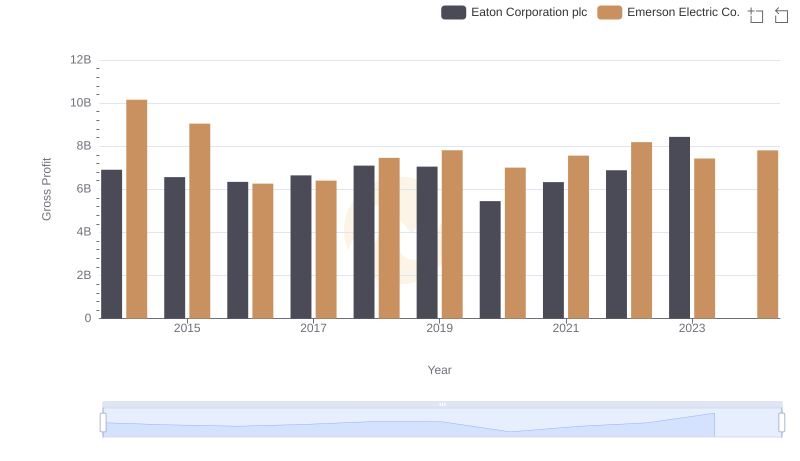

| __timestamp | Eaton Corporation plc | FedEx Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 6906000000 | 9373000000 |

| Thursday, January 1, 2015 | 6563000000 | 8558000000 |

| Friday, January 1, 2016 | 6347000000 | 10328000000 |

| Sunday, January 1, 2017 | 6648000000 | 13808000000 |

| Monday, January 1, 2018 | 7098000000 | 14700000000 |

| Tuesday, January 1, 2019 | 7052000000 | 14827000000 |

| Wednesday, January 1, 2020 | 5450000000 | 13344000000 |

| Friday, January 1, 2021 | 6335000000 | 17954000000 |

| Saturday, January 1, 2022 | 6887000000 | 20167000000 |

| Sunday, January 1, 2023 | 8433000000 | 19166000000 |

| Monday, January 1, 2024 | 9503000000 | 18952000000 |

Unveiling the hidden dimensions of data

In the competitive landscape of industrial and logistics giants, Eaton Corporation plc and FedEx Corporation have showcased intriguing financial trajectories over the past decade. From 2014 to 2023, FedEx consistently outperformed Eaton in terms of gross profit, with FedEx's figures peaking at approximately $20 billion in 2022, marking a 115% increase from its 2014 value. Eaton, while trailing, demonstrated resilience with a notable 22% growth in gross profit, reaching its zenith in 2023.

The year 2020 marked a downturn for Eaton, with gross profit dipping to its lowest, likely due to global disruptions. However, Eaton rebounded strongly by 2023, achieving its highest gross profit in the decade. Meanwhile, FedEx's steady climb reflects its robust adaptation to the e-commerce boom. This analysis underscores the dynamic shifts in the industrial and logistics sectors, highlighting the resilience and strategic pivots of these corporate titans.

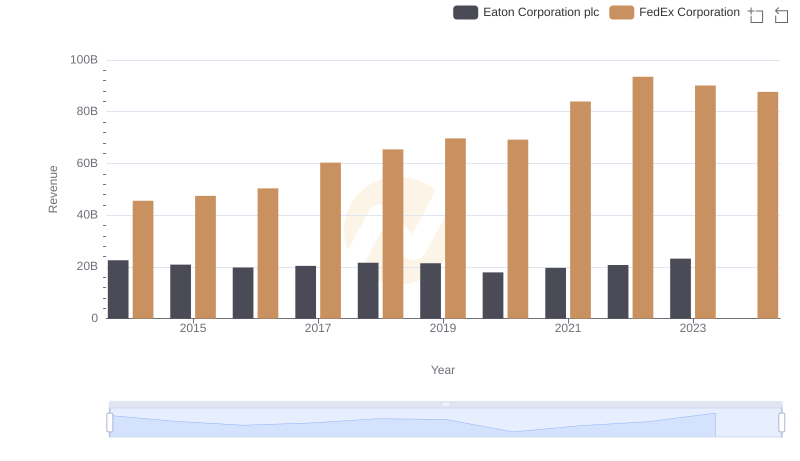

Eaton Corporation plc or FedEx Corporation: Who Leads in Yearly Revenue?

