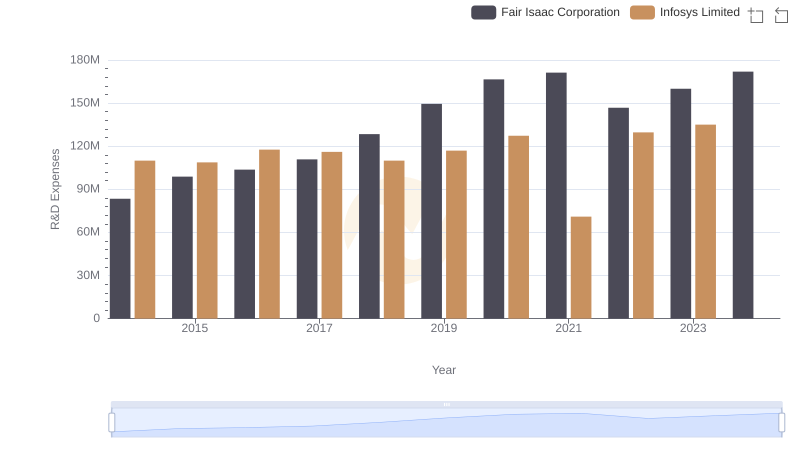

| __timestamp | Fair Isaac Corporation | Infosys Limited |

|---|---|---|

| Wednesday, January 1, 2014 | 278203000 | 1079000000 |

| Thursday, January 1, 2015 | 300002000 | 1176000000 |

| Friday, January 1, 2016 | 328940000 | 1020000000 |

| Sunday, January 1, 2017 | 339796000 | 1279000000 |

| Monday, January 1, 2018 | 380362000 | 1220000000 |

| Tuesday, January 1, 2019 | 414086000 | 1504000000 |

| Wednesday, January 1, 2020 | 420930000 | 1223000000 |

| Friday, January 1, 2021 | 396281000 | 1391000000 |

| Saturday, January 1, 2022 | 383863000 | 1678000000 |

| Sunday, January 1, 2023 | 400565000 | 1632000000 |

| Monday, January 1, 2024 | 462834000 |

Unleashing the power of data

In the competitive world of technology and analytics, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, Infosys Limited and Fair Isaac Corporation have demonstrated contrasting strategies in optimizing these costs. From 2014 to 2023, Infosys consistently reported higher SG&A expenses, averaging around 1.32 billion annually, compared to Fair Isaac's 373 million. However, Fair Isaac's expenses grew by approximately 66% over this period, while Infosys saw a 51% increase. This suggests that while Infosys operates on a larger scale, Fair Isaac is rapidly expanding its operational footprint. Notably, 2024 data for Infosys is missing, indicating potential reporting delays or strategic shifts. As these companies continue to evolve, their ability to manage SG&A costs will remain a key indicator of their financial health and operational efficiency.

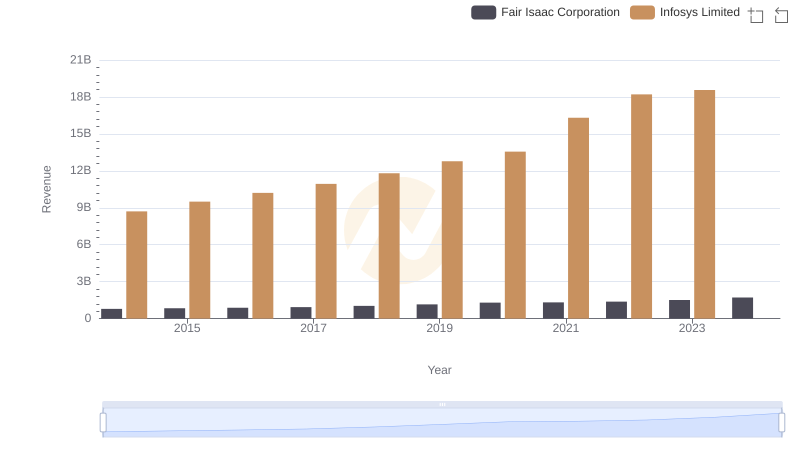

Revenue Insights: Infosys Limited and Fair Isaac Corporation Performance Compared

