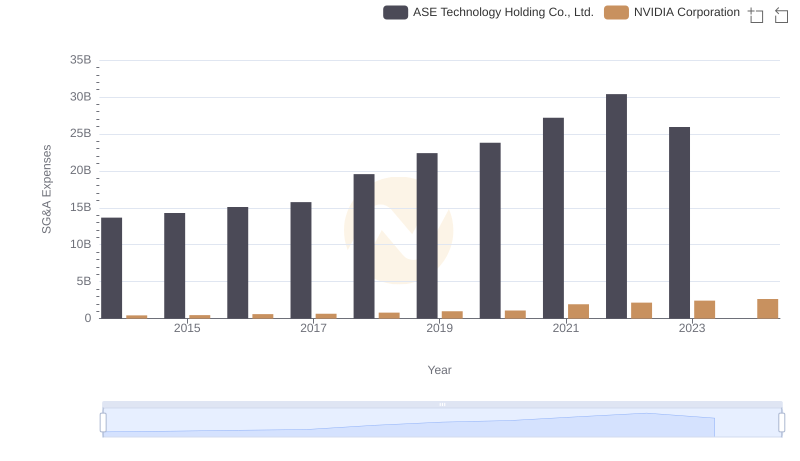

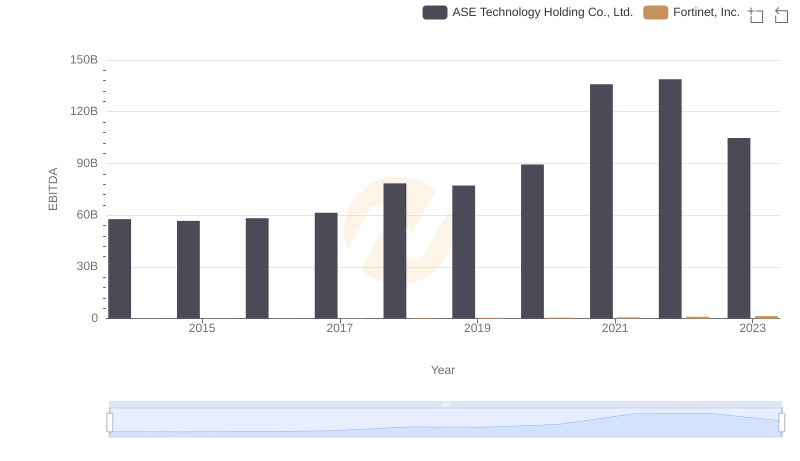

| __timestamp | ASE Technology Holding Co., Ltd. | Fortinet, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 13673000000 | 357151000 |

| Thursday, January 1, 2015 | 14295000000 | 541885000 |

| Friday, January 1, 2016 | 15099000000 | 707581000 |

| Sunday, January 1, 2017 | 15767000000 | 788888000 |

| Monday, January 1, 2018 | 19552000000 | 875300000 |

| Tuesday, January 1, 2019 | 22389000000 | 1029000000 |

| Wednesday, January 1, 2020 | 23806000000 | 1191400000 |

| Friday, January 1, 2021 | 27191000000 | 1489200000 |

| Saturday, January 1, 2022 | 30384000000 | 1855100000 |

| Sunday, January 1, 2023 | 25930017000 | 2217300000 |

| Monday, January 1, 2024 | 27353513000 | 2282600000 |

Unleashing the power of data

In the competitive landscape of technology companies, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, Fortinet, Inc. and ASE Technology Holding Co., Ltd. have shown contrasting approaches to handling these costs. From 2014 to 2023, ASE Technology's SG&A expenses have surged by approximately 90%, peaking in 2022. In contrast, Fortinet's expenses have increased by about 520% over the same period, reflecting its rapid growth and expansion strategy.

While ASE Technology's expenses are significantly higher in absolute terms, Fortinet's relative increase suggests a more aggressive investment in scaling operations. This data provides a fascinating insight into how these two giants prioritize cost management in their strategic planning. As the tech industry continues to evolve, monitoring these trends will be essential for investors and analysts alike.

