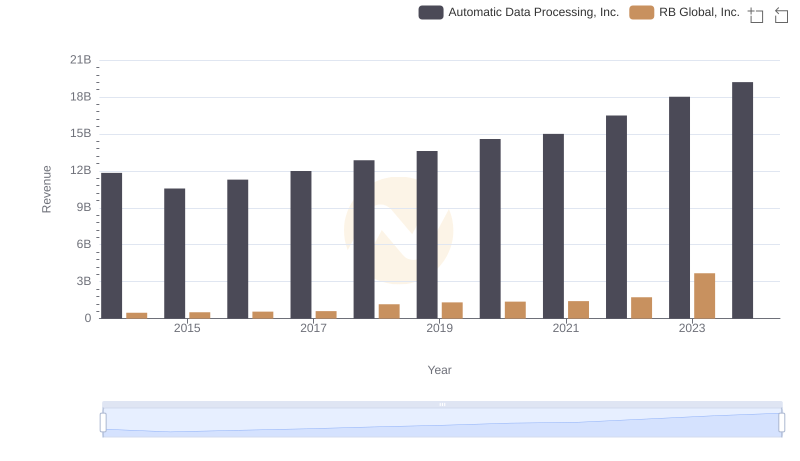

| __timestamp | Automatic Data Processing, Inc. | RB Global, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 7221400000 | 57884000 |

| Thursday, January 1, 2015 | 6427600000 | 56026000 |

| Friday, January 1, 2016 | 6840300000 | 66062000 |

| Sunday, January 1, 2017 | 7269800000 | 79013000 |

| Monday, January 1, 2018 | 7842600000 | 533397000 |

| Tuesday, January 1, 2019 | 8086600000 | 645816000 |

| Wednesday, January 1, 2020 | 8445100000 | 615589000 |

| Friday, January 1, 2021 | 8640300000 | 594783000 |

| Saturday, January 1, 2022 | 9461900000 | 776701000 |

| Sunday, January 1, 2023 | 9953400000 | 1901200000 |

| Monday, January 1, 2024 | 10476700000 | 0 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of corporate finance, understanding cost efficiency is paramount. Automatic Data Processing, Inc. (ADP) and RB Global, Inc. (RBA) offer a fascinating study in contrasts. Over the past decade, ADP has consistently demonstrated robust cost management, with its cost of revenue growing from approximately $7.2 billion in 2014 to an impressive $10.5 billion in 2024. This represents a steady increase of around 45%, reflecting ADP's strategic investments and operational efficiency.

Conversely, RB Global, Inc. has shown a more volatile trajectory. Starting at a modest $57 million in 2014, its cost of revenue surged to $1.9 billion by 2023, marking an exponential growth of over 3,200%. This dramatic rise underscores RB Global's aggressive expansion and market penetration strategies. However, the absence of data for 2024 suggests potential challenges or strategic shifts. As these two giants navigate the financial seas, their contrasting paths offer valuable insights into cost management strategies.

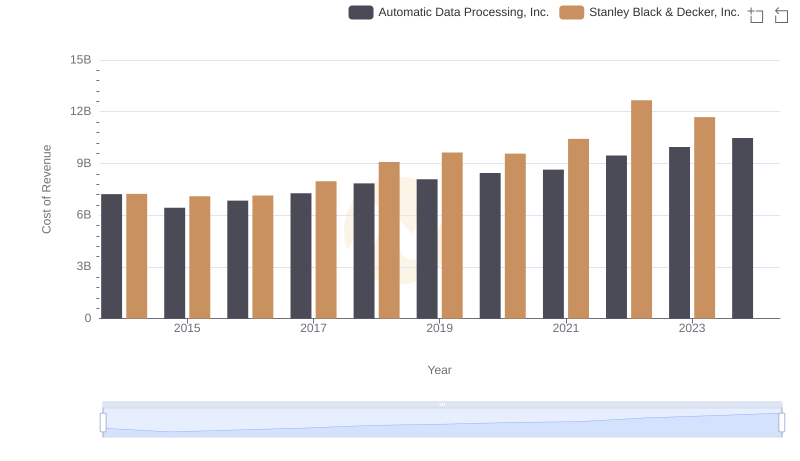

Automatic Data Processing, Inc. vs Stanley Black & Decker, Inc.: Efficiency in Cost of Revenue Explored

