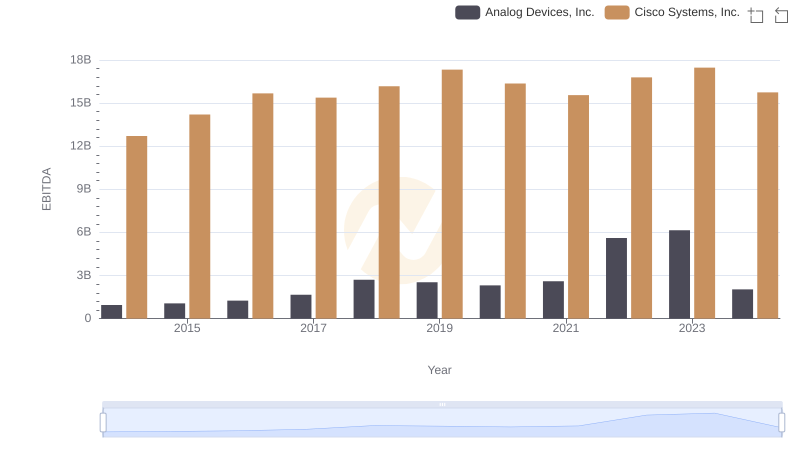

| __timestamp | Analog Devices, Inc. | Cisco Systems, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 454676000 | 11437000000 |

| Thursday, January 1, 2015 | 478972000 | 11861000000 |

| Friday, January 1, 2016 | 461438000 | 11433000000 |

| Sunday, January 1, 2017 | 691046000 | 11177000000 |

| Monday, January 1, 2018 | 695937000 | 11386000000 |

| Tuesday, January 1, 2019 | 648094000 | 11398000000 |

| Wednesday, January 1, 2020 | 659923000 | 11094000000 |

| Friday, January 1, 2021 | 915418000 | 11411000000 |

| Saturday, January 1, 2022 | 1266175000 | 11186000000 |

| Sunday, January 1, 2023 | 1273584000 | 12358000000 |

| Monday, January 1, 2024 | 1068640000 | 13177000000 |

Infusing magic into the data realm

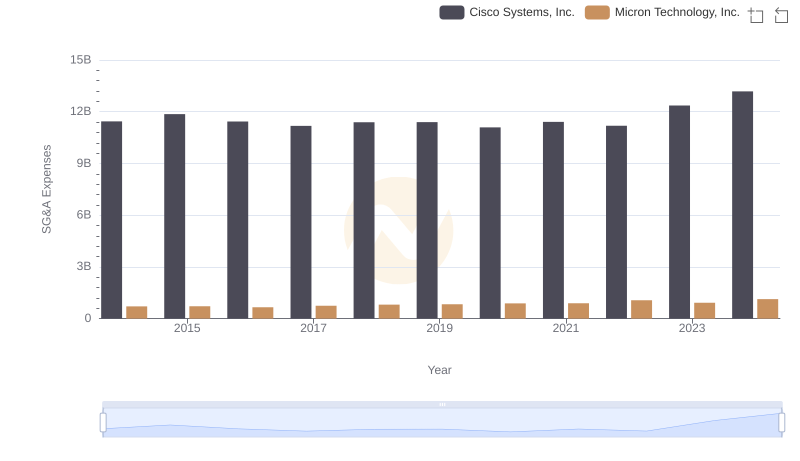

In the ever-evolving tech industry, understanding the financial strategies of leading companies is crucial. Over the past decade, Cisco Systems, Inc. and Analog Devices, Inc. have shown distinct trends in their Selling, General, and Administrative (SG&A) expenses. From 2014 to 2024, Cisco's SG&A expenses have consistently been higher, peaking in 2024 with a 15% increase from 2014. In contrast, Analog Devices saw a significant rise, with expenses nearly tripling by 2023 compared to 2014. This divergence highlights Cisco's steady approach versus Analog Devices' aggressive expansion strategy. Such insights are vital for investors and analysts aiming to gauge the operational efficiency and strategic priorities of these tech giants. As the industry continues to grow, monitoring these financial metrics will provide a window into the companies' future directions.

