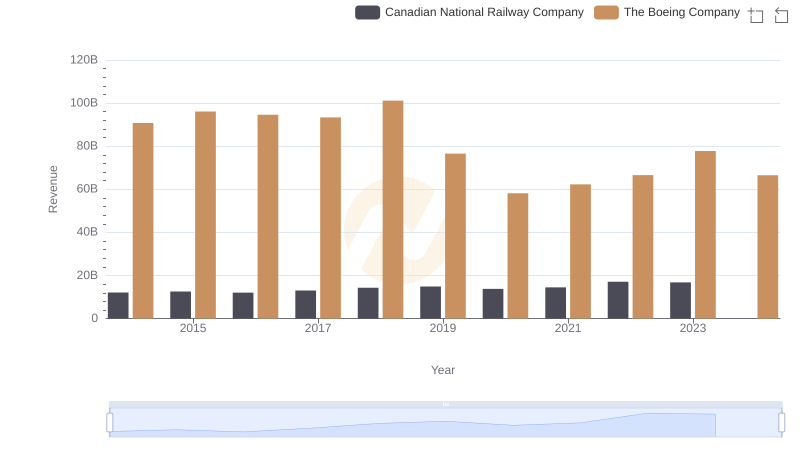

| __timestamp | Canadian National Railway Company | The Boeing Company |

|---|---|---|

| Wednesday, January 1, 2014 | 7142000000 | 76752000000 |

| Thursday, January 1, 2015 | 6951000000 | 82088000000 |

| Friday, January 1, 2016 | 6362000000 | 80790000000 |

| Sunday, January 1, 2017 | 7366000000 | 76066000000 |

| Monday, January 1, 2018 | 8359000000 | 81490000000 |

| Tuesday, January 1, 2019 | 8832000000 | 72093000000 |

| Wednesday, January 1, 2020 | 8048000000 | 63843000000 |

| Friday, January 1, 2021 | 8408000000 | 59237000000 |

| Saturday, January 1, 2022 | 9711000000 | 63078000000 |

| Sunday, January 1, 2023 | 9677000000 | 70070000000 |

| Monday, January 1, 2024 | 68508000000 |

Infusing magic into the data realm

In the ever-evolving landscape of global industries, understanding the cost of revenue is crucial for assessing a company's financial health. This analysis delves into the cost of revenue trends for The Boeing Company and Canadian National Railway Company from 2014 to 2023.

Boeing, a titan in aerospace, experienced a notable fluctuation in its cost of revenue. From a peak in 2015, the cost saw a decline, reaching its lowest in 2021. This 28% drop reflects the challenges faced during the pandemic, with a gradual recovery evident by 2023.

Conversely, Canadian National Railway showcased a more stable trajectory. Despite a slight dip in 2016, the company maintained a consistent upward trend, culminating in a 36% increase by 2023. This resilience underscores the robustness of the rail industry.

It's worth noting that data for Canadian National in 2024 is unavailable, highlighting the need for continuous data monitoring.

Comparing Revenue Performance: The Boeing Company or Canadian National Railway Company?

