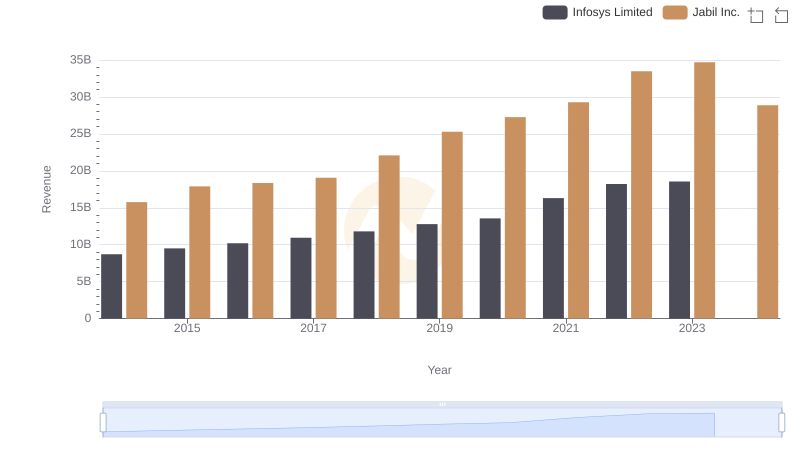

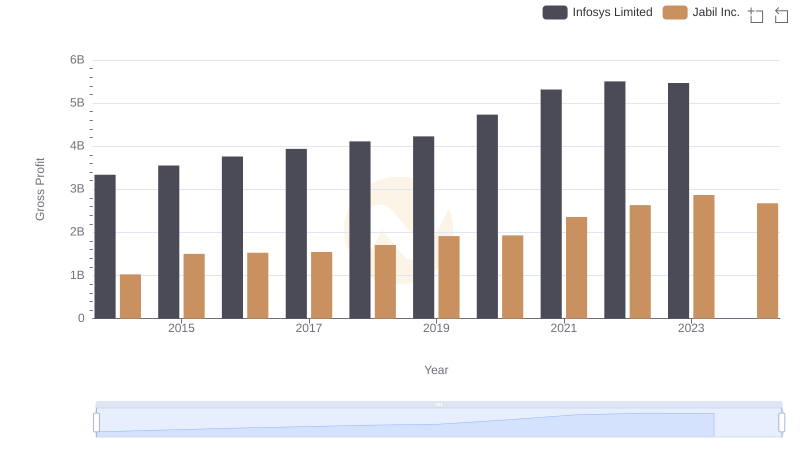

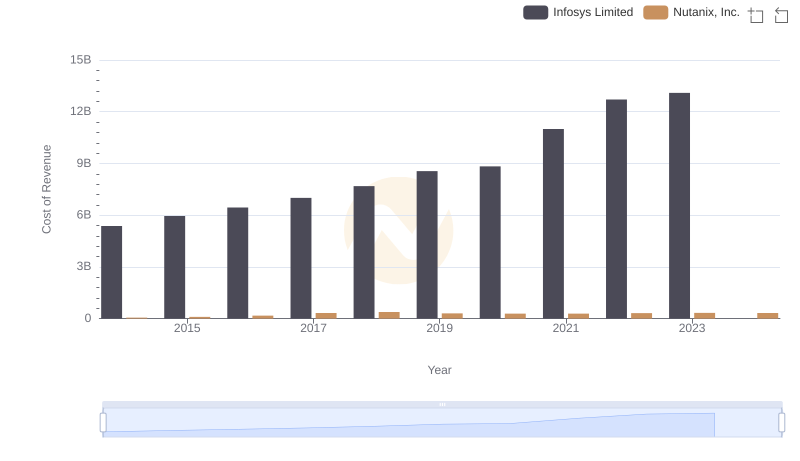

| __timestamp | Infosys Limited | Jabil Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 5374000000 | 14736543000 |