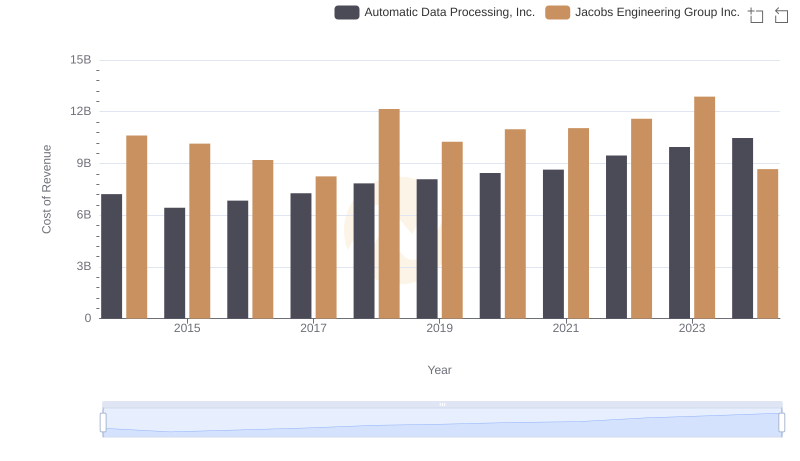

Automatic Data Processing, Inc. vs Jacobs Engineering Group Inc.: Efficiency in Cost of Revenue Explored

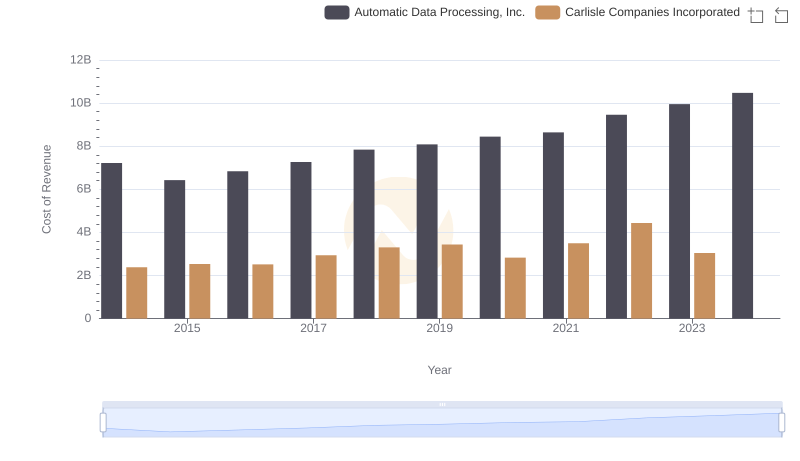

Cost of Revenue: Key Insights for Automatic Data Processing, Inc. and Carlisle Companies Incorporated

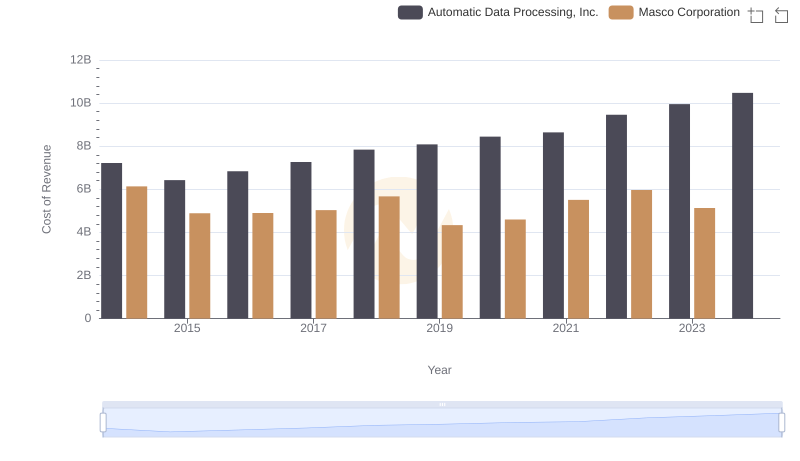

Cost of Revenue Trends: Automatic Data Processing, Inc. vs Masco Corporation

Annual Revenue Comparison: Automatic Data Processing, Inc. vs RB Global, Inc.

