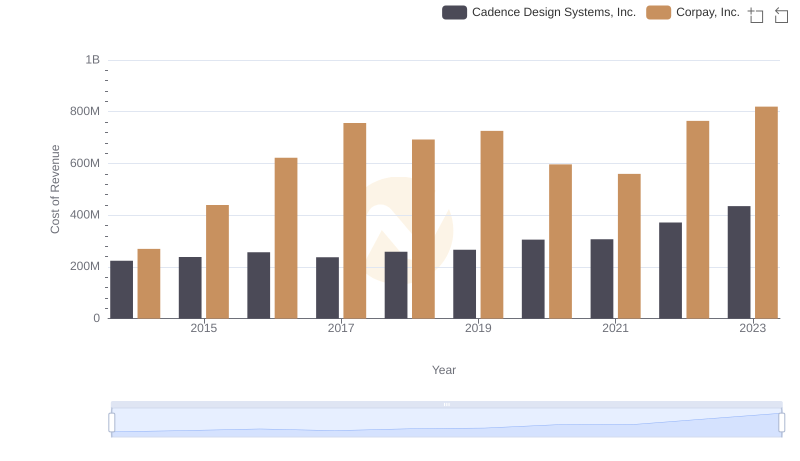

| __timestamp | Cadence Design Systems, Inc. | Corpay, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 513307000 | 281490000 |

| Thursday, January 1, 2015 | 512414000 | 406790000 |

| Friday, January 1, 2016 | 520300000 | 450953000 |

| Sunday, January 1, 2017 | 553342000 | 603268000 |

| Monday, January 1, 2018 | 573075000 | 631142000 |

| Tuesday, January 1, 2019 | 621479000 | 683511000 |

| Wednesday, January 1, 2020 | 670885000 | 567410000 |

| Friday, January 1, 2021 | 749280000 | 747948000 |

| Saturday, January 1, 2022 | 846340000 | 893217000 |

| Sunday, January 1, 2023 | 920649000 | 943581000 |

| Monday, January 1, 2024 | 1039766000 | 997780000 |

Igniting the spark of knowledge

In the competitive landscape of technology and financial services, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, Cadence Design Systems and Corpay have shown distinct strategies in handling these costs. From 2014 to 2023, Cadence Design Systems saw a steady increase in SG&A expenses, peaking at approximately 920 million in 2023. This represents a 79% increase from their 2014 levels. Meanwhile, Corpay's SG&A expenses surged by 235% over the same period, reaching around 944 million in 2023. Despite Corpay's higher growth rate, Cadence's more consistent expense management may indicate a strategic advantage. As businesses navigate economic uncertainties, understanding these trends offers valuable insights into corporate financial health and strategic planning.

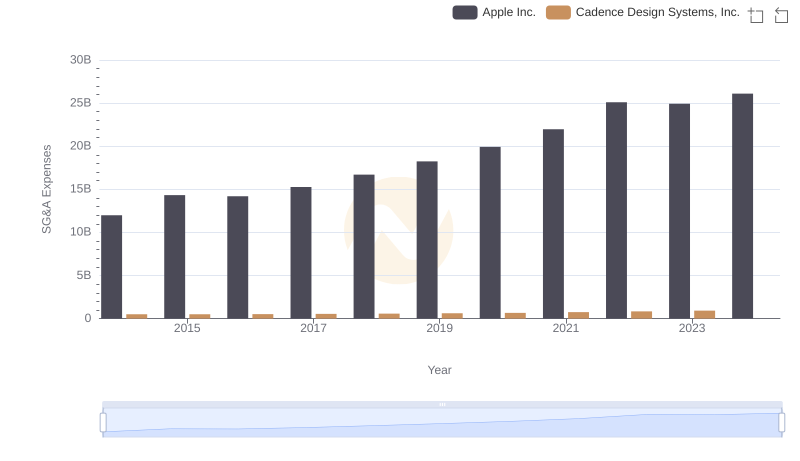

SG&A Efficiency Analysis: Comparing Apple Inc. and Cadence Design Systems, Inc.

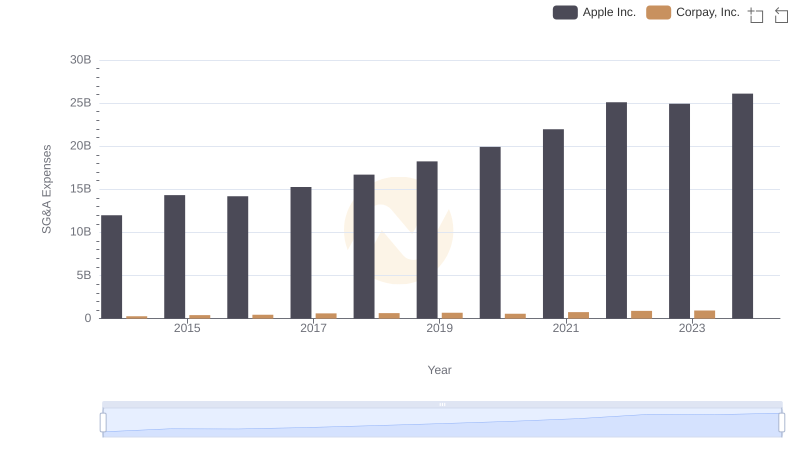

SG&A Efficiency Analysis: Comparing Apple Inc. and Corpay, Inc.

