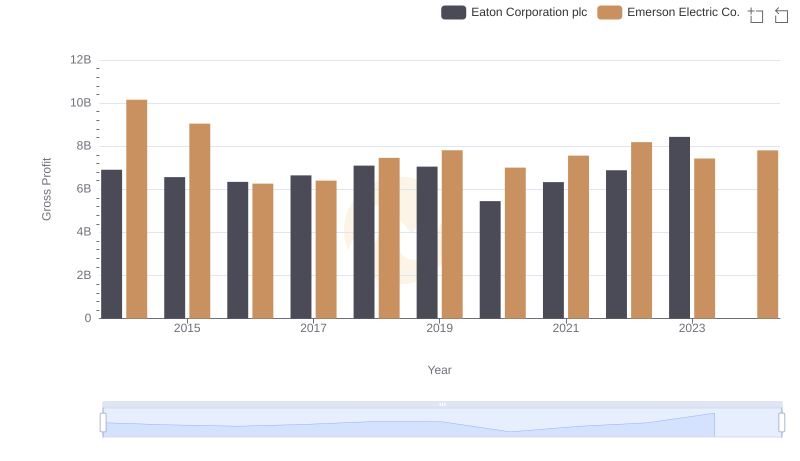

| __timestamp | Eaton Corporation plc | Emerson Electric Co. |

|---|---|---|

| Wednesday, January 1, 2014 | 15646000000 | 14379000000 |

| Thursday, January 1, 2015 | 14292000000 | 13256000000 |

| Friday, January 1, 2016 | 13400000000 | 8260000000 |

| Sunday, January 1, 2017 | 13756000000 | 8860000000 |

| Monday, January 1, 2018 | 14511000000 | 9948000000 |

| Tuesday, January 1, 2019 | 14338000000 | 10557000000 |

| Wednesday, January 1, 2020 | 12408000000 | 9776000000 |

| Friday, January 1, 2021 | 13293000000 | 10673000000 |

| Saturday, January 1, 2022 | 13865000000 | 11441000000 |

| Sunday, January 1, 2023 | 14763000000 | 7738000000 |

| Monday, January 1, 2024 | 15375000000 | 9684000000 |

Unleashing the power of data

In the competitive landscape of industrial giants, Eaton Corporation plc and Emerson Electric Co. have been pivotal players. Over the past decade, from 2014 to 2023, these companies have showcased their prowess in managing cost efficiency. Eaton's cost of revenue peaked in 2014 at approximately $15.6 billion, while Emerson's highest was around $14.4 billion the same year. However, by 2023, Eaton's cost efficiency improved, reducing its cost of revenue by about 5%, whereas Emerson saw a more significant reduction of nearly 46%. This trend highlights Emerson's aggressive cost management strategies, especially evident in 2023, where their cost of revenue dropped to $7.7 billion. Notably, 2024 data for Eaton is missing, leaving room for speculation on their continued efficiency. As these industrial titans evolve, their financial strategies offer valuable insights into the broader market dynamics.

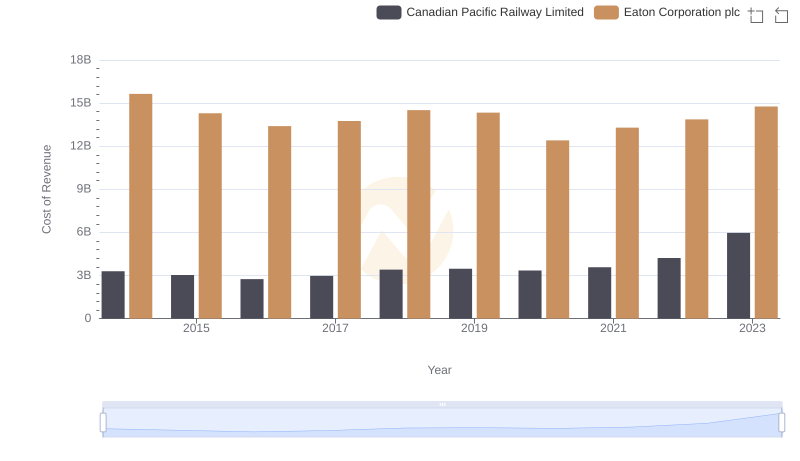

Comparing Cost of Revenue Efficiency: Eaton Corporation plc vs Canadian Pacific Railway Limited

