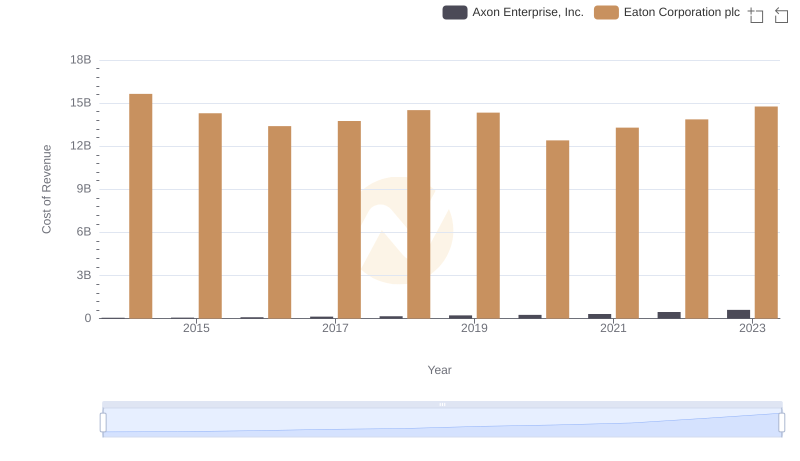

| __timestamp | Axon Enterprise, Inc. | Eaton Corporation plc |

|---|---|---|

| Wednesday, January 1, 2014 | 101548000 | 6906000000 |

| Thursday, January 1, 2015 | 128647000 | 6563000000 |

| Friday, January 1, 2016 | 170536000 | 6347000000 |

| Sunday, January 1, 2017 | 207088000 | 6648000000 |

| Monday, January 1, 2018 | 258583000 | 7098000000 |

| Tuesday, January 1, 2019 | 307286000 | 7052000000 |

| Wednesday, January 1, 2020 | 416331000 | 5450000000 |

| Friday, January 1, 2021 | 540910000 | 6335000000 |

| Saturday, January 1, 2022 | 728638000 | 6887000000 |

| Sunday, January 1, 2023 | 955382000 | 8433000000 |

| Monday, January 1, 2024 | 9503000000 |

Unlocking the unknown

In the ever-evolving landscape of industrial and technology sectors, Eaton Corporation plc and Axon Enterprise, Inc. have showcased remarkable growth in gross profit over the past decade. From 2014 to 2023, Eaton's gross profit has consistently dominated, peaking at approximately $8.4 billion in 2023, marking a 22% increase from 2014. Meanwhile, Axon has demonstrated impressive growth, with its gross profit surging by over 840% during the same period, reaching nearly $955 million in 2023.

Eaton, a leader in power management, has maintained a steady trajectory, reflecting its robust market position. In contrast, Axon, known for its innovative public safety solutions, has experienced exponential growth, highlighting its expanding influence in the tech industry. This comparison underscores the dynamic nature of these sectors, where strategic innovation and market adaptation are key to financial success.

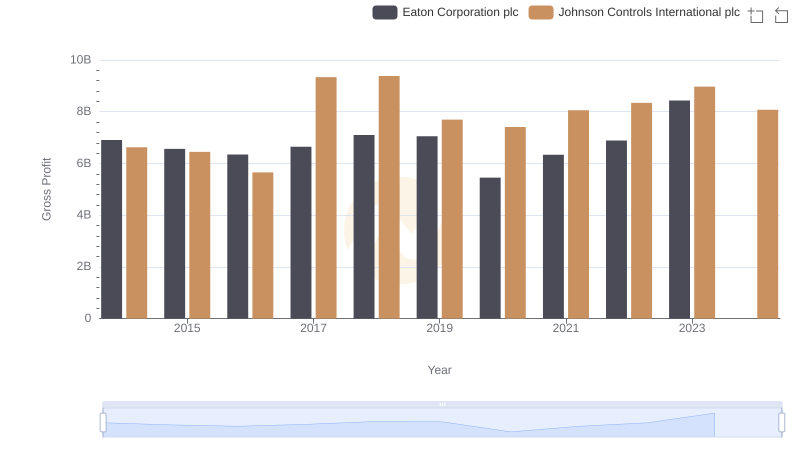

Gross Profit Trends Compared: Eaton Corporation plc vs Johnson Controls International plc

Cost of Revenue Trends: Eaton Corporation plc vs Axon Enterprise, Inc.

