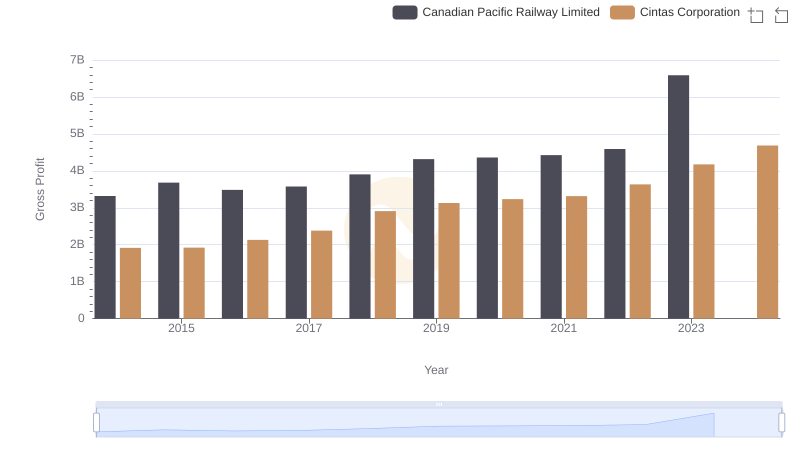

| __timestamp | Canadian Pacific Railway Limited | Cintas Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 3300000000 | 2637426000 |

| Thursday, January 1, 2015 | 3032000000 | 2555549000 |

| Friday, January 1, 2016 | 2749000000 | 2775588000 |

| Sunday, January 1, 2017 | 2979000000 | 2943086000 |

| Monday, January 1, 2018 | 3413000000 | 3568109000 |

| Tuesday, January 1, 2019 | 3475000000 | 3763715000 |

| Wednesday, January 1, 2020 | 3349000000 | 3851372000 |

| Friday, January 1, 2021 | 3571000000 | 3801689000 |

| Saturday, January 1, 2022 | 4223000000 | 4222213000 |

| Sunday, January 1, 2023 | 5968000000 | 4642401000 |

| Monday, January 1, 2024 | 7003000000 | 4910199000 |

Unleashing insights

In the ever-evolving landscape of corporate efficiency, the cost of revenue serves as a critical metric for evaluating a company's operational prowess. This analysis delves into the cost efficiency of two industry giants: Cintas Corporation and Canadian Pacific Railway Limited, from 2014 to 2023.

Over the past decade, Cintas Corporation has demonstrated a steady increase in cost efficiency, with its cost of revenue rising by approximately 76% from 2014 to 2023. In contrast, Canadian Pacific Railway Limited experienced a more volatile trajectory, with a significant spike of 80% in 2023, reaching its peak.

Interestingly, while both companies showed growth, Cintas maintained a more consistent upward trend, suggesting a robust strategy in managing operational costs. The data for 2024 is incomplete, leaving room for speculation on future trends. This comparison highlights the importance of strategic cost management in maintaining competitive advantage.

