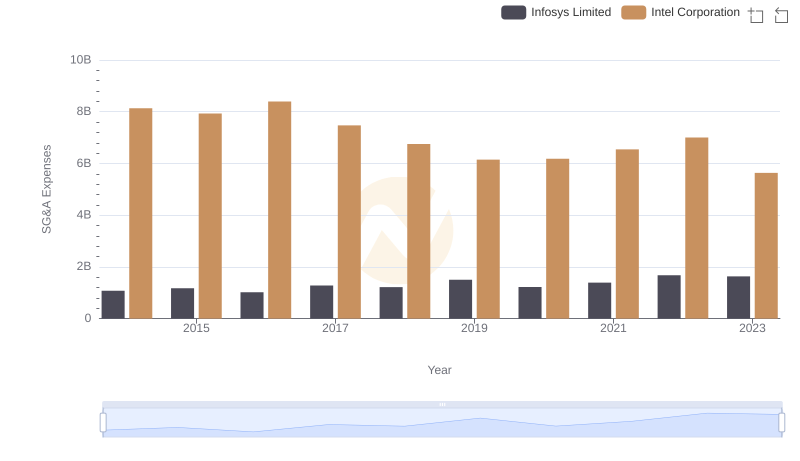

| __timestamp | Infosys Limited | Intel Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2258000000 | 24191000000 |

| Thursday, January 1, 2015 | 2590000000 | 23067000000 |

| Friday, January 1, 2016 | 2765000000 | 22795000000 |

| Sunday, January 1, 2017 | 2936000000 | 26563000000 |

| Monday, January 1, 2018 | 2984000000 | 32329000000 |

| Tuesday, January 1, 2019 | 3053000000 | 33254000000 |

| Wednesday, January 1, 2020 | 4053342784 | 36115000000 |

| Friday, January 1, 2021 | 4116000000 | 33874000000 |

| Saturday, January 1, 2022 | 4707334610 | 15610000000 |

| Sunday, January 1, 2023 | 4206000000 | 11242000000 |

| Monday, January 1, 2024 | 1203000000 |

Infusing magic into the data realm

In the ever-evolving tech industry, financial performance is a key indicator of a company's resilience and adaptability. Over the past decade, Infosys Limited and Intel Corporation have showcased contrasting EBITDA trends. From 2014 to 2023, Infosys demonstrated a steady growth trajectory, with EBITDA increasing by approximately 86%, peaking in 2022. This growth reflects Infosys's strategic expansion and robust service offerings.

Conversely, Intel's EBITDA journey tells a different story. Despite a strong start in 2014, Intel's EBITDA saw a decline of about 54% by 2023. This downturn, particularly sharp post-2020, highlights the challenges Intel faces in a competitive semiconductor market. The contrasting paths of these tech giants underscore the diverse challenges and opportunities within the industry, offering valuable insights for investors and stakeholders.

