| __timestamp | Avery Dennison Corporation | Eaton Corporation plc |

|---|---|---|

| Wednesday, January 1, 2014 | 4679100000 | 15646000000 |

| Thursday, January 1, 2015 | 4321100000 | 14292000000 |

| Friday, January 1, 2016 | 4386800000 | 13400000000 |

| Sunday, January 1, 2017 | 4801600000 | 13756000000 |

| Monday, January 1, 2018 | 5243500000 | 14511000000 |

| Tuesday, January 1, 2019 | 5166000000 | 14338000000 |

| Wednesday, January 1, 2020 | 5048200000 | 12408000000 |

| Friday, January 1, 2021 | 6095500000 | 13293000000 |

| Saturday, January 1, 2022 | 6635100000 | 13865000000 |

| Sunday, January 1, 2023 | 6086800000 | 14763000000 |

| Monday, January 1, 2024 | 6225000000 | 15375000000 |

Infusing magic into the data realm

In the competitive landscape of industrial manufacturing, Eaton Corporation plc and Avery Dennison Corporation stand as titans. Over the past decade, Eaton has consistently demonstrated a robust cost of revenue efficiency, averaging around 14 billion annually. In contrast, Avery Dennison, while smaller in scale, has shown remarkable growth, with its cost of revenue increasing by approximately 42% from 2014 to 2023.

From 2014 to 2023, Eaton's cost of revenue peaked in 2014, while Avery Dennison saw its highest figures in 2022. This period highlights Eaton's steady operational efficiency, maintaining a cost of revenue around 1.4 times that of Avery Dennison. Meanwhile, Avery Dennison's strategic initiatives have propelled its cost of revenue from 4.7 billion in 2014 to over 6 billion in recent years, showcasing its dynamic growth trajectory.

These trends underscore the importance of strategic cost management in maintaining competitive advantage. As both companies continue to innovate, their cost of revenue efficiency will remain a critical metric for investors and stakeholders alike.

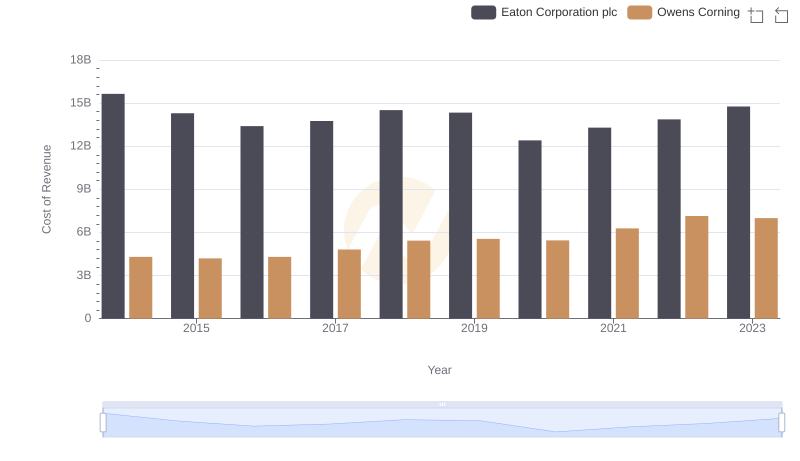

Cost of Revenue Comparison: Eaton Corporation plc vs Owens Corning

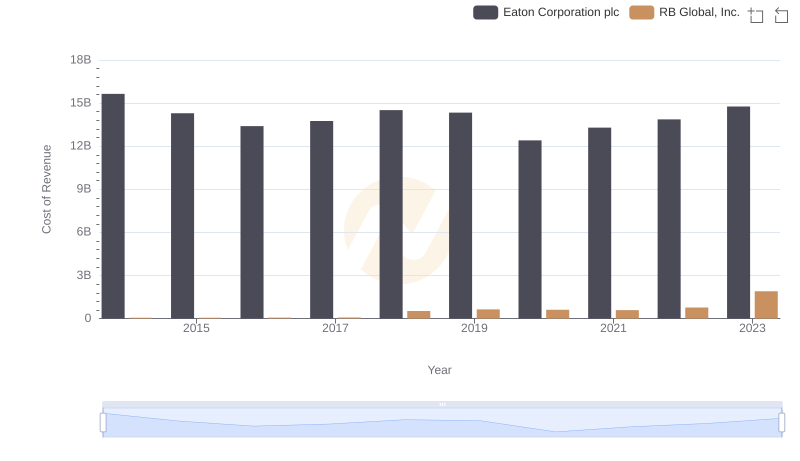

Cost Insights: Breaking Down Eaton Corporation plc and RB Global, Inc.'s Expenses

