| __timestamp | Adobe Inc. | Western Digital Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2215140000 | 761000000 |

| Thursday, January 1, 2015 | 2215161000 | 773000000 |

| Friday, January 1, 2016 | 2487907000 | 997000000 |

| Sunday, January 1, 2017 | 2822298000 | 1445000000 |

| Monday, January 1, 2018 | 3365727000 | 1473000000 |

| Tuesday, January 1, 2019 | 4124984000 | 1317000000 |

| Wednesday, January 1, 2020 | 4559000000 | 1153000000 |

| Friday, January 1, 2021 | 5406000000 | 1105000000 |

| Saturday, January 1, 2022 | 6187000000 | 1117000000 |

| Sunday, January 1, 2023 | 6764000000 | 970000000 |

| Monday, January 1, 2024 | 7293000000 | 828000000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of technology, understanding the financial strategies of industry giants is crucial. Over the past decade, Adobe Inc. has demonstrated a remarkable upward trajectory in its Selling, General, and Administrative (SG&A) expenses, reflecting a strategic investment in growth and innovation. From 2014 to 2024, Adobe's SG&A expenses surged by over 230%, highlighting its commitment to expanding its market presence and enhancing customer engagement.

Conversely, Western Digital Corporation's SG&A expenses have shown a more conservative growth pattern, peaking in 2018 and gradually declining thereafter. This trend suggests a strategic shift towards operational efficiency and cost management. By 2024, Western Digital's SG&A expenses had decreased by approximately 44% from their 2018 peak.

These contrasting trends underscore the diverse approaches these tech titans employ to navigate the competitive landscape, offering valuable insights into their long-term strategic priorities.

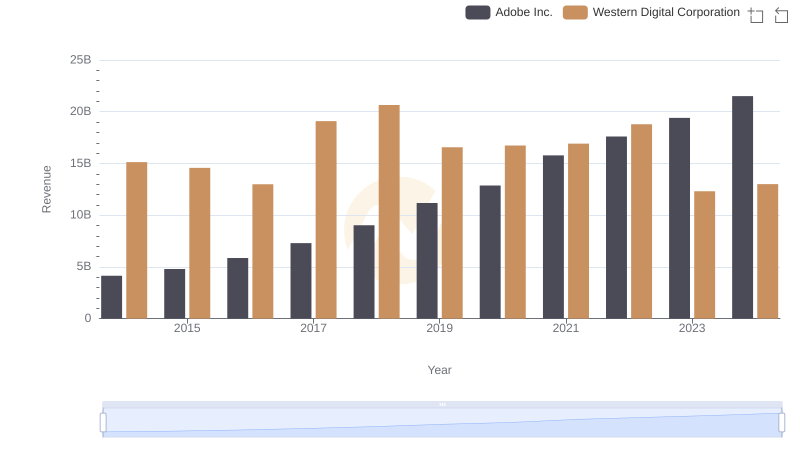

Comparing Revenue Performance: Adobe Inc. or Western Digital Corporation?