| Thursday, January 1, 2015 | 5950000000 | 16395978000 |

| Friday, January 1, 2016 | 6446000000 | 16825382000 |

| Sunday, January 1, 2017 | 7001000000 | 17517478000 |

| Monday, January 1, 2018 | 7687000000 | 20388624000 |

| Tuesday, January 1, 2019 | 8552000000 | 23368919000 |

| Wednesday, January 1, 2020 | 8828000000 | 25335625000 |

| Friday, January 1, 2021 | 10996000000 | 26926000000 |

| Saturday, January 1, 2022 | 12709000000 | 30846000000 |

| Sunday, January 1, 2023 | 13096000000 | 31835000000 |

| Monday, January 1, 2024 | 26207000000 |

Cracking the code

In the ever-evolving landscape of global business, understanding the cost of revenue is crucial for evaluating a company's operational efficiency. From 2014 to 2023, Infosys Limited and Jabil Inc. have shown distinct trends in their cost of revenue. Infosys Limited, a leader in IT services, has seen a steady increase, with costs rising by approximately 144% over the decade. This growth reflects its expanding global footprint and investment in cutting-edge technologies. Meanwhile, Jabil Inc., a key player in manufacturing solutions, experienced a 116% increase, peaking in 2023. This surge underscores its strategic diversification and robust supply chain management. Notably, 2024 data for Infosys is missing, indicating potential reporting delays or strategic shifts. As these giants continue to navigate the complexities of their industries, stakeholders must keep a keen eye on these financial metrics to gauge future performance.

Infosys Limited and Jabil Inc.: A Comprehensive Revenue Analysis

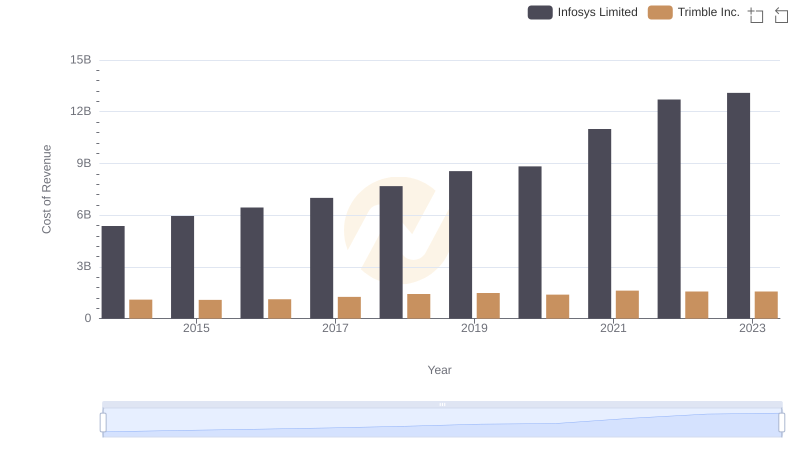

Infosys Limited vs Trimble Inc.: Efficiency in Cost of Revenue Explored

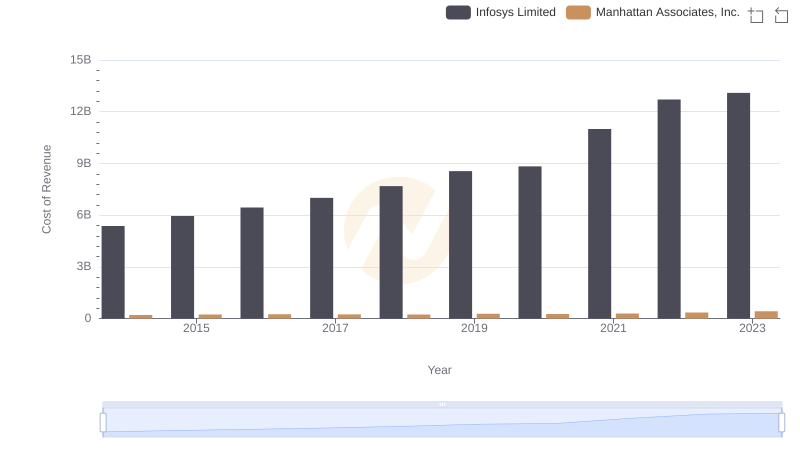

Cost of Revenue Trends: Infosys Limited vs Manhattan Associates, Inc.

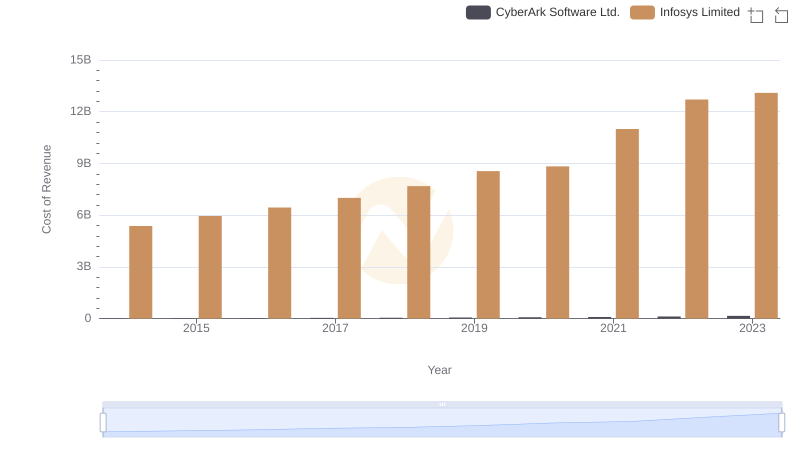

Cost of Revenue: Key Insights for Infosys Limited and CyberArk Software Ltd.

