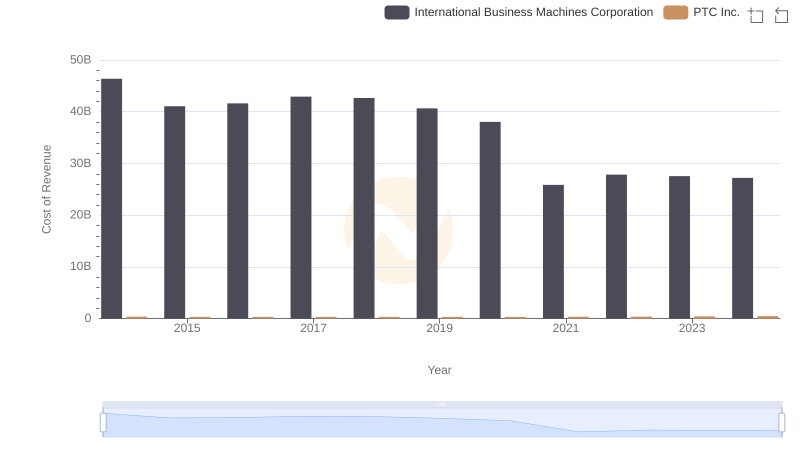

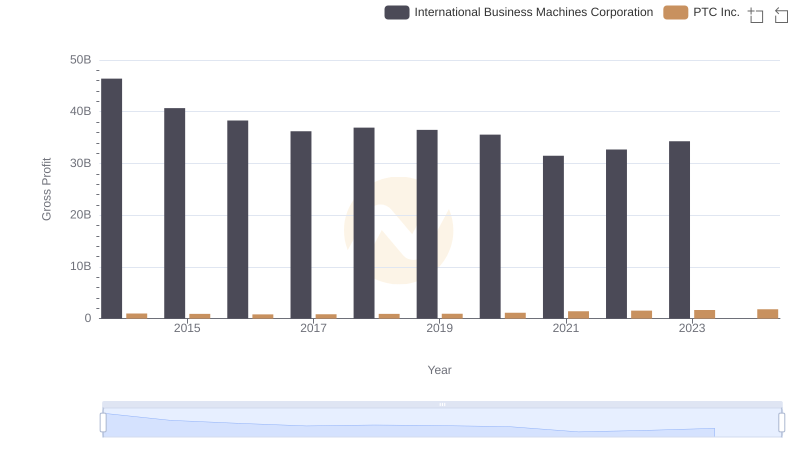

| __timestamp | International Business Machines Corporation | PTC Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 92793000000 | 1356967000 |

| Thursday, January 1, 2015 | 81742000000 | 1255242000 |

| Friday, January 1, 2016 | 79920000000 | 1140533000 |

| Sunday, January 1, 2017 | 79139000000 | 1164039000 |

| Monday, January 1, 2018 | 79591000000 | 1241824000 |

| Tuesday, January 1, 2019 | 57714000000 | 1255631000 |

| Wednesday, January 1, 2020 | 55179000000 | 1458415000 |

| Friday, January 1, 2021 | 57351000000 | 1807159000 |

| Saturday, January 1, 2022 | 60530000000 | 1933347000 |

| Sunday, January 1, 2023 | 61860000000 | 2097053000 |

| Monday, January 1, 2024 | 62753000000 | 2298472000 |

Data in motion

In the ever-evolving landscape of technology, International Business Machines Corporation (IBM) and PTC Inc. have carved distinct paths. Over the past decade, IBM's revenue has seen a notable decline, dropping approximately 32% from its peak in 2014. This trend reflects the company's strategic shift towards cloud computing and AI, moving away from traditional hardware and services.

Conversely, PTC Inc., a leader in digital transformation and IoT, has experienced a robust growth trajectory. Since 2014, PTC's revenue has surged by over 69%, underscoring its successful pivot towards software solutions and subscription-based models.

This analysis highlights the contrasting strategies of these two tech titans. While IBM adapts to new market demands, PTC capitalizes on emerging technologies, showcasing the dynamic nature of the tech industry.

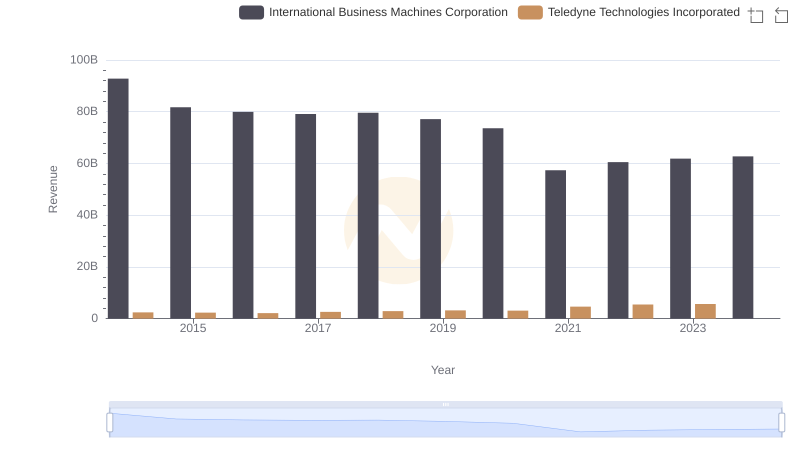

Revenue Insights: International Business Machines Corporation and Teledyne Technologies Incorporated Performance Compared