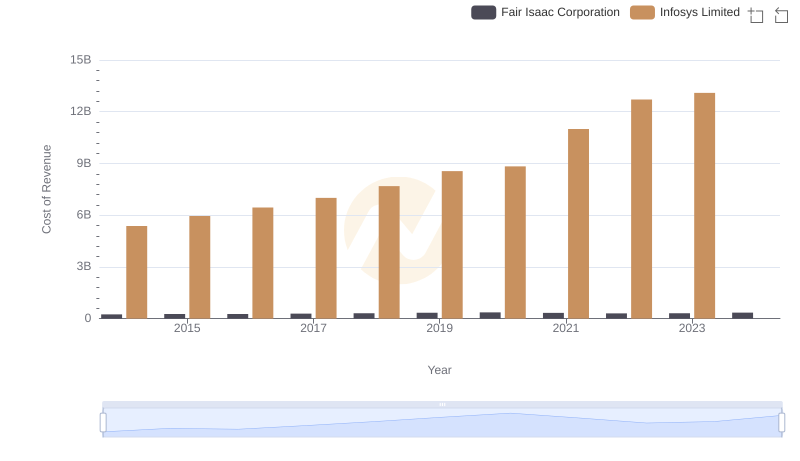

Cost Insights: Breaking Down Infosys Limited and Fair Isaac Corporation's Expenses

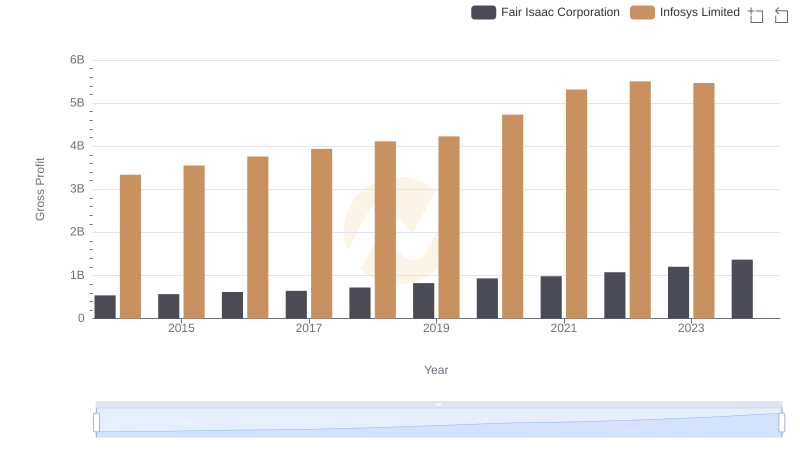

Gross Profit Trends Compared: Infosys Limited vs Fair Isaac Corporation

Research and Development Expenses Breakdown: Infosys Limited vs Fair Isaac Corporation

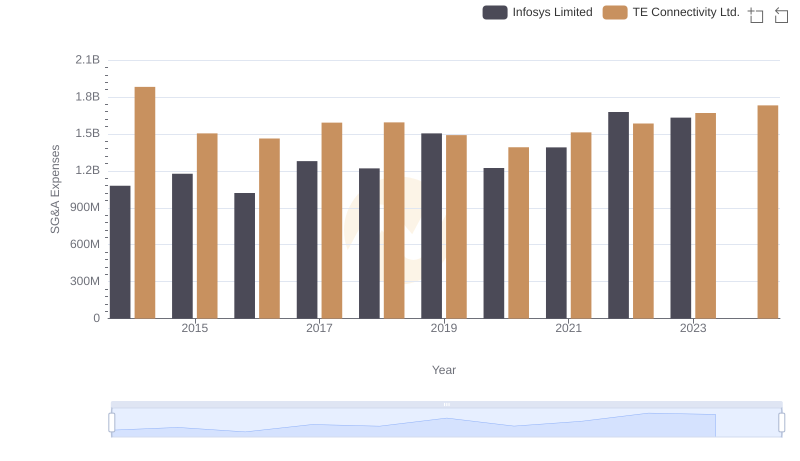

Breaking Down SG&A Expenses: Infosys Limited vs TE Connectivity Ltd.

