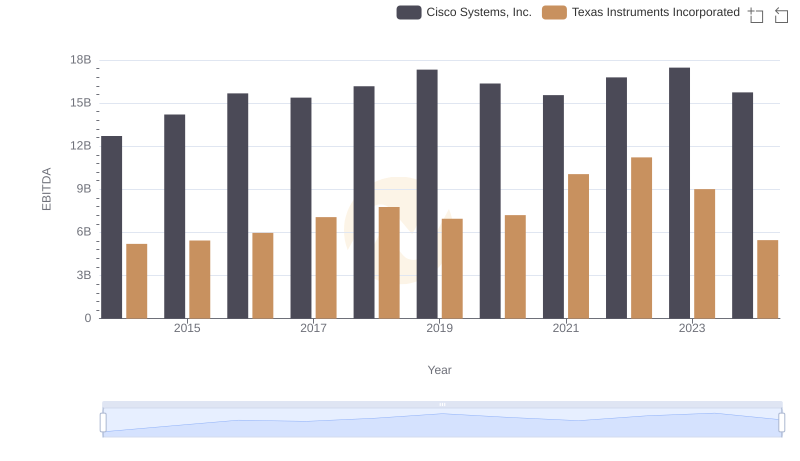

| __timestamp | Cisco Systems, Inc. | Texas Instruments Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 11437000000 | 1843000000 |

| Thursday, January 1, 2015 | 11861000000 | 1748000000 |

| Friday, January 1, 2016 | 11433000000 | 1767000000 |

| Sunday, January 1, 2017 | 11177000000 | 1694000000 |

| Monday, January 1, 2018 | 11386000000 | 1684000000 |

| Tuesday, January 1, 2019 | 11398000000 | 1645000000 |

| Wednesday, January 1, 2020 | 11094000000 | 1623000000 |

| Friday, January 1, 2021 | 11411000000 | 1666000000 |

| Saturday, January 1, 2022 | 11186000000 | 1704000000 |

| Sunday, January 1, 2023 | 12358000000 | 1825000000 |

| Monday, January 1, 2024 | 13177000000 | 1794000000 |

Unleashing the power of data

In the competitive landscape of technology giants, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, Cisco Systems, Inc. and Texas Instruments Incorporated have demonstrated contrasting approaches to SG&A management. From 2014 to 2024, Cisco's SG&A expenses have shown a steady increase, peaking at approximately $13.2 billion in 2024, reflecting a 15% rise from 2014. In contrast, Texas Instruments has maintained a more stable SG&A cost structure, with expenses fluctuating around $1.7 billion, showing a modest 3% decrease over the same period. This suggests that Texas Instruments has been more effective in controlling its SG&A costs relative to its revenue, potentially offering a leaner operational model. As investors and analysts evaluate these companies, understanding their cost management strategies provides valuable insights into their financial health and operational efficiency.

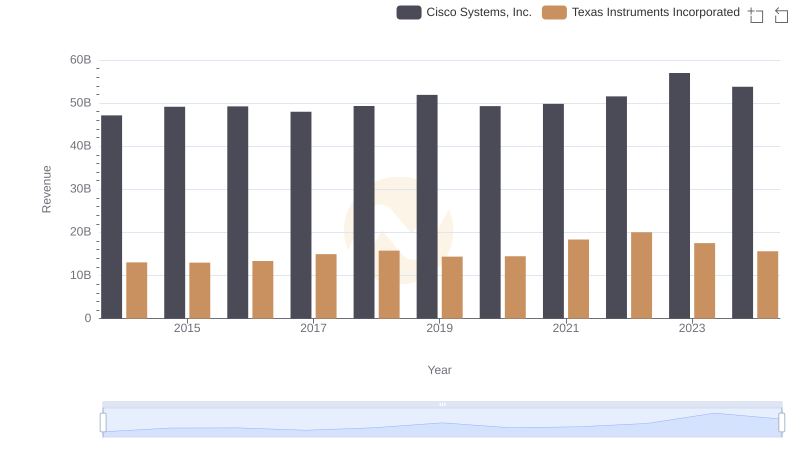

Breaking Down Revenue Trends: Cisco Systems, Inc. vs Texas Instruments Incorporated

