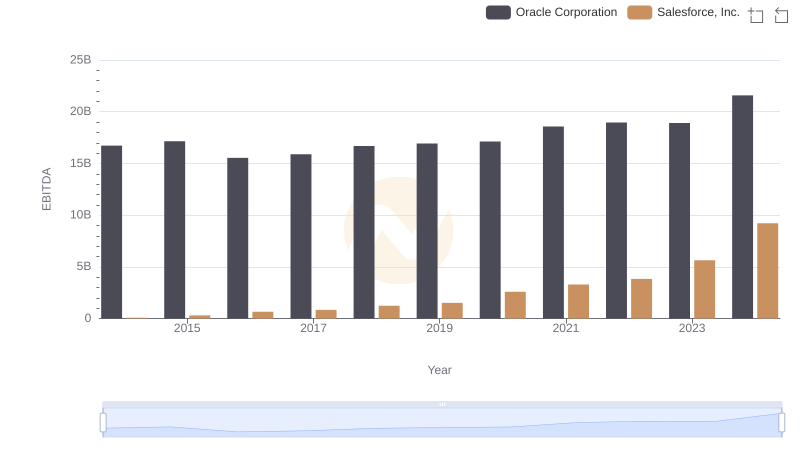

| __timestamp | Oracle Corporation | Salesforce, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 8605000000 | 2764851000 |

| Thursday, January 1, 2015 | 8732000000 | 3437032000 |

| Friday, January 1, 2016 | 9039000000 | 3951445000 |

| Sunday, January 1, 2017 | 9299000000 | 4777000000 |

| Monday, January 1, 2018 | 9715000000 | 5760000000 |

| Tuesday, January 1, 2019 | 9774000000 | 7410000000 |

| Wednesday, January 1, 2020 | 9275000000 | 9634000000 |

| Friday, January 1, 2021 | 8936000000 | 11761000000 |

| Saturday, January 1, 2022 | 9364000000 | 14453000000 |

| Sunday, January 1, 2023 | 10412000000 | 16079000000 |

| Monday, January 1, 2024 | 9822000000 | 15411000000 |

Igniting the spark of knowledge

In the ever-evolving tech industry, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, Oracle Corporation and Salesforce, Inc. have demonstrated contrasting strategies in optimizing these costs.

From 2014 to 2024, Oracle's SG&A expenses have shown a relatively stable trend, with a modest increase of about 14% over the period. In contrast, Salesforce's SG&A expenses have surged by approximately 457%, reflecting its aggressive growth strategy. Notably, in 2023, Salesforce's SG&A expenses were about 54% higher than Oracle's, highlighting its expansive market approach.

While Oracle maintains a steady course, Salesforce's rapid increase in SG&A expenses suggests a focus on scaling and market penetration. This divergence in strategies offers a fascinating insight into how these tech giants prioritize cost management in their quest for market dominance.

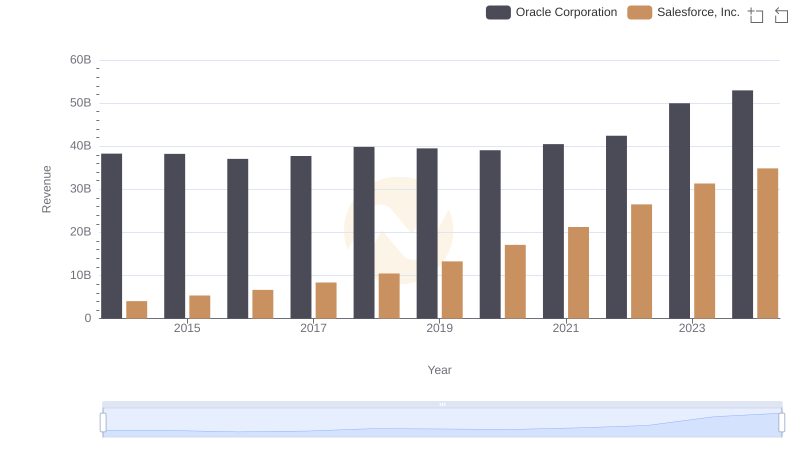

Annual Revenue Comparison: Oracle Corporation vs Salesforce, Inc.