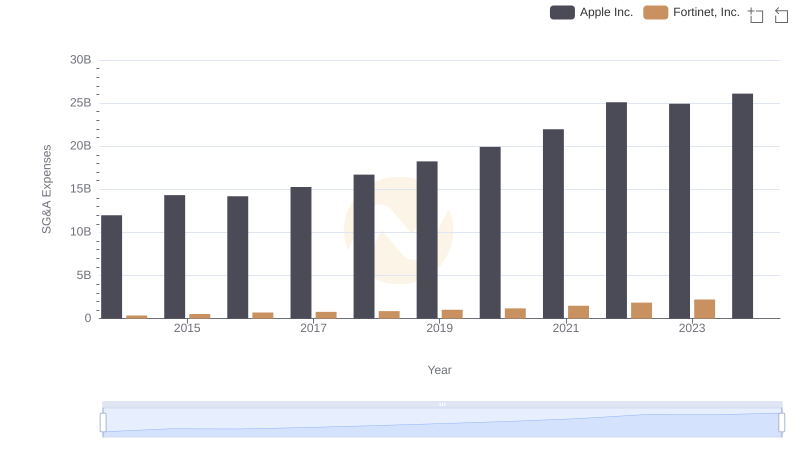

Apple Inc. and Fortinet, Inc.: SG&A Spending Patterns Compared

Operational Costs Compared: SG&A Analysis of NVIDIA Corporation and ASE Technology Holding Co., Ltd.

Who Optimizes SG&A Costs Better? Taiwan Semiconductor Manufacturing Company Limited or Fortinet, Inc.

Who Optimizes SG&A Costs Better? Taiwan Semiconductor Manufacturing Company Limited or ASE Technology Holding Co., Ltd.

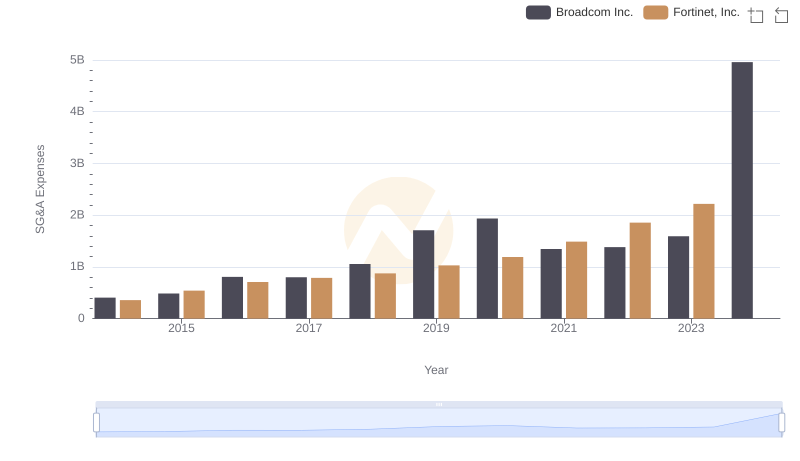

Breaking Down SG&A Expenses: Broadcom Inc. vs Fortinet, Inc.

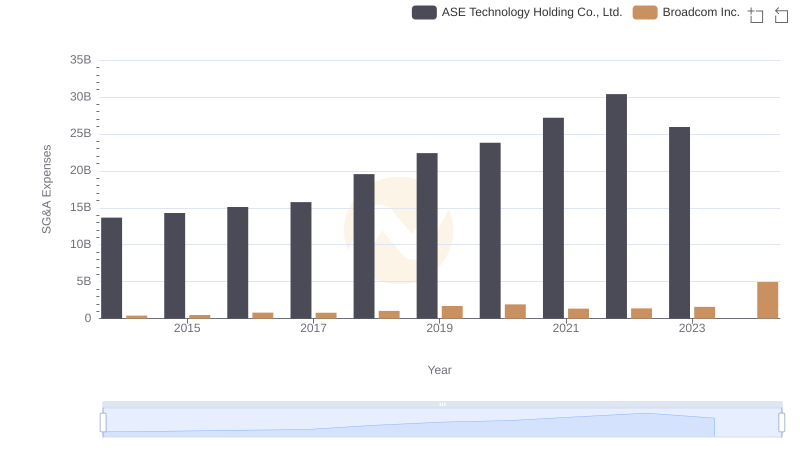

Breaking Down SG&A Expenses: Broadcom Inc. vs ASE Technology Holding Co., Ltd.

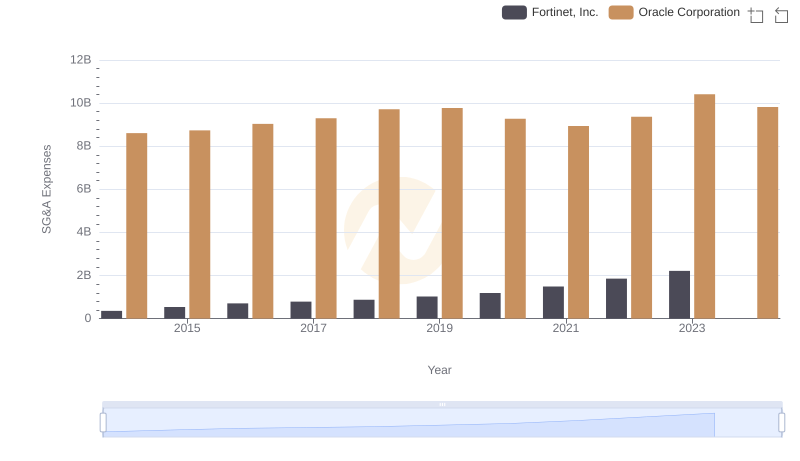

SG&A Efficiency Analysis: Comparing Oracle Corporation and Fortinet, Inc.

