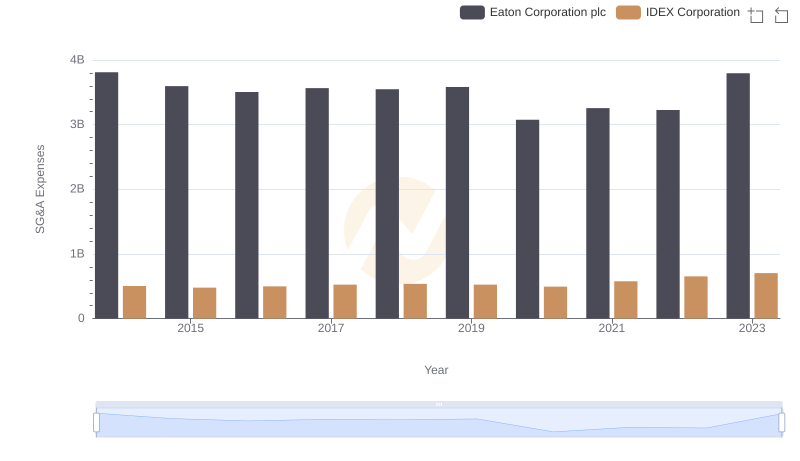

| __timestamp | Eaton Corporation plc | IDEX Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 15646000000 | 1198452000 |

| Thursday, January 1, 2015 | 14292000000 | 1116353000 |

| Friday, January 1, 2016 | 13400000000 | 1182276000 |

| Sunday, January 1, 2017 | 13756000000 | 1260634000 |

| Monday, January 1, 2018 | 14511000000 | 1365771000 |

| Tuesday, January 1, 2019 | 14338000000 | 1369539000 |

| Wednesday, January 1, 2020 | 12408000000 | 1324222000 |

| Friday, January 1, 2021 | 13293000000 | 1540300000 |

| Saturday, January 1, 2022 | 13865000000 | 1755000000 |

| Sunday, January 1, 2023 | 14763000000 | 1825400000 |

| Monday, January 1, 2024 | 15375000000 | 1814000000 |

Data in motion

In the competitive landscape of industrial manufacturing, cost efficiency is a critical metric. Over the past decade, Eaton Corporation plc and IDEX Corporation have demonstrated contrasting trends in their cost of revenue. Eaton, a global leader in power management, has seen its cost of revenue fluctuate, peaking in 2014 and experiencing a dip in 2020. Despite this, Eaton's cost efficiency has improved, with a 6% reduction from 2014 to 2023.

Conversely, IDEX Corporation, known for its innovative fluid and metering technologies, has shown a consistent upward trend. From 2014 to 2023, IDEX's cost of revenue increased by approximately 52%, reflecting its expansion and increased operational scale. This growth trajectory highlights IDEX's strategic investments in technology and infrastructure.

These insights underscore the dynamic nature of cost management in the industrial sector, where strategic decisions can significantly impact financial performance.

Revenue Insights: Eaton Corporation plc and IDEX Corporation Performance Compared

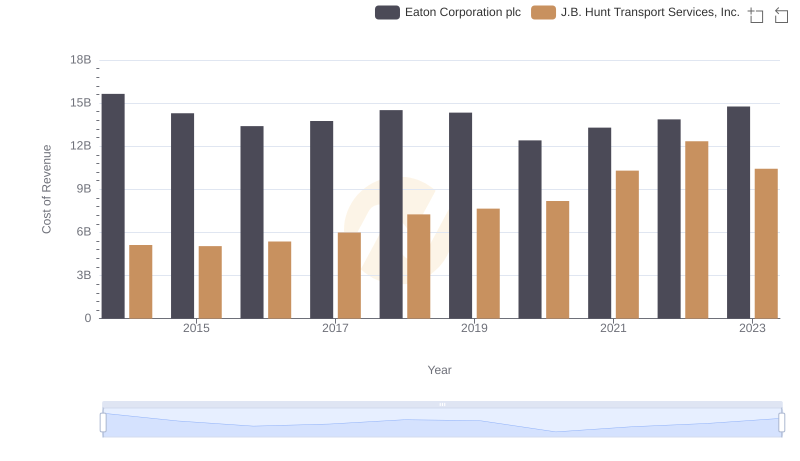

Cost of Revenue: Key Insights for Eaton Corporation plc and J.B. Hunt Transport Services, Inc.