Eaton Corporation plc and Waste Connections, Inc.: A Detailed Gross Profit Analysis

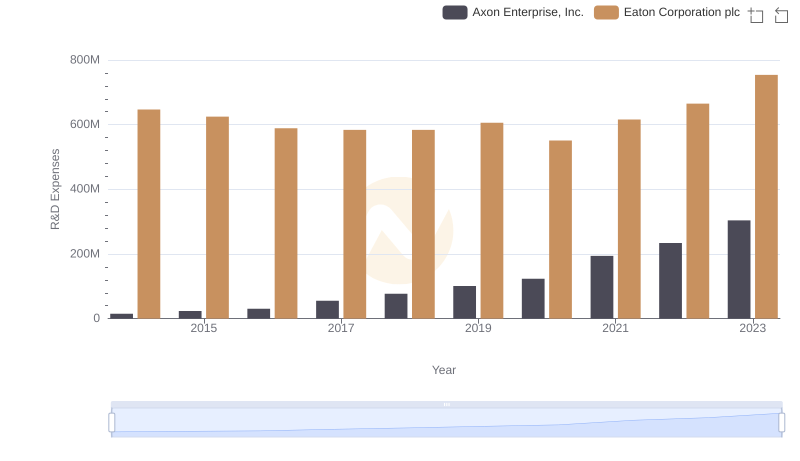

Eaton Corporation plc or Axon Enterprise, Inc.: Who Invests More in Innovation?

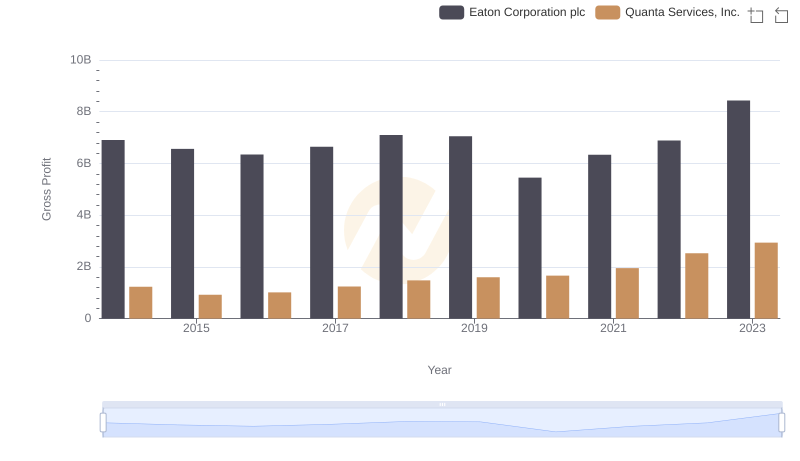

Who Generates Higher Gross Profit? Eaton Corporation plc or Quanta Services, Inc.

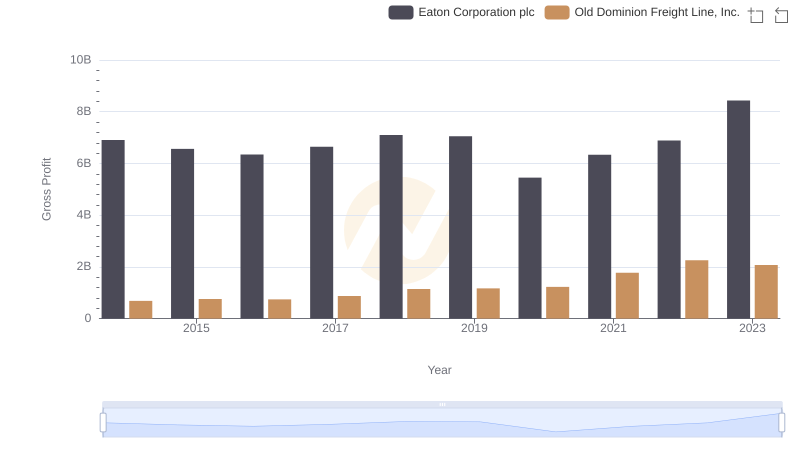

Gross Profit Analysis: Comparing Eaton Corporation plc and Old Dominion Freight Line, Inc.