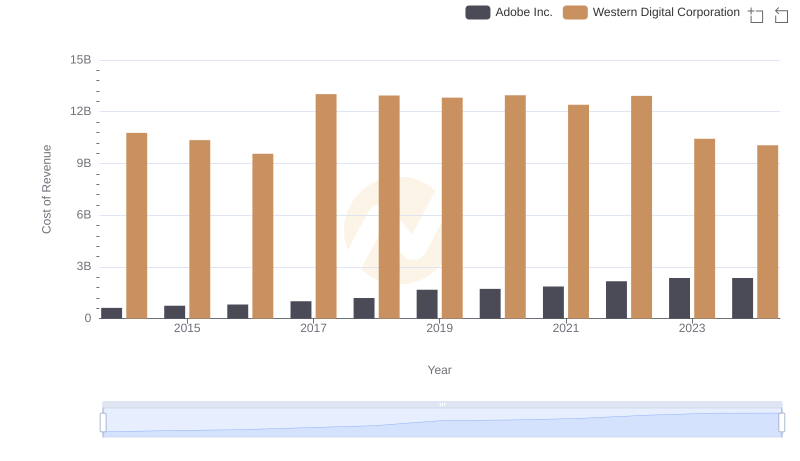

Cost of Revenue Trends: Adobe Inc. vs Western Digital Corporation

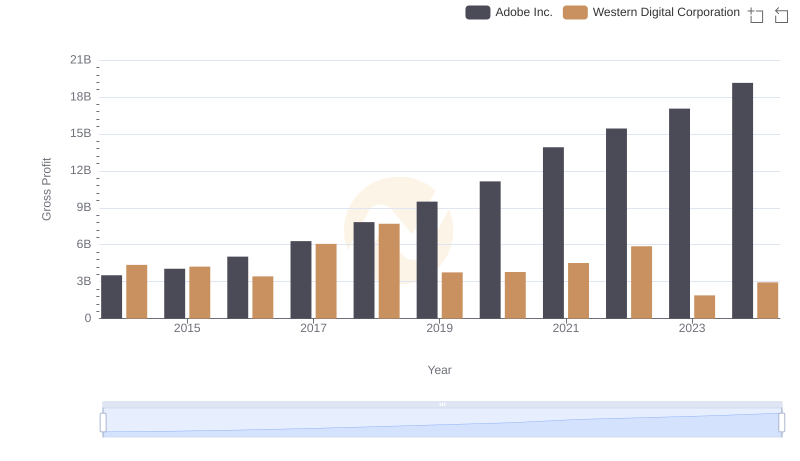

Gross Profit Trends Compared: Adobe Inc. vs Western Digital Corporation

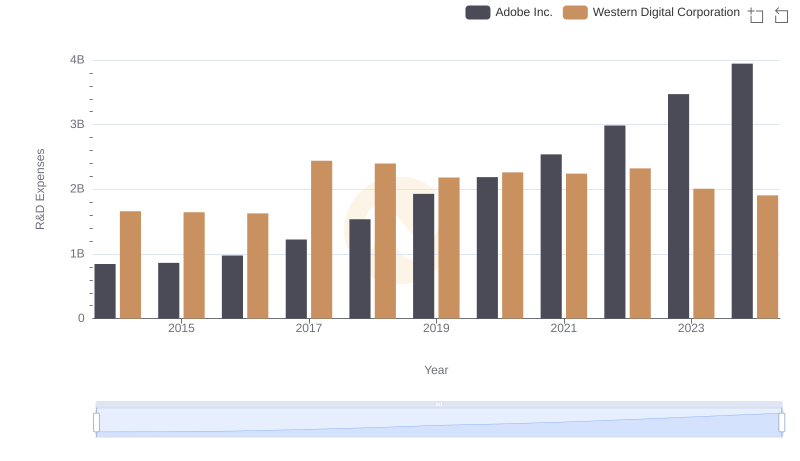

Research and Development Investment: Adobe Inc. vs Western Digital Corporation

Operational Costs Compared: SG&A Analysis of Adobe Inc. and ON Semiconductor Corporation

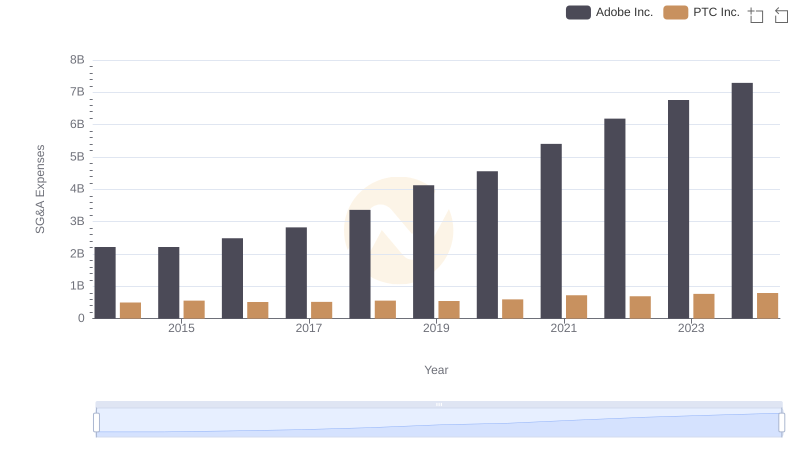

Selling, General, and Administrative Costs: Adobe Inc. vs PTC Inc.

