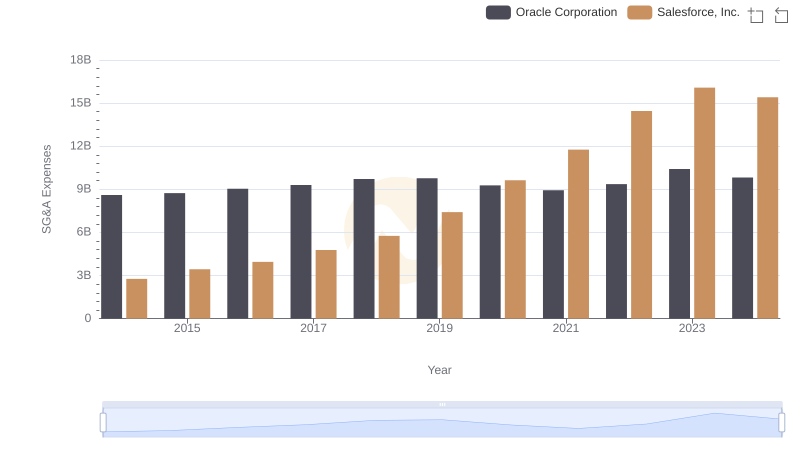

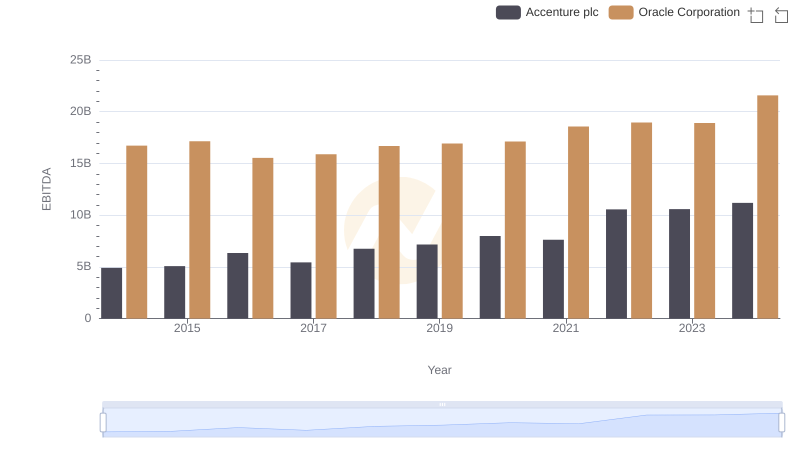

| __timestamp | Accenture plc | Oracle Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 5401969000 | 8605000000 |

| Thursday, January 1, 2015 | 5373370000 | 8732000000 |

| Friday, January 1, 2016 | 5466982000 | 9039000000 |

| Sunday, January 1, 2017 | 6397883000 | 9299000000 |

| Monday, January 1, 2018 | 6601872000 | 9715000000 |

| Tuesday, January 1, 2019 | 7009614000 | 9774000000 |

| Wednesday, January 1, 2020 | 7462514000 | 9275000000 |

| Friday, January 1, 2021 | 8742599000 | 8936000000 |

| Saturday, January 1, 2022 | 10334358000 | 9364000000 |

| Sunday, January 1, 2023 | 10858572000 | 10412000000 |

| Monday, January 1, 2024 | 11128030000 | 9822000000 |

Infusing magic into the data realm

In the ever-evolving landscape of technology and consulting, understanding the financial strategies of industry giants like Oracle Corporation and Accenture plc is crucial. Over the past decade, from 2014 to 2024, these two companies have shown distinct trends in their Selling, General, and Administrative (SG&A) expenses, a key indicator of operational efficiency and strategic investment.

Oracle's SG&A expenses have remained relatively stable, with a slight increase of approximately 14% from 2014 to 2023. This consistency reflects Oracle's focus on maintaining operational efficiency while navigating the competitive tech industry.

In contrast, Accenture has seen a significant rise in SG&A expenses, growing by nearly 106% over the same period. This increase underscores Accenture's aggressive expansion and investment in global consulting services, positioning itself as a leader in the consulting sector.

