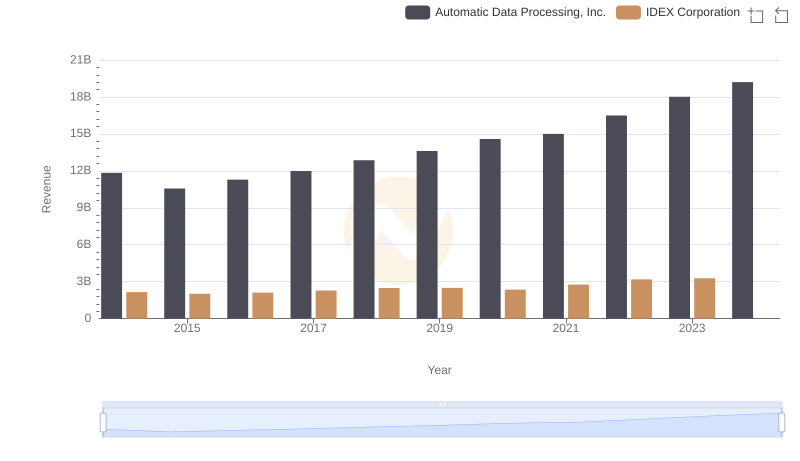

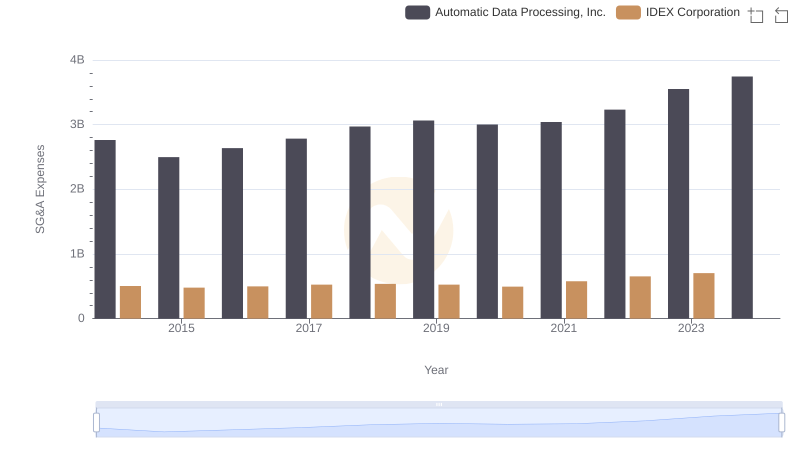

| __timestamp | Automatic Data Processing, Inc. | IDEX Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 7221400000 | 1198452000 |

| Thursday, January 1, 2015 | 6427600000 | 1116353000 |

| Friday, January 1, 2016 | 6840300000 | 1182276000 |

| Sunday, January 1, 2017 | 7269800000 | 1260634000 |

| Monday, January 1, 2018 | 7842600000 | 1365771000 |

| Tuesday, January 1, 2019 | 8086600000 | 1369539000 |

| Wednesday, January 1, 2020 | 8445100000 | 1324222000 |

| Friday, January 1, 2021 | 8640300000 | 1540300000 |

| Saturday, January 1, 2022 | 9461900000 | 1755000000 |

| Sunday, January 1, 2023 | 9953400000 | 1825400000 |

| Monday, January 1, 2024 | 10476700000 | 1814000000 |

In pursuit of knowledge

In the ever-evolving landscape of corporate finance, understanding the cost of revenue is crucial for evaluating a company's efficiency and profitability. This analysis focuses on Automatic Data Processing, Inc. (ADP) and IDEX Corporation, two giants in their respective industries. Over the past decade, ADP has seen a steady increase in its cost of revenue, rising approximately 45% from 2014 to 2023. This growth reflects ADP's expanding operations and market reach. In contrast, IDEX Corporation's cost of revenue has grown by about 52% over the same period, indicating a robust expansion strategy. Notably, 2024 data for IDEX is missing, suggesting a need for further investigation. These trends highlight the dynamic nature of cost management in large corporations and underscore the importance of strategic planning in maintaining competitive advantage.

