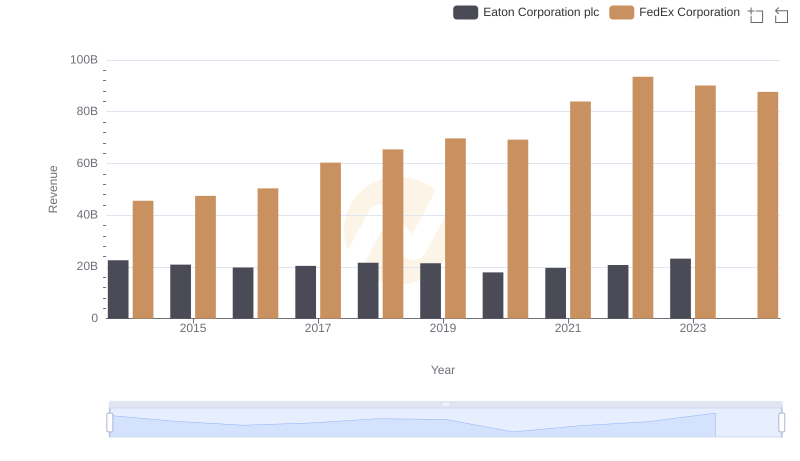

| __timestamp | Eaton Corporation plc | FedEx Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 15646000000 | 36194000000 |

| Thursday, January 1, 2015 | 14292000000 | 38895000000 |

| Friday, January 1, 2016 | 13400000000 | 40037000000 |

| Sunday, January 1, 2017 | 13756000000 | 46511000000 |

| Monday, January 1, 2018 | 14511000000 | 50750000000 |

| Tuesday, January 1, 2019 | 14338000000 | 54866000000 |

| Wednesday, January 1, 2020 | 12408000000 | 55873000000 |

| Friday, January 1, 2021 | 13293000000 | 66005000000 |

| Saturday, January 1, 2022 | 13865000000 | 73345000000 |

| Sunday, January 1, 2023 | 14763000000 | 70989000000 |

| Monday, January 1, 2024 | 15375000000 | 68741000000 |

Unlocking the unknown

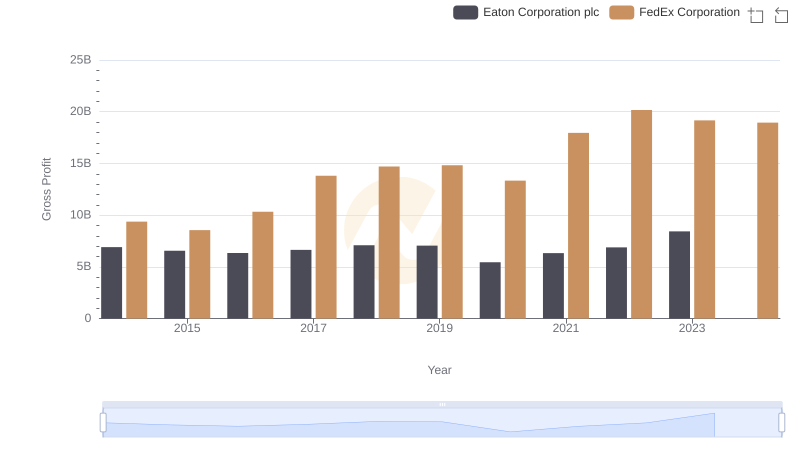

In the ever-evolving landscape of global commerce, cost efficiency remains a pivotal factor for corporate success. This analysis delves into the cost of revenue trends for Eaton Corporation plc and FedEx Corporation from 2014 to 2023. Over this period, FedEx consistently outpaced Eaton in terms of cost of revenue, reflecting its expansive logistics operations. Notably, FedEx's cost of revenue surged by approximately 102% from 2014 to 2022, peaking in 2022. In contrast, Eaton's cost of revenue exhibited a more stable trajectory, with a modest increase of around 6% over the same period. The data for 2024 is incomplete, highlighting the dynamic nature of financial forecasting. This comparison underscores the distinct operational scales and strategies of these industry giants, offering valuable insights into their financial health and efficiency.

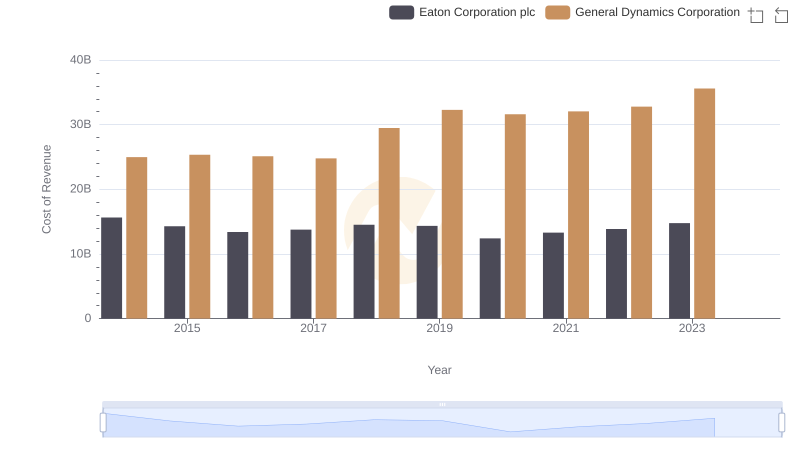

Cost of Revenue: Key Insights for Eaton Corporation plc and General Dynamics Corporation

Eaton Corporation plc or FedEx Corporation: Who Leads in Yearly Revenue?