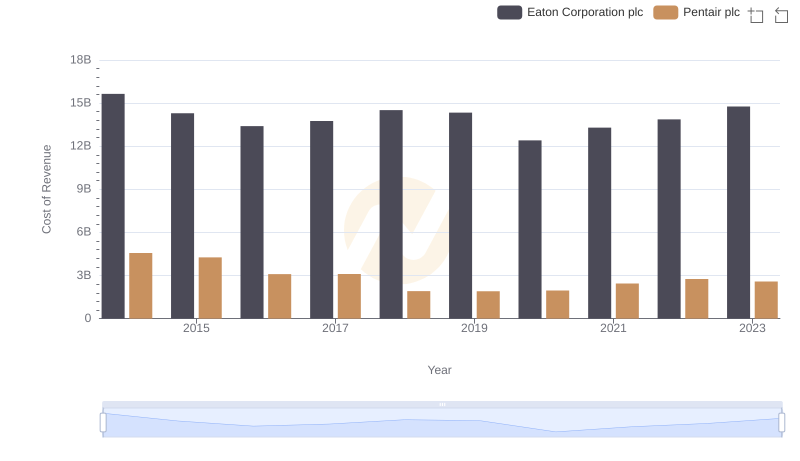

Comparing Cost of Revenue Efficiency: Eaton Corporation plc vs Pentair plc

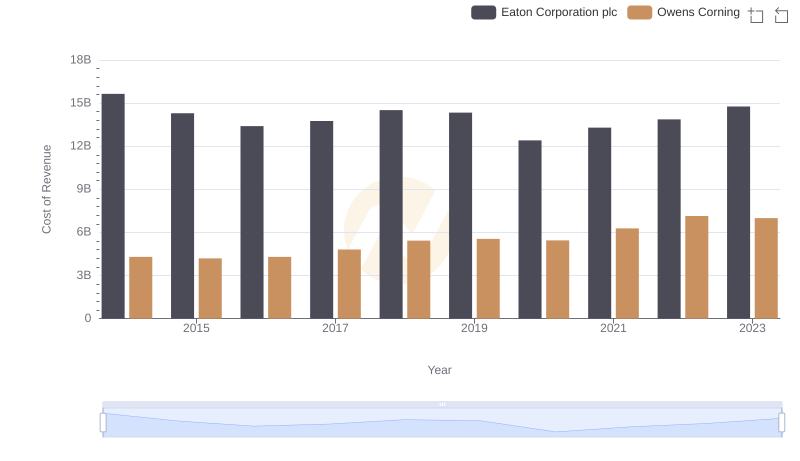

Cost of Revenue Comparison: Eaton Corporation plc vs Owens Corning

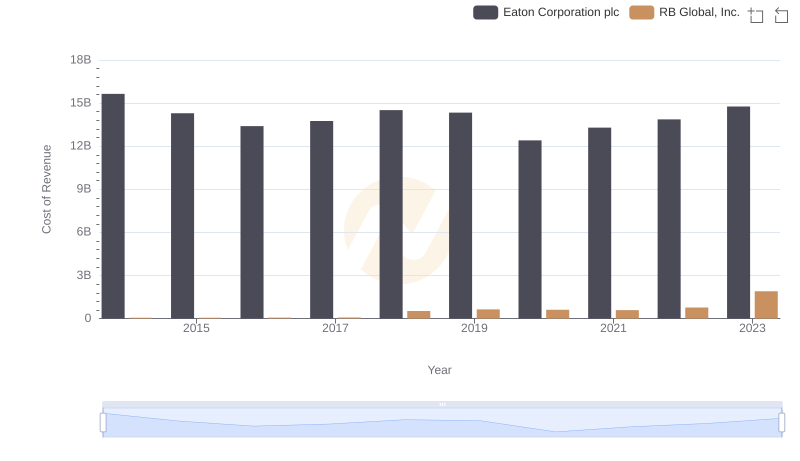

Cost Insights: Breaking Down Eaton Corporation plc and RB Global, Inc.'s Expenses

