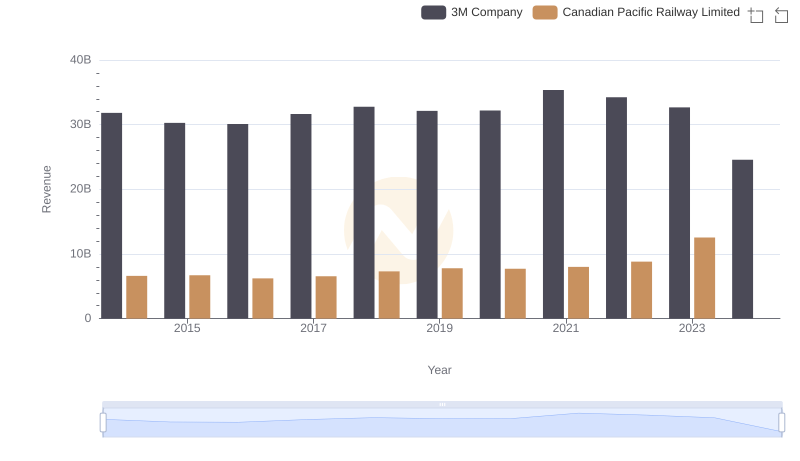

| __timestamp | 3M Company | Canadian Pacific Railway Limited |

|---|---|---|

| Wednesday, January 1, 2014 | 16447000000 | 3300000000 |

| Thursday, January 1, 2015 | 15383000000 | 3032000000 |

| Friday, January 1, 2016 | 15040000000 | 2749000000 |

| Sunday, January 1, 2017 | 16001000000 | 2979000000 |

| Monday, January 1, 2018 | 16682000000 | 3413000000 |

| Tuesday, January 1, 2019 | 17136000000 | 3475000000 |

| Wednesday, January 1, 2020 | 16605000000 | 3349000000 |

| Friday, January 1, 2021 | 18795000000 | 3571000000 |

| Saturday, January 1, 2022 | 19232000000 | 4223000000 |

| Sunday, January 1, 2023 | 18477000000 | 5968000000 |

| Monday, January 1, 2024 | 14447000000 | 7003000000 |

Unleashing insights

In the ever-evolving landscape of industrial giants, understanding cost efficiency is crucial. This analysis delves into the cost of revenue trends for 3M Company and Canadian Pacific Railway Limited from 2014 to 2023. Over this decade, 3M Company consistently maintained a higher cost of revenue, peaking in 2022 with a 15% increase from 2014. In contrast, Canadian Pacific Railway Limited showcased a remarkable 81% growth in cost of revenue, highlighting its expanding operations. Notably, 3M's cost of revenue saw a significant dip in 2024, indicating potential strategic shifts or market challenges. Missing data for Canadian Pacific in 2024 suggests a need for further investigation. This comparative analysis underscores the dynamic nature of cost management strategies in these industry leaders, offering insights into their operational efficiencies.

3M Company and Canadian Pacific Railway Limited: A Comprehensive Revenue Analysis

Cost of Revenue: Key Insights for 3M Company and General Dynamics Corporation

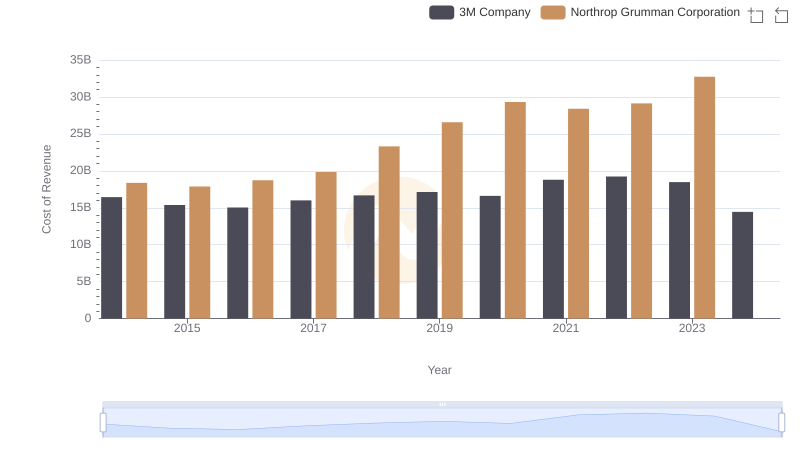

Cost of Revenue Comparison: 3M Company vs Northrop Grumman Corporation

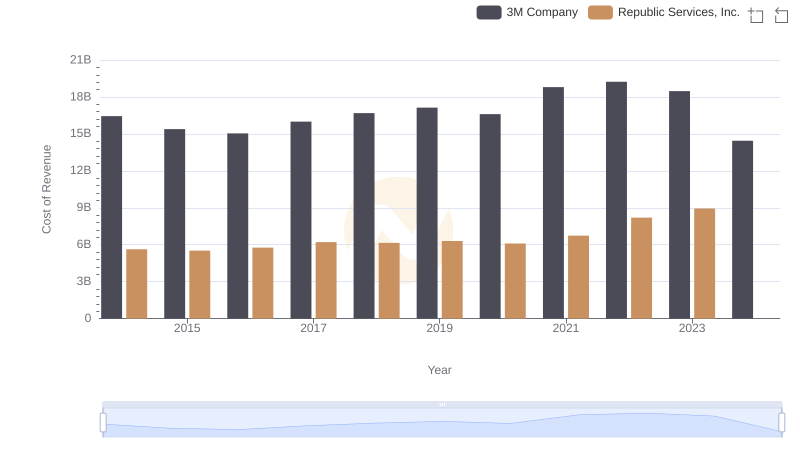

Analyzing Cost of Revenue: 3M Company and Republic Services, Inc.

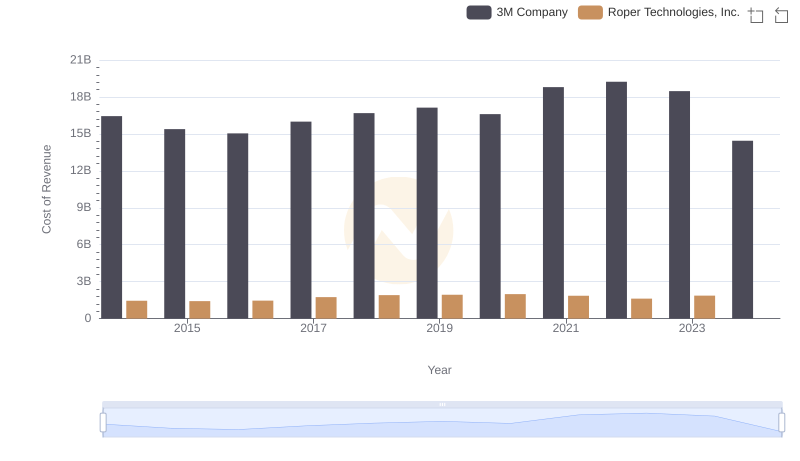

Cost of Revenue: Key Insights for 3M Company and Roper Technologies, Inc.