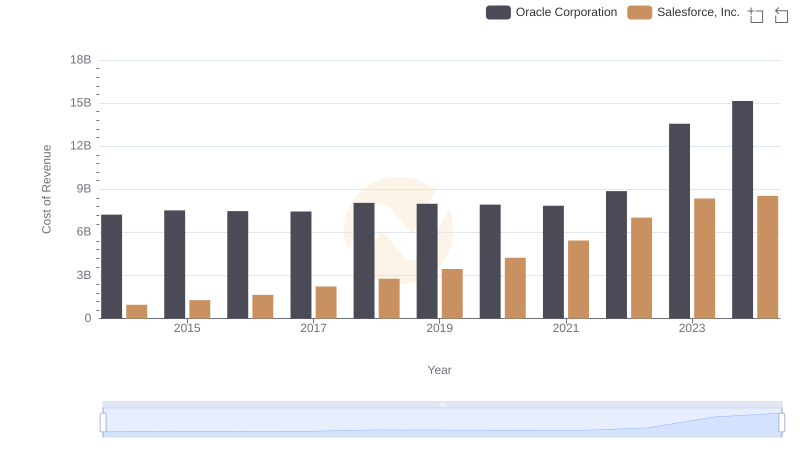

Analyzing Cost of Revenue: Oracle Corporation and Salesforce, Inc.

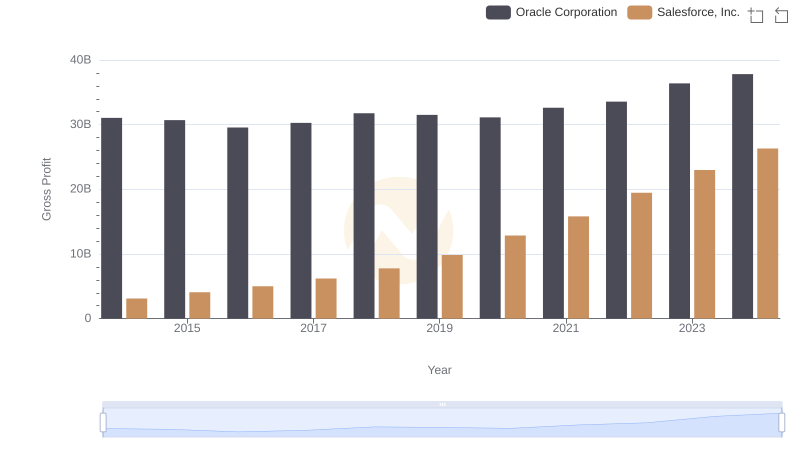

Who Generates Higher Gross Profit? Oracle Corporation or Salesforce, Inc.

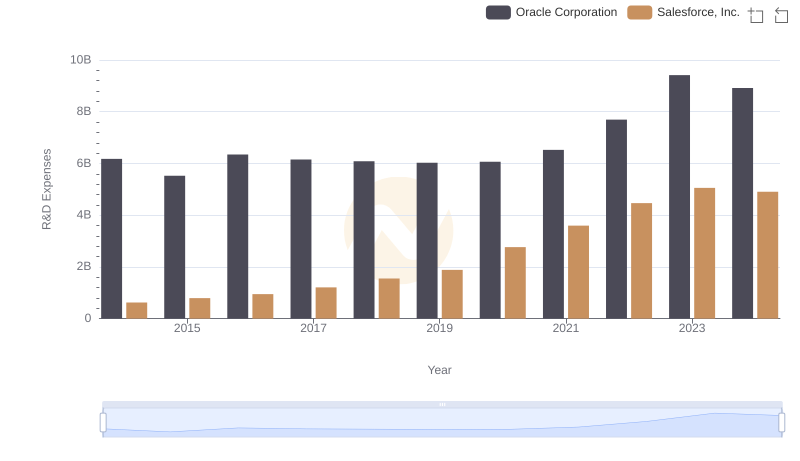

R&D Spending Showdown: Oracle Corporation vs Salesforce, Inc.

