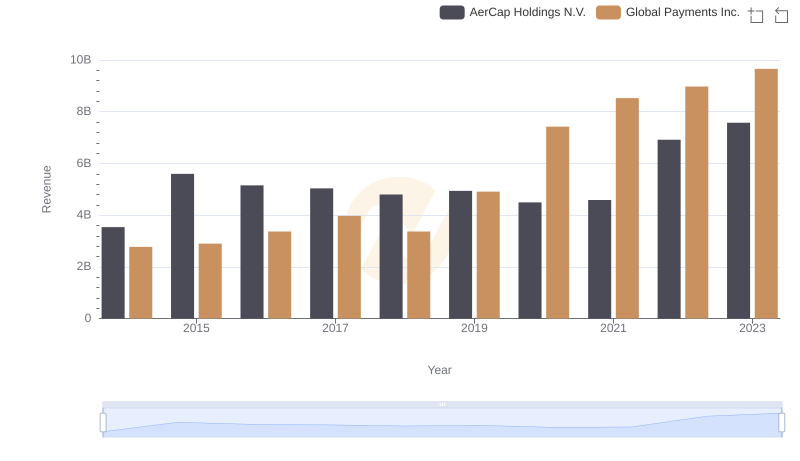

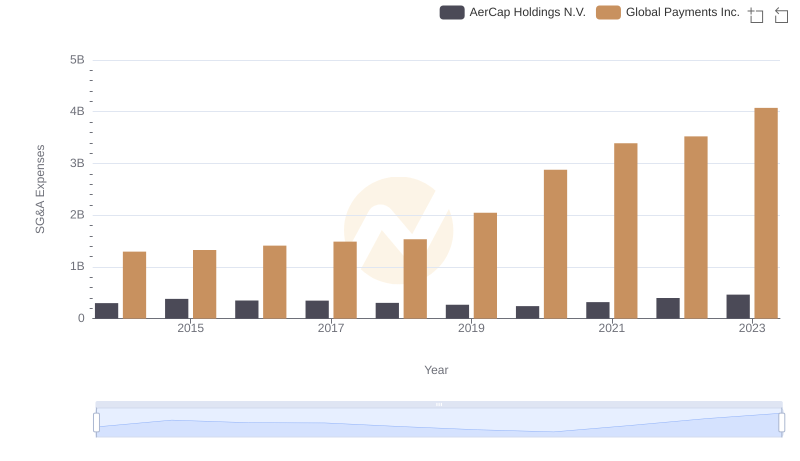

| __timestamp | AerCap Holdings N.V. | Global Payments Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1282919000 | 1751611000 |