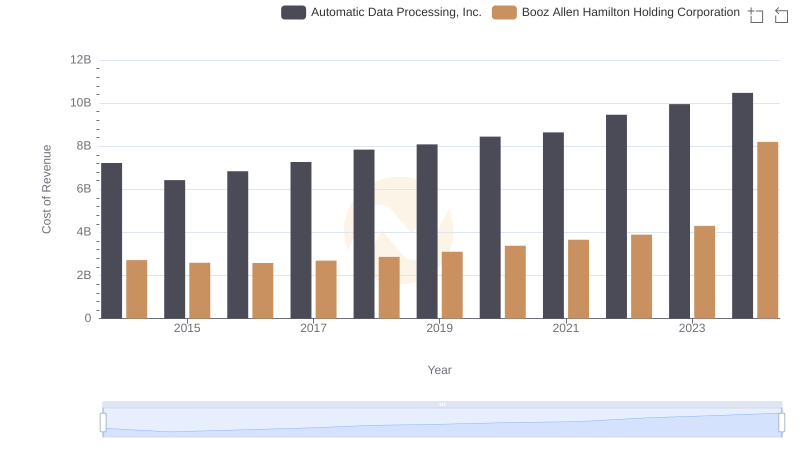

Automatic Data Processing, Inc. vs Booz Allen Hamilton Holding Corporation: Efficiency in Cost of Revenue Explored

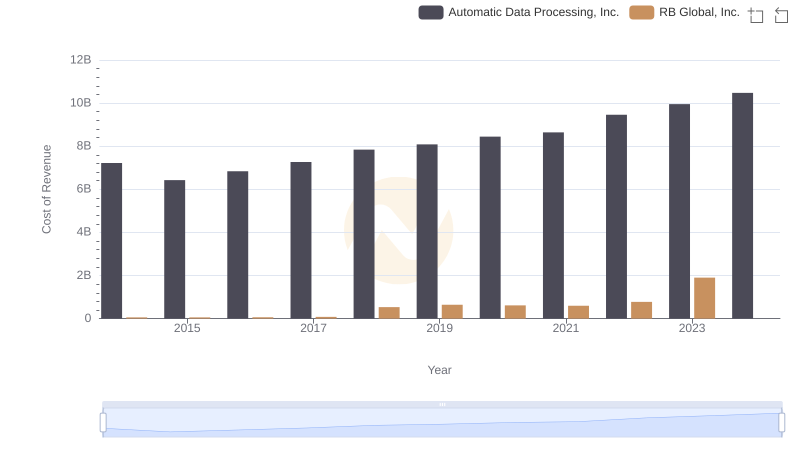

Comparing Cost of Revenue Efficiency: Automatic Data Processing, Inc. vs RB Global, Inc.

Breaking Down Revenue Trends: Automatic Data Processing, Inc. vs IDEX Corporation

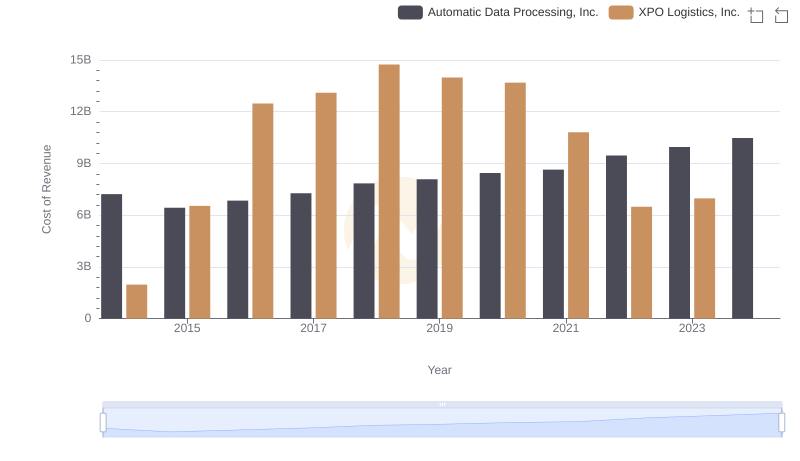

Cost Insights: Breaking Down Automatic Data Processing, Inc. and XPO Logistics, Inc.'s Expenses

Selling, General, and Administrative Costs: Automatic Data Processing, Inc. vs IDEX Corporation