| __timestamp | Automatic Data Processing, Inc. | HEICO Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 7221400000 | 733999000 |

| Thursday, January 1, 2015 | 6427600000 | 754469000 |

| Friday, January 1, 2016 | 6840300000 | 860766000 |

| Sunday, January 1, 2017 | 7269800000 | 950088000 |

| Monday, January 1, 2018 | 7842600000 | 1087006000 |

| Tuesday, January 1, 2019 | 8086600000 | 1241807000 |

| Wednesday, January 1, 2020 | 8445100000 | 1104882000 |

| Friday, January 1, 2021 | 8640300000 | 1138259000 |

| Saturday, January 1, 2022 | 9461900000 | 1345563000 |

| Sunday, January 1, 2023 | 9953400000 | 1814617000 |

| Monday, January 1, 2024 | 10476700000 | 2355943000 |

Unleashing the power of data

In the ever-evolving landscape of corporate finance, understanding the cost of revenue is crucial for evaluating a company's efficiency. This analysis focuses on Automatic Data Processing, Inc. (ADP) and HEICO Corporation, two giants in their respective industries. Over the past decade, ADP has consistently outperformed HEICO in terms of cost of revenue, with a notable increase of approximately 45% from 2014 to 2024. In contrast, HEICO's cost of revenue has surged by over 220% during the same period, reflecting its aggressive growth strategy.

ADP's cost of revenue peaked in 2024, reaching over $10 billion, while HEICO's reached nearly $2.4 billion. This disparity highlights ADP's larger scale of operations. However, HEICO's rapid growth trajectory suggests a dynamic shift in its business model. As we move forward, these trends offer valuable insights into the strategic priorities of these companies.

Comparing Cost of Revenue Efficiency: Automatic Data Processing, Inc. vs Rockwell Automation, Inc.

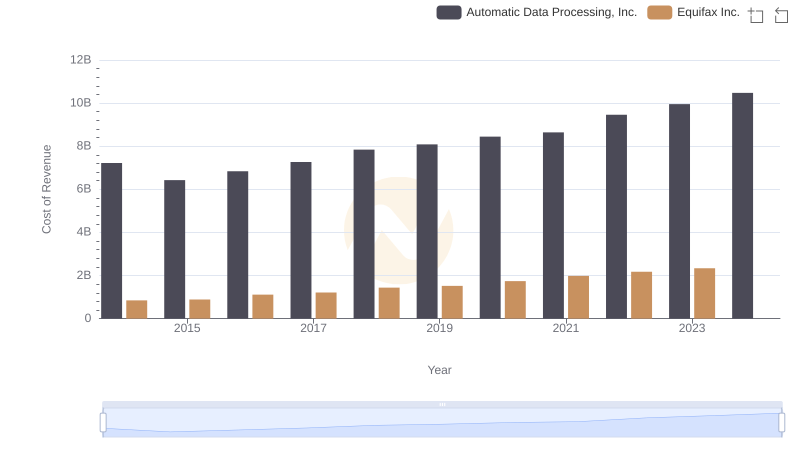

Cost of Revenue: Key Insights for Automatic Data Processing, Inc. and Equifax Inc.

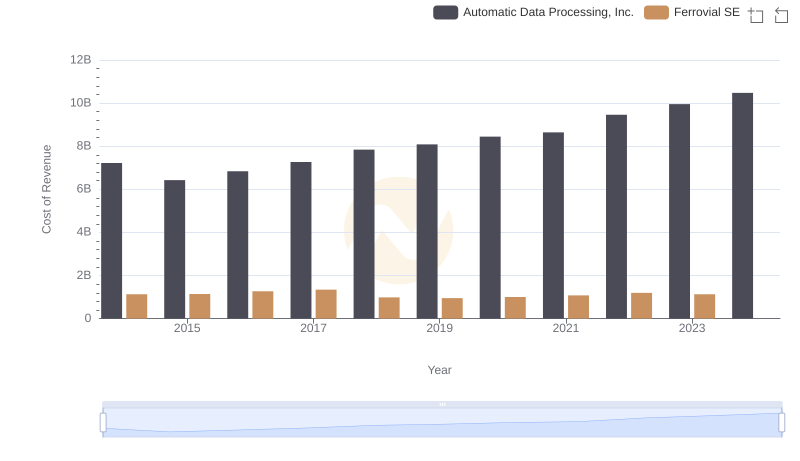

Cost of Revenue Comparison: Automatic Data Processing, Inc. vs Ferrovial SE

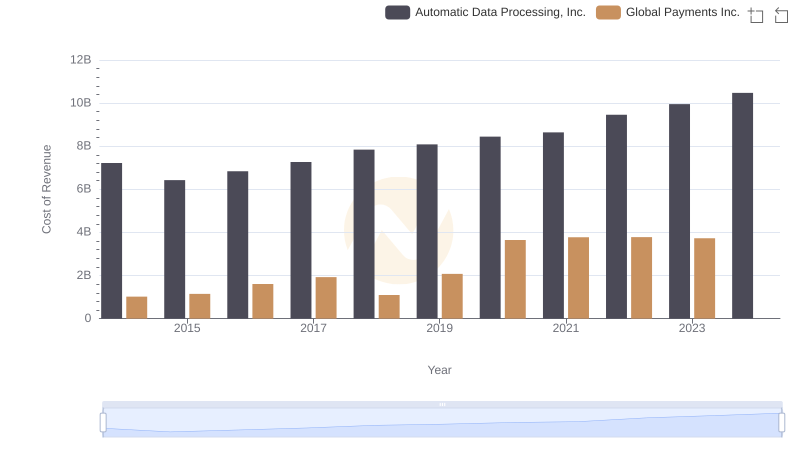

Cost of Revenue: Key Insights for Automatic Data Processing, Inc. and Global Payments Inc.

Automatic Data Processing, Inc. vs HEICO Corporation: In-Depth EBITDA Performance Comparison