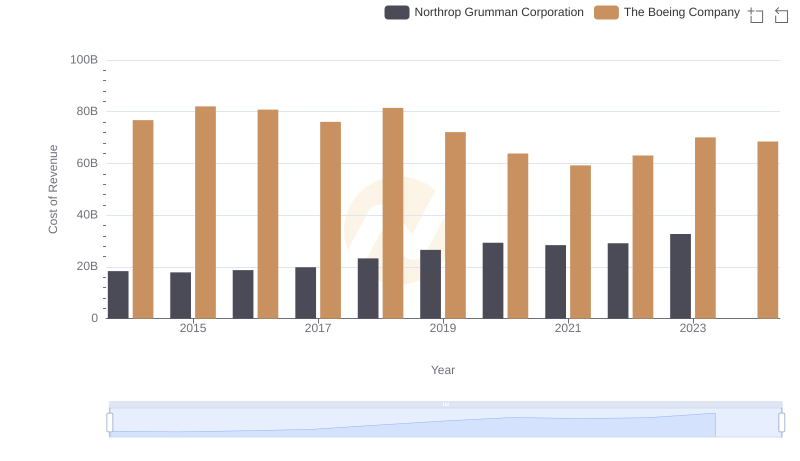

Analyzing Cost of Revenue: The Boeing Company and Northrop Grumman Corporation

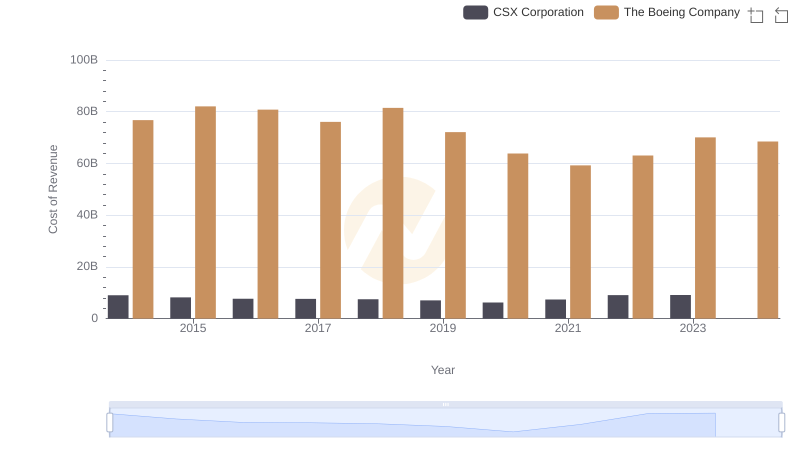

Analyzing Cost of Revenue: The Boeing Company and CSX Corporation

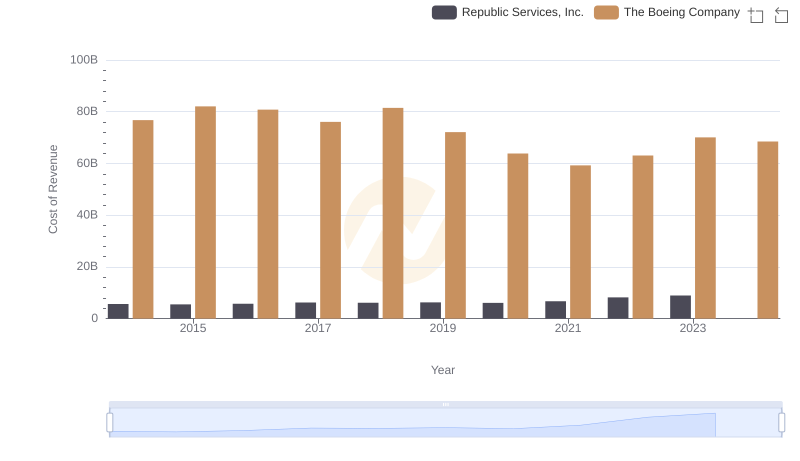

Cost of Revenue Comparison: The Boeing Company vs Republic Services, Inc.

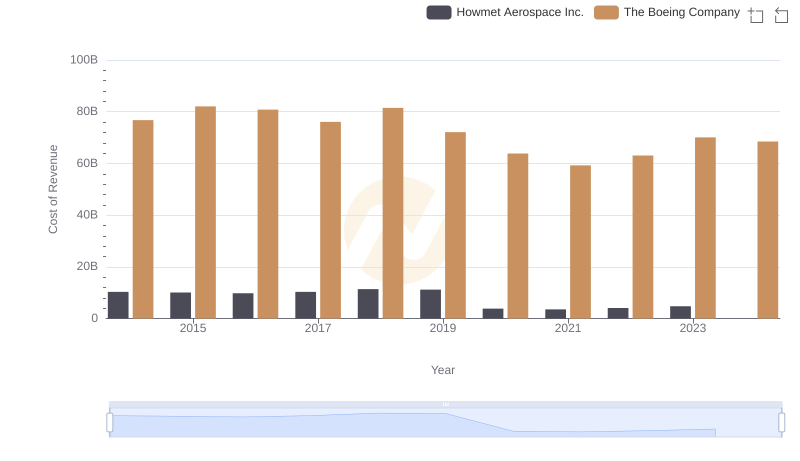

Analyzing Cost of Revenue: The Boeing Company and Howmet Aerospace Inc.

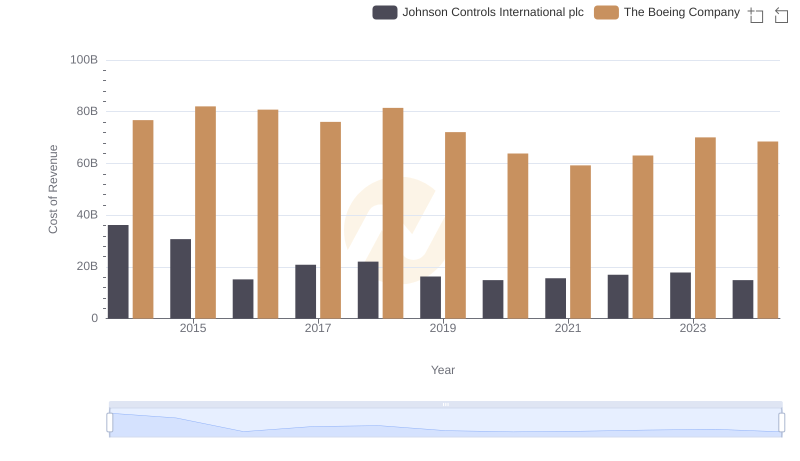

Analyzing Cost of Revenue: The Boeing Company and Johnson Controls International plc