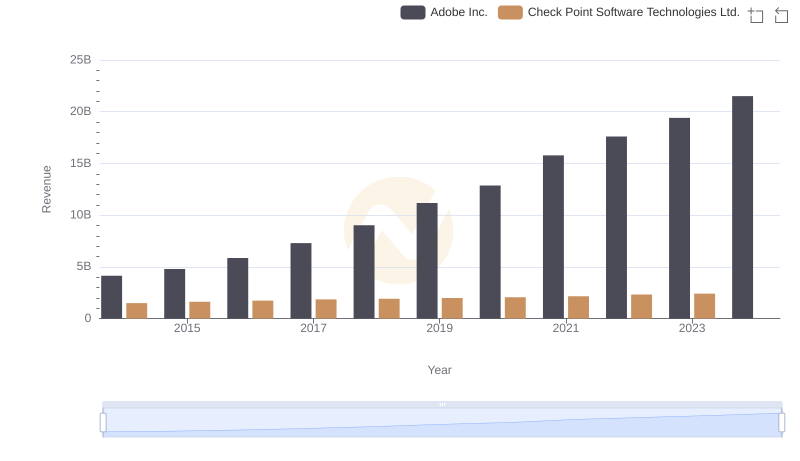

| __timestamp | Adobe Inc. | Check Point Software Technologies Ltd. |

|---|---|---|

| Wednesday, January 1, 2014 | 3524985000 | 1319275000 |

| Thursday, January 1, 2015 | 4051194000 | 1440781000 |

| Friday, January 1, 2016 | 5034522000 | 1539298000 |

| Sunday, January 1, 2017 | 6291014000 | 1641695000 |

| Monday, January 1, 2018 | 7835009000 | 1715096000 |

| Tuesday, January 1, 2019 | 9498577000 | 1779400000 |

| Wednesday, January 1, 2020 | 11146000000 | 1838400000 |

| Friday, January 1, 2021 | 13920000000 | 1908700000 |

| Saturday, January 1, 2022 | 15441000000 | 2025500000 |

| Sunday, January 1, 2023 | 17055000000 | 2132100000 |

| Monday, January 1, 2024 | 19147000000 |

Unlocking the unknown

In the ever-evolving landscape of technology, Adobe Inc. and Check Point Software Technologies Ltd. have carved out significant niches. Over the past decade, Adobe's gross profit has surged by an impressive 443%, reflecting its robust growth and market adaptability. In contrast, Check Point Software Technologies Ltd. has maintained a steady trajectory, with a 62% increase in gross profit since 2014. This divergence highlights Adobe's aggressive expansion and innovation strategy, particularly in digital media and marketing solutions, while Check Point remains a stalwart in cybersecurity.

From 2014 to 2023, Adobe's gross profit consistently outpaced Check Point's, peaking at nearly $19 billion in 2023. Meanwhile, Check Point's gross profit reached just over $2 billion. This stark contrast underscores the different growth dynamics and market strategies of these two tech titans. As we look to the future, the missing data for 2024 suggests potential shifts in the competitive landscape.

Adobe Inc. and Check Point Software Technologies Ltd.: A Comprehensive Revenue Analysis