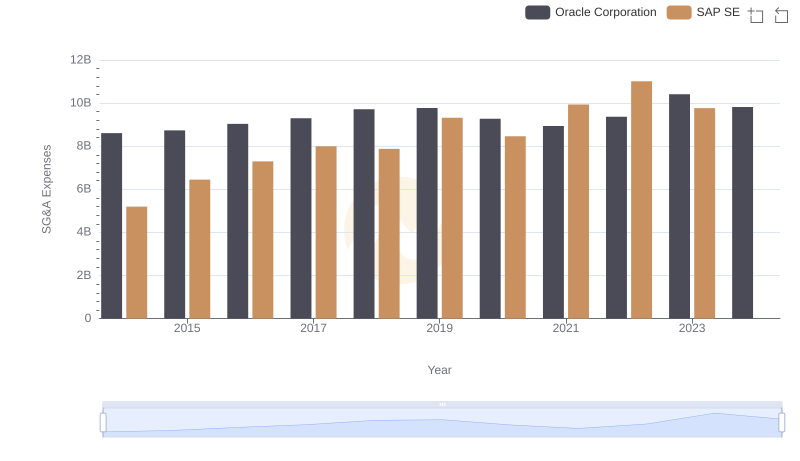

Oracle Corporation vs SAP SE: SG&A Expense Trends

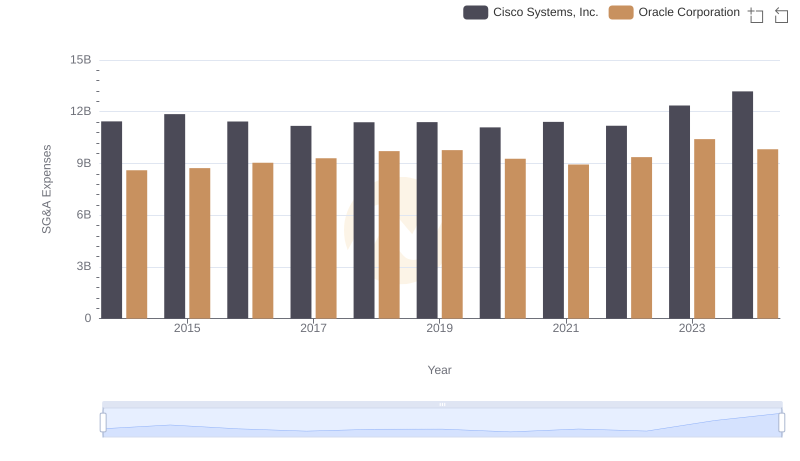

Cost Management Insights: SG&A Expenses for Oracle Corporation and Cisco Systems, Inc.

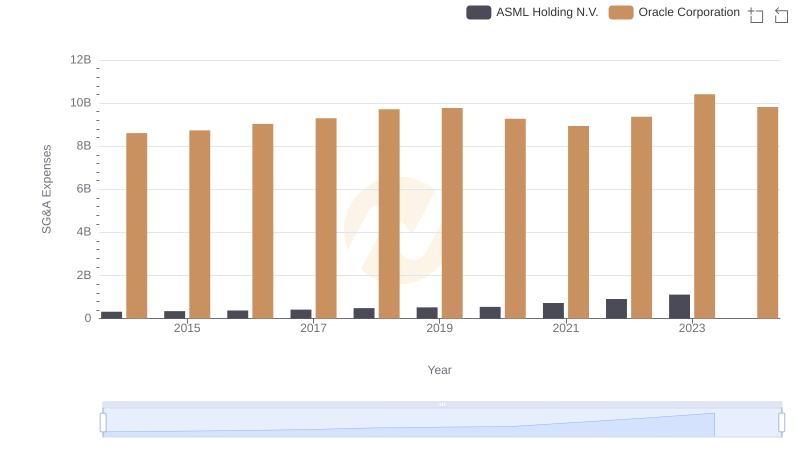

SG&A Efficiency Analysis: Comparing Oracle Corporation and ASML Holding N.V.

Comprehensive EBITDA Comparison: Oracle Corporation vs Salesforce, Inc.

