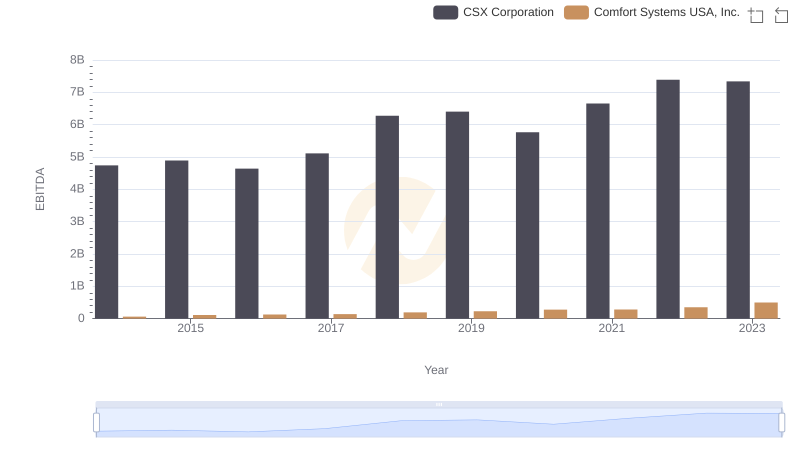

| __timestamp | CSX Corporation | Graco Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 4740000000 | 369321000 |

| Thursday, January 1, 2015 | 4890000000 | 346732000 |

| Friday, January 1, 2016 | 4640000000 | 354454000 |

| Sunday, January 1, 2017 | 5113000000 | 408879000 |

| Monday, January 1, 2018 | 6274000000 | 472905000 |

| Tuesday, January 1, 2019 | 6402000000 | 466687000 |

| Wednesday, January 1, 2020 | 5764000000 | 440431000 |

| Friday, January 1, 2021 | 6653000000 | 578005000 |

| Saturday, January 1, 2022 | 7390000000 | 641618000 |

| Sunday, January 1, 2023 | 7340000000 | 686593000 |

| Monday, January 1, 2024 | 570098000 |

Data in motion

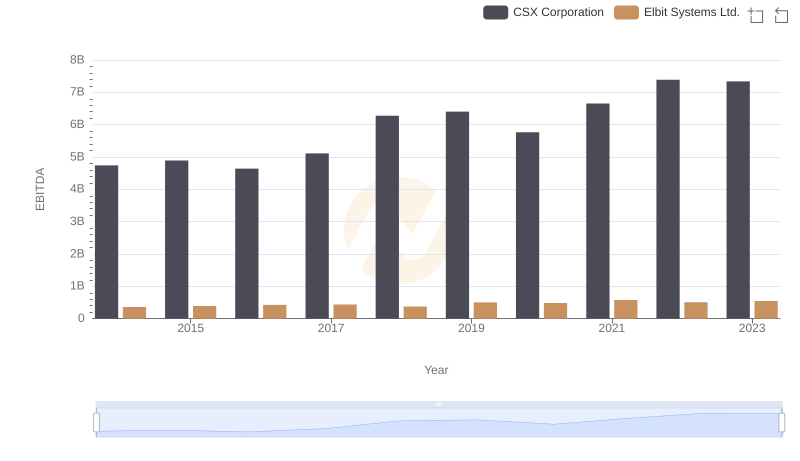

In the competitive landscape of American industry, CSX Corporation and Graco Inc. stand as exemplars of financial resilience and growth. Over the past decade, CSX Corporation has demonstrated a robust EBITDA growth, surging by approximately 55% from 2014 to 2023. This growth reflects the company's strategic initiatives and operational efficiencies. In contrast, Graco Inc. has shown a steady, albeit more modest, increase of around 86% in the same period, highlighting its consistent market presence and adaptability.

While CSX Corporation's EBITDA peaked in 2022, Graco Inc. reached its highest in 2023, showcasing a potential for continued growth. However, the data for 2024 is incomplete, leaving room for speculation on future trajectories. This analysis underscores the dynamic nature of the market and the importance of strategic planning in maintaining financial health.