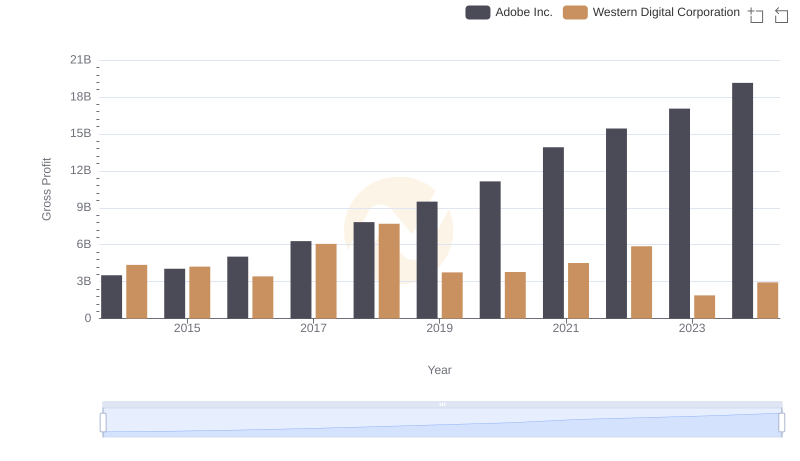

Gross Profit Trends Compared: Adobe Inc. vs Western Digital Corporation

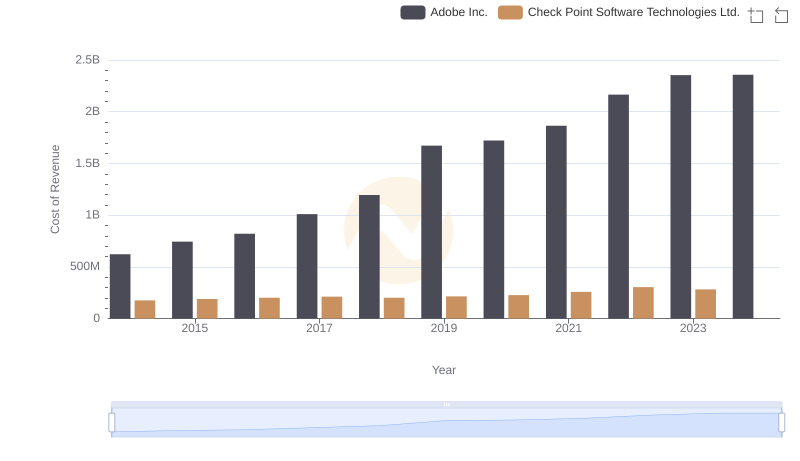

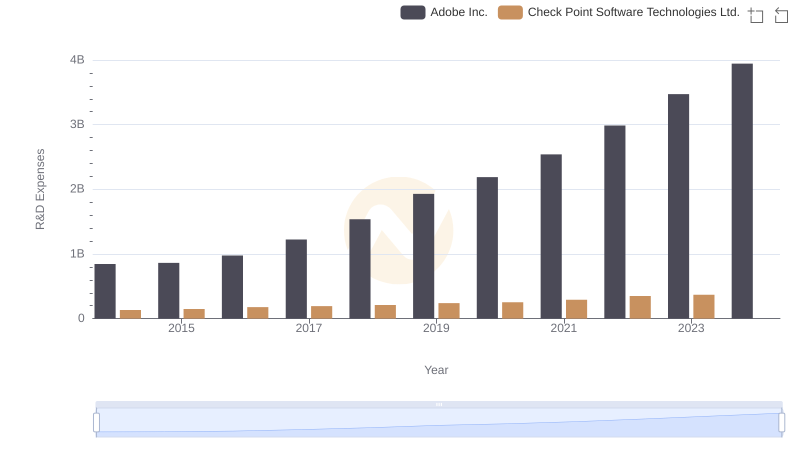

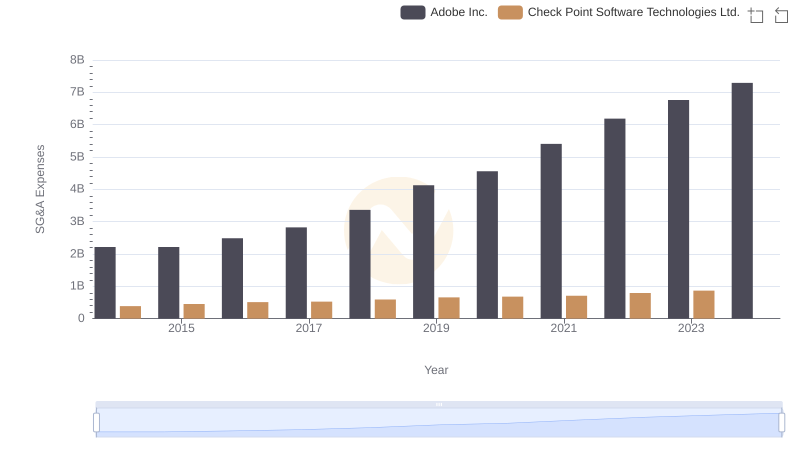

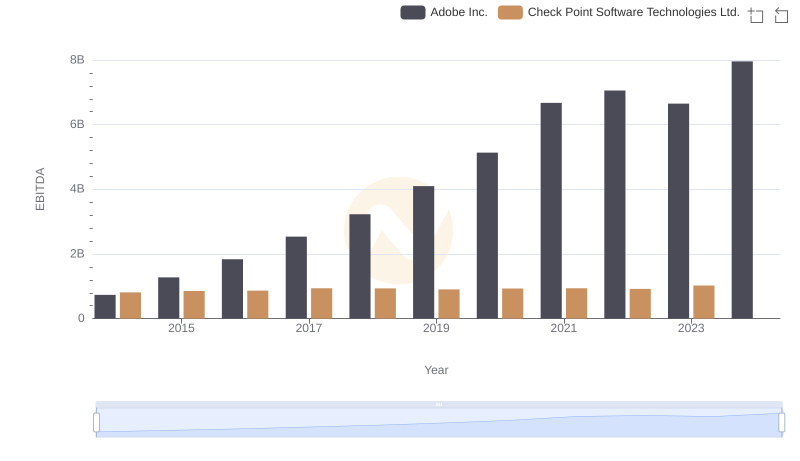

Cost Insights: Breaking Down Adobe Inc. and Check Point Software Technologies Ltd.'s Expenses

