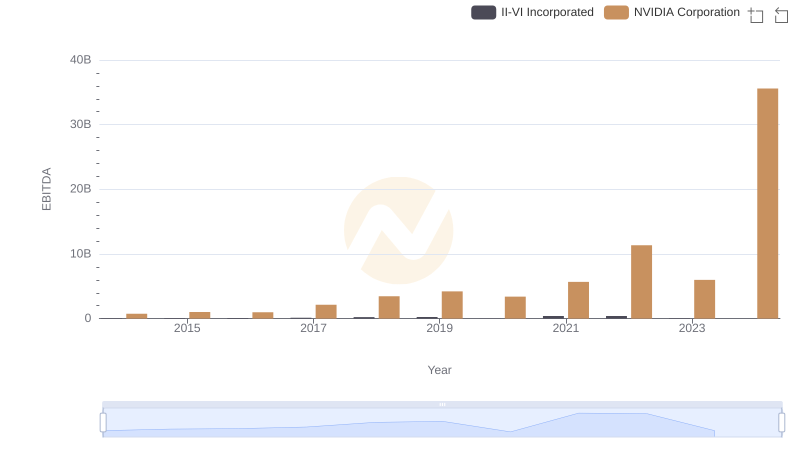

Comparative EBITDA Analysis: NVIDIA Corporation vs II-VI Incorporated

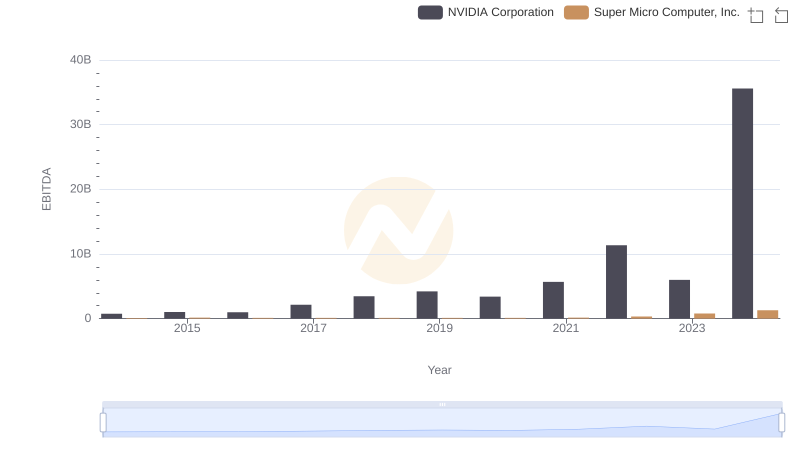

A Professional Review of EBITDA: NVIDIA Corporation Compared to Super Micro Computer, Inc.

Comparative EBITDA Analysis: Taiwan Semiconductor Manufacturing Company Limited vs II-VI Incorporated

EBITDA Performance Review: Taiwan Semiconductor Manufacturing Company Limited vs Super Micro Computer, Inc.

