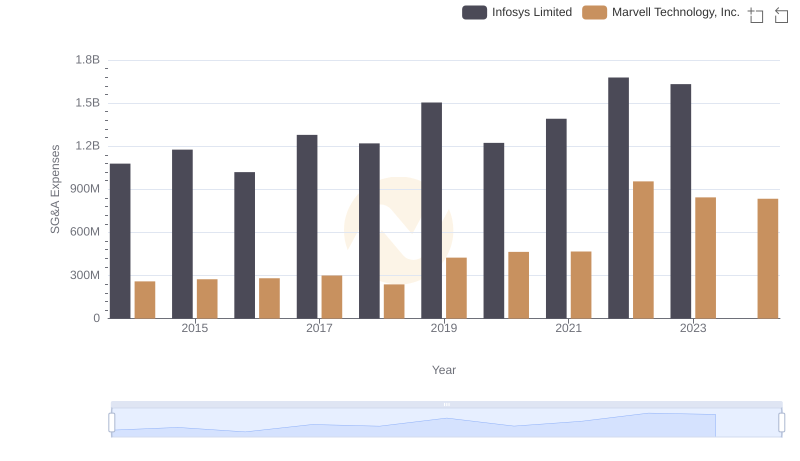

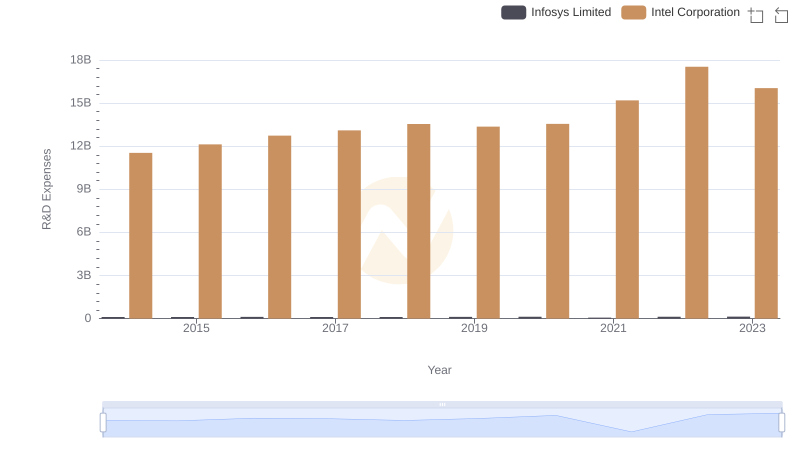

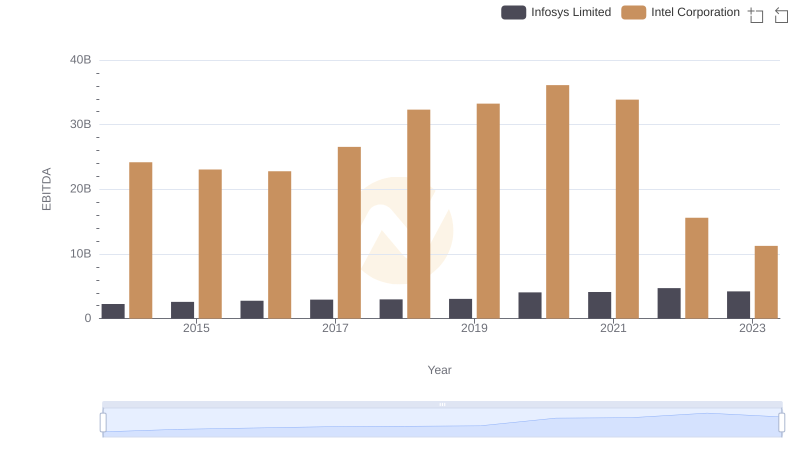

| __timestamp | Infosys Limited | Intel Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1079000000 | 8136000000 |

| Thursday, January 1, 2015 | 1176000000 | 7930000000 |

| Friday, January 1, 2016 | 1020000000 | 8397000000 |

| Sunday, January 1, 2017 | 1279000000 | 7474000000 |

| Monday, January 1, 2018 | 1220000000 | 6750000000 |

| Tuesday, January 1, 2019 | 1504000000 | 6150000000 |

| Wednesday, January 1, 2020 | 1223000000 | 6180000000 |

| Friday, January 1, 2021 | 1391000000 | 6543000000 |

| Saturday, January 1, 2022 | 1678000000 | 7002000000 |

| Sunday, January 1, 2023 | 1632000000 | 5634000000 |

| Monday, January 1, 2024 | 5507000000 |

Unveiling the hidden dimensions of data

In the ever-evolving tech industry, understanding the financial strategies of giants like Infosys Limited and Intel Corporation is crucial. Over the past decade, from 2014 to 2023, these companies have showcased distinct approaches to their Selling, General, and Administrative (SG&A) expenses.