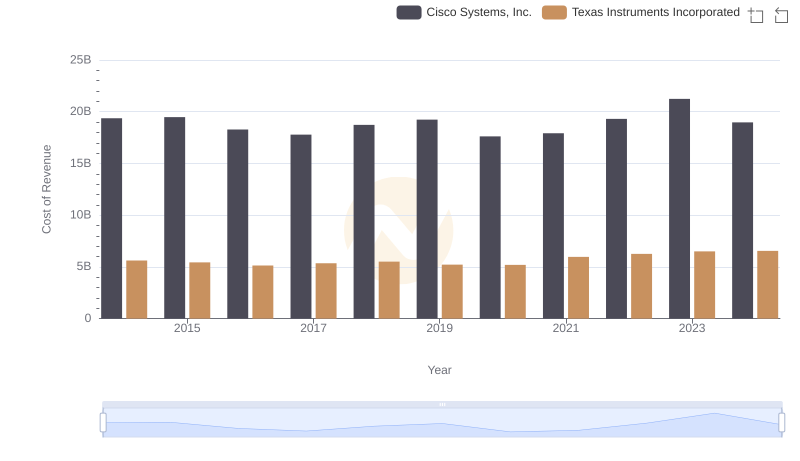

Cost of Revenue Trends: Cisco Systems, Inc. vs Texas Instruments Incorporated

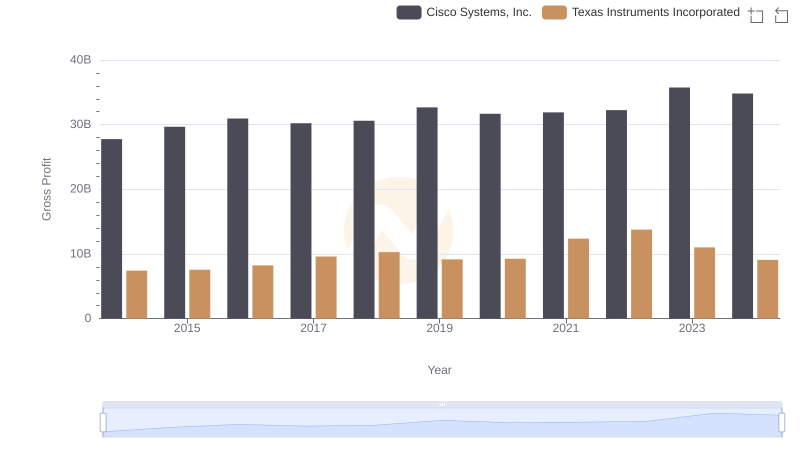

Cisco Systems, Inc. and Texas Instruments Incorporated: A Detailed Gross Profit Analysis

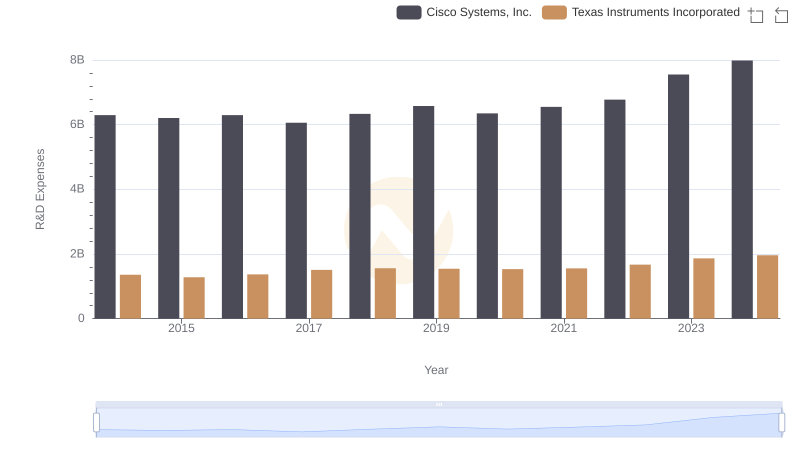

Research and Development: Comparing Key Metrics for Cisco Systems, Inc. and Texas Instruments Incorporated