| Thursday, January 1, 2015 | 1822255000 | 1750511000 |

| Friday, January 1, 2016 | 1686404000 | 1767444000 |

| Sunday, January 1, 2017 | 1660054000 | 2047126000 |

| Monday, January 1, 2018 | 1500345000 | 2271352000 |

| Tuesday, January 1, 2019 | 1678249000 | 2838089000 |

| Wednesday, January 1, 2020 | 1276496000 | 3772831000 |

| Friday, January 1, 2021 | 1301517000 | 4750037000 |

| Saturday, January 1, 2022 | 2109708000 | 5196898000 |

| Sunday, January 1, 2023 | 4337648000 | 5926898000 |

| Monday, January 1, 2024 | 6345778000 |

Unlocking the unknown

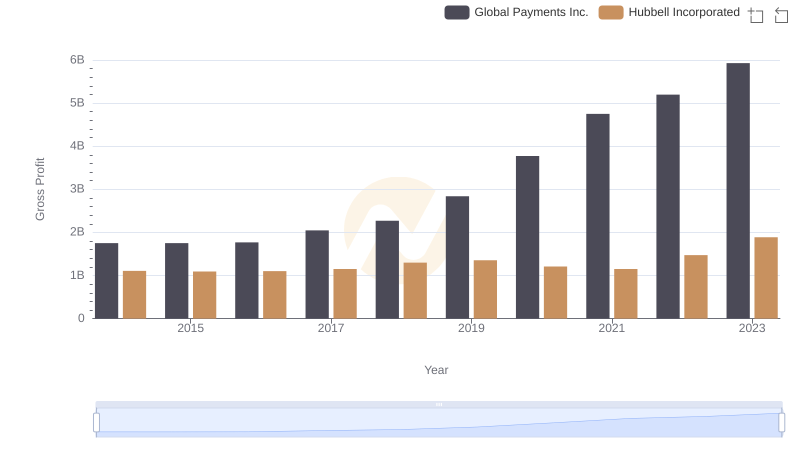

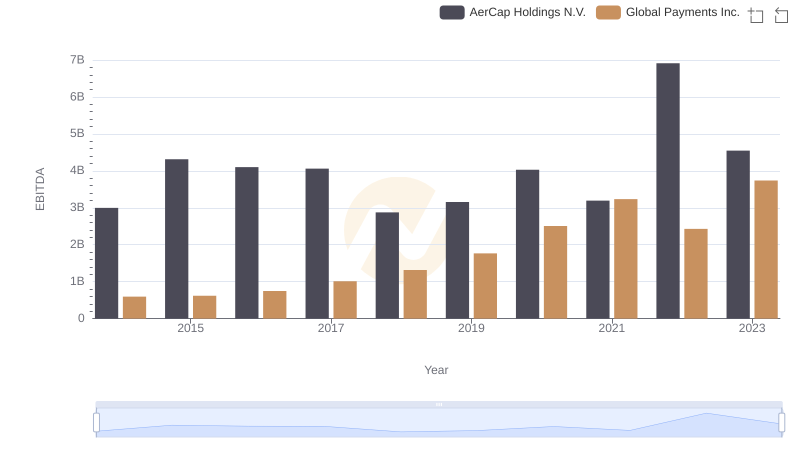

In the ever-evolving landscape of global finance, two titans stand out: Global Payments Inc. and AerCap Holdings N.V. Over the past decade, these companies have showcased remarkable growth in their gross profits, reflecting their strategic prowess and market adaptability. From 2014 to 2023, Global Payments Inc. has seen its gross profit soar by approximately 238%, while AerCap Holdings N.V. experienced a staggering 238% increase in the same period. This growth trajectory highlights the resilience and innovation of these industry leaders.

Global Payments Inc., a key player in the payment technology sector, has consistently outperformed, with its gross profit peaking in 2023. Meanwhile, AerCap Holdings N.V., a leader in aircraft leasing, has demonstrated a robust recovery post-2020, culminating in a significant profit surge in 2023. This comparison not only underscores their individual successes but also offers insights into the broader economic trends shaping their industries.

Global Payments Inc. vs AerCap Holdings N.V.: Examining Key Revenue Metrics

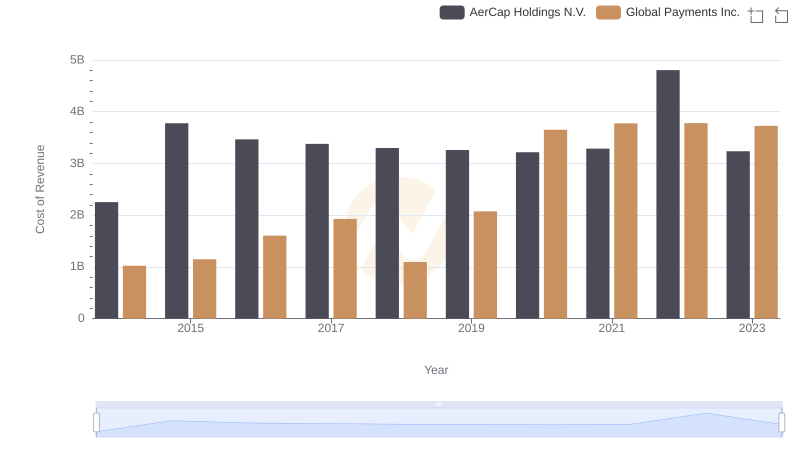

Cost of Revenue: Key Insights for Global Payments Inc. and AerCap Holdings N.V.

Gross Profit Comparison: Global Payments Inc. and Hubbell Incorporated Trends

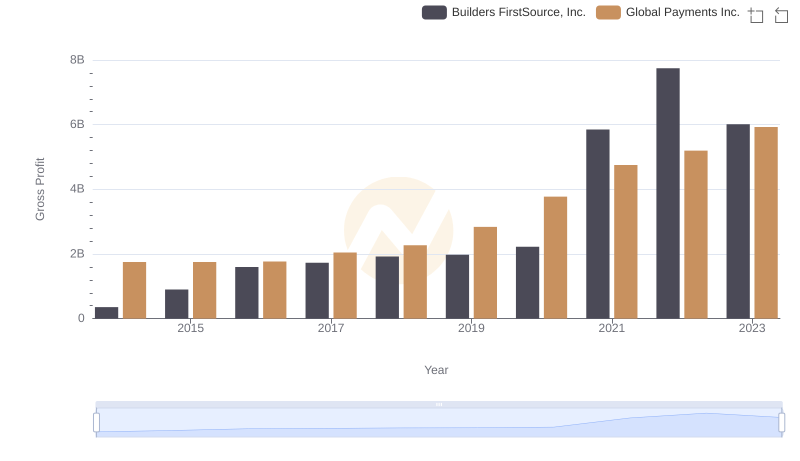

Who Generates Higher Gross Profit? Global Payments Inc. or Builders FirstSource, Inc.