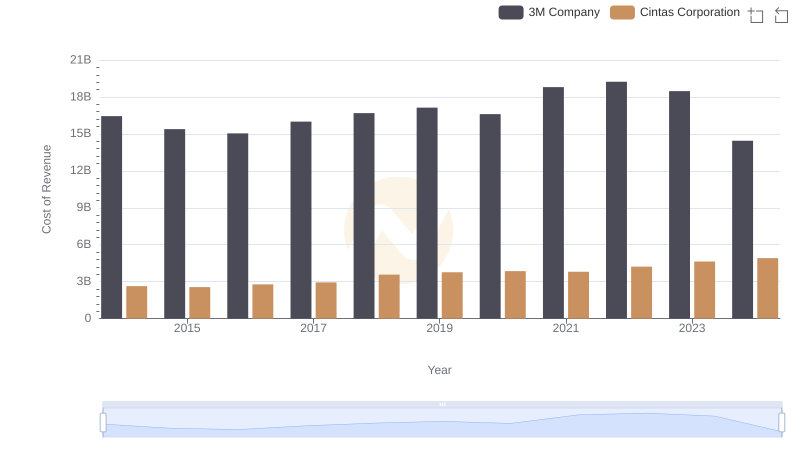

Analyzing Cost of Revenue: Cintas Corporation and 3M Company

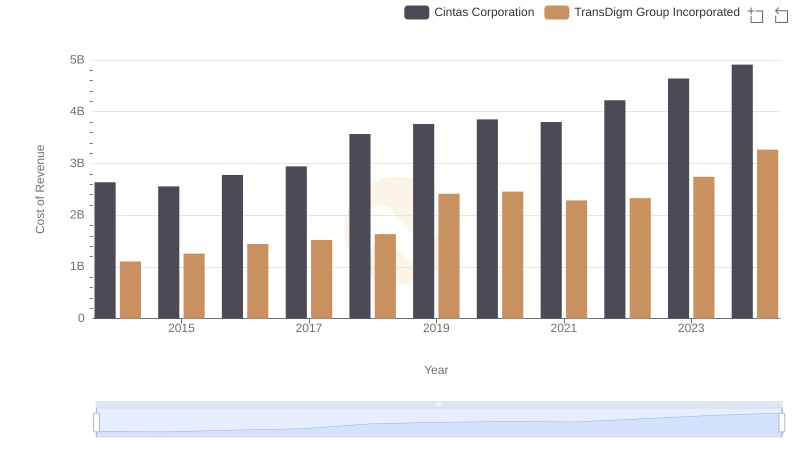

Cost of Revenue Comparison: Cintas Corporation vs TransDigm Group Incorporated

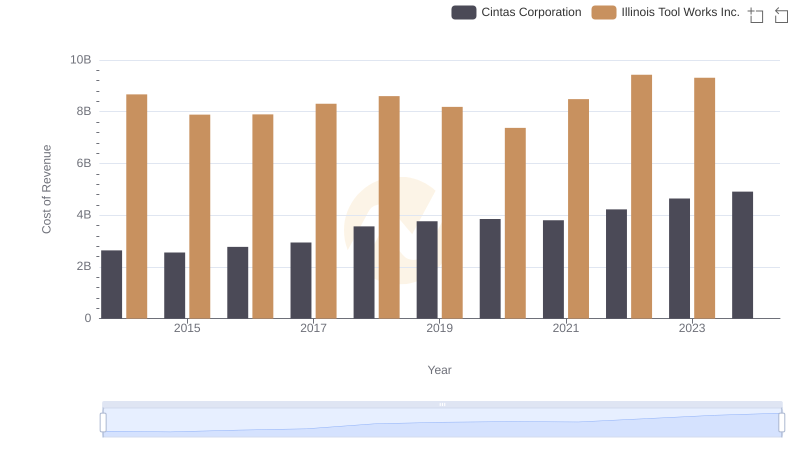

Cost of Revenue Comparison: Cintas Corporation vs Illinois Tool Works Inc.

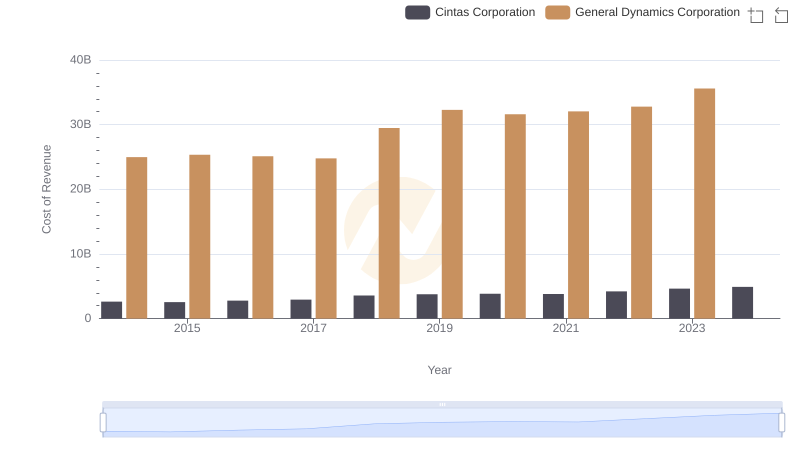

Cintas Corporation vs General Dynamics Corporation: Efficiency in Cost of Revenue Explored

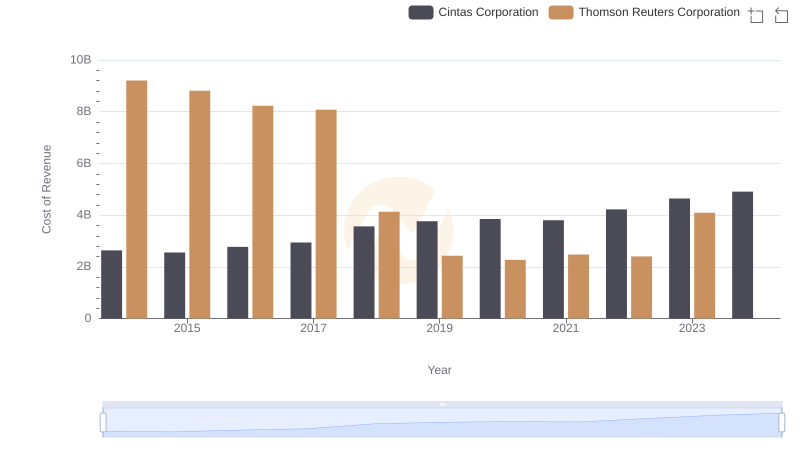

Cost Insights: Breaking Down Cintas Corporation and Thomson Reuters Corporation's Expenses