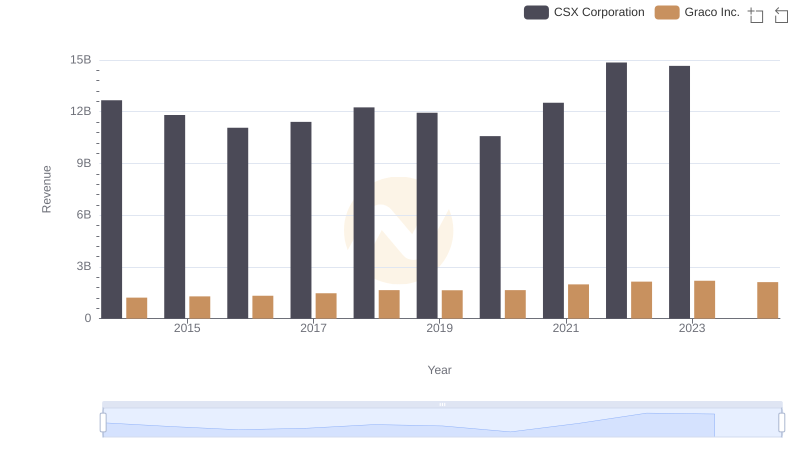

Who Generates More Revenue? CSX Corporation or Graco Inc.

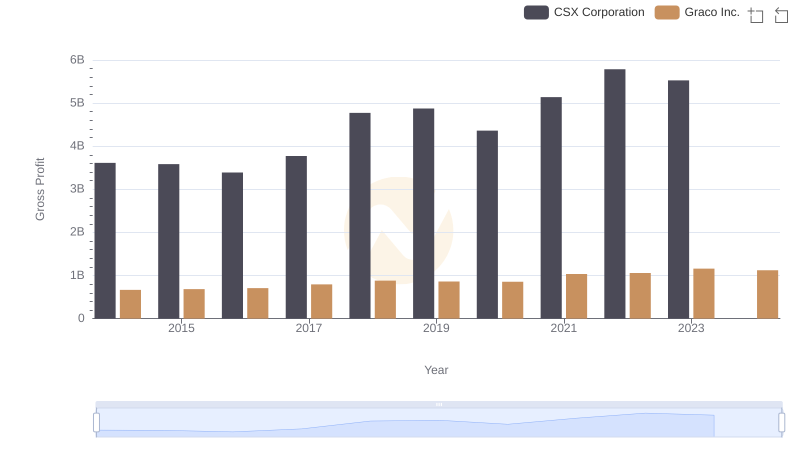

Gross Profit Comparison: CSX Corporation and Graco Inc. Trends

A Professional Review of EBITDA: CSX Corporation Compared to Comfort Systems USA, Inc.

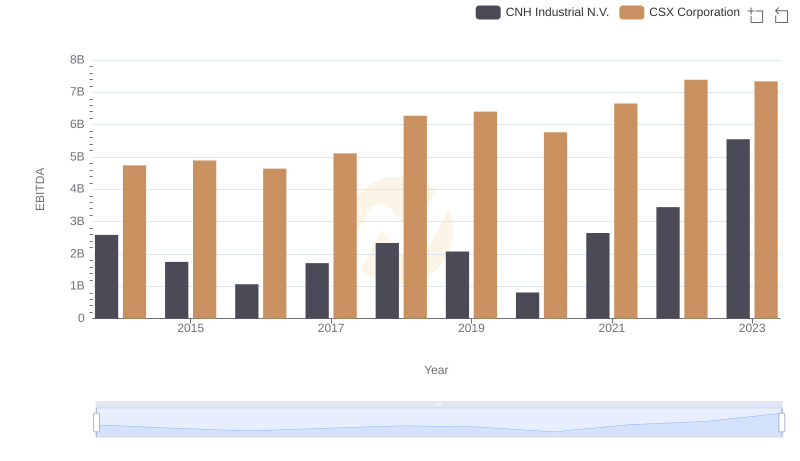

CSX Corporation and CNH Industrial N.V.: A Detailed Examination of EBITDA Performance

CSX Corporation vs Elbit Systems Ltd.: In-Depth EBITDA Performance Comparison