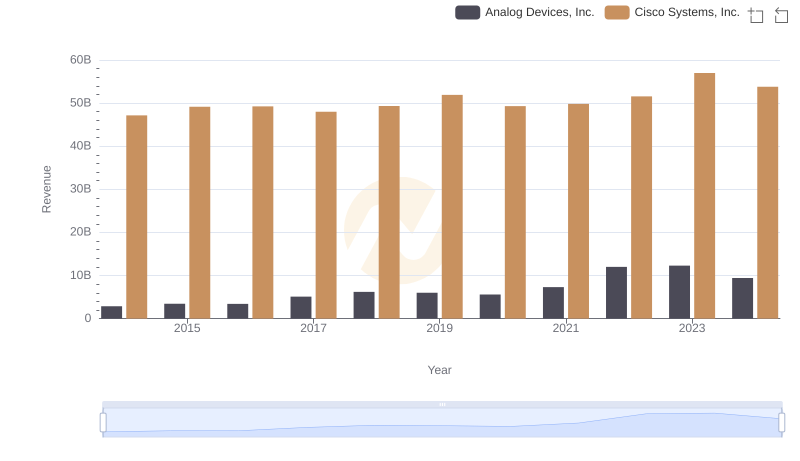

Cisco Systems, Inc. and Analog Devices, Inc.: A Comprehensive Revenue Analysis

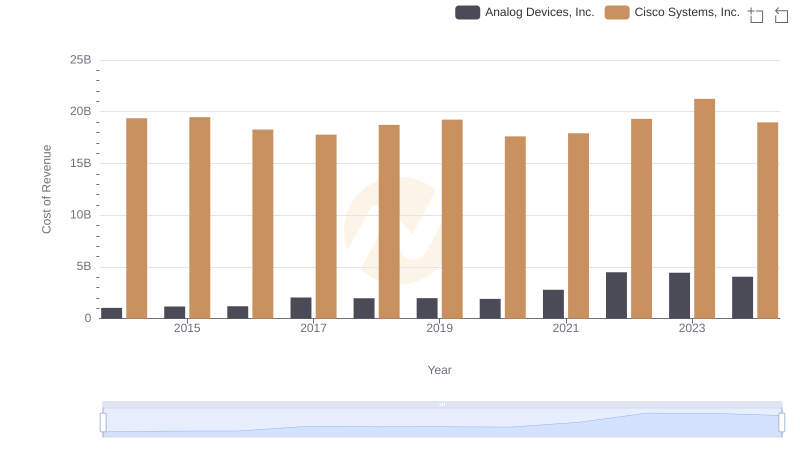

Comparing Cost of Revenue Efficiency: Cisco Systems, Inc. vs Analog Devices, Inc.

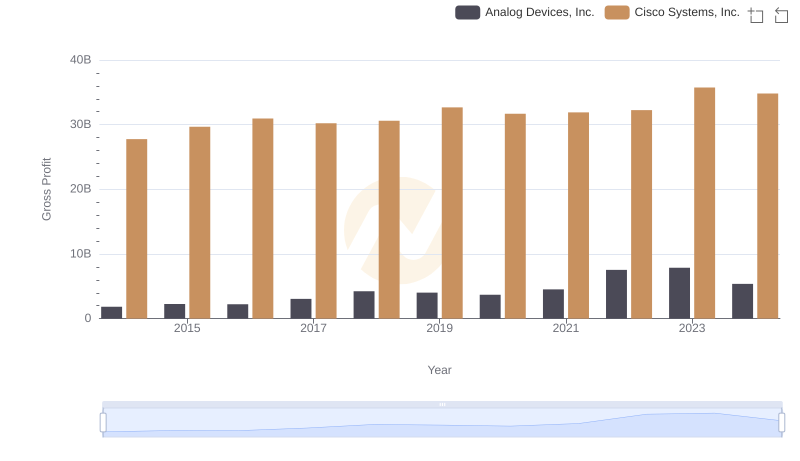

Gross Profit Analysis: Comparing Cisco Systems, Inc. and Analog Devices, Inc.

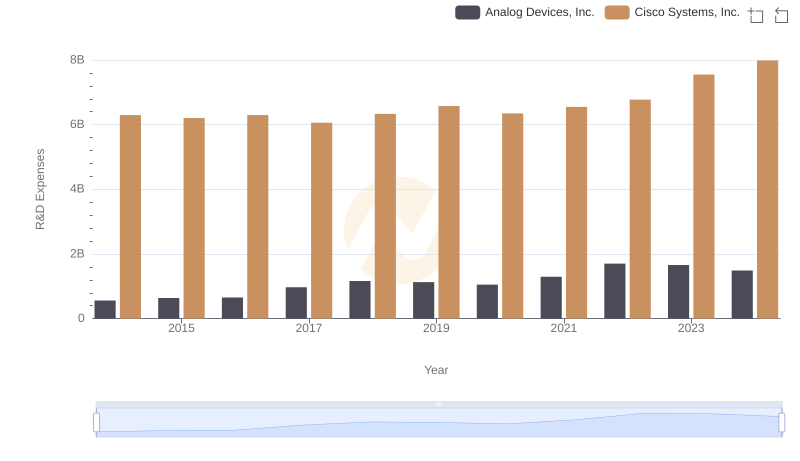

Cisco Systems, Inc. or Analog Devices, Inc.: Who Invests More in Innovation?