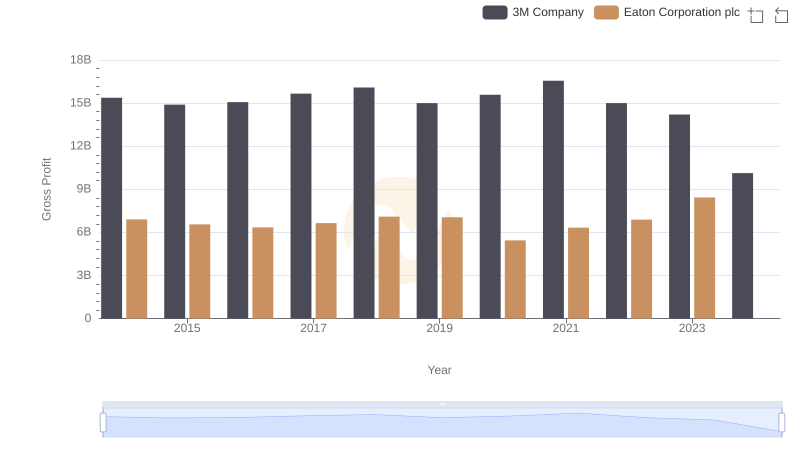

Key Insights on Gross Profit: Eaton Corporation plc vs 3M Company

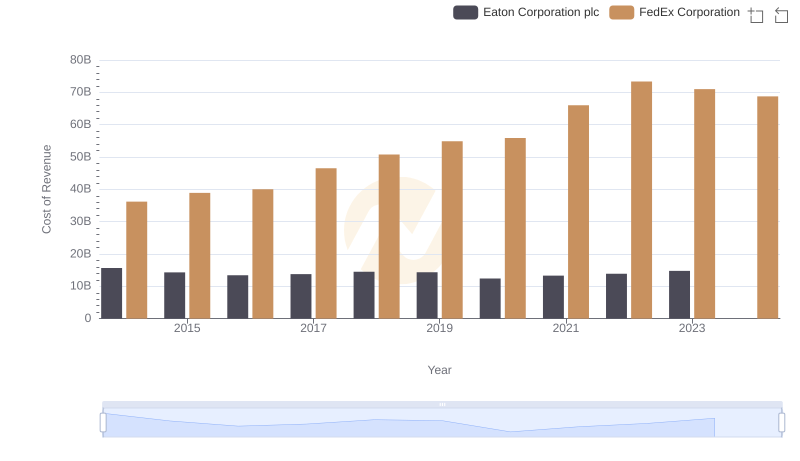

Comparing Cost of Revenue Efficiency: Eaton Corporation plc vs FedEx Corporation

Key Insights on Gross Profit: Eaton Corporation plc vs Emerson Electric Co.

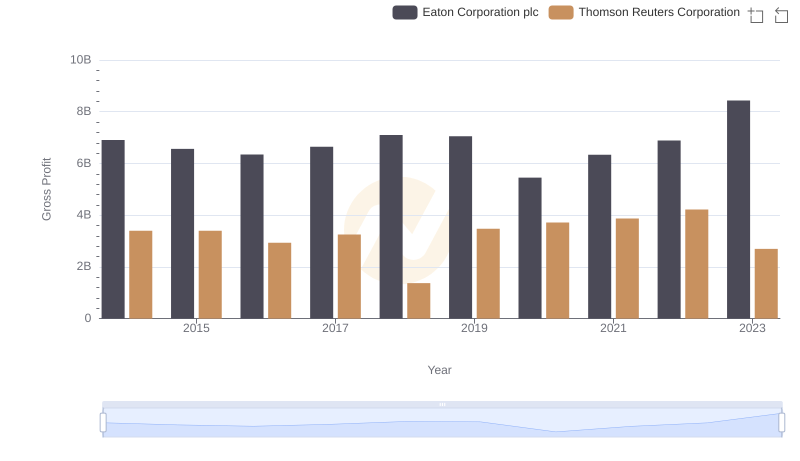

Eaton Corporation plc and Thomson Reuters Corporation: A Detailed Gross Profit Analysis