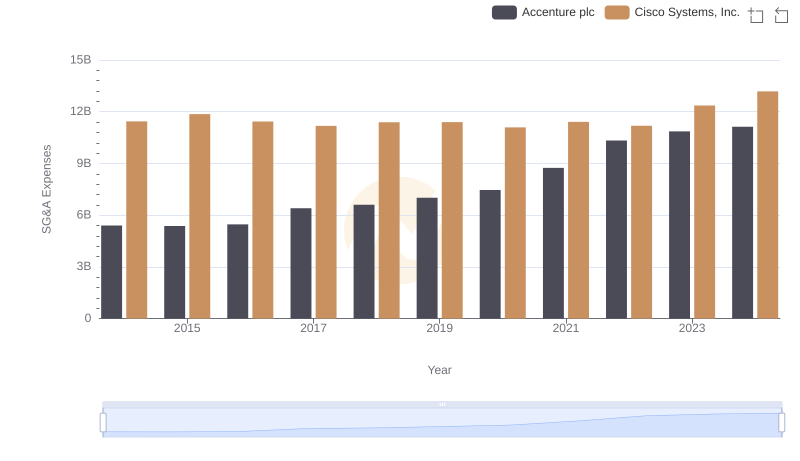

Cisco Systems, Inc. vs Accenture plc: SG&A Expense Trends

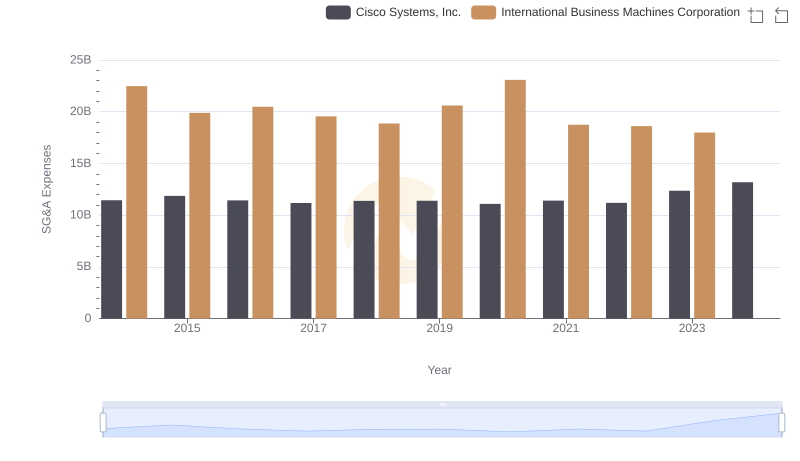

Breaking Down SG&A Expenses: Cisco Systems, Inc. vs International Business Machines Corporation

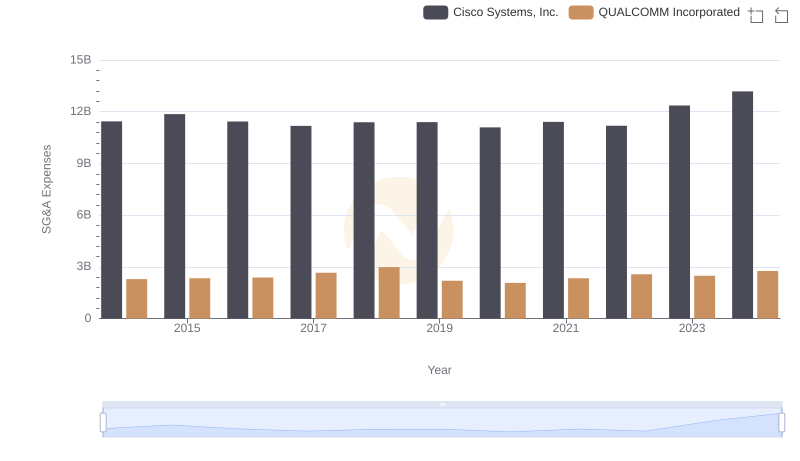

SG&A Efficiency Analysis: Comparing Cisco Systems, Inc. and QUALCOMM Incorporated

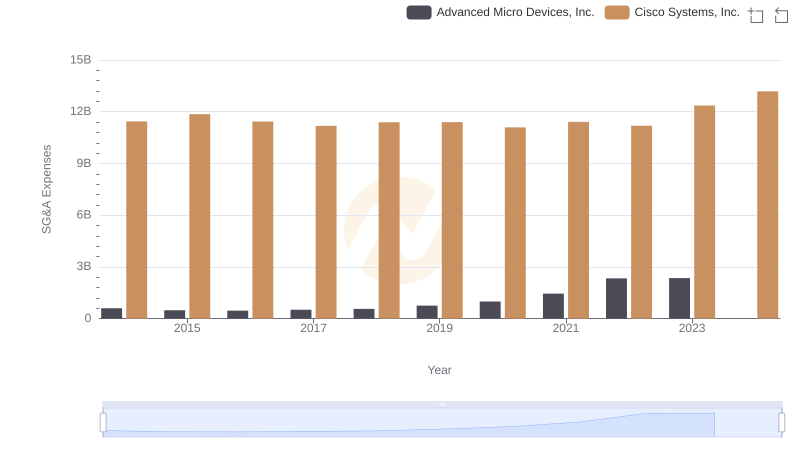

SG&A Efficiency Analysis: Comparing Cisco Systems, Inc. and Advanced Micro Devices, Inc.

