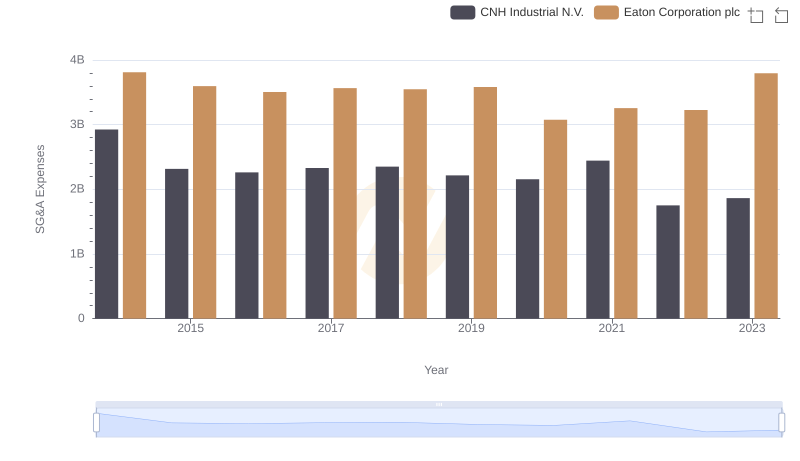

| __timestamp | CNH Industrial N.V. | Eaton Corporation plc |

|---|---|---|

| Wednesday, January 1, 2014 | 25534000000 | 15646000000 |

| Thursday, January 1, 2015 | 20357000000 | 14292000000 |

| Friday, January 1, 2016 | 19539000000 | 13400000000 |

| Sunday, January 1, 2017 | 21621000000 | 13756000000 |

| Monday, January 1, 2018 | 22958000000 | 14511000000 |

| Tuesday, January 1, 2019 | 21832000000 | 14338000000 |

| Wednesday, January 1, 2020 | 21327000000 | 12408000000 |

| Friday, January 1, 2021 | 25951000000 | 13293000000 |

| Saturday, January 1, 2022 | 16797000000 | 13865000000 |

| Sunday, January 1, 2023 | 16805000000 | 14763000000 |

| Monday, January 1, 2024 | 15375000000 |

Infusing magic into the data realm

In the competitive landscape of industrial giants, cost efficiency is a critical metric. Over the past decade, Eaton Corporation plc and CNH Industrial N.V. have showcased distinct trends in their cost of revenue. From 2014 to 2023, CNH Industrial N.V. consistently reported higher costs, peaking in 2021 with a 55% increase from its lowest point in 2022. Meanwhile, Eaton Corporation plc maintained a more stable trajectory, with costs fluctuating within a narrower range, reflecting a strategic focus on cost management.

By 2023, Eaton's cost of revenue was approximately 12% lower than its 2014 figure, indicating improved efficiency. In contrast, CNH's costs decreased by 34% from their 2021 peak, suggesting a recent shift towards cost optimization. This analysis highlights the dynamic strategies of these corporations in managing operational expenses, offering valuable insights for investors and industry analysts.

Comparing Revenue Performance: Eaton Corporation plc or CNH Industrial N.V.?

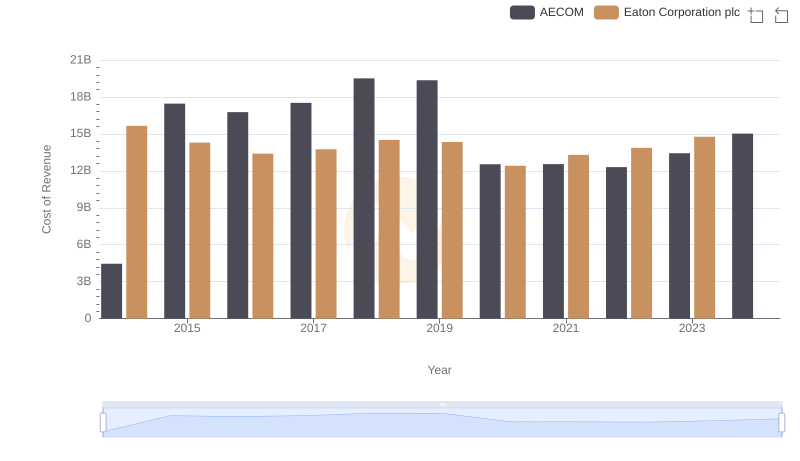

Cost of Revenue Trends: Eaton Corporation plc vs AECOM

Eaton Corporation plc vs Saia, Inc.: Efficiency in Cost of Revenue Explored

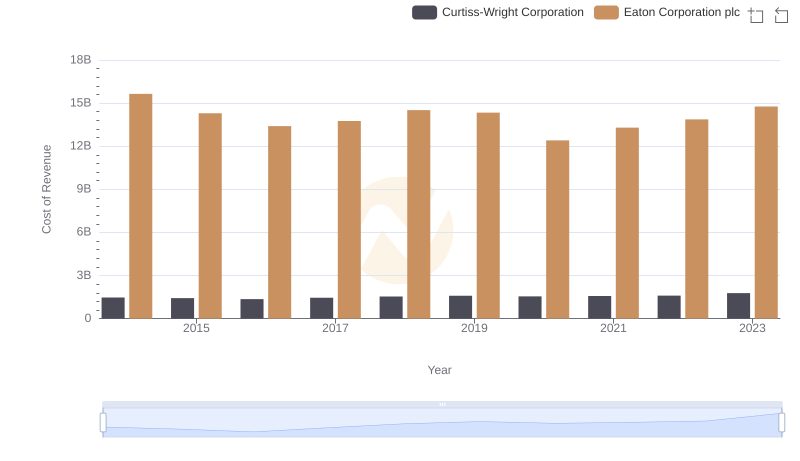

Cost of Revenue: Key Insights for Eaton Corporation plc and Curtiss-Wright Corporation

Eaton Corporation plc or CNH Industrial N.V.: Who Invests More in Innovation?

Eaton Corporation plc and CNH Industrial N.V.: SG&A Spending Patterns Compared