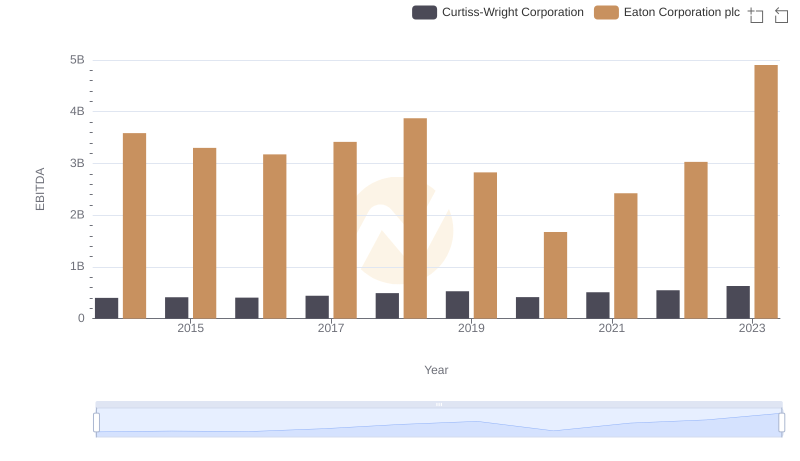

| __timestamp | Curtiss-Wright Corporation | Eaton Corporation plc |

|---|---|---|

| Wednesday, January 1, 2014 | 2243126000 | 22552000000 |

| Thursday, January 1, 2015 | 2205683000 | 20855000000 |

| Friday, January 1, 2016 | 2108931000 | 19747000000 |

| Sunday, January 1, 2017 | 2271026000 | 20404000000 |

| Monday, January 1, 2018 | 2411835000 | 21609000000 |

| Tuesday, January 1, 2019 | 2487961000 | 21390000000 |

| Wednesday, January 1, 2020 | 2391336000 | 17858000000 |

| Friday, January 1, 2021 | 2505931000 | 19628000000 |

| Saturday, January 1, 2022 | 2557025000 | 20752000000 |

| Sunday, January 1, 2023 | 2845373000 | 23196000000 |

| Monday, January 1, 2024 | 3121189000 | 24878000000 |

Unlocking the unknown

In the ever-evolving landscape of industrial manufacturing, Eaton Corporation plc and Curtiss-Wright Corporation have stood as titans, each carving out a significant niche. Over the past decade, Eaton has consistently outpaced Curtiss-Wright in revenue, boasting figures nearly ten times higher. From 2014 to 2023, Eaton's revenue peaked in 2023 at approximately $23.2 billion, marking a 30% increase from its 2020 low. Meanwhile, Curtiss-Wright's revenue saw a steady climb, reaching its zenith in 2023 with a 28% rise from 2014.

These insights underscore the dynamic nature of the industrial sector and the strategic maneuvers of these two industry leaders.

