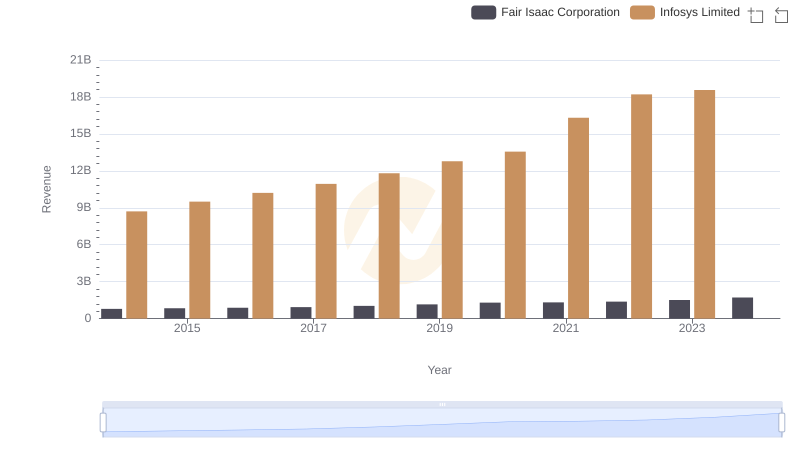

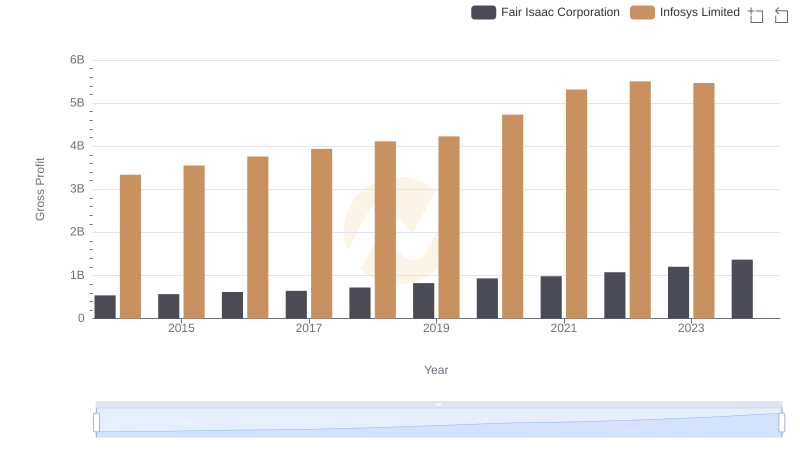

| __timestamp | Fair Isaac Corporation | Infosys Limited |

|---|---|---|

| Wednesday, January 1, 2014 | 249281000 | 5374000000 |

| Thursday, January 1, 2015 | 270535000 | 5950000000 |

| Friday, January 1, 2016 | 265173000 | 6446000000 |

| Sunday, January 1, 2017 | 287123000 | 7001000000 |

| Monday, January 1, 2018 | 310699000 | 7687000000 |

| Tuesday, January 1, 2019 | 336845000 | 8552000000 |

| Wednesday, January 1, 2020 | 361142000 | 8828000000 |

| Friday, January 1, 2021 | 332462000 | 10996000000 |

| Saturday, January 1, 2022 | 302174000 | 12709000000 |

| Sunday, January 1, 2023 | 311053000 | 13096000000 |

| Monday, January 1, 2024 | 348206000 |

Data in motion

In the ever-evolving landscape of global business, understanding cost structures is pivotal. This analysis delves into the cost of revenue trends for two industry giants: Infosys Limited and Fair Isaac Corporation, from 2014 to 2023. Over this decade, Infosys Limited has seen a remarkable 144% increase in its cost of revenue, reflecting its expansive growth and operational scaling. In contrast, Fair Isaac Corporation's cost of revenue has grown by approximately 40%, indicating a more stable yet consistent expansion.

These insights offer a window into the strategic financial maneuvers of these corporations, highlighting their distinct growth trajectories.

Analyzing Cost of Revenue: Infosys Limited and NXP Semiconductors N.V.