Infosys has demonstrated a steady increase in SG&A expenses, peaking in 2022 with a 55% rise from 2014. This growth reflects their strategic investments in global expansion and innovation. In contrast, Intel's SG&A expenses have seen a more volatile pattern, with a notable 31% decrease from 2014 to 2023, indicating a shift towards cost optimization and efficiency.

While Infosys focuses on scaling operations, Intel's strategy leans towards streamlining. These trends highlight the diverse paths tech leaders take to maintain competitive edges in a dynamic market.

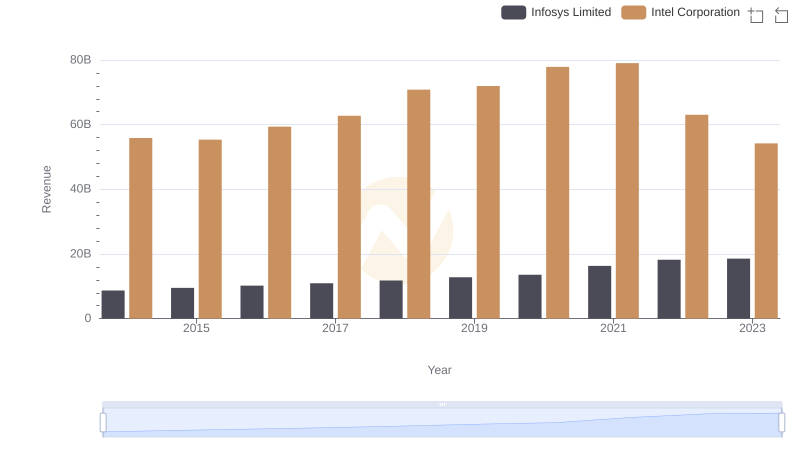

Breaking Down Revenue Trends: Infosys Limited vs Intel Corporation

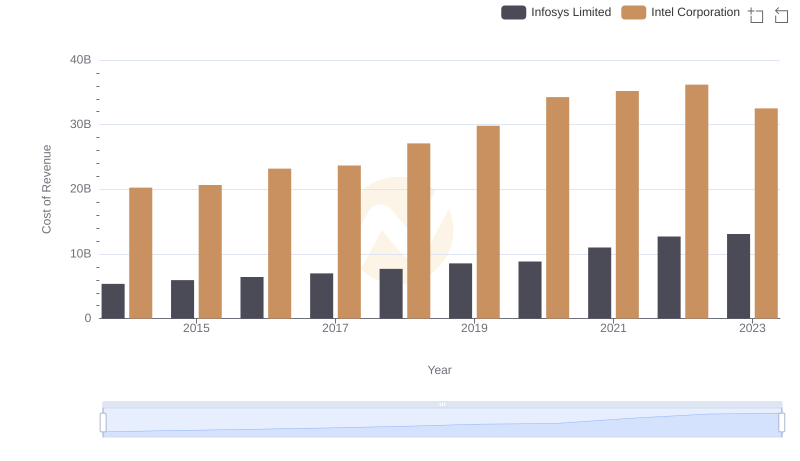

Infosys Limited vs Intel Corporation: Efficiency in Cost of Revenue Explored

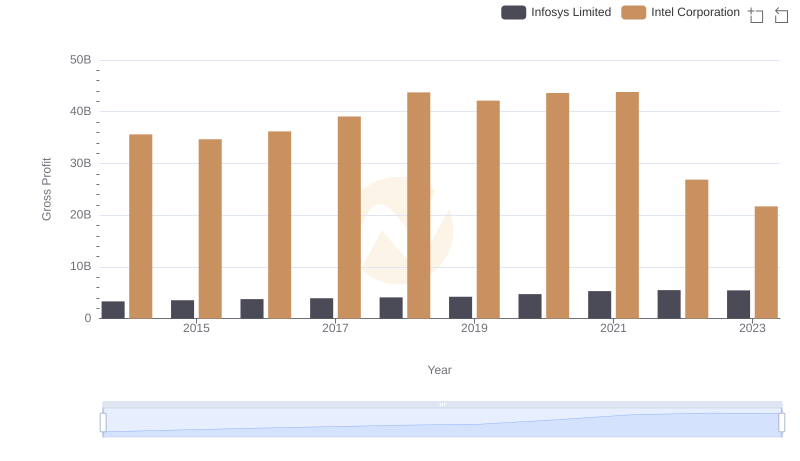

Gross Profit Analysis: Comparing Infosys Limited and Intel Corporation

SG&A Efficiency Analysis: Comparing Infosys Limited and Marvell Technology, Inc.