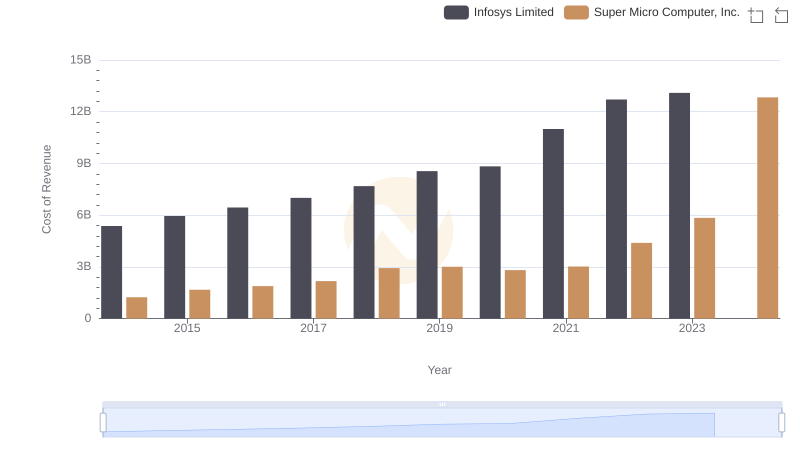

Cost Insights: Breaking Down Infosys Limited and Super Micro Computer, Inc.'s Expenses

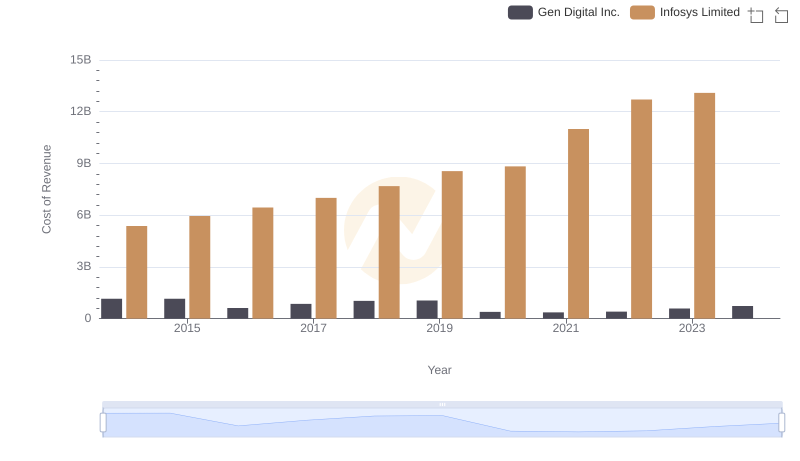

Cost of Revenue Trends: Infosys Limited vs Gen Digital Inc.

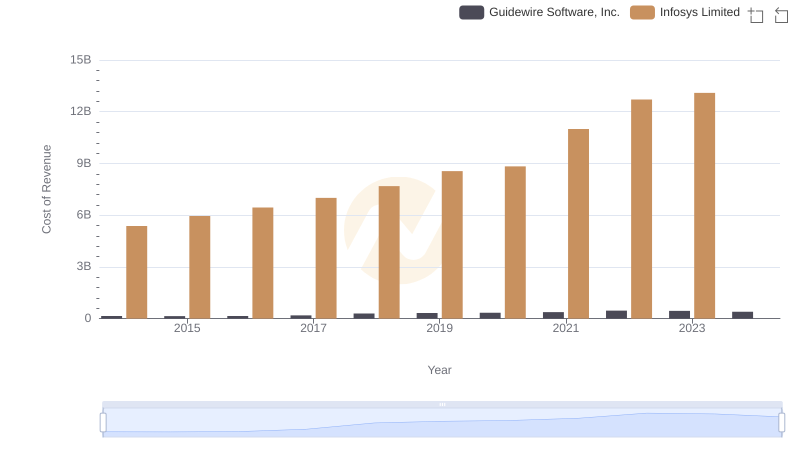

Comparing Cost of Revenue Efficiency: Infosys Limited vs Guidewire Software, Inc.