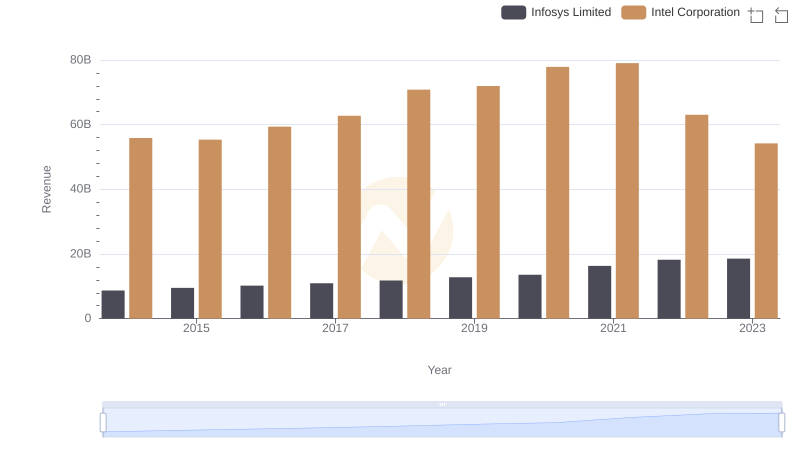

Breaking Down Revenue Trends: Infosys Limited vs Intel Corporation

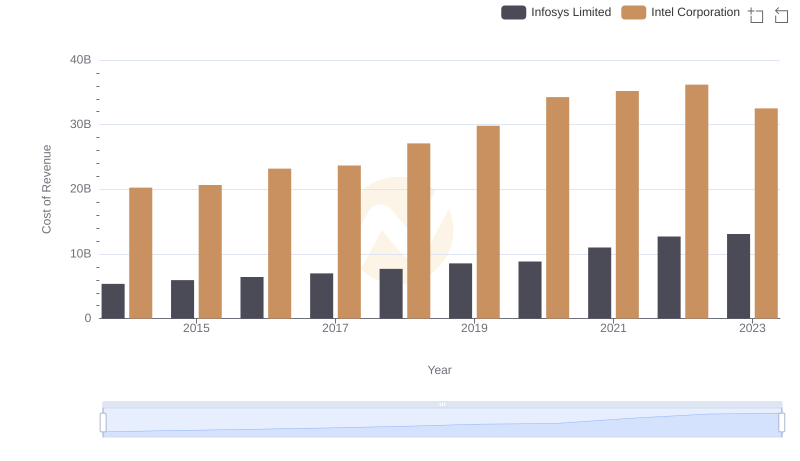

Infosys Limited vs Intel Corporation: Efficiency in Cost of Revenue Explored

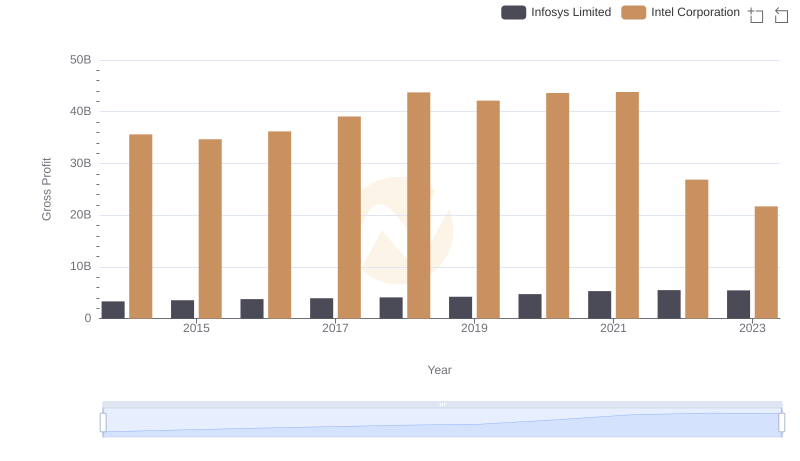

Gross Profit Analysis: Comparing Infosys Limited and Intel Corporation

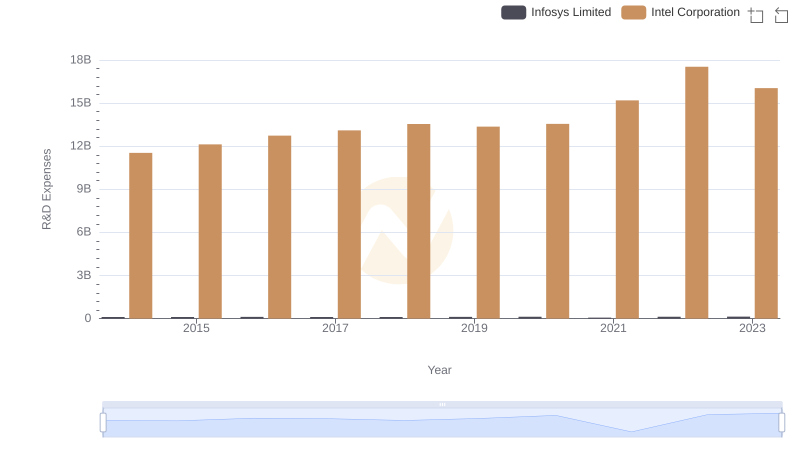

Research and Development: Comparing Key Metrics for Infosys Limited and Intel Corporation