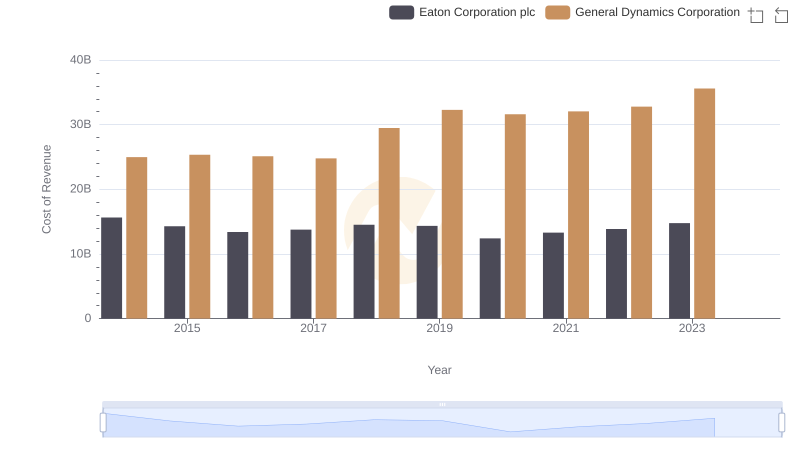

Cost of Revenue: Key Insights for Eaton Corporation plc and General Dynamics Corporation

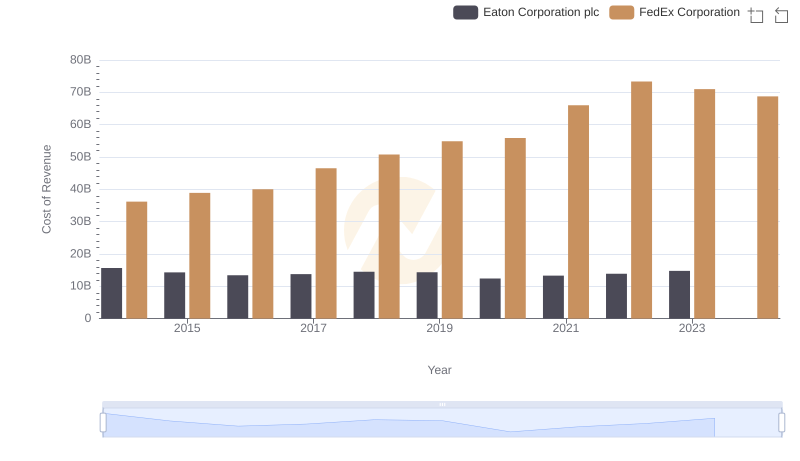

Comparing Cost of Revenue Efficiency: Eaton Corporation plc vs FedEx Corporation

Key Insights on Gross Profit: Eaton Corporation plc vs Emerson Electric Co.

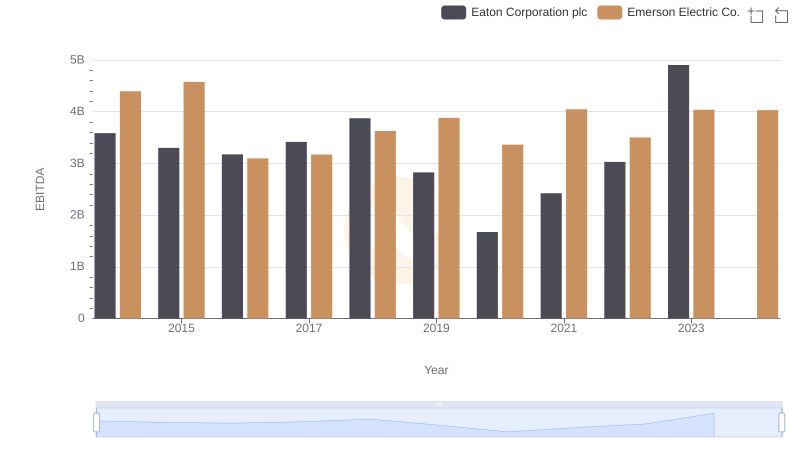

EBITDA Performance Review: Eaton Corporation plc vs Emerson Electric Co.