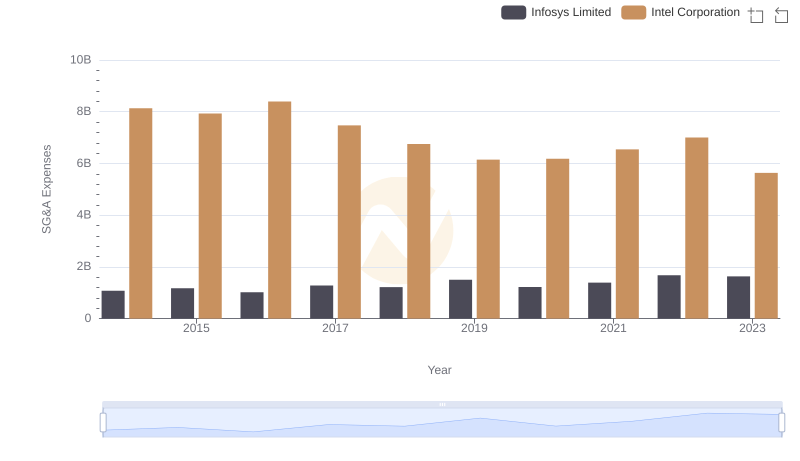

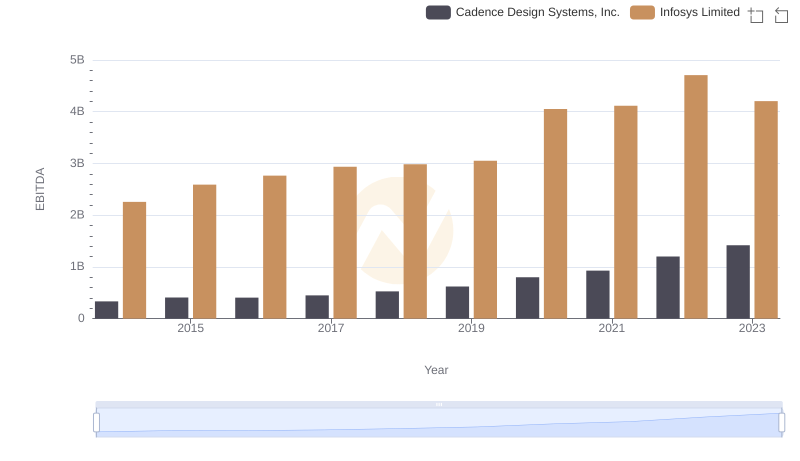

| __timestamp | Cadence Design Systems, Inc. | Infosys Limited |

|---|---|---|

| Wednesday, January 1, 2014 | 513307000 | 1079000000 |

| Thursday, January 1, 2015 | 512414000 | 1176000000 |

| Friday, January 1, 2016 | 520300000 | 1020000000 |

| Sunday, January 1, 2017 | 553342000 | 1279000000 |

| Monday, January 1, 2018 | 573075000 | 1220000000 |

| Tuesday, January 1, 2019 | 621479000 | 1504000000 |

| Wednesday, January 1, 2020 | 670885000 | 1223000000 |

| Friday, January 1, 2021 | 749280000 | 1391000000 |

| Saturday, January 1, 2022 | 846340000 | 1678000000 |

| Sunday, January 1, 2023 | 920649000 | 1632000000 |

| Monday, January 1, 2024 | 1039766000 |

Cracking the code

In the competitive landscape of global business, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. From 2014 to 2023, Infosys Limited and Cadence Design Systems, Inc. have shown distinct strategies in handling these costs. Infosys, a leader in IT services, consistently reported higher SG&A expenses, averaging around 1.32 billion annually. In contrast, Cadence, a pioneer in electronic design automation, maintained a more modest average of approximately 648 million, nearly half of Infosys's expenditure.

Despite the higher costs, Infosys's SG&A expenses grew by about 51% over the decade, while Cadence saw a sharper increase of 79%. This trend suggests Cadence is investing more aggressively in administrative and sales functions, potentially to fuel growth. As businesses navigate the post-pandemic economy, these insights into cost management strategies offer valuable lessons for optimizing operational efficiency.