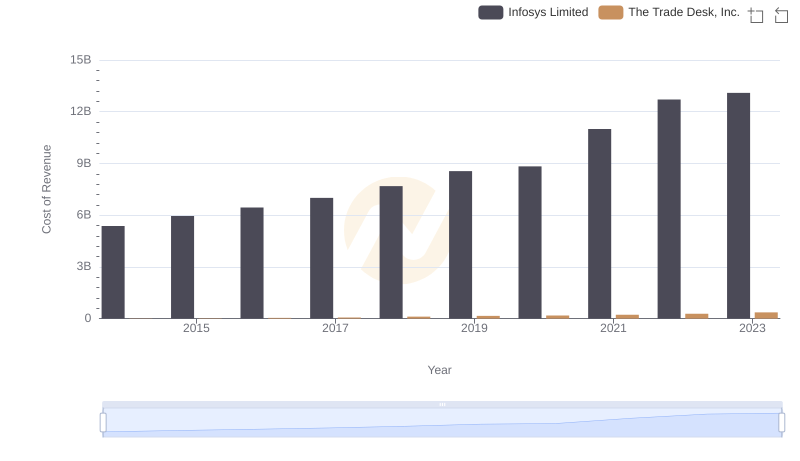

Cost of Revenue: Key Insights for Infosys Limited and The Trade Desk, Inc.

Revenue Insights: Infosys Limited and Fair Isaac Corporation Performance Compared