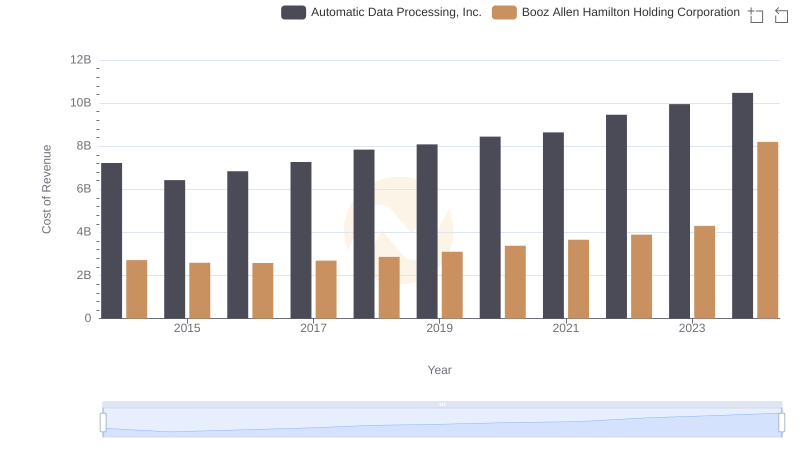

Automatic Data Processing, Inc. vs Booz Allen Hamilton Holding Corporation: Efficiency in Cost of Revenue Explored

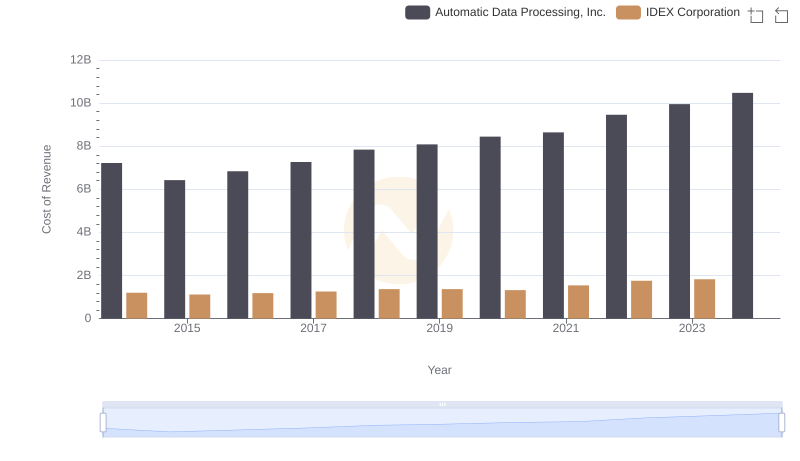

Cost of Revenue: Key Insights for Automatic Data Processing, Inc. and IDEX Corporation

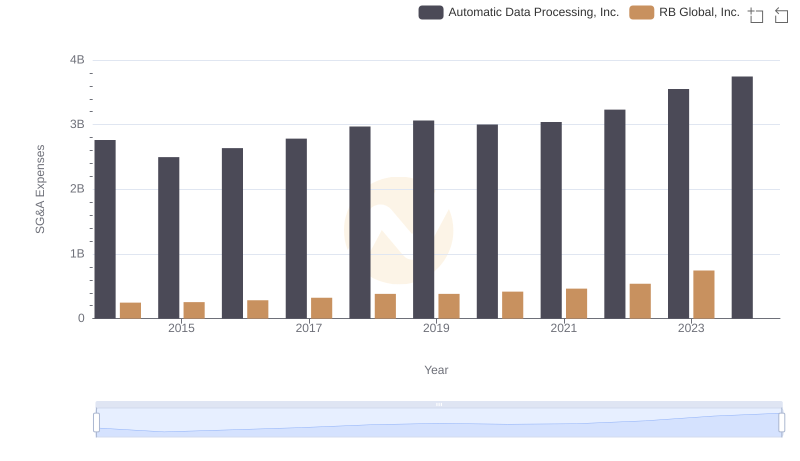

Cost Management Insights: SG&A Expenses for Automatic Data Processing, Inc. and RB Global, Inc.