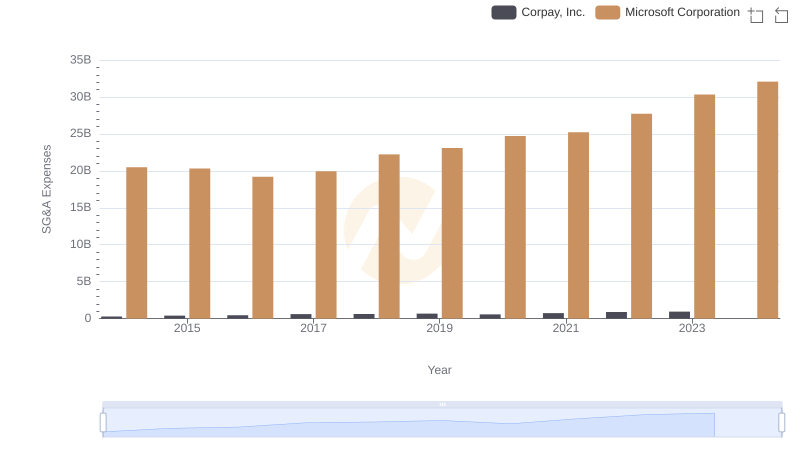

Microsoft Corporation or Corpay, Inc.: Who Manages SG&A Costs Better?

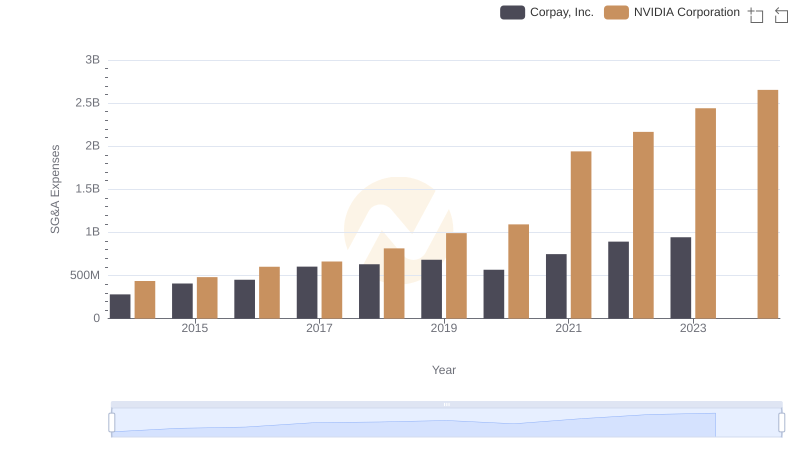

NVIDIA Corporation and Corpay, Inc.: SG&A Spending Patterns Compared

SG&A Efficiency Analysis: Comparing Taiwan Semiconductor Manufacturing Company Limited and Cadence Design Systems, Inc.

Taiwan Semiconductor Manufacturing Company Limited or Corpay, Inc.: Who Manages SG&A Costs Better?

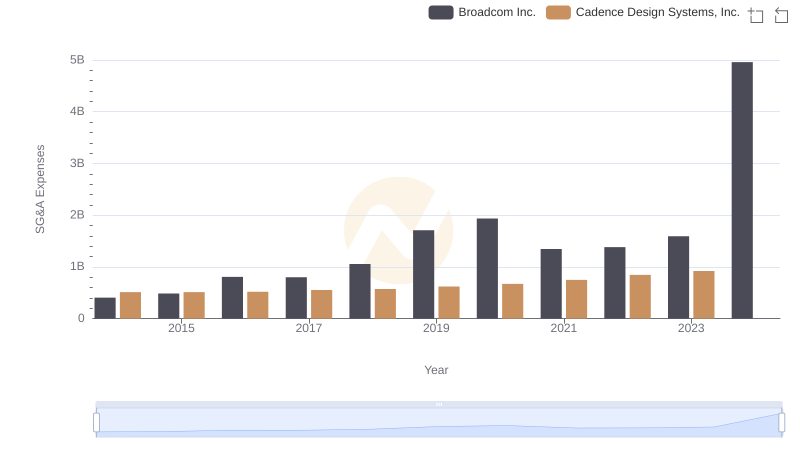

Broadcom Inc. or Cadence Design Systems, Inc.: Who Manages SG&A Costs Better?

