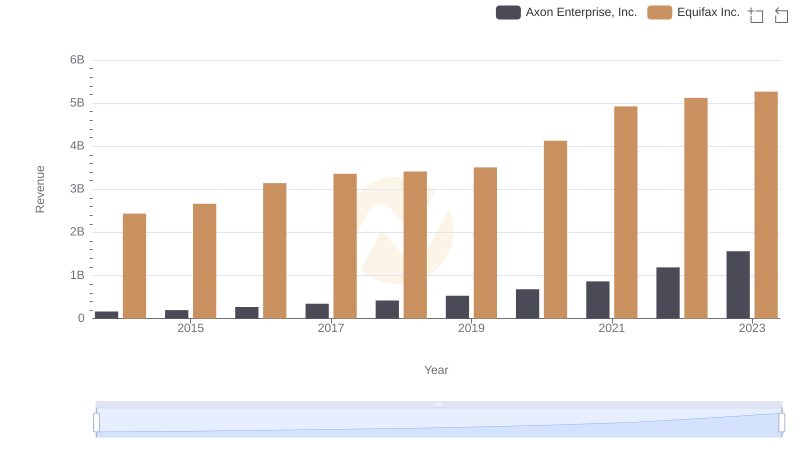

| __timestamp | Axon Enterprise, Inc. | Equifax Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 101548000 | 1591700000 |

| Thursday, January 1, 2015 | 128647000 | 1776200000 |

| Friday, January 1, 2016 | 170536000 | 2031500000 |

| Sunday, January 1, 2017 | 207088000 | 2151500000 |

| Monday, January 1, 2018 | 258583000 | 1971700000 |

| Tuesday, January 1, 2019 | 307286000 | 1985900000 |

| Wednesday, January 1, 2020 | 416331000 | 2390100000 |

| Friday, January 1, 2021 | 540910000 | 2943000000 |

| Saturday, January 1, 2022 | 728638000 | 2945000000 |

| Sunday, January 1, 2023 | 955382000 | 2930100000 |

| Monday, January 1, 2024 | 5681100000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of corporate profitability, understanding which companies lead in generating gross profit is crucial. From 2014 to 2023, Equifax Inc. consistently outperformed Axon Enterprise, Inc. in gross profit generation. Equifax's gross profit peaked in 2022 at approximately $2.95 billion, showcasing a robust growth trajectory. In contrast, Axon Enterprise, Inc. demonstrated impressive growth, with its gross profit increasing nearly tenfold from 2014 to 2023, reaching around $955 million.

This analysis highlights the dynamic nature of the market and the potential for growth even among smaller players like Axon Enterprise, Inc.

Annual Revenue Comparison: Axon Enterprise, Inc. vs Equifax Inc.

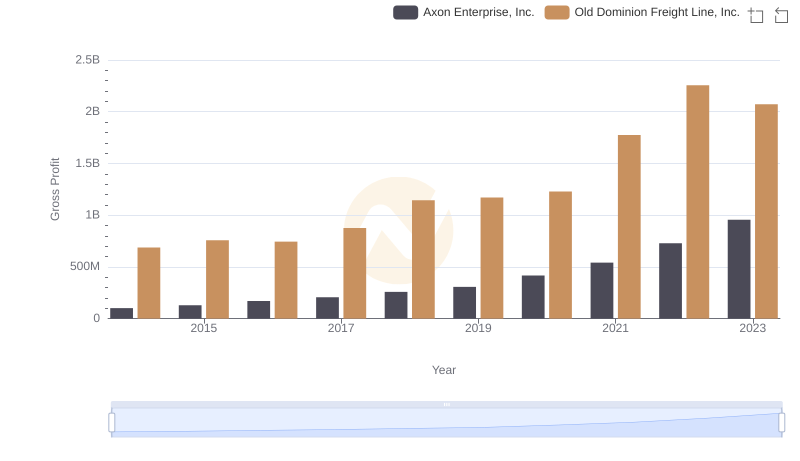

Axon Enterprise, Inc. vs Old Dominion Freight Line, Inc.: A Gross Profit Performance Breakdown

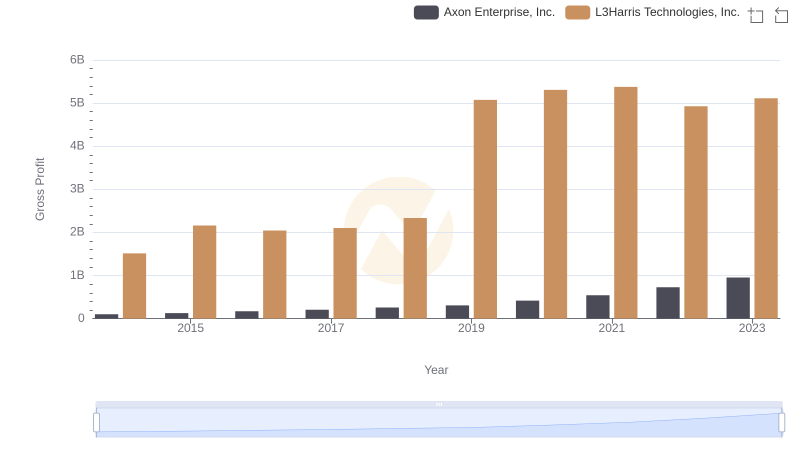

Axon Enterprise, Inc. vs L3Harris Technologies, Inc.: A Gross Profit Performance Breakdown

Gross Profit Trends Compared: Axon Enterprise, Inc. vs AMETEK, Inc.