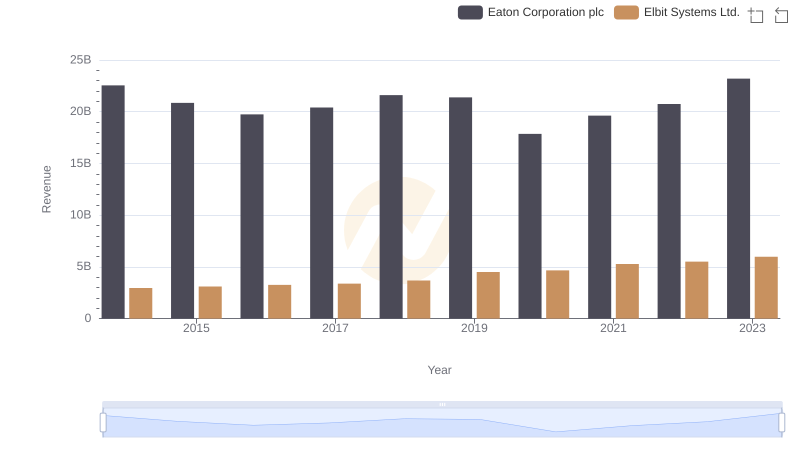

Eaton Corporation plc vs Elbit Systems Ltd.: Examining Key Revenue Metrics

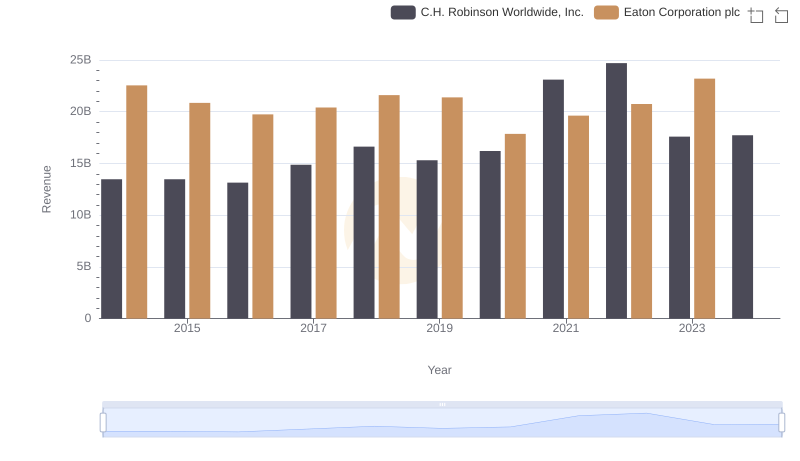

Breaking Down Revenue Trends: Eaton Corporation plc vs C.H. Robinson Worldwide, Inc.

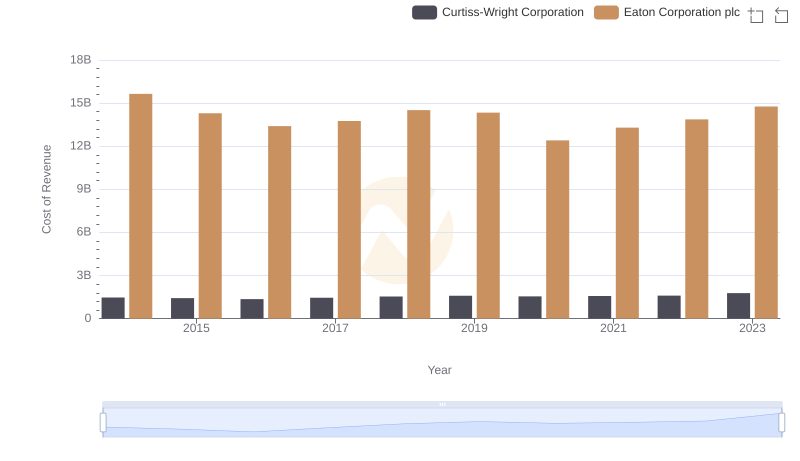

Cost of Revenue: Key Insights for Eaton Corporation plc and Curtiss-Wright Corporation

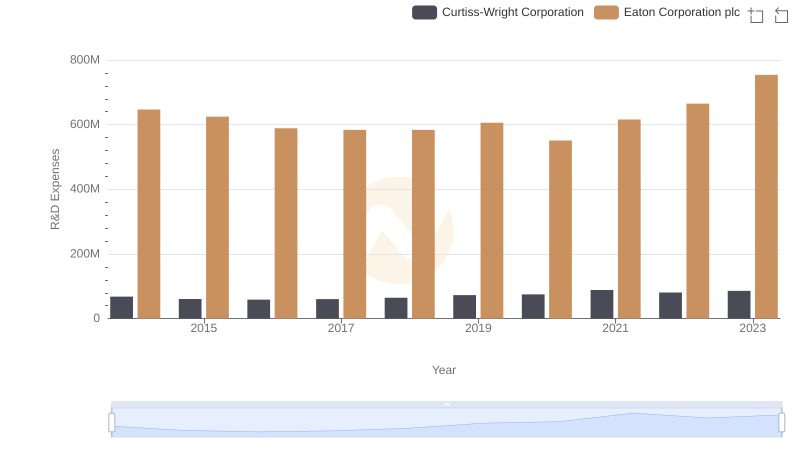

Eaton Corporation plc vs Curtiss-Wright Corporation: Strategic Focus on R&D Spending

A Side-by-Side Analysis of EBITDA: Eaton Corporation plc and Curtiss-Wright Corporation