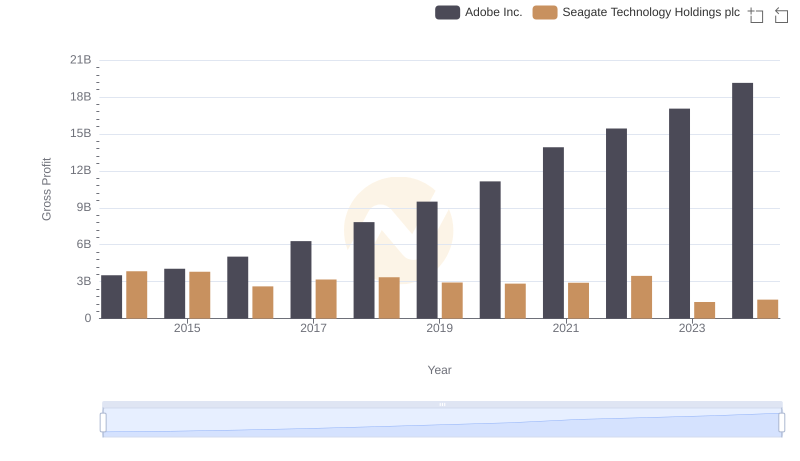

Gross Profit Comparison: Adobe Inc. and Seagate Technology Holdings plc Trends

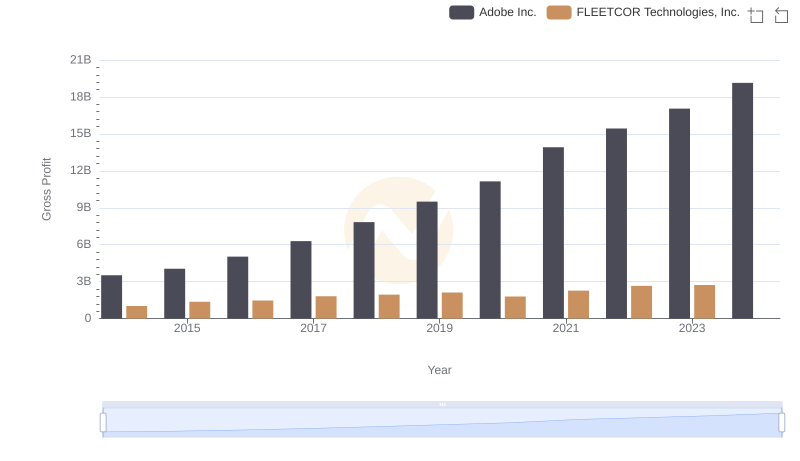

Gross Profit Trends Compared: Adobe Inc. vs FLEETCOR Technologies, Inc.