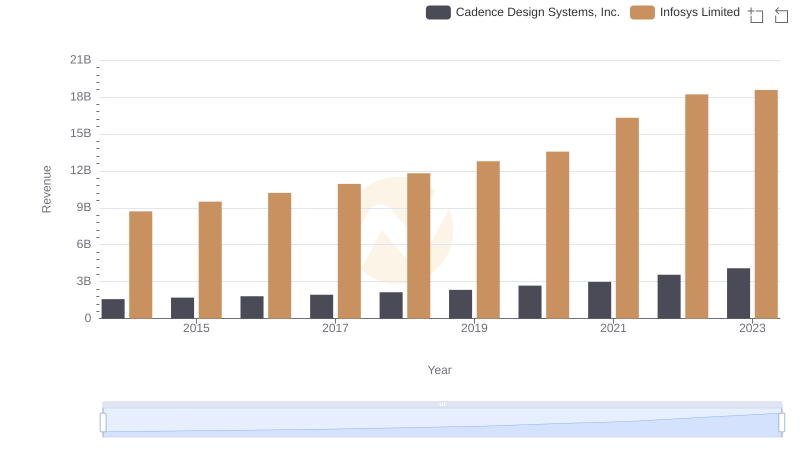

Breaking Down Revenue Trends: Infosys Limited vs Cadence Design Systems, Inc.

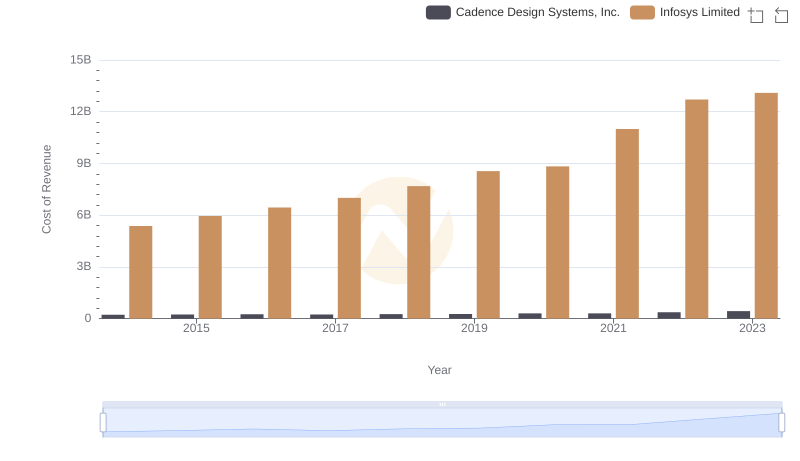

Cost Insights: Breaking Down Infosys Limited and Cadence Design Systems, Inc.'s Expenses

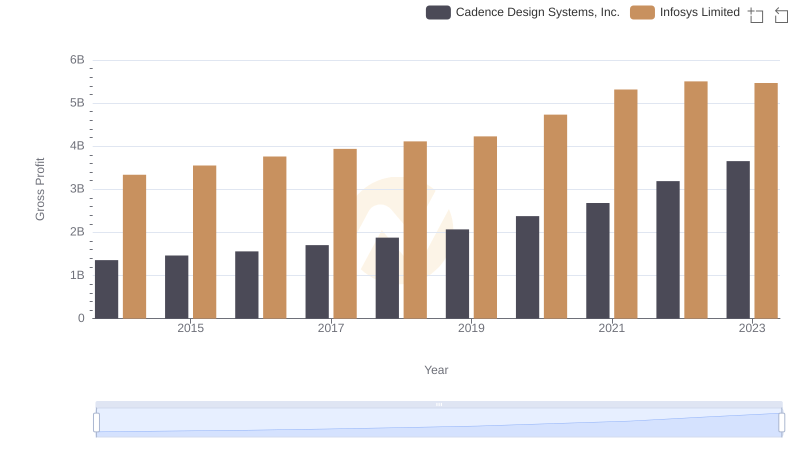

Infosys Limited and Cadence Design Systems, Inc.: A Detailed Gross Profit Analysis