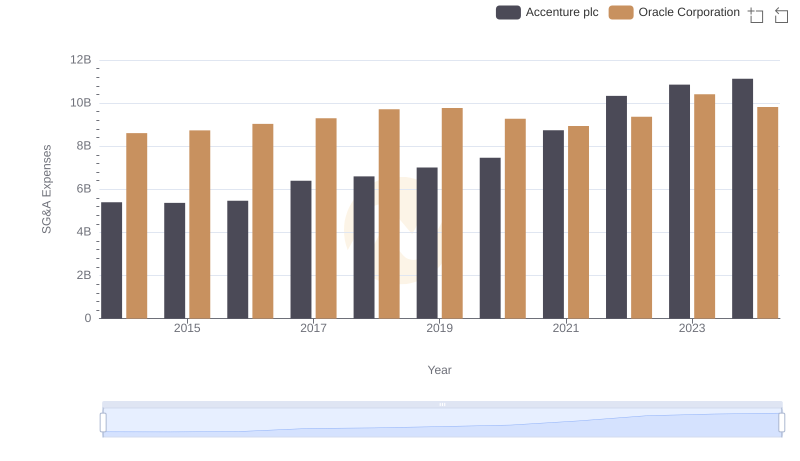

Selling, General, and Administrative Costs: Oracle Corporation vs Accenture plc

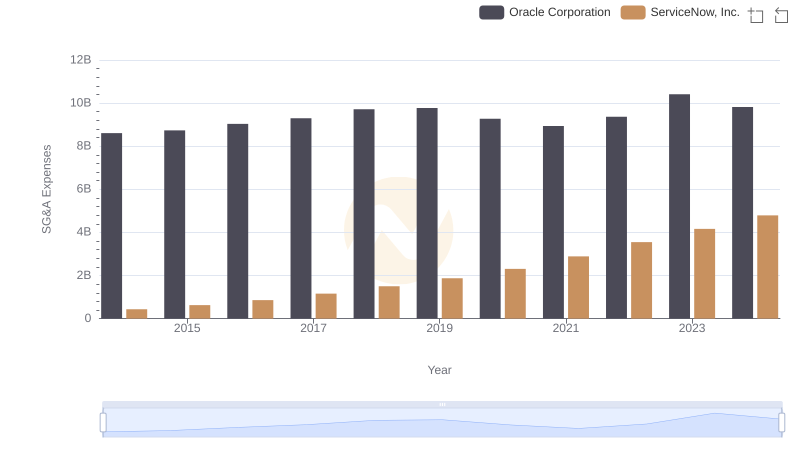

Operational Costs Compared: SG&A Analysis of Oracle Corporation and ServiceNow, Inc.

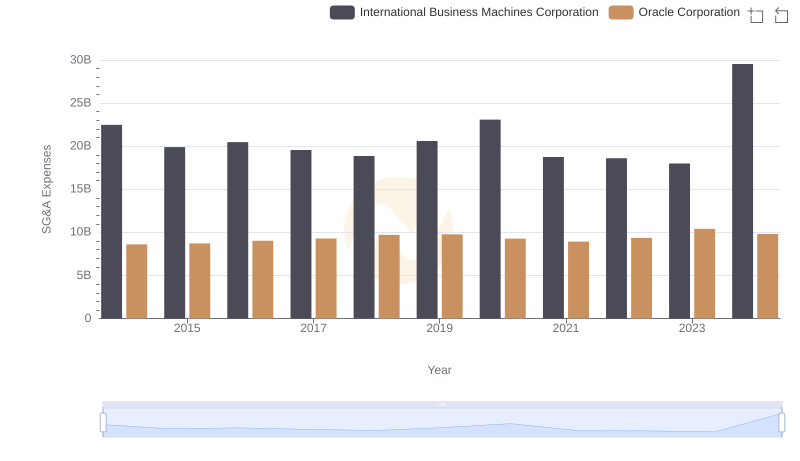

Oracle Corporation or International Business Machines Corporation: Who Manages SG&A Costs Better?

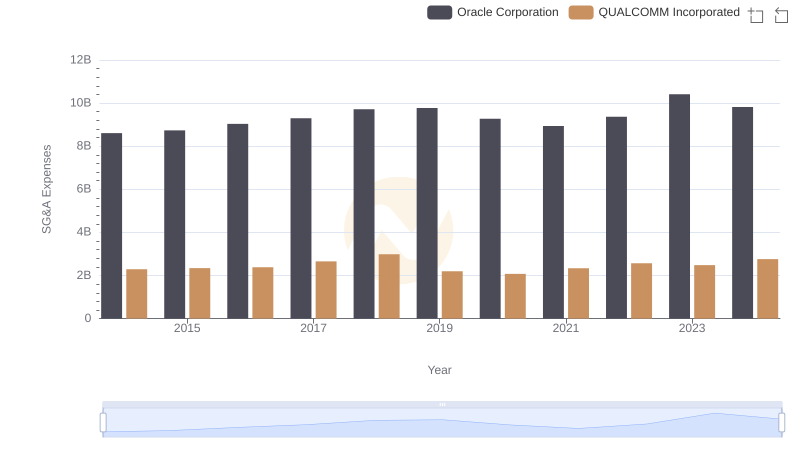

Comparing SG&A Expenses: Oracle Corporation vs QUALCOMM Incorporated Trends and Insights