Research and Development: Comparing Key Metrics for Infosys Limited and Intel Corporation

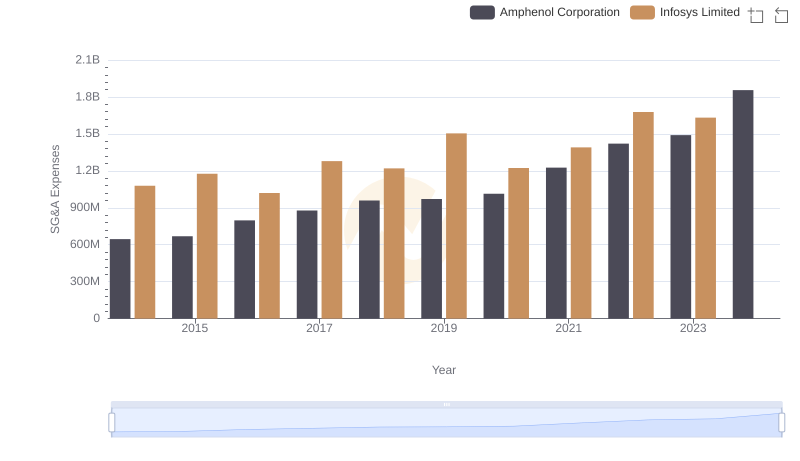

Who Optimizes SG&A Costs Better? Infosys Limited or Amphenol Corporation

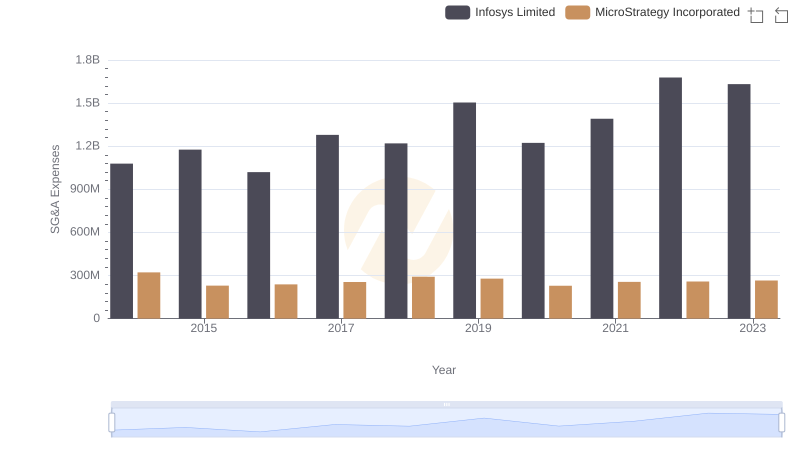

Breaking Down SG&A Expenses: Infosys Limited vs MicroStrategy Incorporated

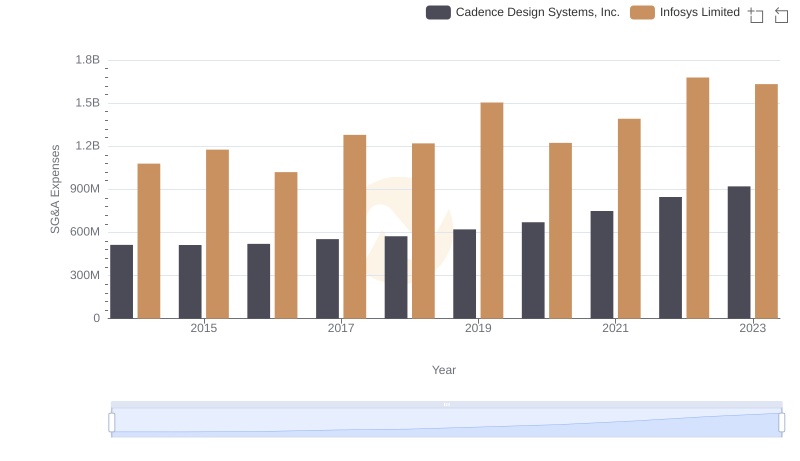

Infosys Limited or Cadence Design Systems, Inc.: Who Manages SG&A Costs Better?