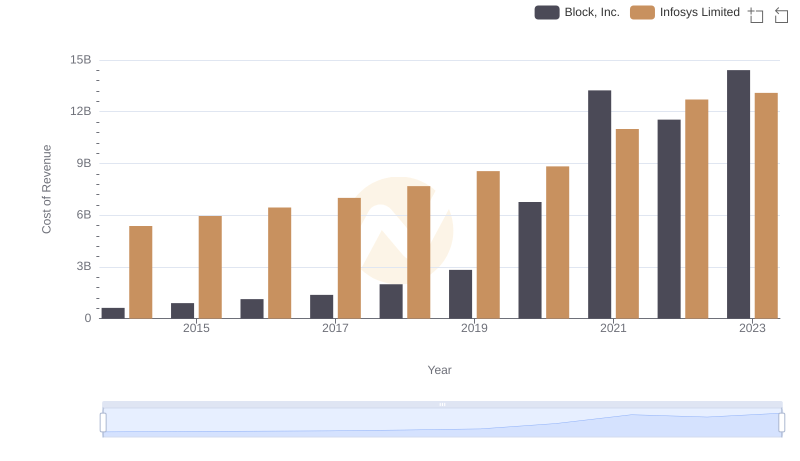

Cost Insights: Breaking Down Infosys Limited and Block, Inc.'s Expenses

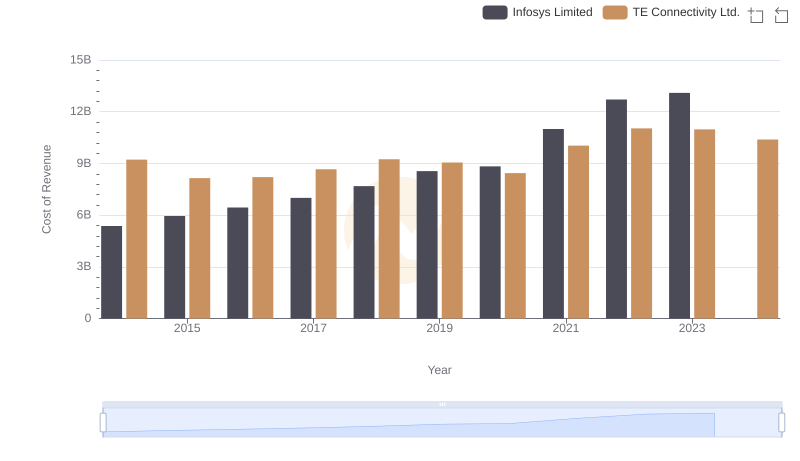

Cost Insights: Breaking Down Infosys Limited and TE Connectivity Ltd.'s Expenses

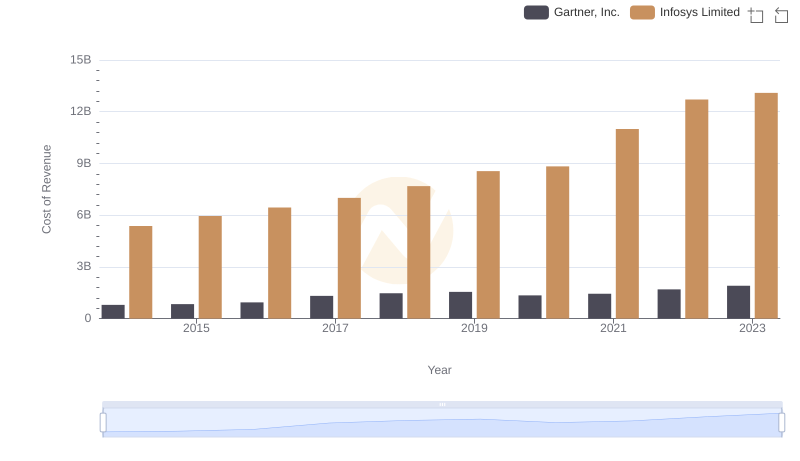

Cost of Revenue Comparison: Infosys Limited vs Gartner, Inc.

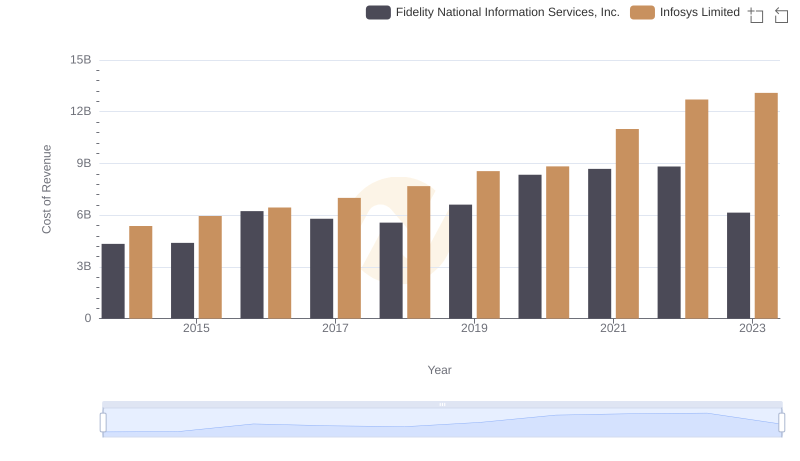

Infosys Limited vs Fidelity National Information Services, Inc.: Efficiency in Cost of Revenue Explored