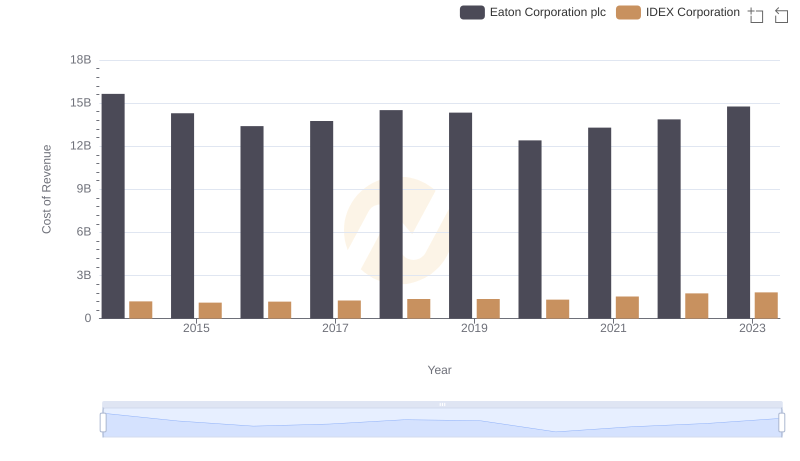

Comparing Cost of Revenue Efficiency: Eaton Corporation plc vs IDEX Corporation

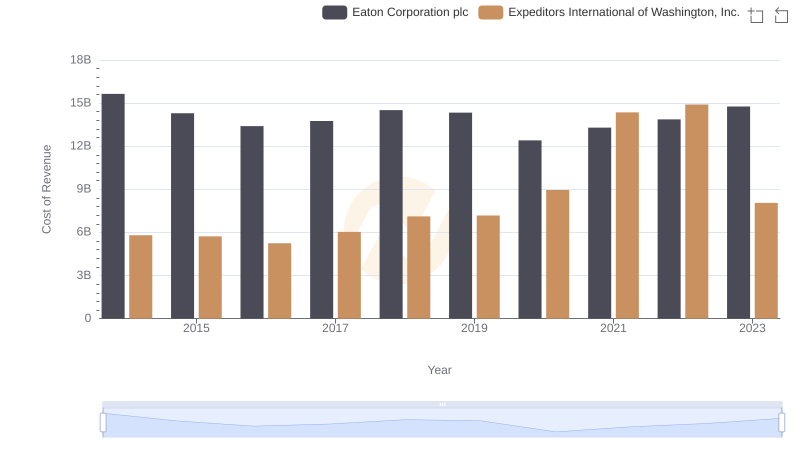

Eaton Corporation plc vs Expeditors International of Washington, Inc.: Efficiency in Cost of Revenue Explored

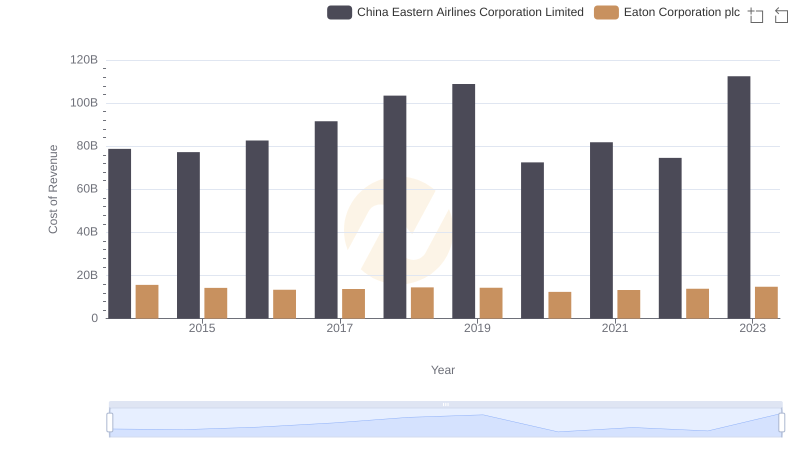

Comparing Cost of Revenue Efficiency: Eaton Corporation plc vs China Eastern Airlines Corporation Limited