Infosys Limited and Intel Corporation: SG&A Spending Patterns Compared

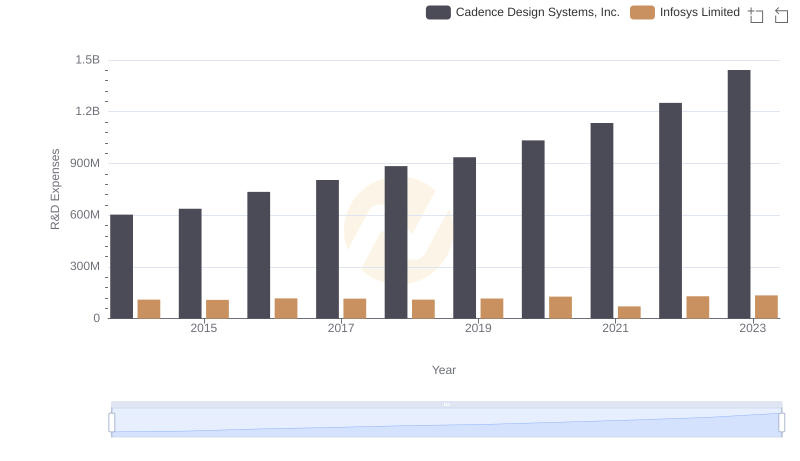

Infosys Limited or Cadence Design Systems, Inc.: Who Invests More in Innovation?

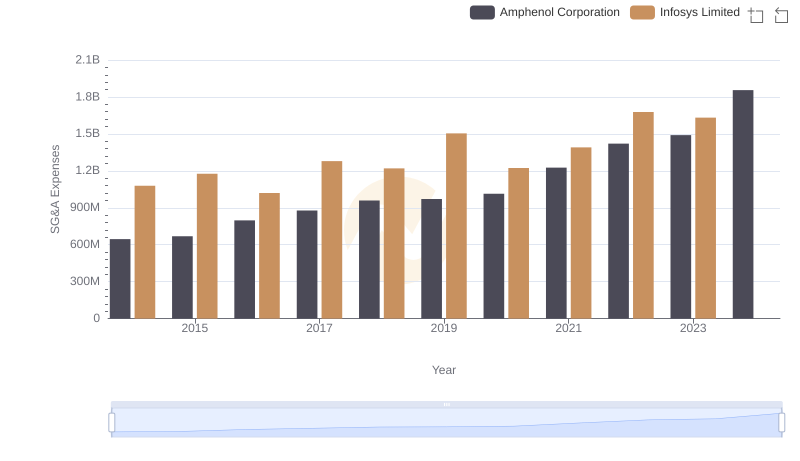

Who Optimizes SG&A Costs Better? Infosys Limited or Amphenol Corporation

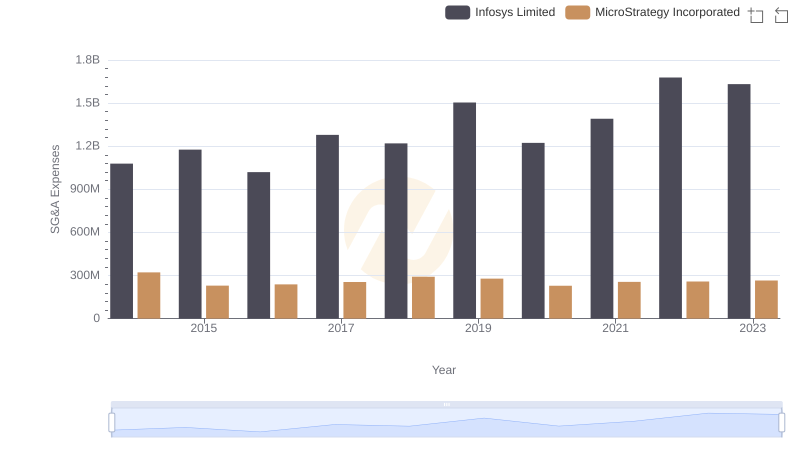

Breaking Down SG&A Expenses: Infosys Limited vs MicroStrategy Incorporated

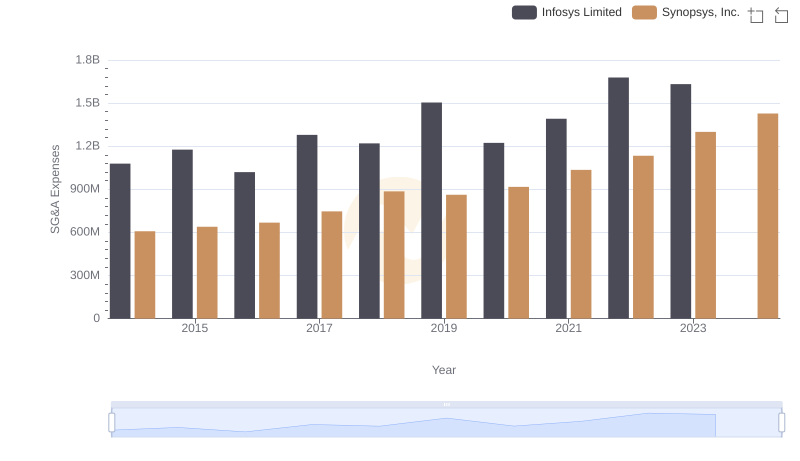

Selling, General, and Administrative Costs: Infosys Limited vs Synopsys, Inc.