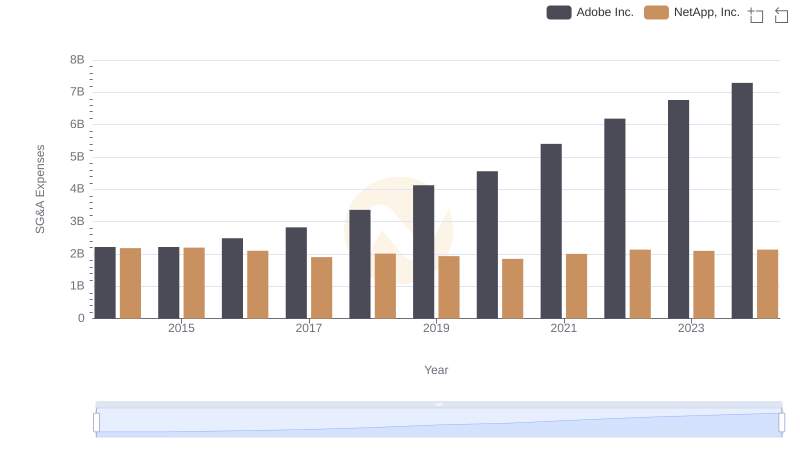

SG&A Efficiency Analysis: Comparing Adobe Inc. and NetApp, Inc.

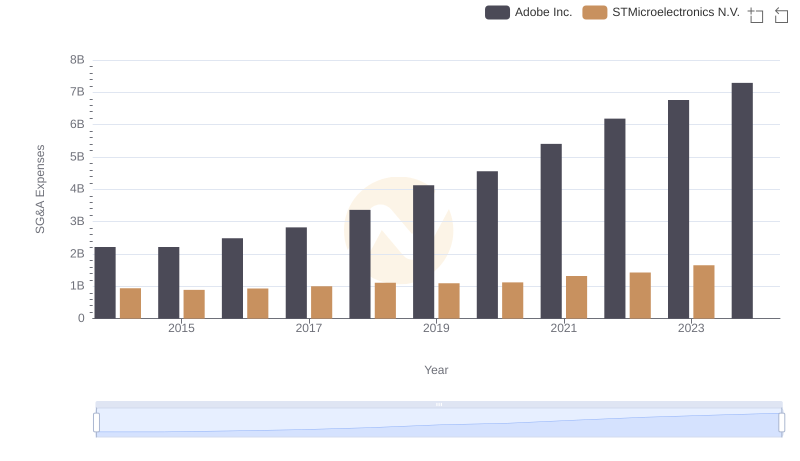

SG&A Efficiency Analysis: Comparing Adobe Inc. and STMicroelectronics N.V.

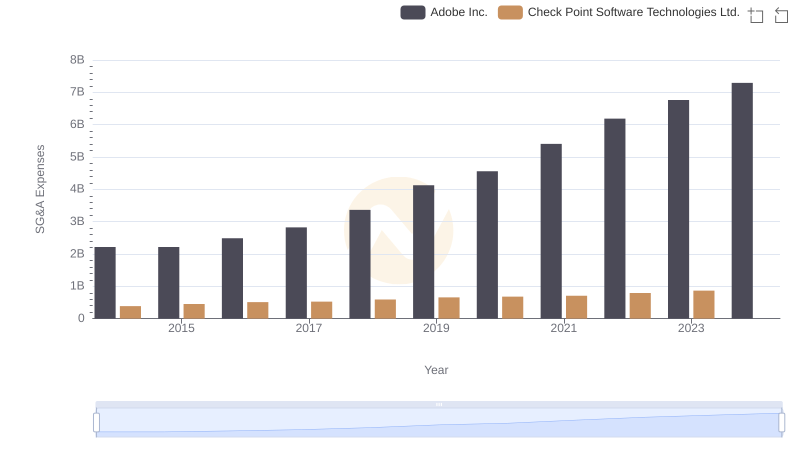

Adobe Inc. and Check Point Software Technologies Ltd.: SG&A Spending Patterns Compared