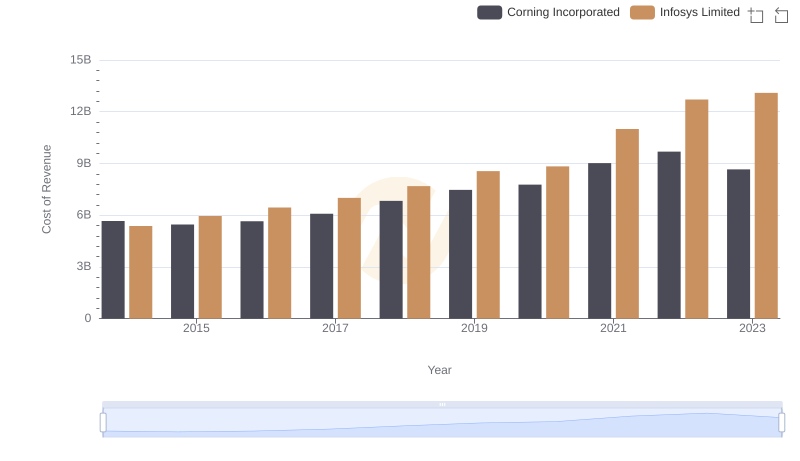

Infosys Limited vs Corning Incorporated: Efficiency in Cost of Revenue Explored

Gross Profit Trends Compared: Infosys Limited vs Fair Isaac Corporation

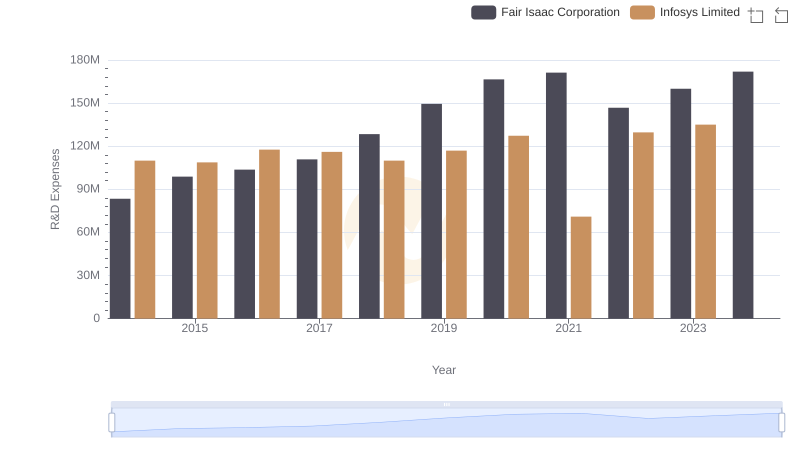

Research and Development Expenses Breakdown: Infosys Limited vs Fair Isaac Corporation

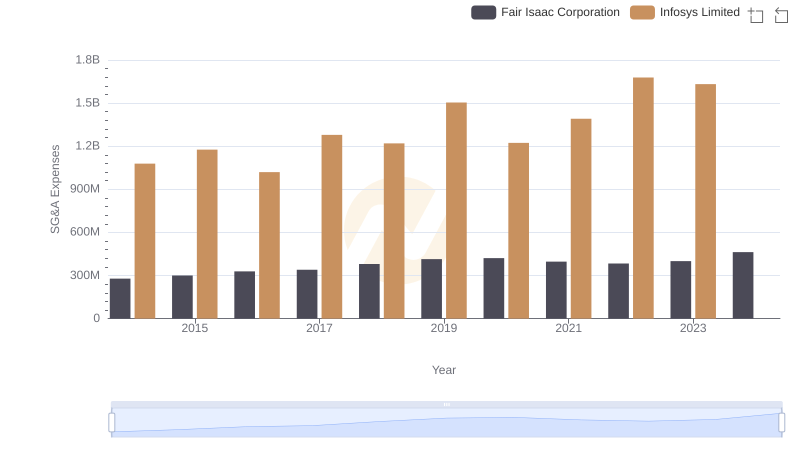

Who Optimizes SG&A Costs Better? Infosys Limited or Fair Isaac Corporation

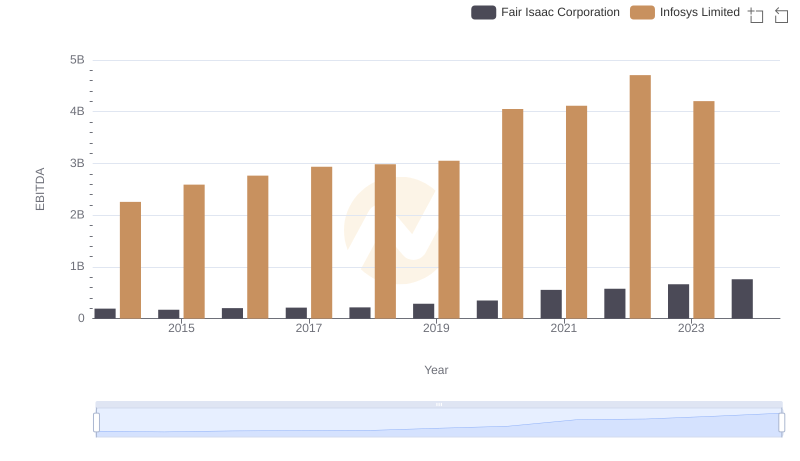

A Side-by-Side Analysis of EBITDA: Infosys Limited and Fair Isaac Corporation