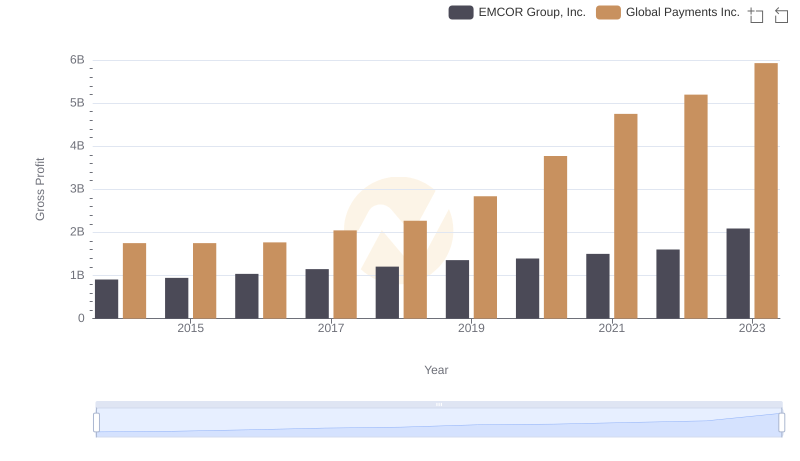

Key Insights on Gross Profit: Global Payments Inc. vs EMCOR Group, Inc.

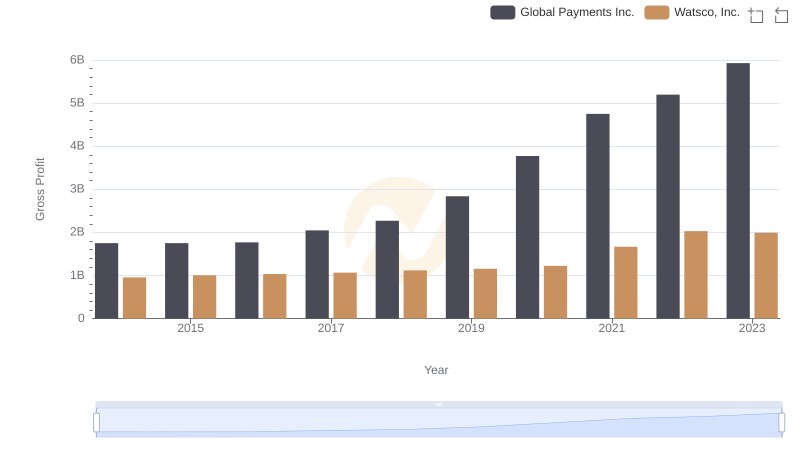

Gross Profit Comparison: Global Payments Inc. and Watsco, Inc. Trends

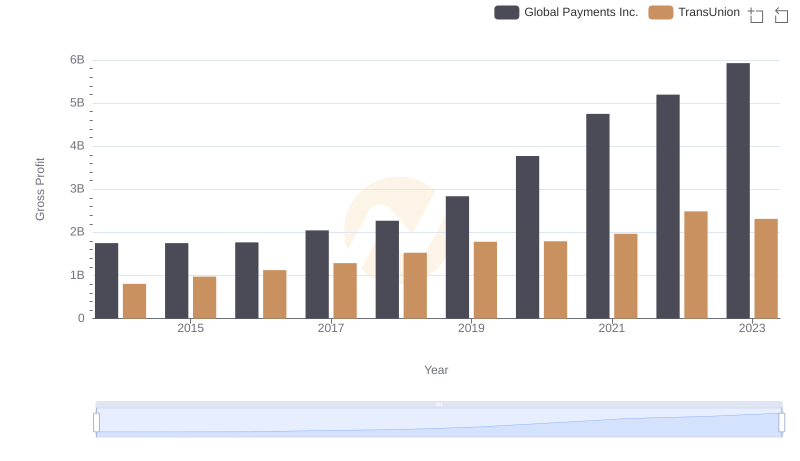

Global Payments Inc. and TransUnion: A Detailed Gross Profit Analysis

Cost Management Insights: SG&A Expenses for Global Payments Inc. and AerCap Holdings N.V.

Global Payments Inc. and AerCap Holdings N.V.: A Detailed Examination of EBITDA Performance