Gross Profit Comparison: Infosys Limited and Jabil Inc. Trends

Infosys Limited vs Nutanix, Inc.: Efficiency in Cost of Revenue Explored

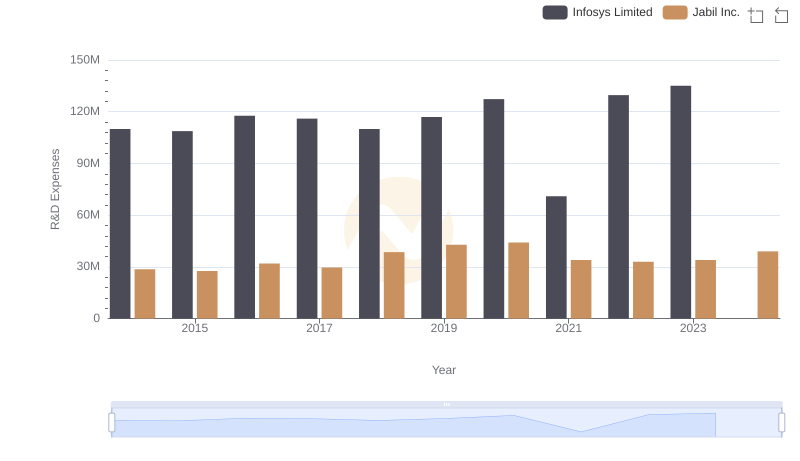

R&D Spending Showdown: Infosys Limited vs Jabil Inc.

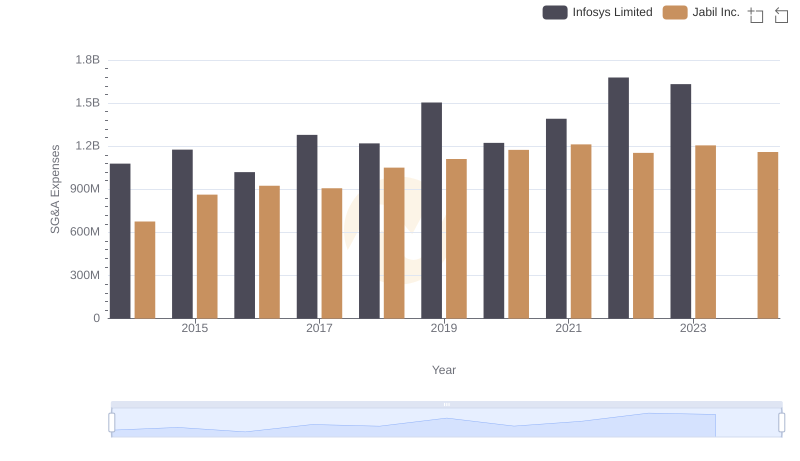

Infosys Limited and Jabil Inc.: SG&A Spending Patterns Compared

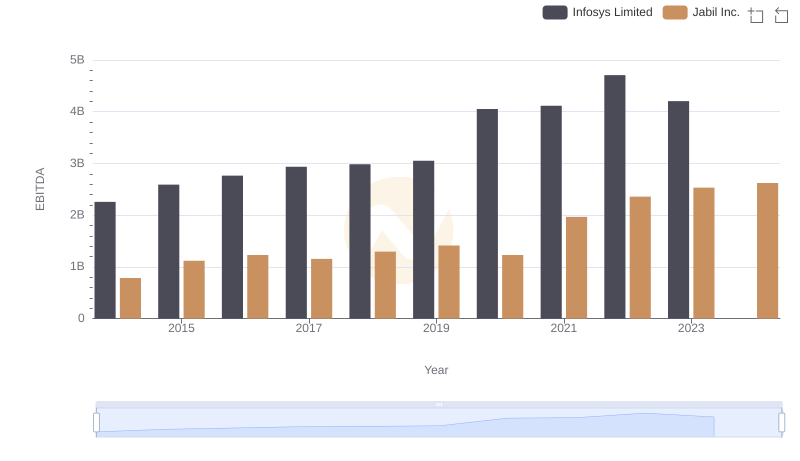

A Professional Review of EBITDA: Infosys Limited Compared to Jabil Inc.