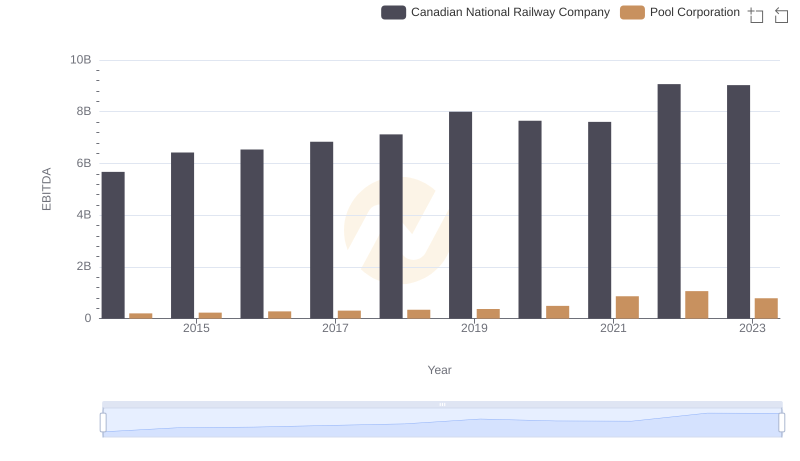

| __timestamp | Canadian National Railway Company | Saia, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 5674000000 | 144715000 |

| Thursday, January 1, 2015 | 6424000000 | 154995000 |

| Friday, January 1, 2016 | 6537000000 | 156092000 |

| Sunday, January 1, 2017 | 6839000000 | 181629000 |

| Monday, January 1, 2018 | 7124000000 | 243709000 |

| Tuesday, January 1, 2019 | 7999000000 | 271318000 |

| Wednesday, January 1, 2020 | 7652000000 | 312448000 |

| Friday, January 1, 2021 | 7607000000 | 472947000 |

| Saturday, January 1, 2022 | 9067000000 | 627741000 |

| Sunday, January 1, 2023 | 9027000000 | 647607000 |

Unleashing insights

In the world of rail transport, Canadian National Railway Company and Saia, Inc. have carved distinct paths over the past decade. From 2014 to 2023, Canadian National Railway's EBITDA surged by approximately 59%, reflecting its robust growth and strategic expansions. In contrast, Saia, Inc. demonstrated a remarkable 347% increase in EBITDA, showcasing its dynamic adaptability and aggressive market strategies.

This comparison highlights the diverse strategies and growth patterns of these two industry players, offering valuable insights into the evolving landscape of North American rail transport.

Gross Profit Comparison: Canadian National Railway Company and Saia, Inc. Trends

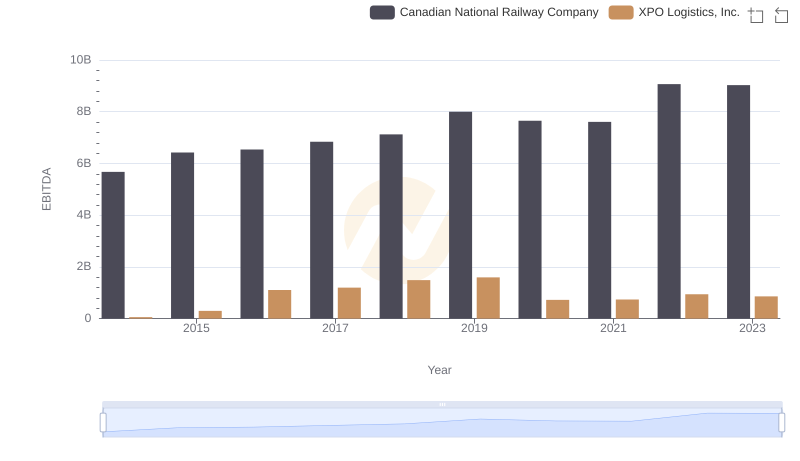

EBITDA Metrics Evaluated: Canadian National Railway Company vs XPO Logistics, Inc.