Infosys Limited and Intel Corporation: SG&A Spending Patterns Compared

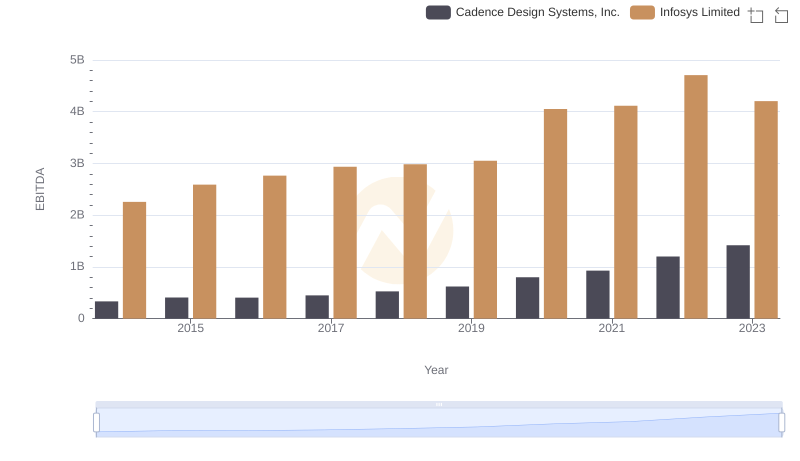

Comparative EBITDA Analysis: Infosys Limited vs Cadence Design Systems, Inc.

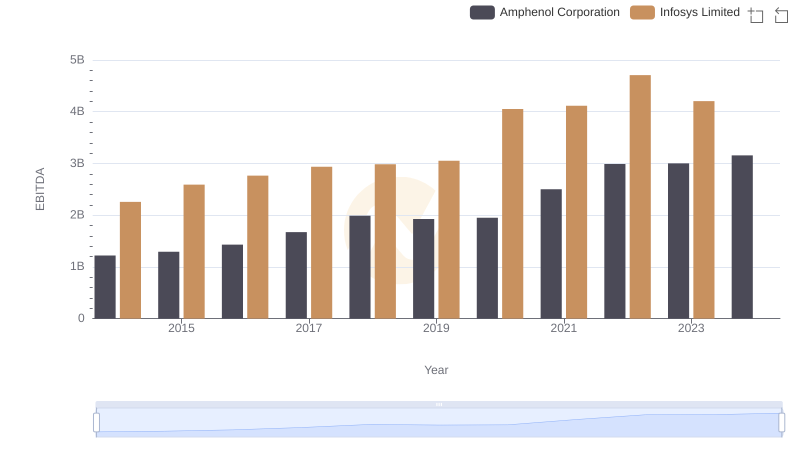

A Side-by-Side Analysis of EBITDA: Infosys Limited and Amphenol Corporation

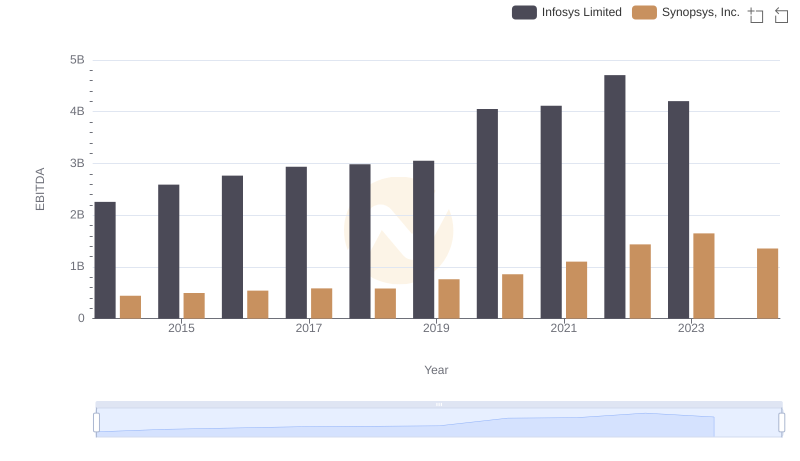

EBITDA Performance Review: Infosys Limited vs Synopsys, Inc.

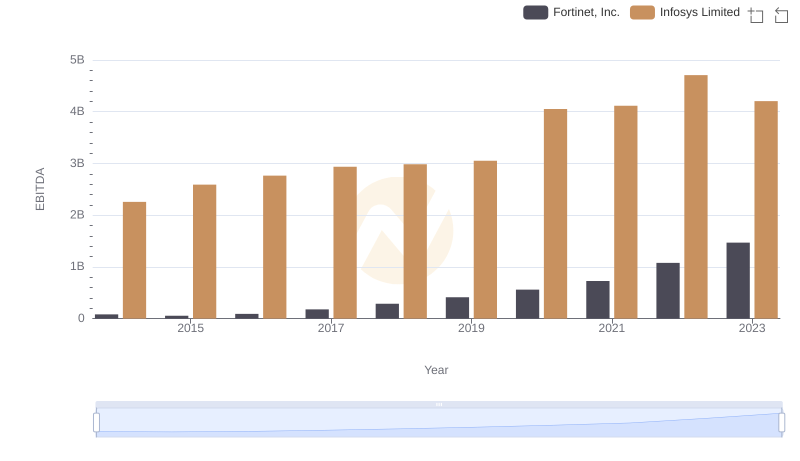

EBITDA Metrics Evaluated: Infosys Limited vs Fortinet, Inc.