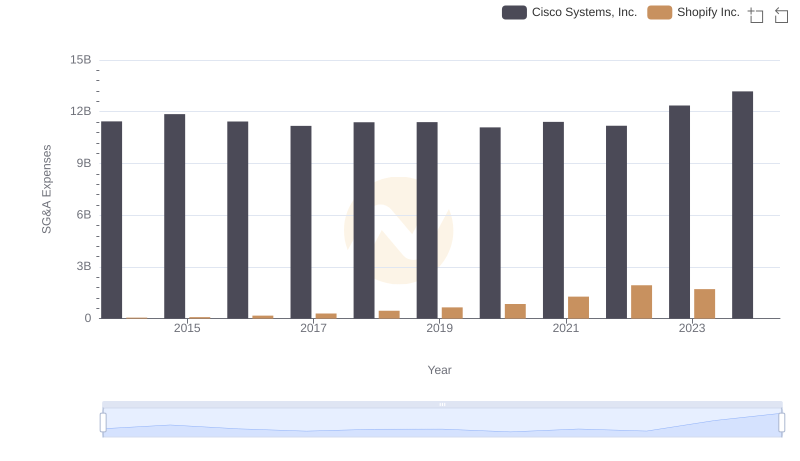

Cisco Systems, Inc. and Shopify Inc.: SG&A Spending Patterns Compared

Cisco Systems, Inc. vs Texas Instruments Incorporated: In-Depth EBITDA Performance Comparison

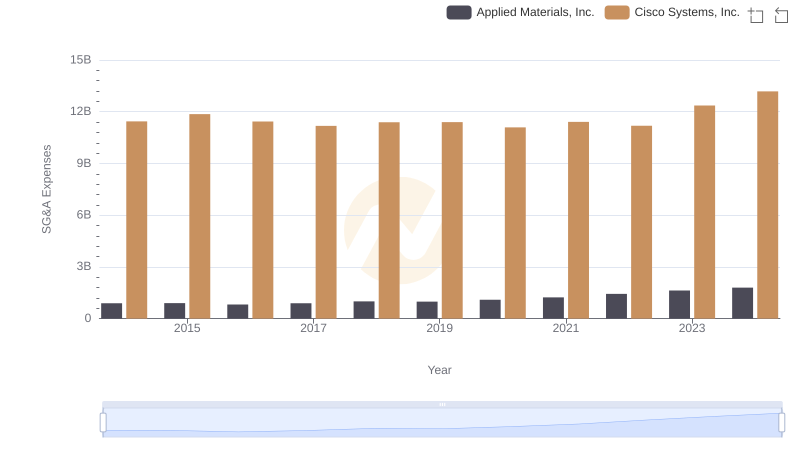

Operational Costs Compared: SG&A Analysis of Cisco Systems, Inc. and Applied Materials, Inc.

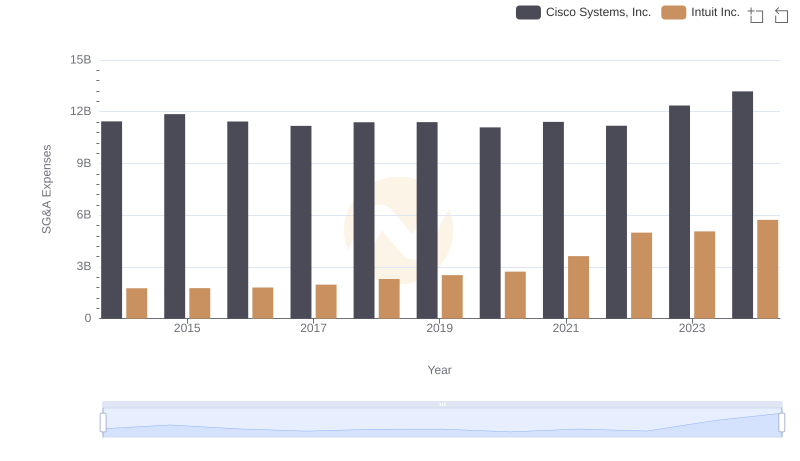

Cost Management Insights: SG&A Expenses for Cisco Systems, Inc. and Intuit Inc.