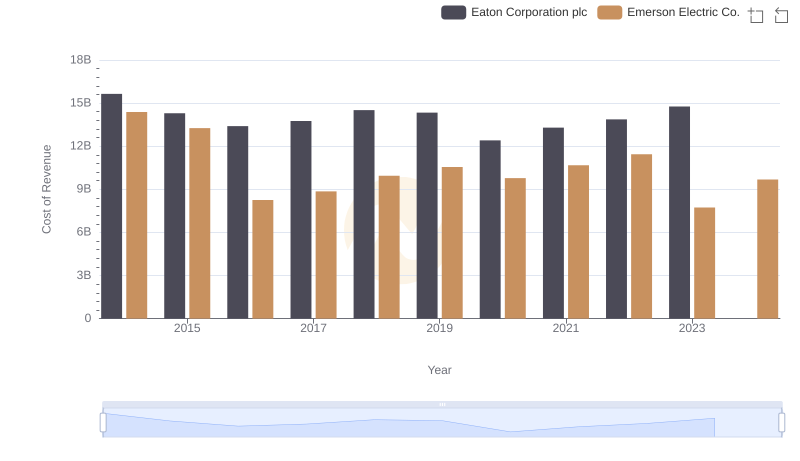

Comparing Cost of Revenue Efficiency: Eaton Corporation plc vs Emerson Electric Co.

Key Insights on Gross Profit: Eaton Corporation plc vs FedEx Corporation

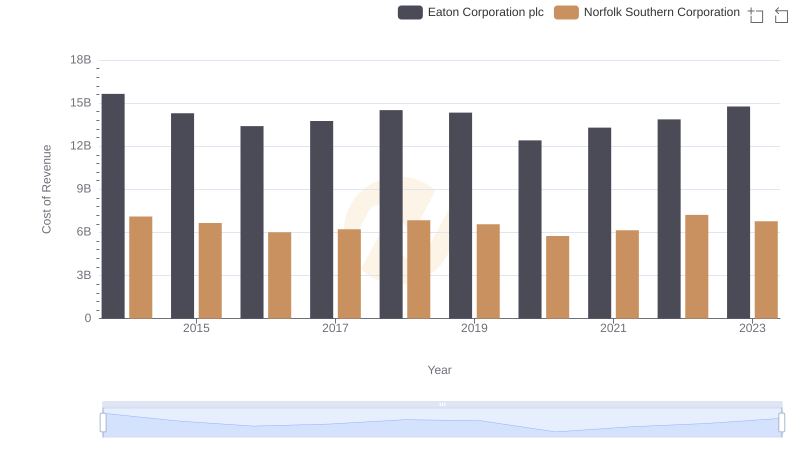

Cost of Revenue Comparison: Eaton Corporation plc vs Norfolk Southern Corporation

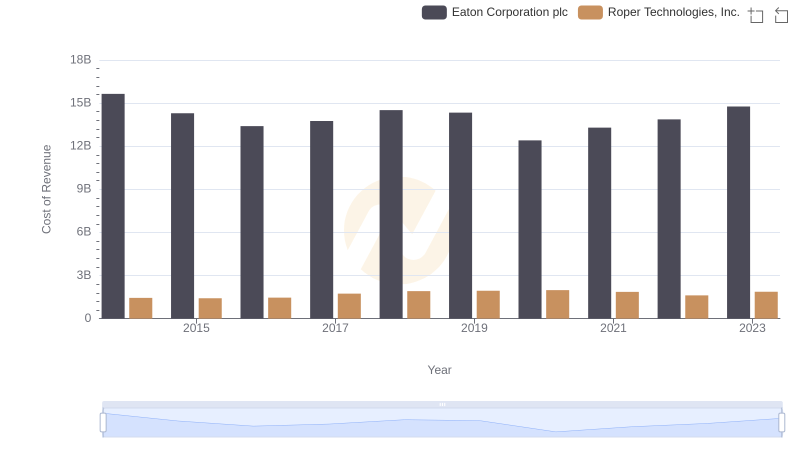

Comparing Cost of Revenue Efficiency: Eaton Corporation plc vs Roper Technologies, Inc.