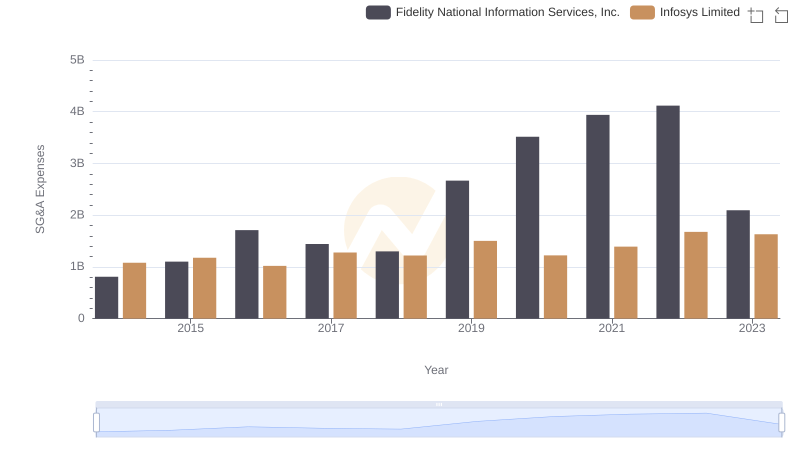

Operational Costs Compared: SG&A Analysis of Infosys Limited and Fidelity National Information Services, Inc.

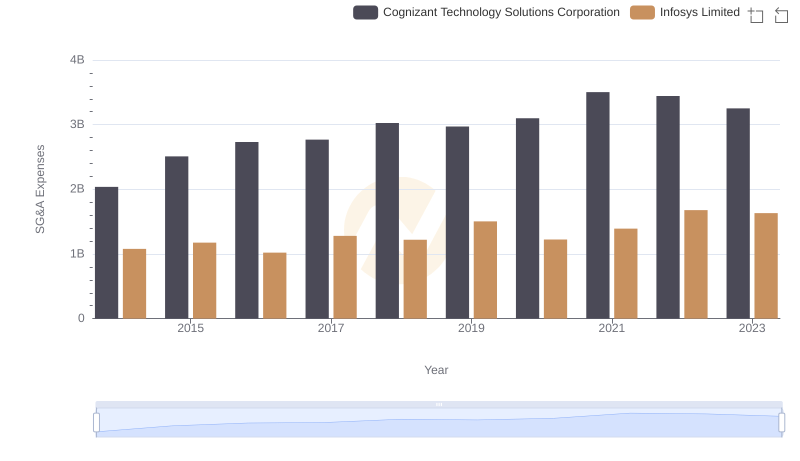

Infosys Limited and Cognizant Technology Solutions Corporation: SG&A Spending Patterns Compared

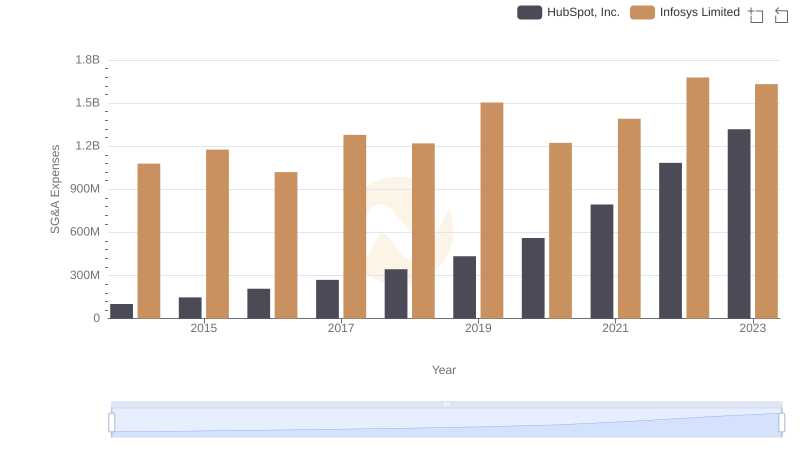

Infosys Limited or HubSpot, Inc.: Who Manages SG&A Costs Better?

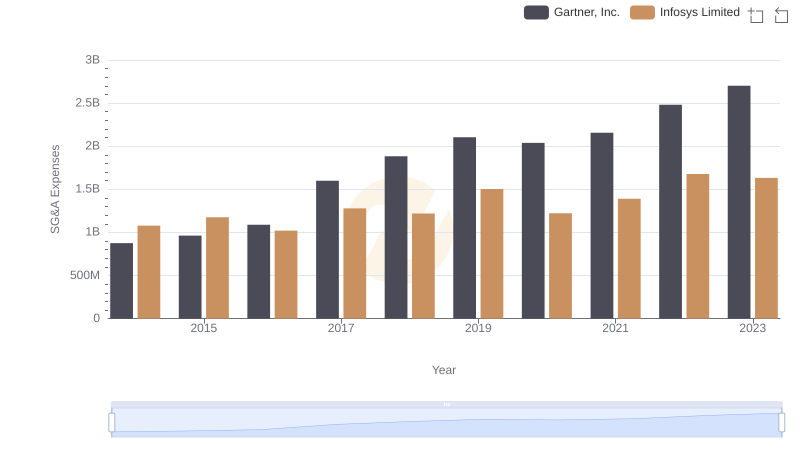

Cost Management Insights: SG&A Expenses for Infosys Limited and Gartner, Inc.