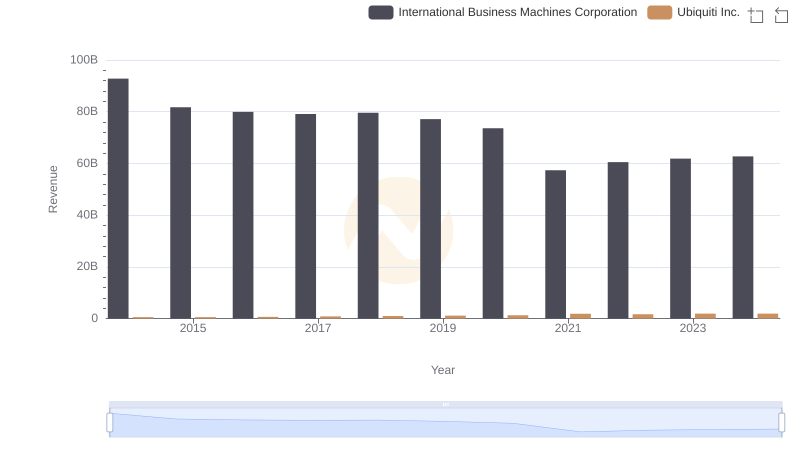

Breaking Down Revenue Trends: International Business Machines Corporation vs Ubiquiti Inc.

Who Generates More Revenue? International Business Machines Corporation or ON Semiconductor Corporation

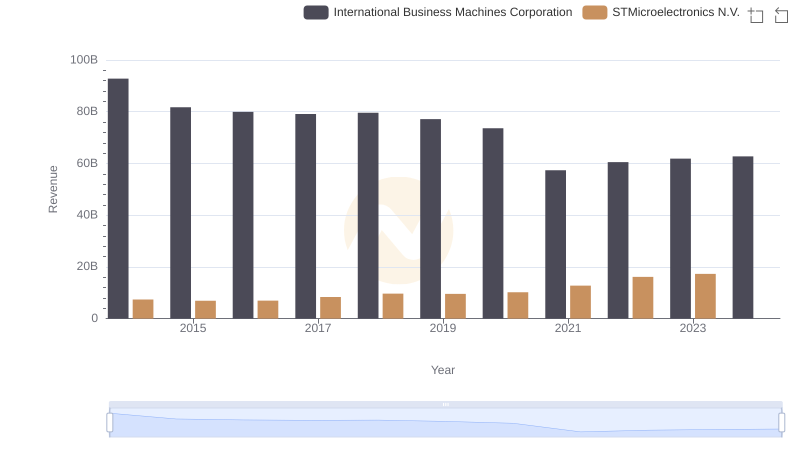

Who Generates More Revenue? International Business Machines Corporation or STMicroelectronics N.V.

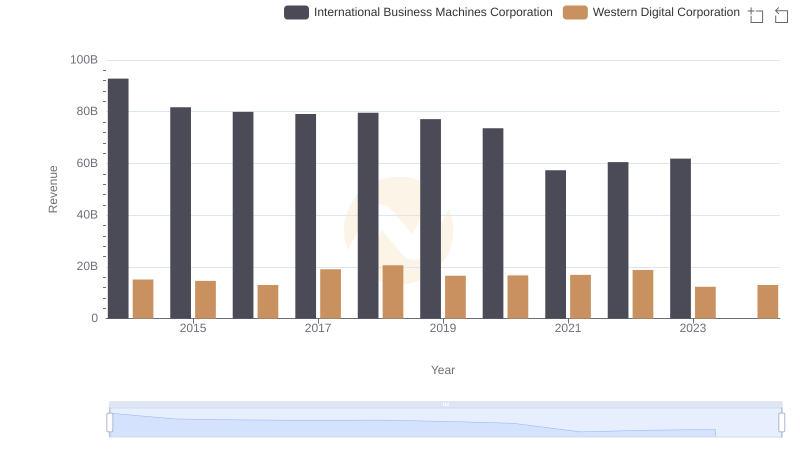

International Business Machines Corporation and Western Digital Corporation: A Comprehensive Revenue Analysis