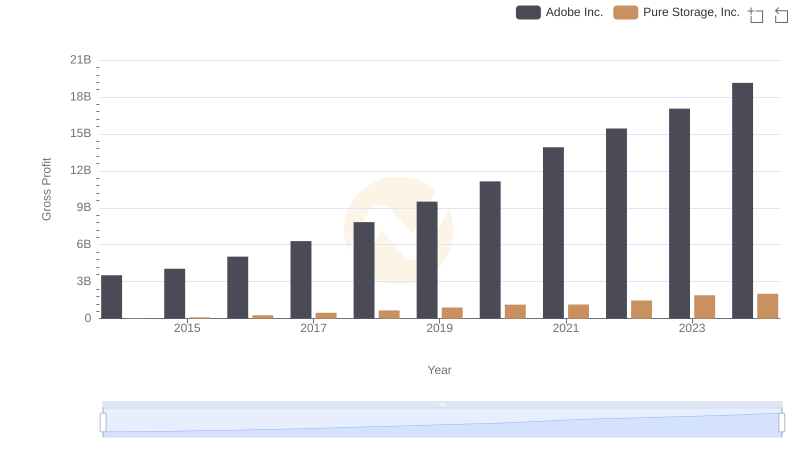

Gross Profit Comparison: Adobe Inc. and Pure Storage, Inc. Trends

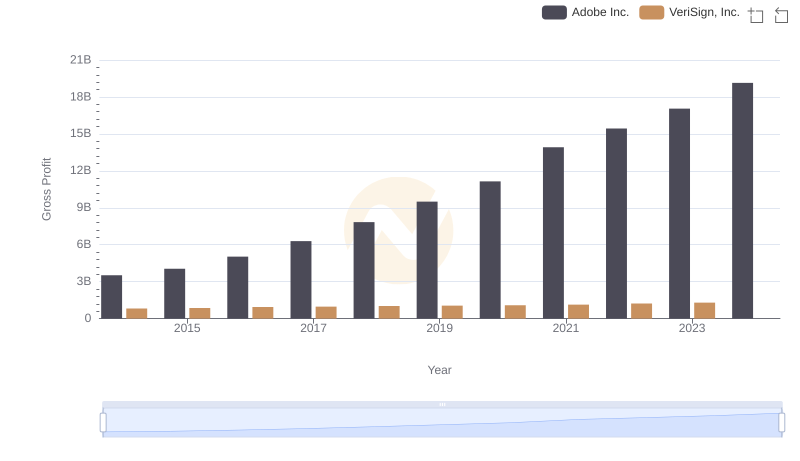

Gross Profit Trends Compared: Adobe Inc. vs VeriSign, Inc.

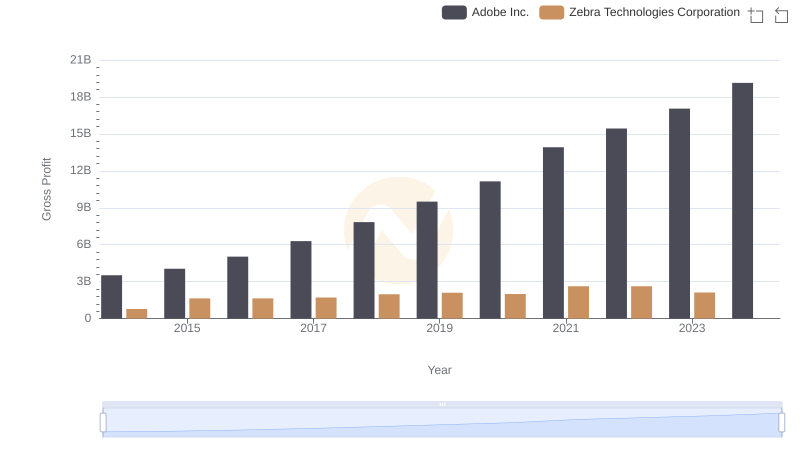

Gross Profit Analysis: Comparing Adobe Inc. and Zebra Technologies Corporation

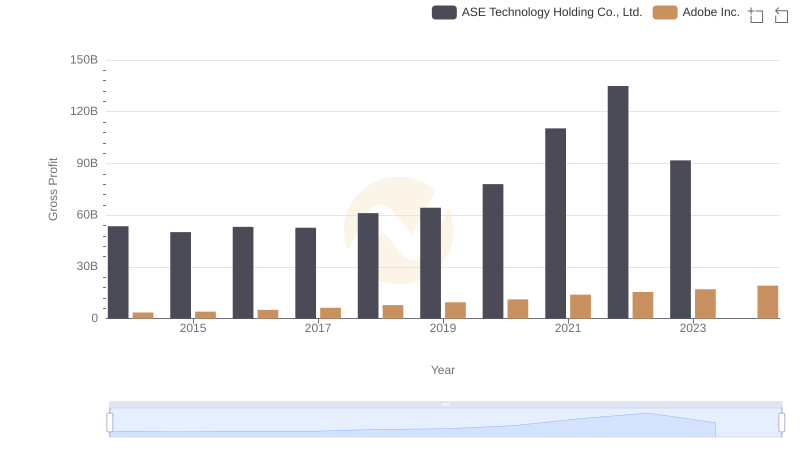

Adobe Inc. vs ASE Technology Holding Co., Ltd.: A Gross Profit Performance Breakdown

Research and Development Expenses Breakdown: Adobe Inc. vs Check Point Software Technologies Ltd.

Adobe Inc. and Check Point Software Technologies Ltd.: SG&A Spending Patterns Compared

EBITDA Performance Review: Adobe Inc. vs Check Point Software Technologies Ltd.