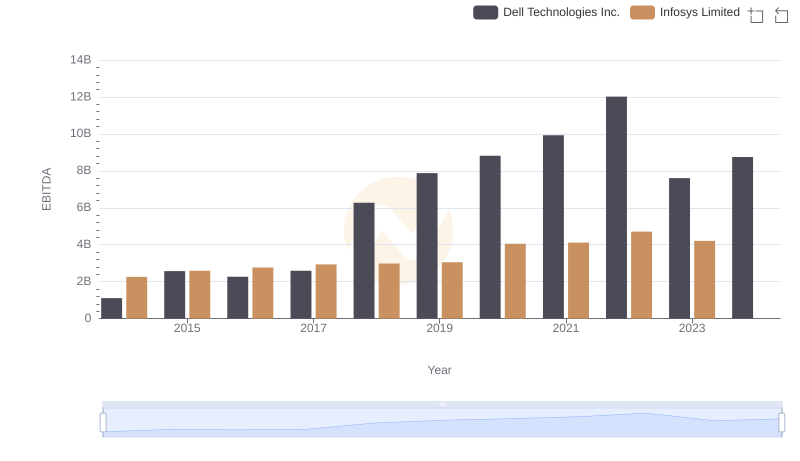

EBITDA Metrics Evaluated: Infosys Limited vs Dell Technologies Inc.

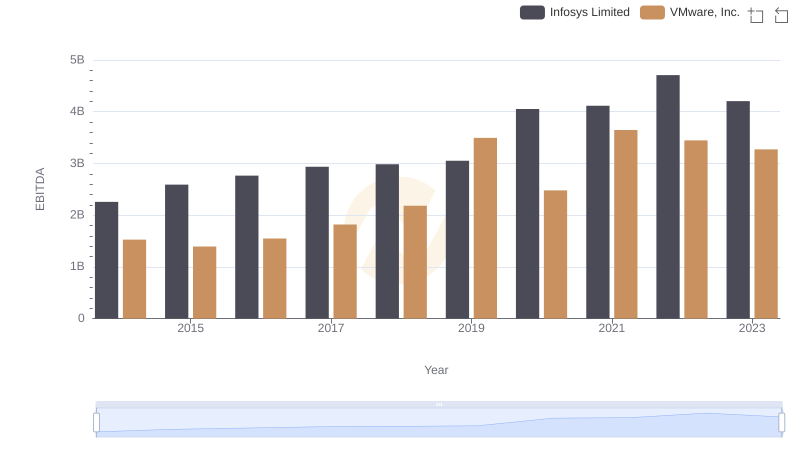

Comprehensive EBITDA Comparison: Infosys Limited vs VMware, Inc.

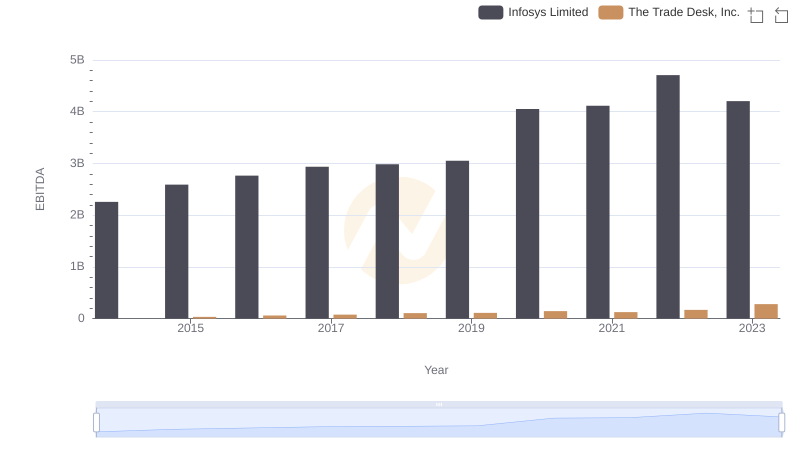

Infosys Limited and The Trade Desk, Inc.: A Detailed Examination of EBITDA Performance