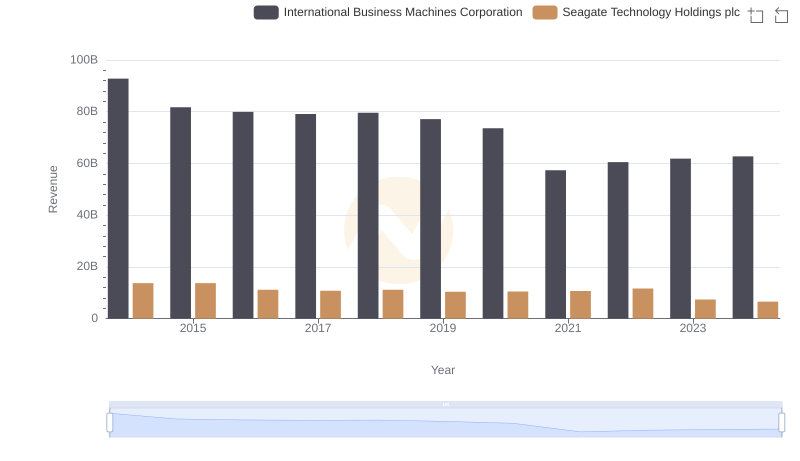

International Business Machines Corporation and Seagate Technology Holdings plc: A Comprehensive Revenue Analysis

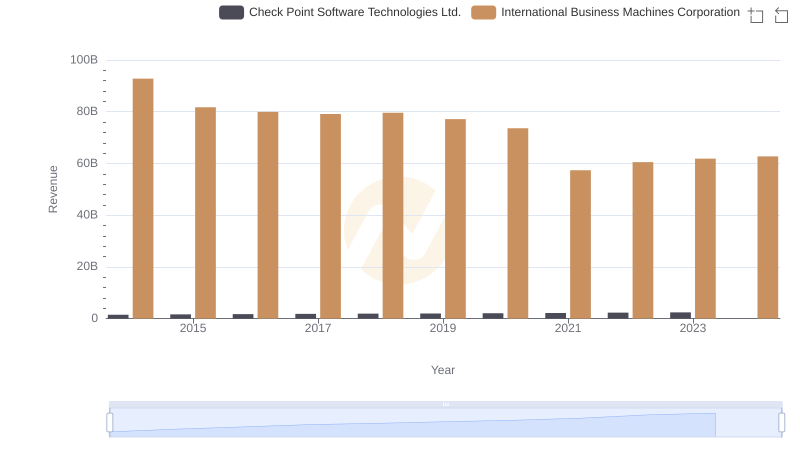

Annual Revenue Comparison: International Business Machines Corporation vs Check Point Software Technologies Ltd.

Cost Insights: Breaking Down International Business Machines Corporation and PTC Inc.'s Expenses

Gross Profit Analysis: Comparing International Business Machines Corporation and PTC Inc.

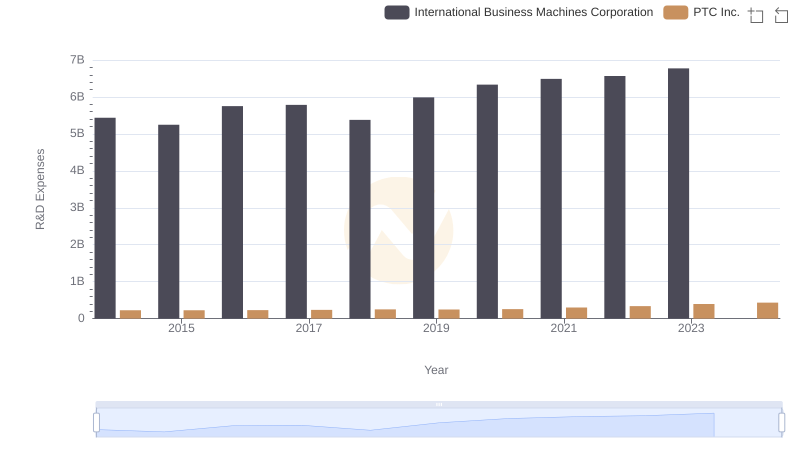

International Business Machines Corporation or PTC Inc.: Who Invests More in Innovation?

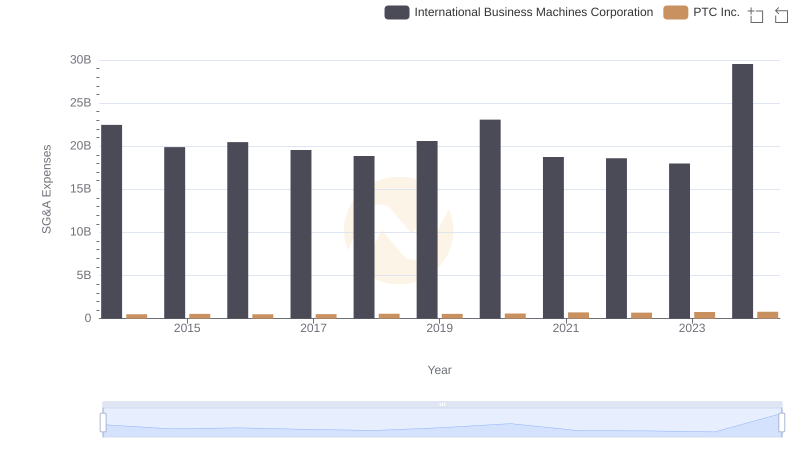

International Business Machines Corporation vs PTC Inc.: SG&A Expense Trends

EBITDA Analysis: Evaluating International Business Machines Corporation Against PTC Inc.