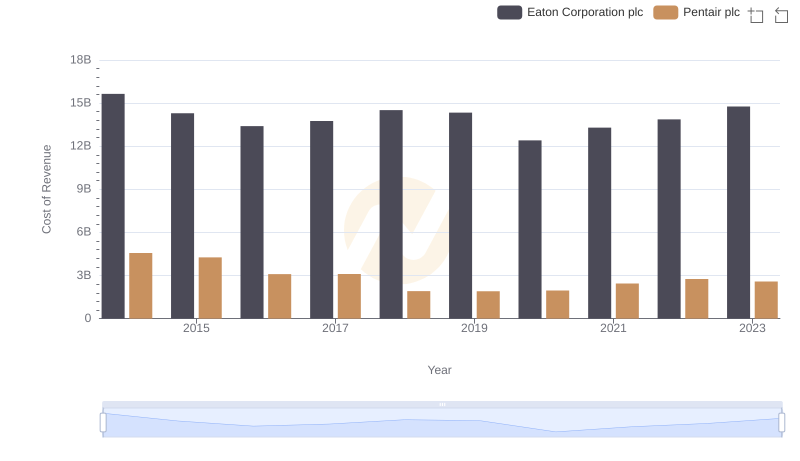

| __timestamp | Eaton Corporation plc | Pentair plc |

|---|---|---|

| Wednesday, January 1, 2014 | 22552000000 | 7039000000 |

| Thursday, January 1, 2015 | 20855000000 | 6449000000 |

| Friday, January 1, 2016 | 19747000000 | 4890000000 |

| Sunday, January 1, 2017 | 20404000000 | 4936500000 |

| Monday, January 1, 2018 | 21609000000 | 2965100000 |

| Tuesday, January 1, 2019 | 21390000000 | 2957200000 |

| Wednesday, January 1, 2020 | 17858000000 | 3017800000 |

| Friday, January 1, 2021 | 19628000000 | 3764800000 |

| Saturday, January 1, 2022 | 20752000000 | 4121800000 |

| Sunday, January 1, 2023 | 23196000000 | 4104500000 |

| Monday, January 1, 2024 | 24878000000 | 4082800000 |

Igniting the spark of knowledge

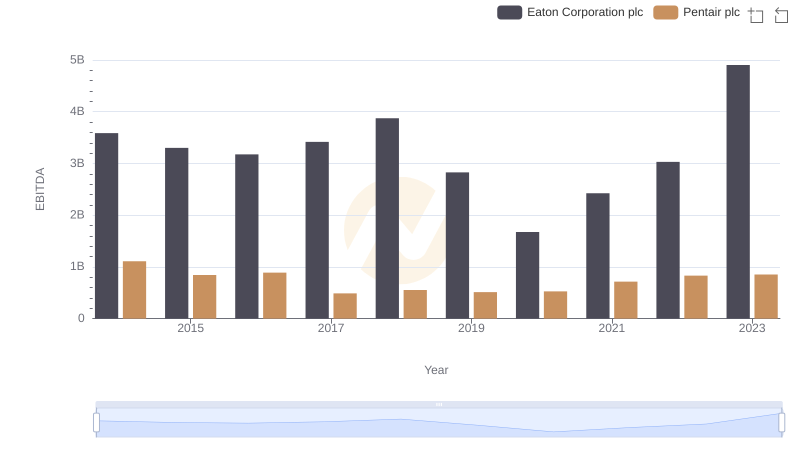

In the competitive landscape of industrial manufacturing, Eaton Corporation plc and Pentair plc have been key players. Over the past decade, Eaton has consistently outperformed Pentair in terms of revenue. From 2014 to 2023, Eaton's revenue grew by approximately 3%, peaking at $23.2 billion in 2023. In contrast, Pentair's revenue saw a decline of about 42% during the same period, ending at $4.1 billion in 2023.

Eaton's resilience is evident, especially during challenging years like 2020, where it managed to bounce back from a dip to $17.9 billion. Meanwhile, Pentair faced a more volatile journey, with significant drops in 2018 and 2019. This comparison highlights Eaton's robust growth strategy and market adaptability, making it a formidable force in the industry. As the market evolves, these insights provide a glimpse into the strategic maneuvers of these industrial giants.

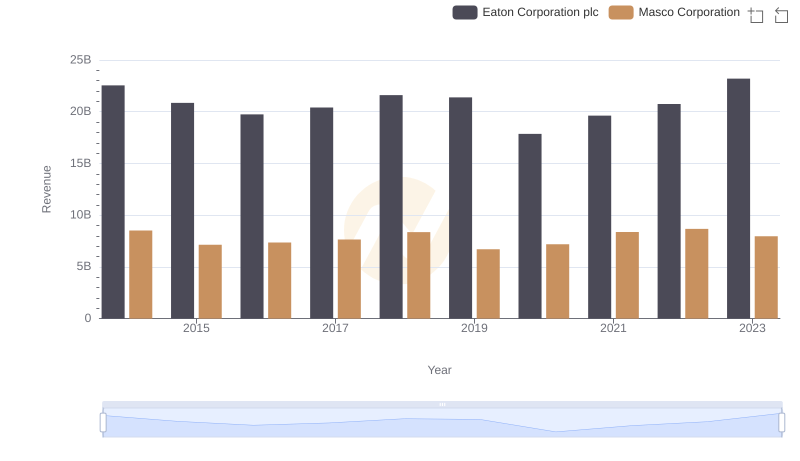

Eaton Corporation plc vs Masco Corporation: Examining Key Revenue Metrics

Comparing Revenue Performance: Eaton Corporation plc or Booz Allen Hamilton Holding Corporation?

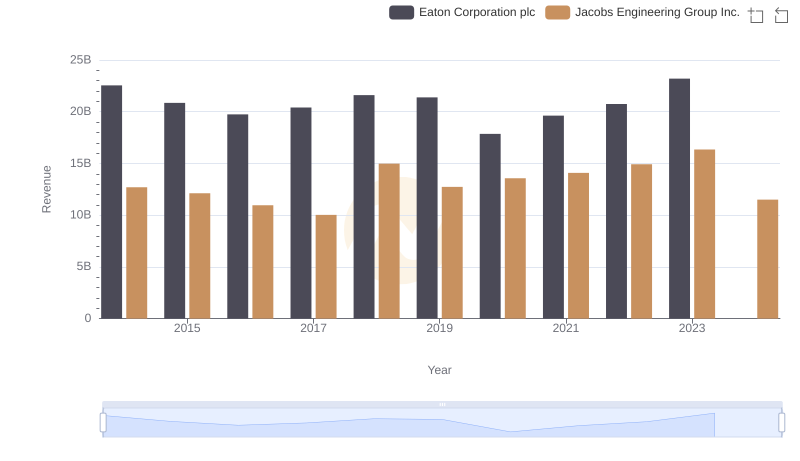

Breaking Down Revenue Trends: Eaton Corporation plc vs Jacobs Engineering Group Inc.

Revenue Insights: Eaton Corporation plc and IDEX Corporation Performance Compared

Comparing Cost of Revenue Efficiency: Eaton Corporation plc vs Pentair plc

Comparing Innovation Spending: Eaton Corporation plc and Pentair plc

Eaton Corporation plc and Pentair plc: A Detailed Examination of EBITDA Performance