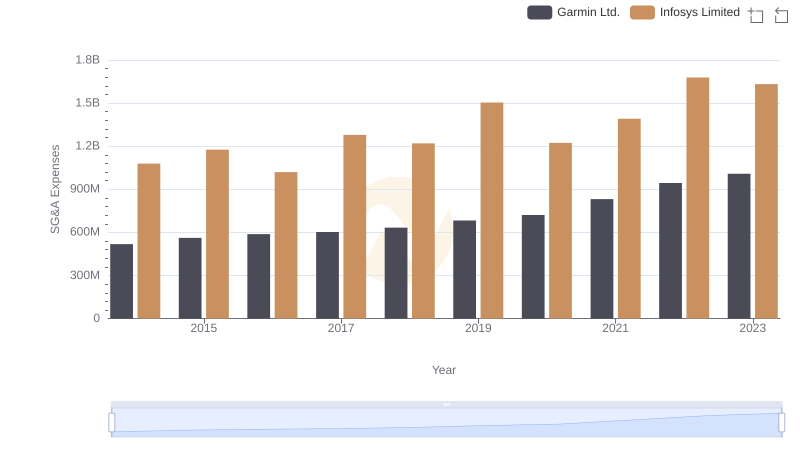

Infosys Limited and Garmin Ltd.: SG&A Spending Patterns Compared

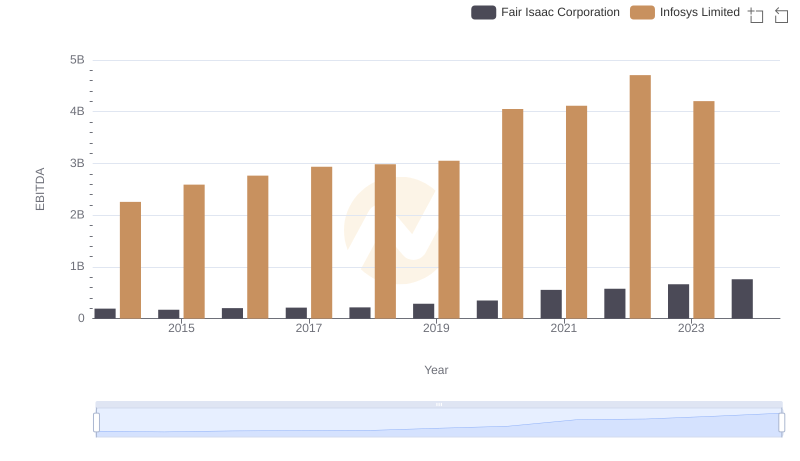

A Side-by-Side Analysis of EBITDA: Infosys Limited and Fair Isaac Corporation

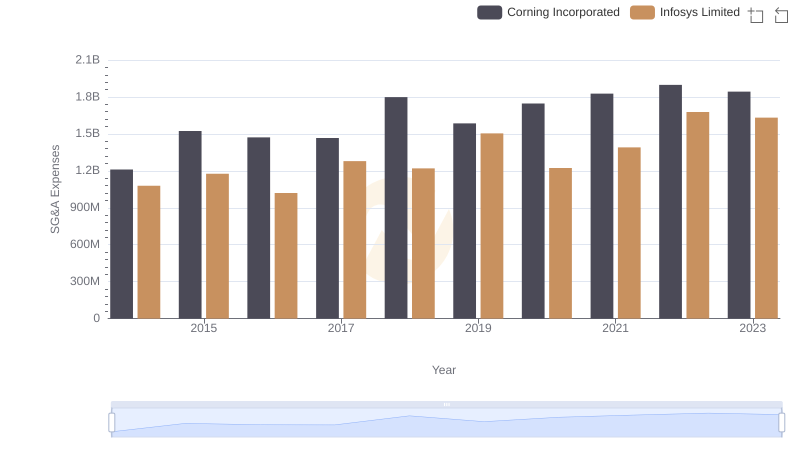

Selling, General, and Administrative Costs: Infosys Limited vs Corning Incorporated