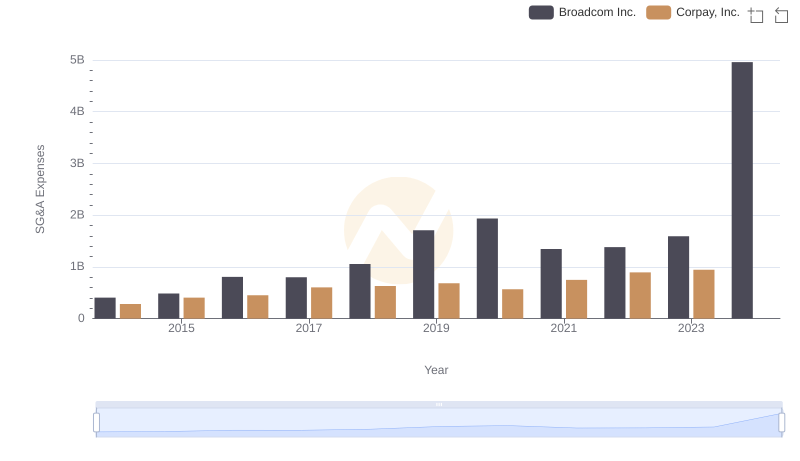

Operational Costs Compared: SG&A Analysis of Broadcom Inc. and Corpay, Inc.

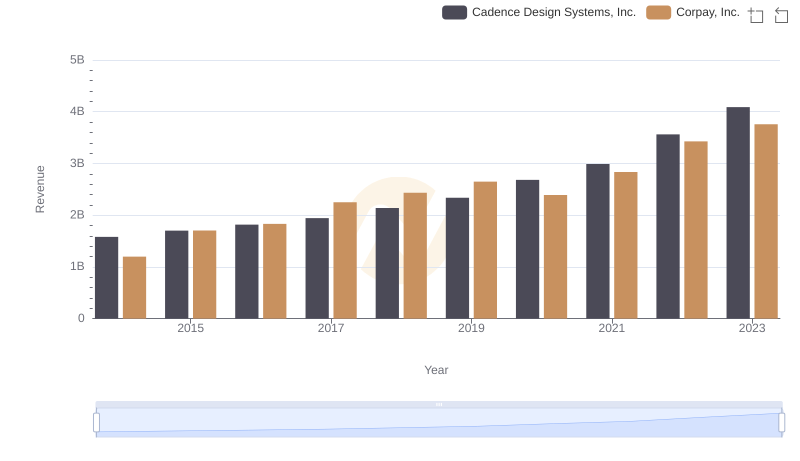

Breaking Down Revenue Trends: Cadence Design Systems, Inc. vs Corpay, Inc.

Comparing Cost of Revenue Efficiency: Cadence Design Systems, Inc. vs Corpay, Inc.

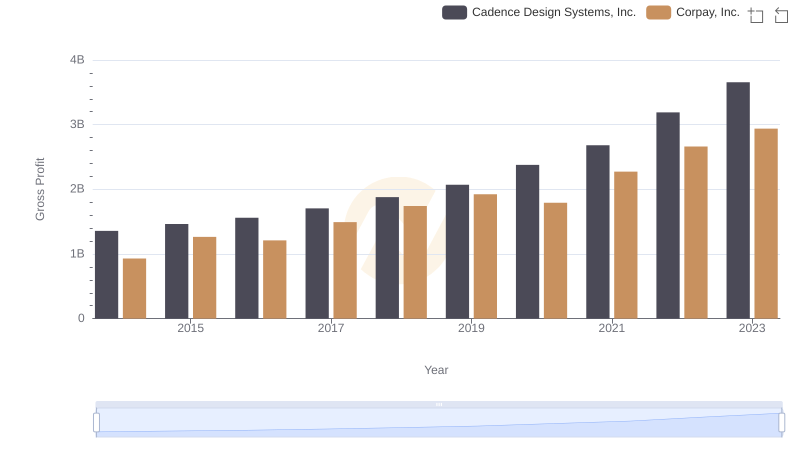

Gross Profit Comparison: Cadence Design Systems, Inc. and Corpay, Inc. Trends

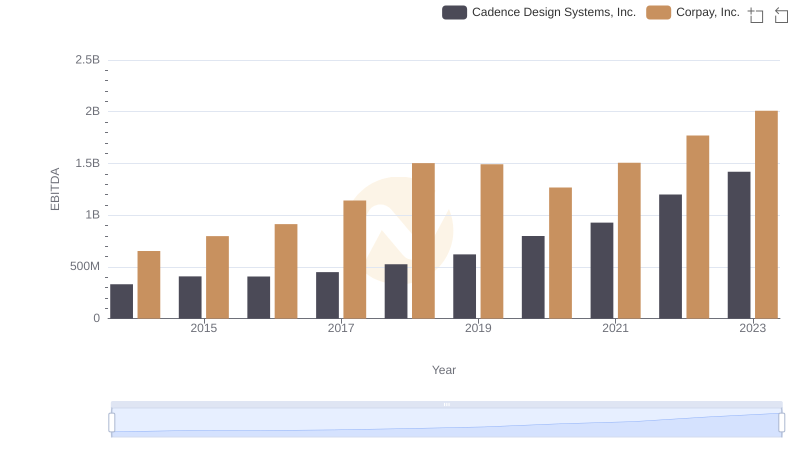

Cadence Design Systems, Inc. and Corpay, Inc.: A Detailed Examination of EBITDA Performance