| __timestamp | CSX Corporation | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 3613000000 | 3027744000 |

| Thursday, January 1, 2015 | 3584000000 | 3056499000 |

| Friday, January 1, 2016 | 3389000000 | 2537369000 |

| Sunday, January 1, 2017 | 3773000000 | 2840350000 |

| Monday, January 1, 2018 | 4773000000 | 3539551000 |

| Tuesday, January 1, 2019 | 4874000000 | 3616840000 |

| Wednesday, January 1, 2020 | 4362000000 | 3409002000 |

| Friday, January 1, 2021 | 5140000000 | 3897960000 |

| Saturday, January 1, 2022 | 5785000000 | 4474341000 |

| Sunday, January 1, 2023 | 5527000000 | 6429302000 |

| Monday, January 1, 2024 | 7127790000 |

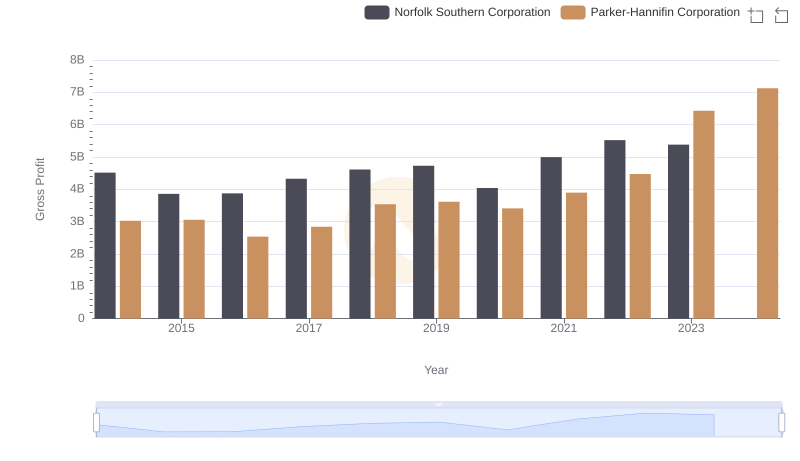

Unlocking the unknown

In the ever-evolving landscape of industrial and transportation sectors, Parker-Hannifin Corporation and CSX Corporation have been pivotal players. Over the past decade, these companies have showcased remarkable growth in their gross profit margins, reflecting their strategic prowess and market adaptability.

From 2014 to 2023, CSX Corporation's gross profit surged by approximately 53%, peaking in 2022. Meanwhile, Parker-Hannifin Corporation demonstrated an impressive 112% increase, culminating in 2023. This growth trajectory highlights Parker-Hannifin's robust expansion strategies and market penetration.

While CSX Corporation maintained a steady growth pattern, Parker-Hannifin's leap in 2023, with a gross profit of over 6.4 billion, underscores its aggressive market strategies. Notably, the data for 2024 is incomplete, leaving room for speculation on future trends.

In conclusion, both corporations have carved significant niches, with Parker-Hannifin currently leading the charge in gross profit performance.

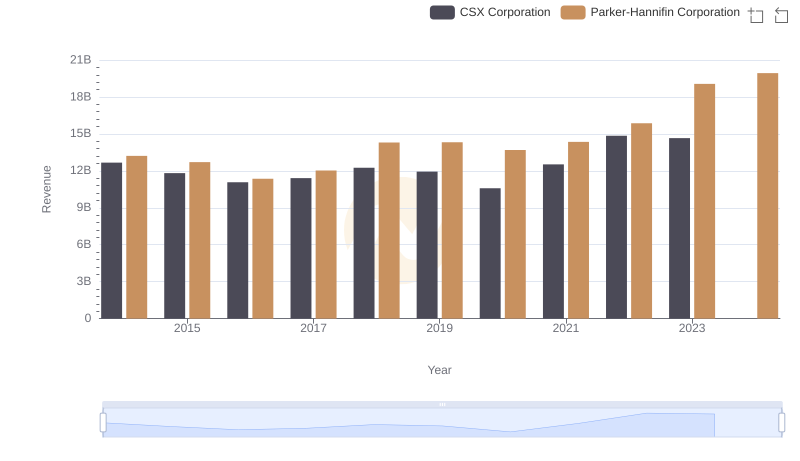

Comparing Revenue Performance: Parker-Hannifin Corporation or CSX Corporation?