These trends highlight the differing strategies of these two giants, offering insights into their future directions.

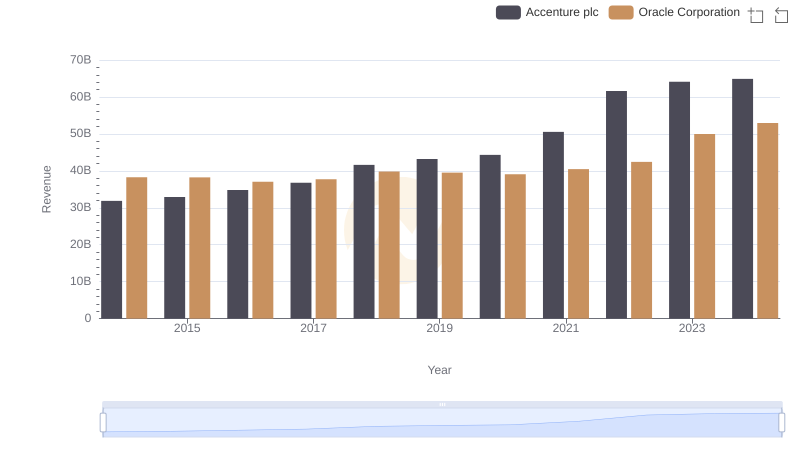

Annual Revenue Comparison: Oracle Corporation vs Accenture plc

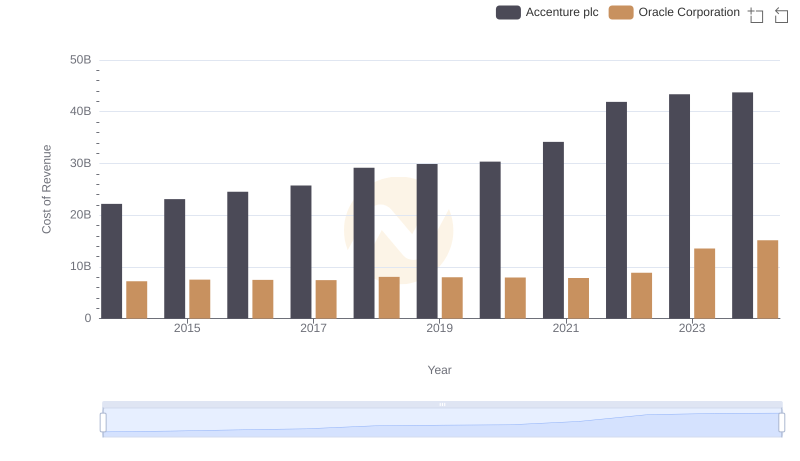

Cost Insights: Breaking Down Oracle Corporation and Accenture plc's Expenses

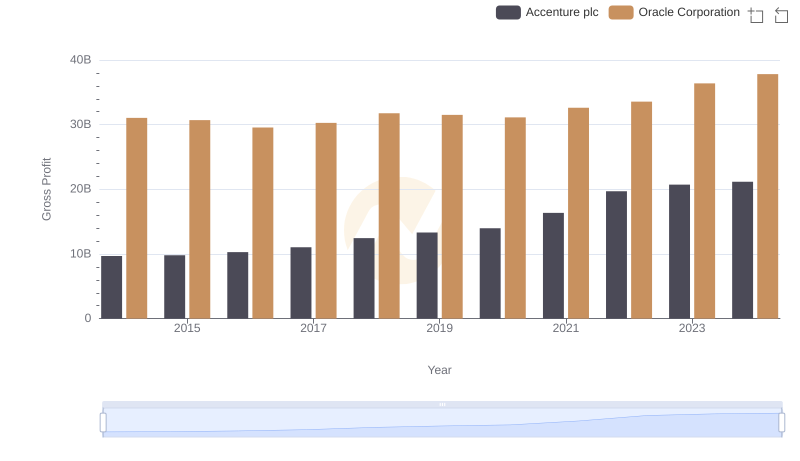

Oracle Corporation vs Accenture plc: A Gross Profit Performance Breakdown

Who Optimizes SG&A Costs Better? Oracle Corporation or Salesforce, Inc.