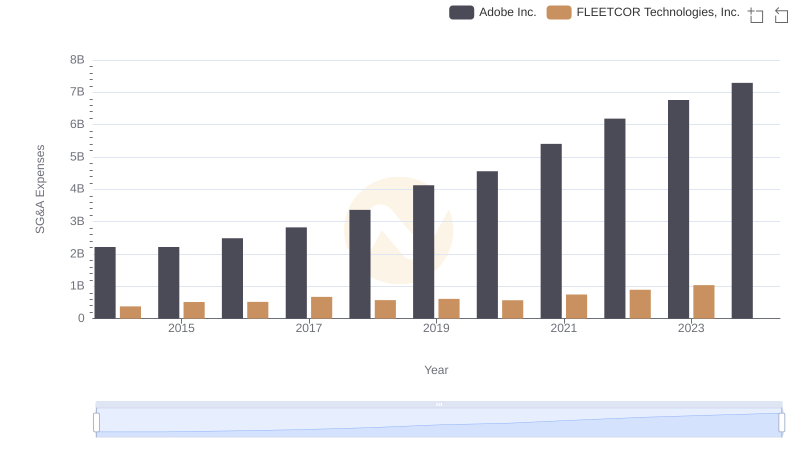

Adobe Inc. or FLEETCOR Technologies, Inc.: Who Manages SG&A Costs Better?

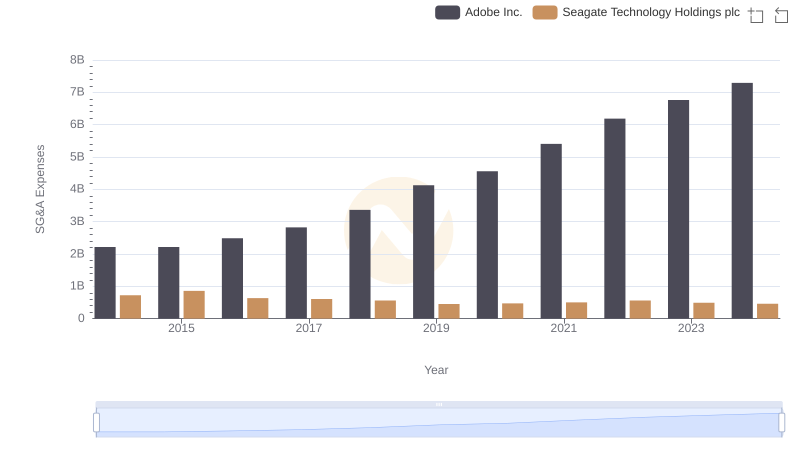

Operational Costs Compared: SG&A Analysis of Adobe Inc. and Seagate Technology Holdings plc

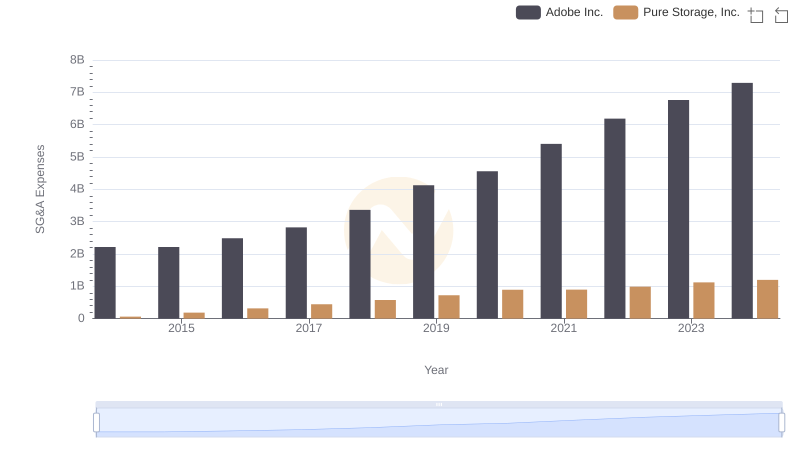

Comparing SG&A Expenses: Adobe Inc. vs Pure Storage, Inc. Trends and Insights