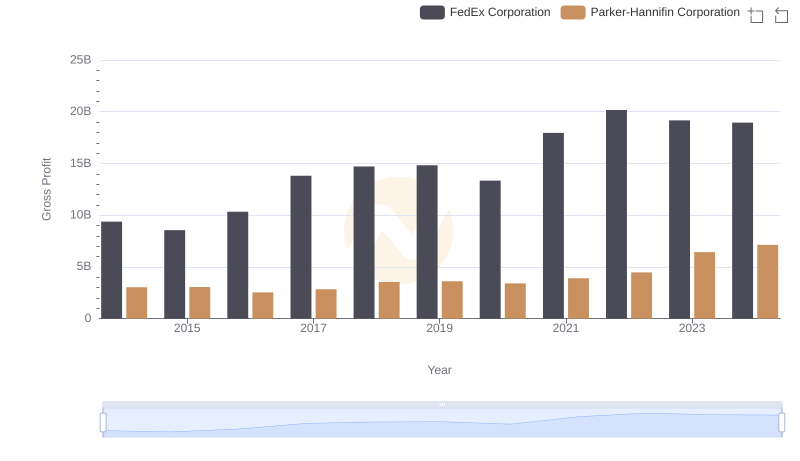

Gross Profit Comparison: Parker-Hannifin Corporation and FedEx Corporation Trends

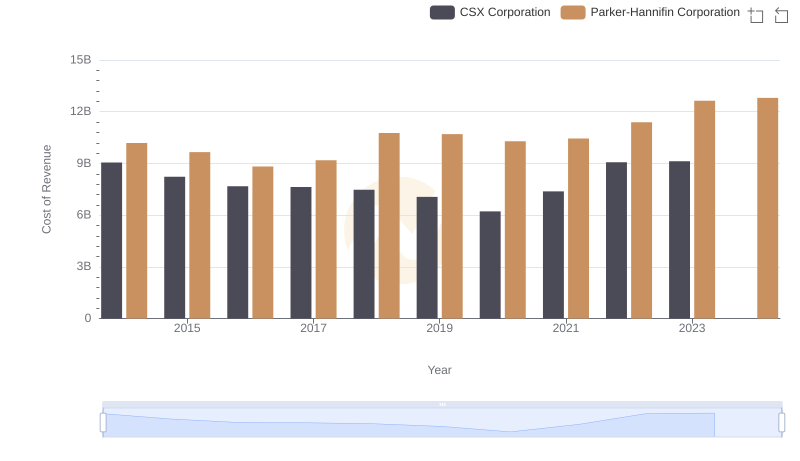

Cost of Revenue Trends: Parker-Hannifin Corporation vs CSX Corporation

Gross Profit Trends Compared: Parker-Hannifin Corporation vs Republic Services, Inc.

Parker-Hannifin Corporation vs Roper Technologies, Inc.: A Gross Profit Performance Breakdown

Who Generates Higher Gross Profit? Parker-Hannifin Corporation or Norfolk Southern Corporation

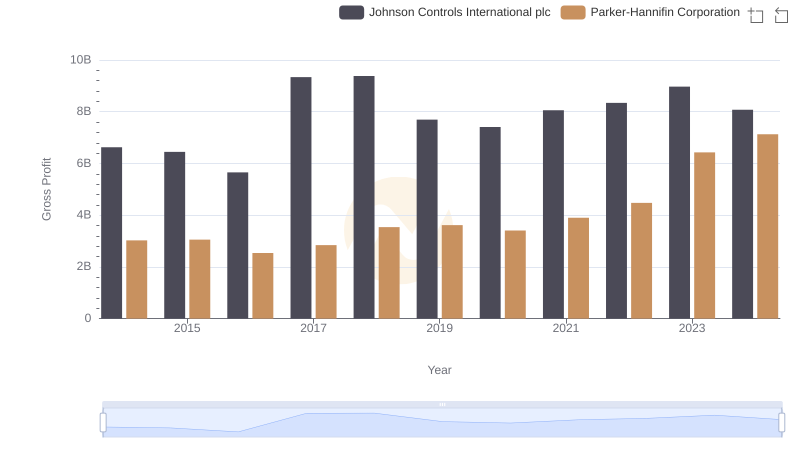

Gross Profit Comparison: Parker-Hannifin Corporation and Johnson Controls International plc Trends

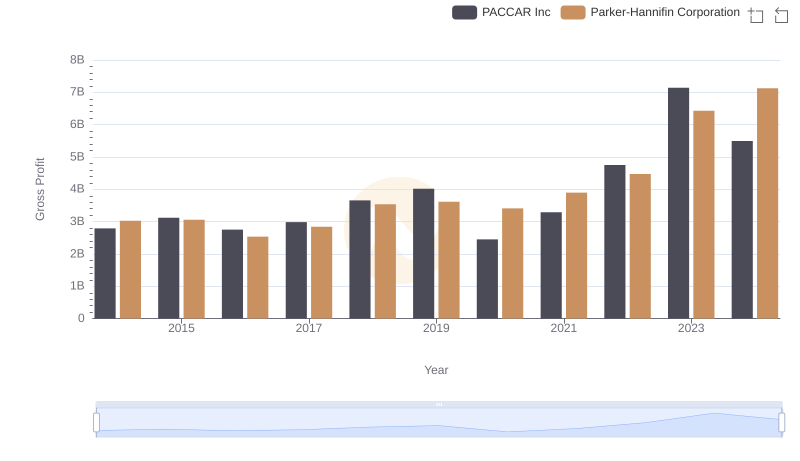

Key Insights on Gross Profit: Parker-Hannifin Corporation vs PACCAR Inc