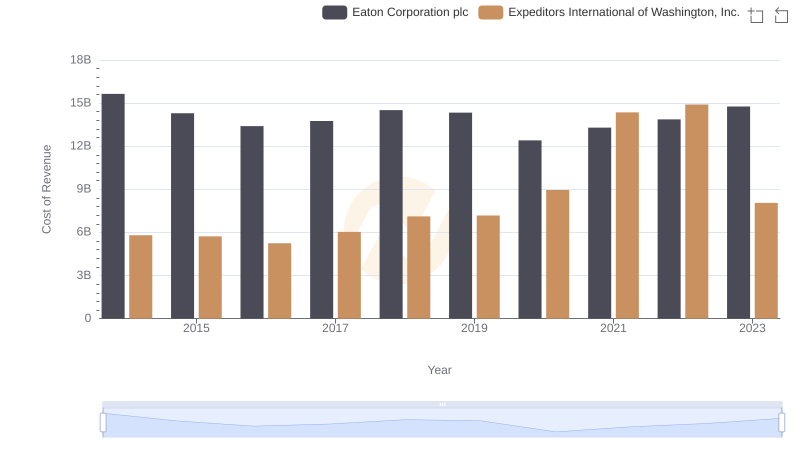

Eaton Corporation plc vs Expeditors International of Washington, Inc.: Efficiency in Cost of Revenue Explored

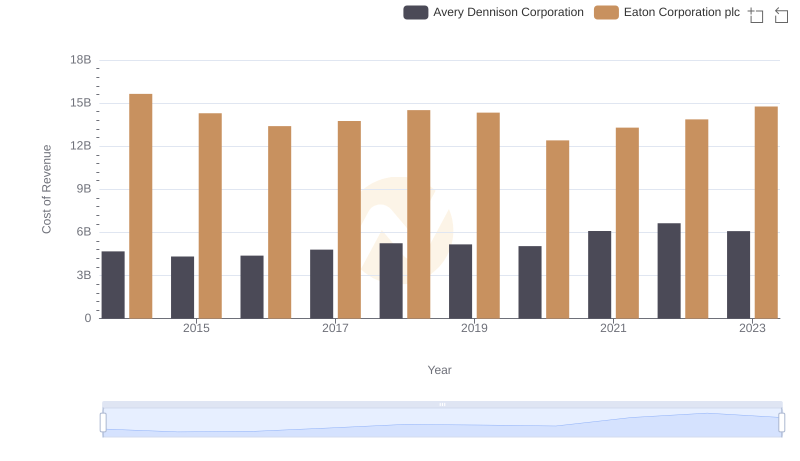

Comparing Cost of Revenue Efficiency: Eaton Corporation plc vs Avery Dennison Corporation

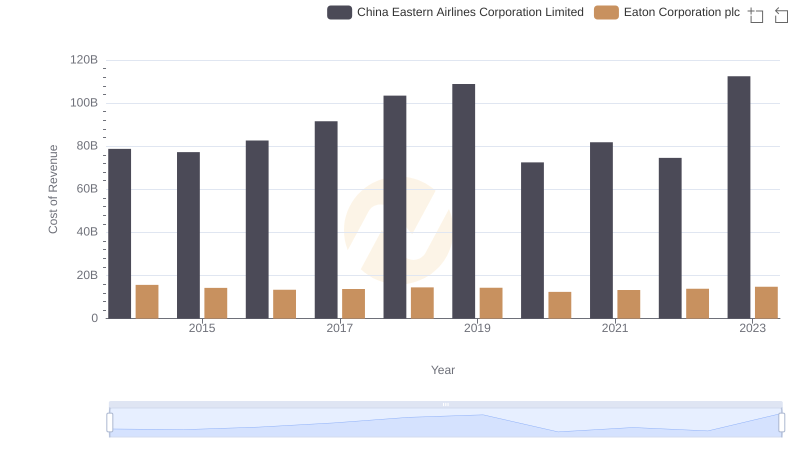

Comparing Cost of Revenue Efficiency: Eaton Corporation plc vs China Eastern Airlines Corporation Limited

Selling, General, and Administrative Costs: Eaton Corporation plc vs IDEX Corporation