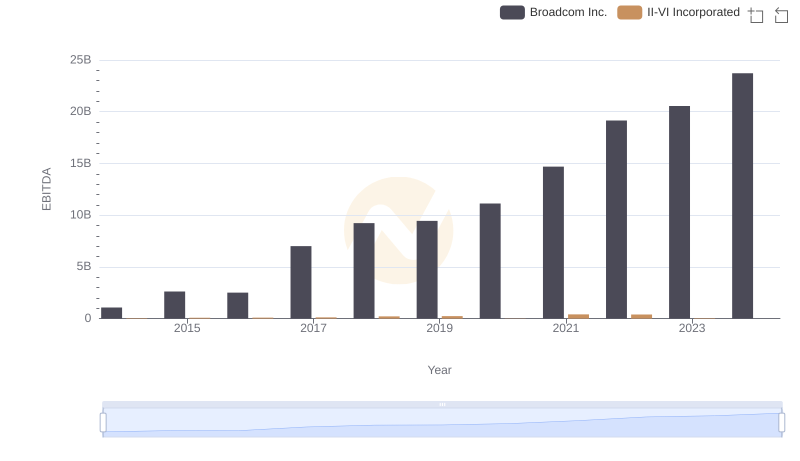

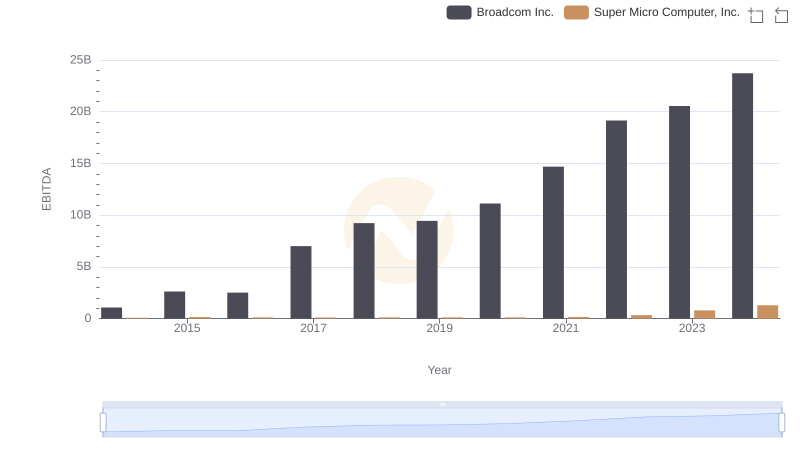

Comprehensive EBITDA Comparison: Broadcom Inc. vs II-VI Incorporated

A Side-by-Side Analysis of EBITDA: Broadcom Inc. and Super Micro Computer, Inc.

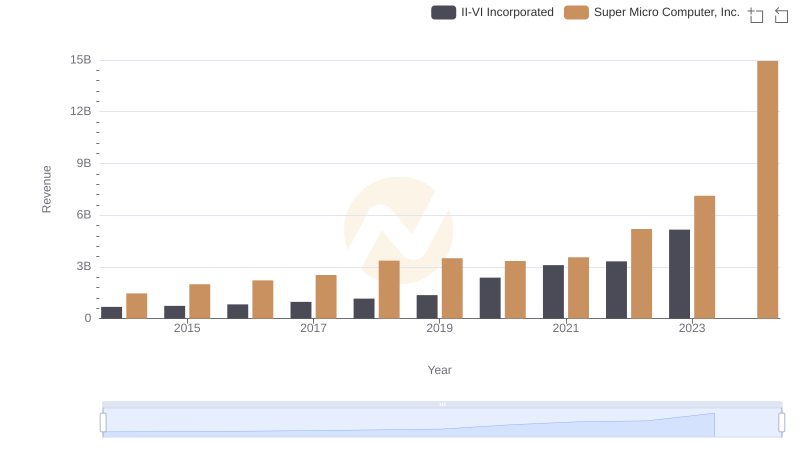

Annual Revenue Comparison: II-VI Incorporated vs Super Micro Computer, Inc.

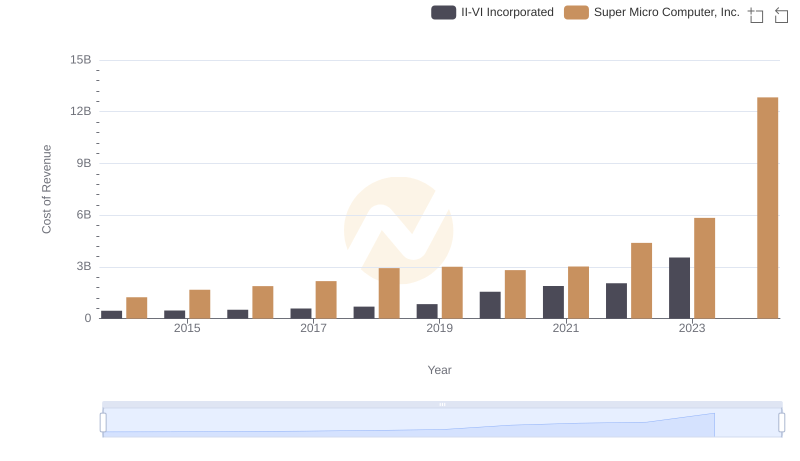

Cost of Revenue Comparison: II-VI Incorporated vs Super Micro Computer, Inc.

Gross Profit Trends Compared: II-VI Incorporated vs Super Micro Computer, Inc.

Research and Development Investment: II-VI Incorporated vs Super Micro Computer, Inc.

II-VI Incorporated and Super Micro Computer, Inc.: SG&A Spending Patterns Compared