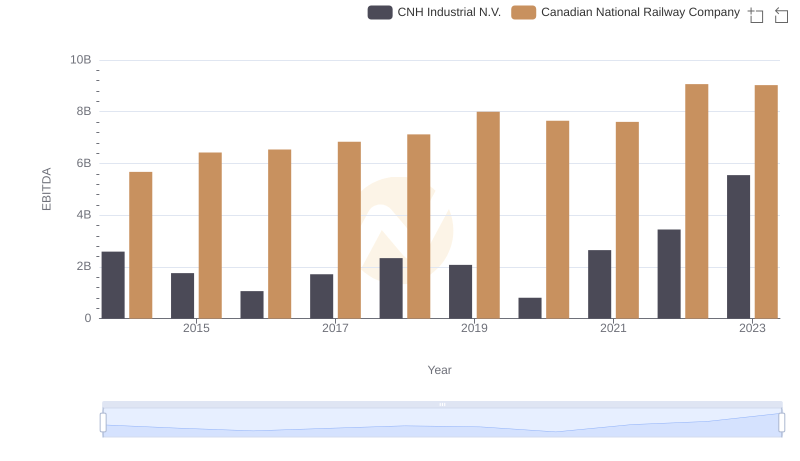

A Professional Review of EBITDA: Canadian National Railway Company Compared to CNH Industrial N.V.

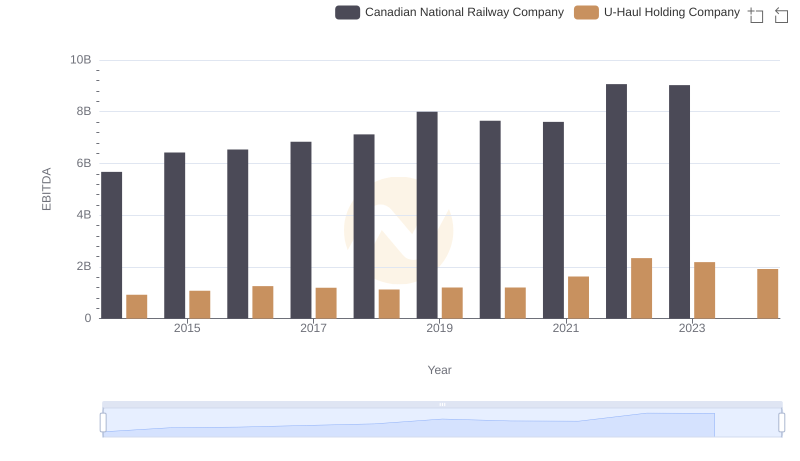

EBITDA Analysis: Evaluating Canadian National Railway Company Against U-Haul Holding Company

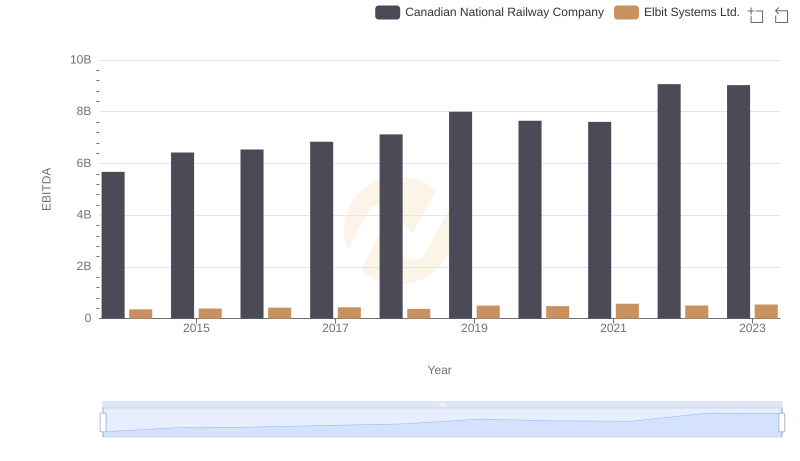

EBITDA Analysis: Evaluating Canadian National Railway Company Against Elbit Systems Ltd.

Professional EBITDA Benchmarking: Canadian National Railway Company vs Pool Corporation