| __timestamp | Rockwell Automation, Inc. | The Boeing Company |

|---|---|---|

| Wednesday, January 1, 2014 | 1570100000 | 3767000000 |

| Thursday, January 1, 2015 | 1506400000 | 3525000000 |

| Friday, January 1, 2016 | 1467400000 | 3616000000 |

| Sunday, January 1, 2017 | 1591500000 | 4094000000 |

| Monday, January 1, 2018 | 1599000000 | 4567000000 |

| Tuesday, January 1, 2019 | 1538500000 | 3909000000 |

| Wednesday, January 1, 2020 | 1479800000 | 4817000000 |

| Friday, January 1, 2021 | 1680000000 | 4157000000 |

| Saturday, January 1, 2022 | 1766700000 | 4187000000 |

| Sunday, January 1, 2023 | 2023700000 | 5168000000 |

| Monday, January 1, 2024 | 2002600000 | 5021000000 |

Unleashing insights

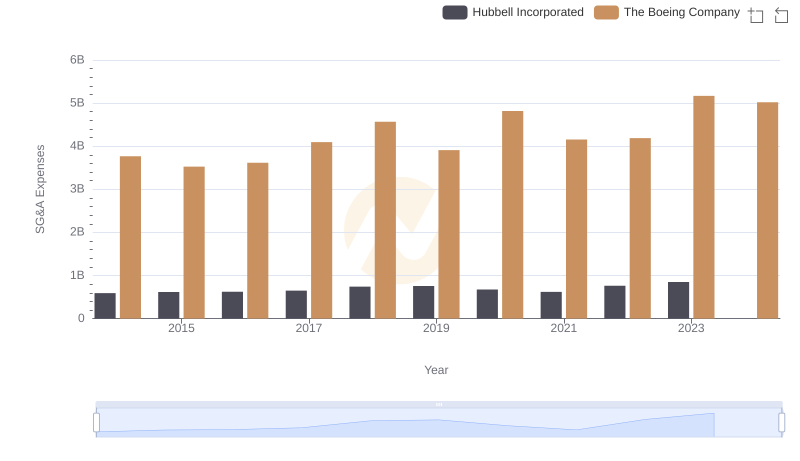

In the competitive world of aerospace and automation, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, Rockwell Automation, Inc. and The Boeing Company have showcased distinct strategies in optimizing these costs.

From 2014 to 2024, Rockwell Automation's SG&A expenses have seen a modest increase of about 28%, starting from approximately $1.57 billion to $2.00 billion. In contrast, Boeing's expenses have surged by nearly 33%, from $3.77 billion to $5.02 billion. This indicates that while both companies have faced rising costs, Rockwell Automation has maintained a more stable growth trajectory.

The data suggests that Rockwell Automation's approach to cost management might be more effective, especially in a volatile economic landscape. As industries evolve, the ability to control SG&A expenses could be a key differentiator in maintaining competitive advantage.