Revenue Showdown: Fortinet, Inc. vs ASE Technology Holding Co., Ltd.

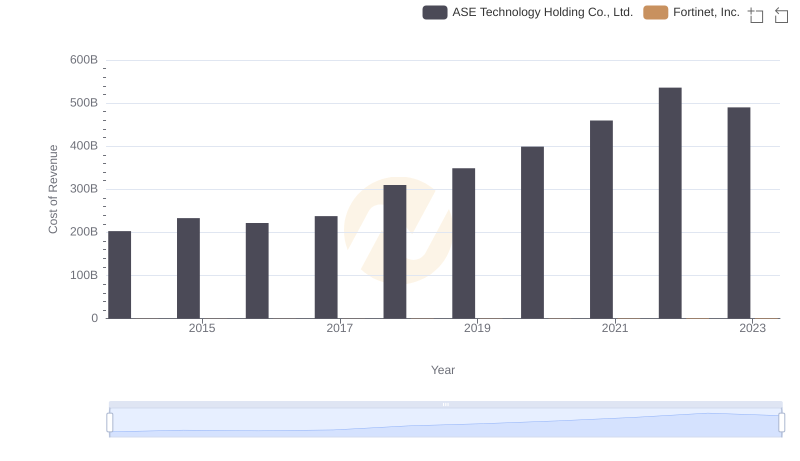

Cost of Revenue Comparison: Fortinet, Inc. vs ASE Technology Holding Co., Ltd.

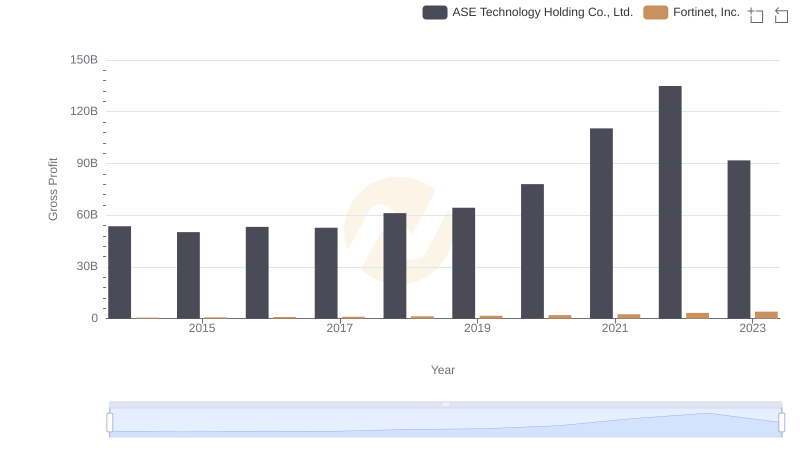

Key Insights on Gross Profit: Fortinet, Inc. vs ASE Technology Holding Co., Ltd.

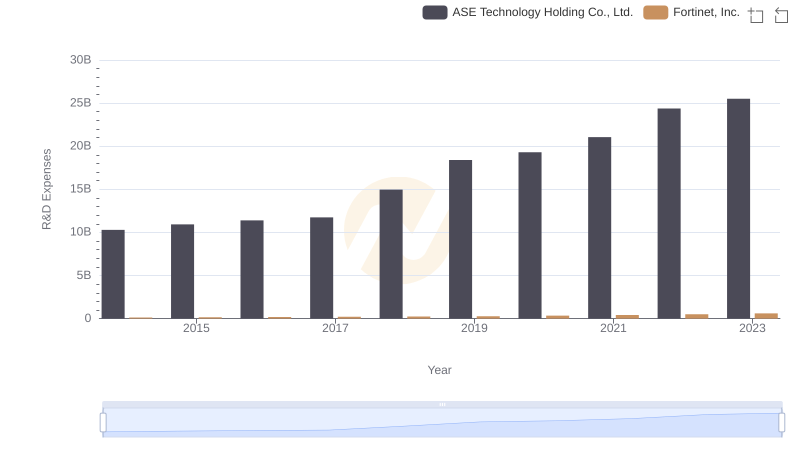

R&D Spending Showdown: Fortinet, Inc. vs ASE Technology Holding Co., Ltd.

Professional EBITDA Benchmarking: Fortinet, Inc. vs ASE Technology Holding Co., Ltd.