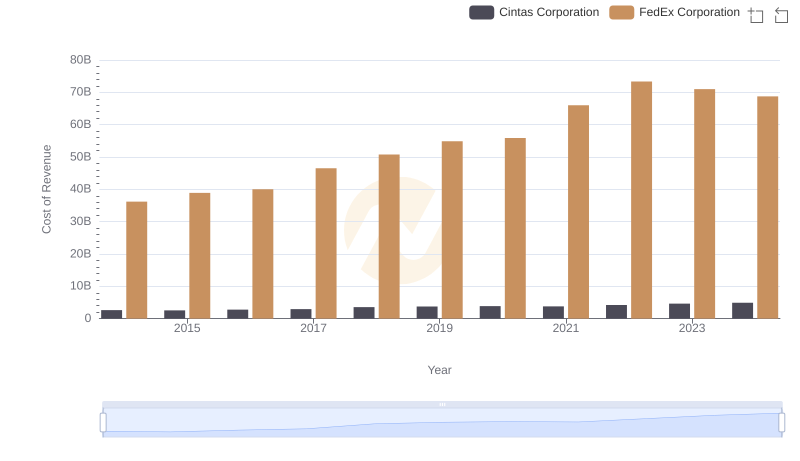

Cintas Corporation vs FedEx Corporation: Efficiency in Cost of Revenue Explored

Gross Profit Comparison: Cintas Corporation and Canadian Pacific Railway Limited Trends

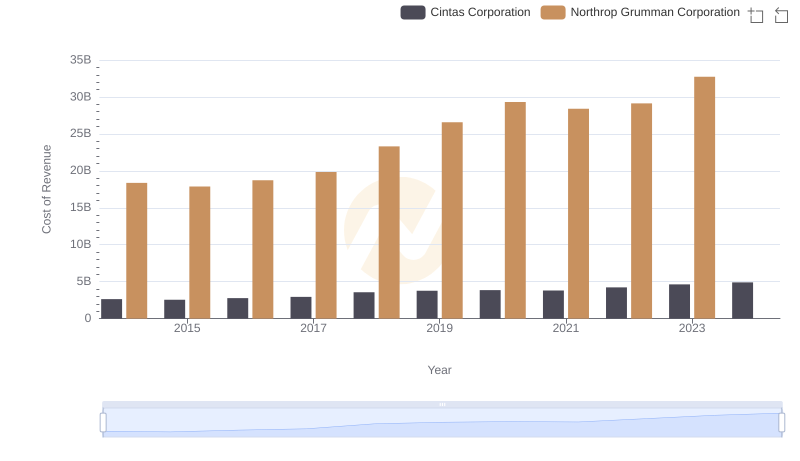

Cost of Revenue: Key Insights for Cintas Corporation and Northrop Grumman Corporation

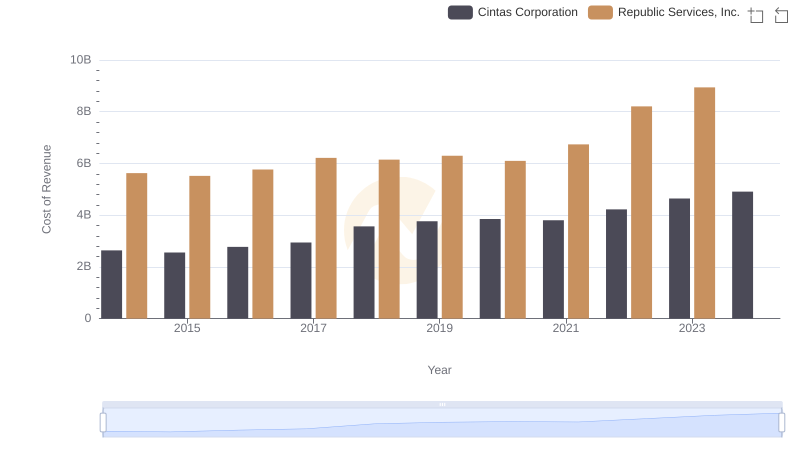

Cost Insights: Breaking Down Cintas Corporation and Republic Services, Inc.'s Expenses

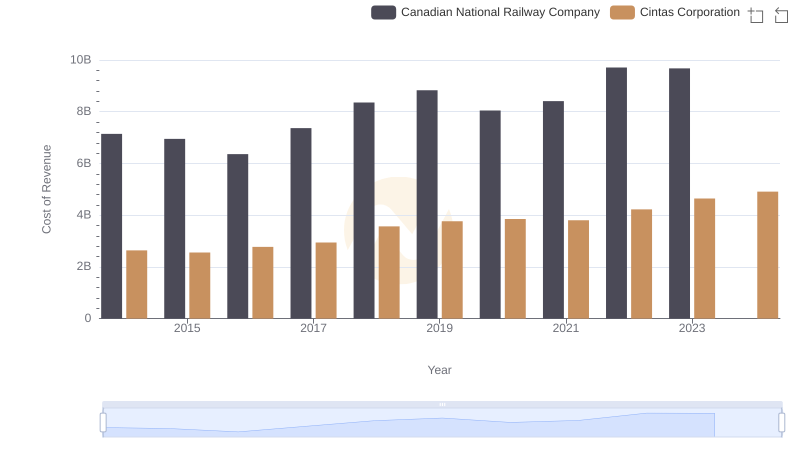

Cost Insights: Breaking Down Cintas Corporation and Canadian National Railway Company's Expenses