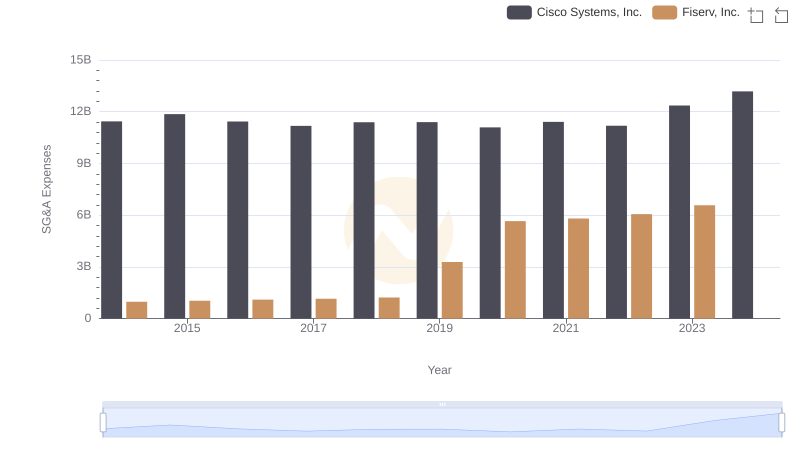

SG&A Efficiency Analysis: Comparing Cisco Systems, Inc. and Fiserv, Inc.

Comparing SG&A Expenses: Cisco Systems, Inc. vs Fiserv, Inc. Trends and Insights

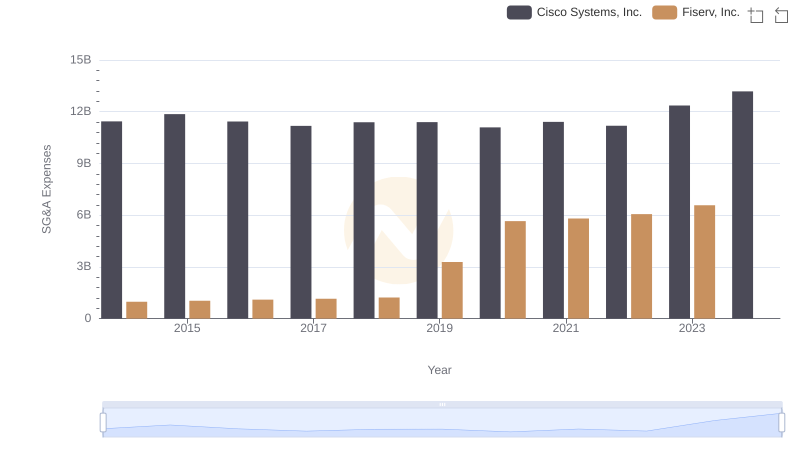

Operational Costs Compared: SG&A Analysis of Cisco Systems, Inc. and Arista Networks, Inc.