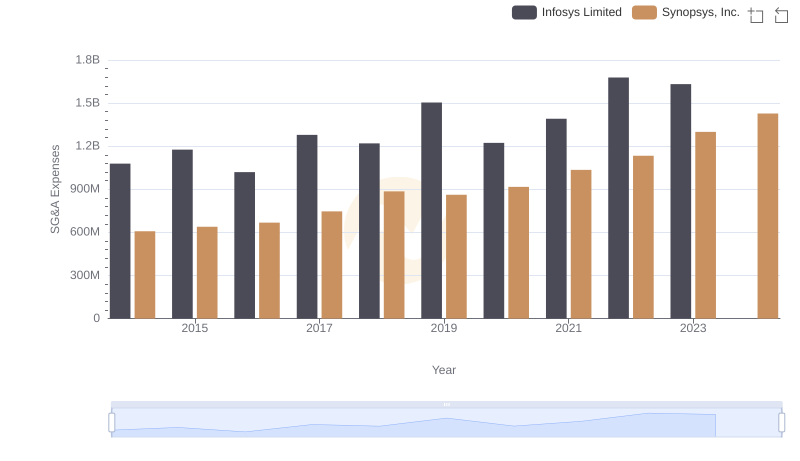

Selling, General, and Administrative Costs: Infosys Limited vs Synopsys, Inc.

EBITDA Performance Review: Infosys Limited vs Intel Corporation

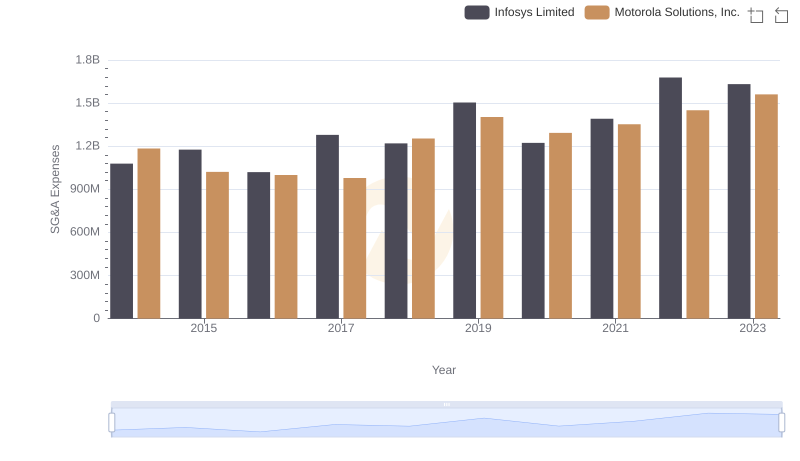

Comparing SG&A Expenses: Infosys Limited vs Motorola Solutions, Inc. Trends and Insights

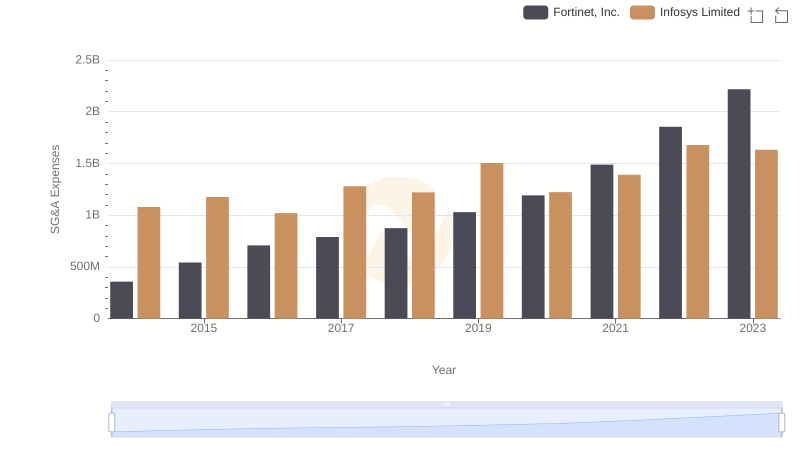

Comparing SG&A Expenses: Infosys Limited vs Fortinet, Inc. Trends and Insights