Key Insights on Gross Profit: Axon Enterprise, Inc. vs Ferguson plc

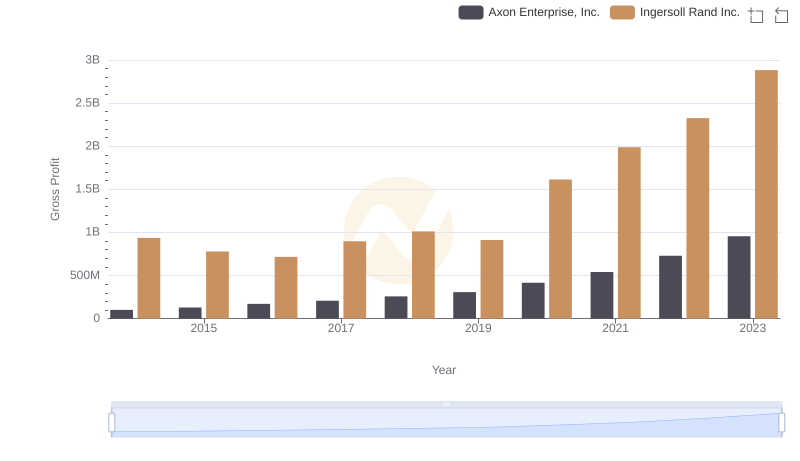

Axon Enterprise, Inc. and Ingersoll Rand Inc.: A Detailed Gross Profit Analysis

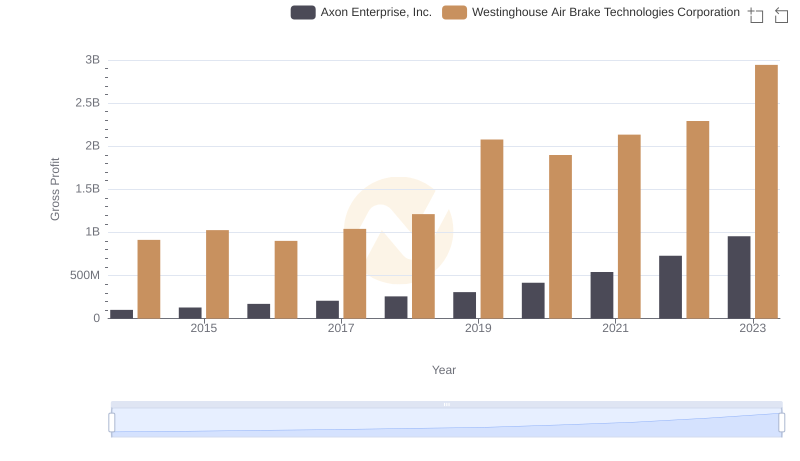

Key Insights on Gross Profit: Axon Enterprise, Inc. vs Westinghouse Air Brake Technologies Corporation

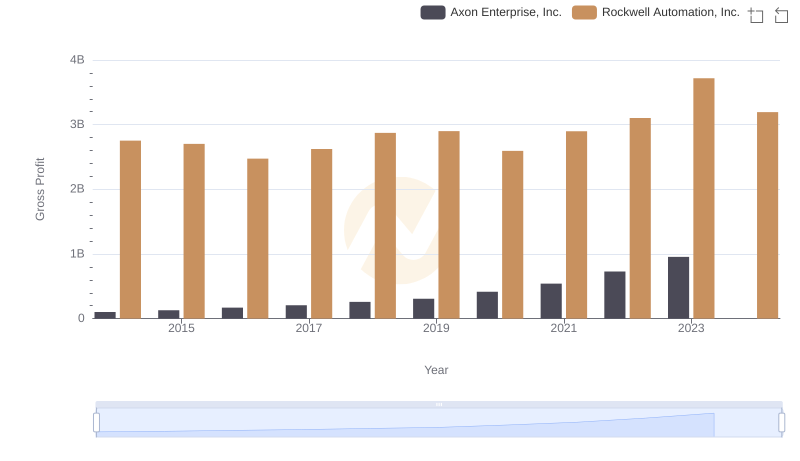

Axon Enterprise, Inc. and Rockwell Automation, Inc.: A Detailed Gross Profit Analysis

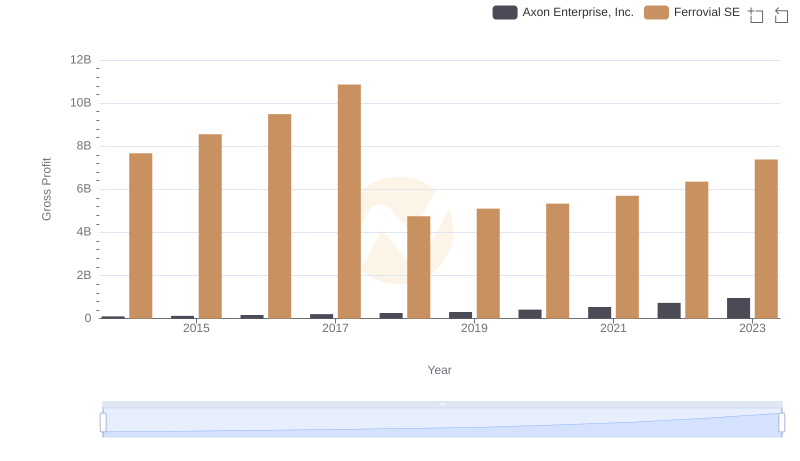

Axon Enterprise, Inc. vs Ferrovial SE: A Gross Profit Performance Breakdown