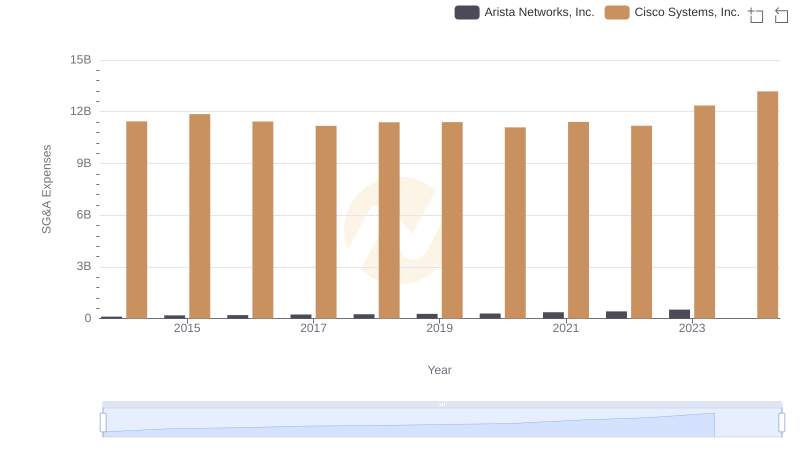

Cisco Systems, Inc. and Micron Technology, Inc.: SG&A Spending Patterns Compared

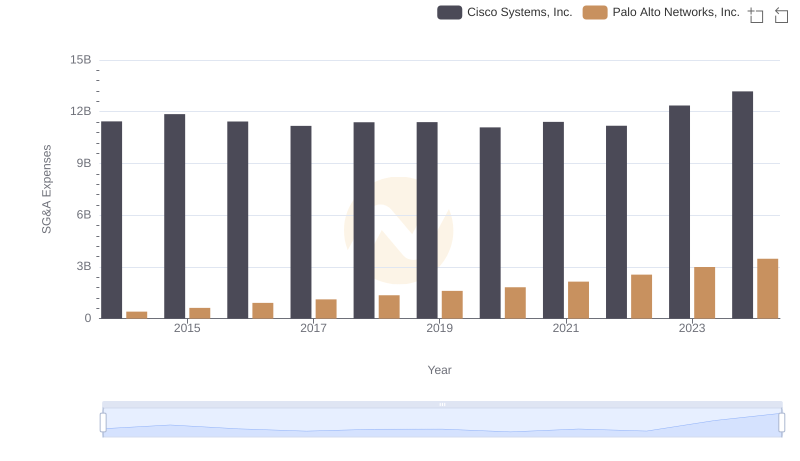

Cisco Systems, Inc. and Palo Alto Networks, Inc.: SG&A Spending Patterns Compared

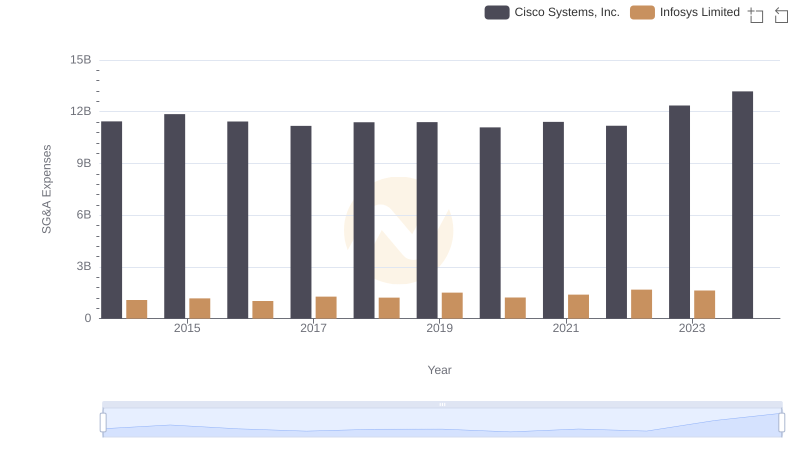

Cisco Systems, Inc. and Infosys Limited: SG&A Spending Patterns Compared

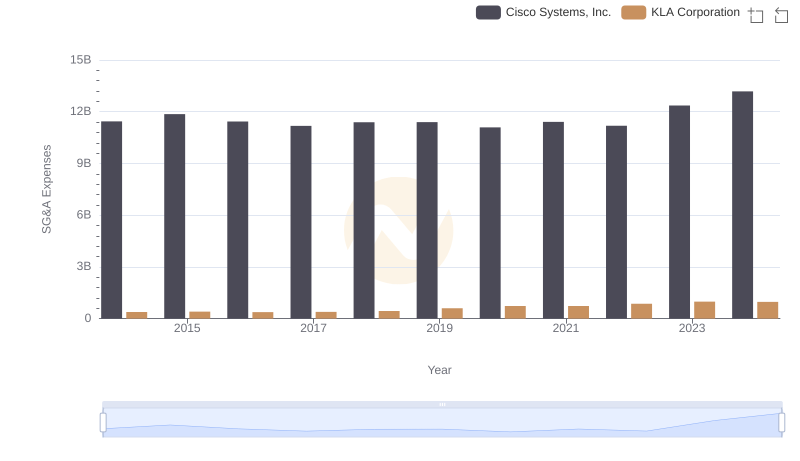

Who Optimizes SG&A Costs Better? Cisco Systems, Inc. or KLA Corporation

Cisco Systems, Inc. vs Analog Devices, Inc.: In-Depth EBITDA Performance Comparison