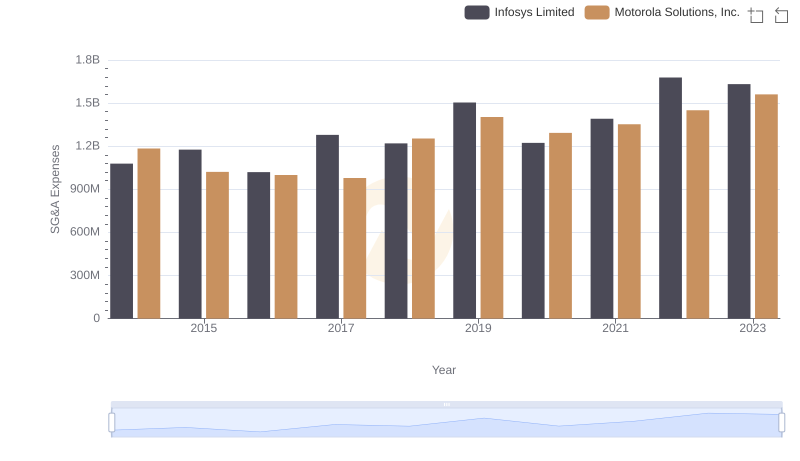

Comparing SG&A Expenses: Infosys Limited vs Motorola Solutions, Inc. Trends and Insights

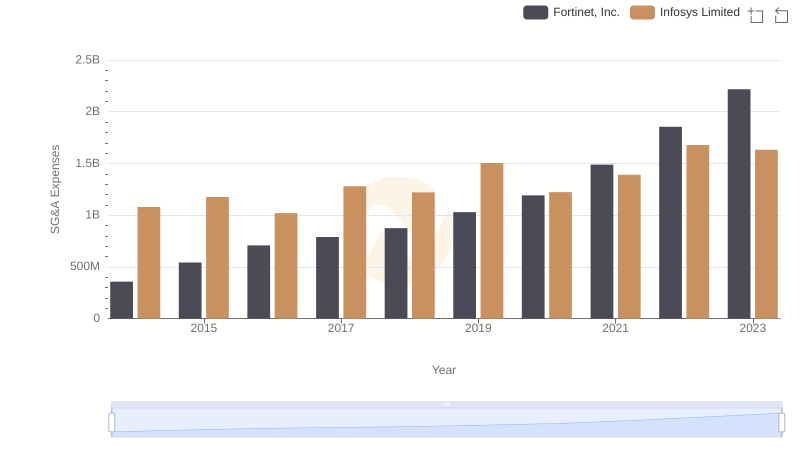

Comparing SG&A Expenses: Infosys Limited vs Fortinet, Inc. Trends and Insights

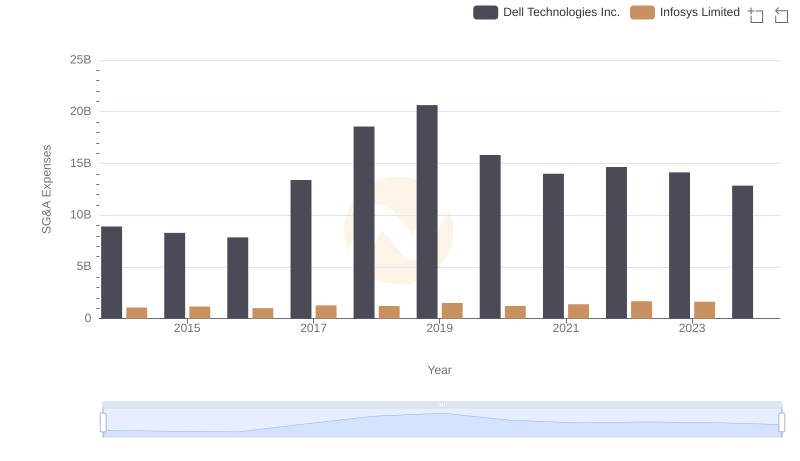

Infosys Limited or Dell Technologies Inc.: Who Manages SG&A Costs Better?

Comparative EBITDA Analysis: Infosys Limited vs Cadence Design Systems, Inc.