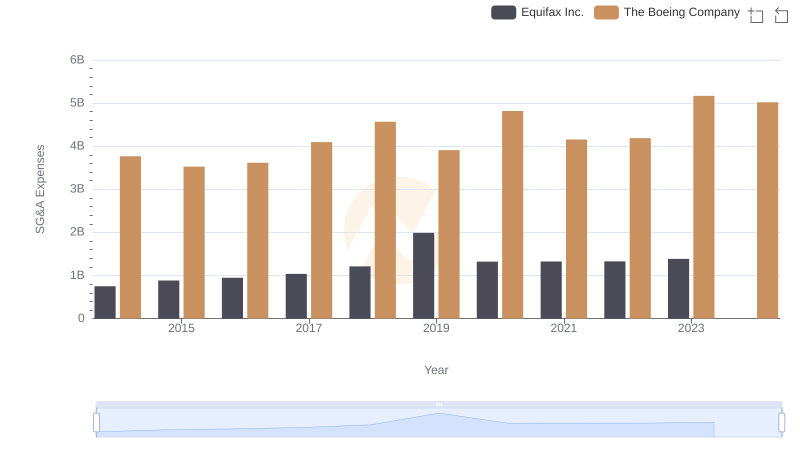

Comparing SG&A Expenses: The Boeing Company vs Equifax Inc. Trends and Insights

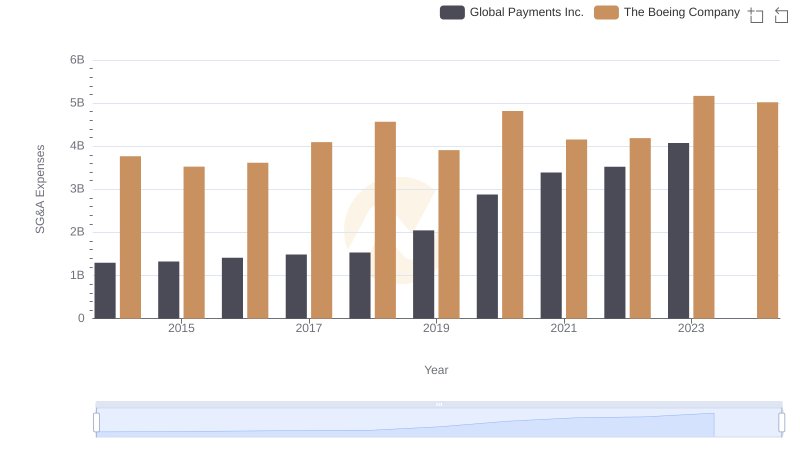

Comparing SG&A Expenses: The Boeing Company vs Global Payments Inc. Trends and Insights

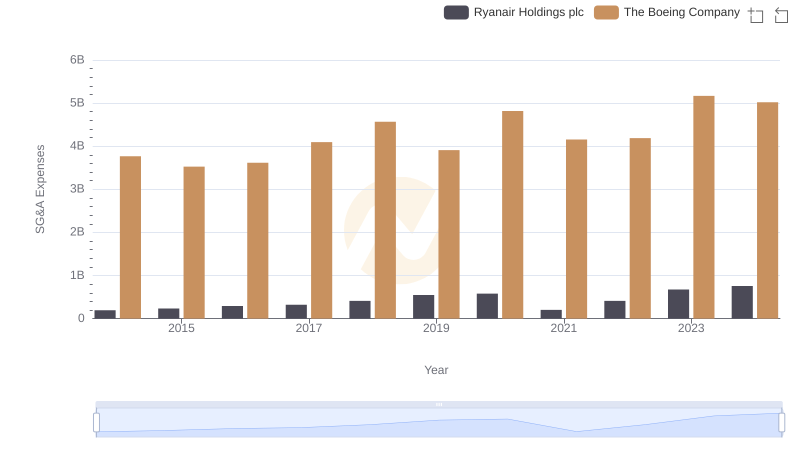

Breaking Down SG&A Expenses: The Boeing Company vs Ryanair Holdings plc

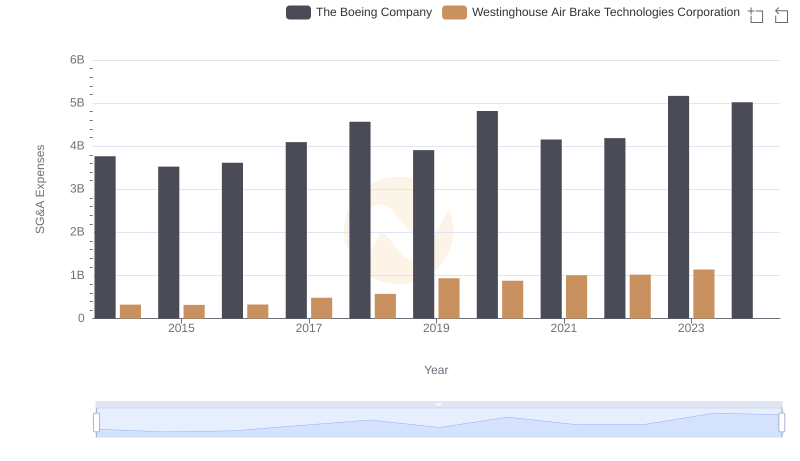

Who Optimizes SG&A Costs Better? The Boeing Company or Westinghouse Air Brake Technologies Corporation

The Boeing Company vs Hubbell Incorporated: SG&A Expense Trends