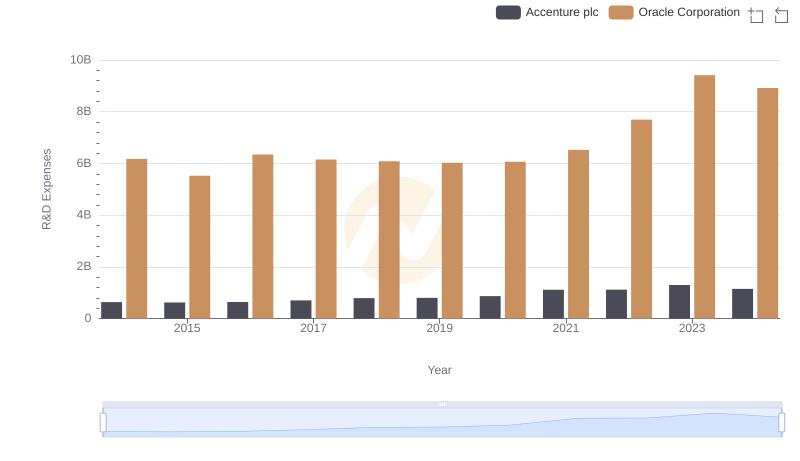

R&D Spending Showdown: Oracle Corporation vs Accenture plc

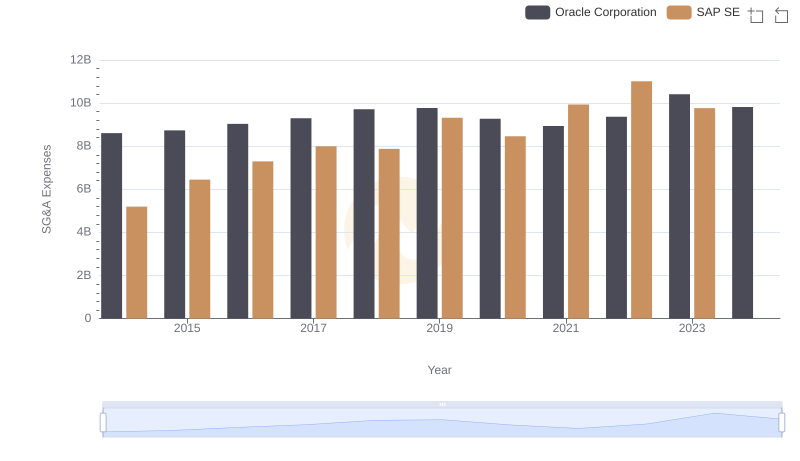

Oracle Corporation vs SAP SE: SG&A Expense Trends

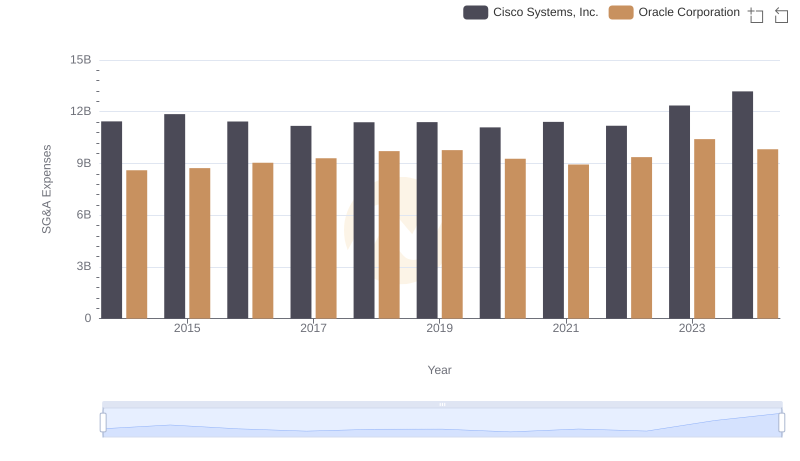

Cost Management Insights: SG&A Expenses for Oracle Corporation and Cisco Systems, Inc.

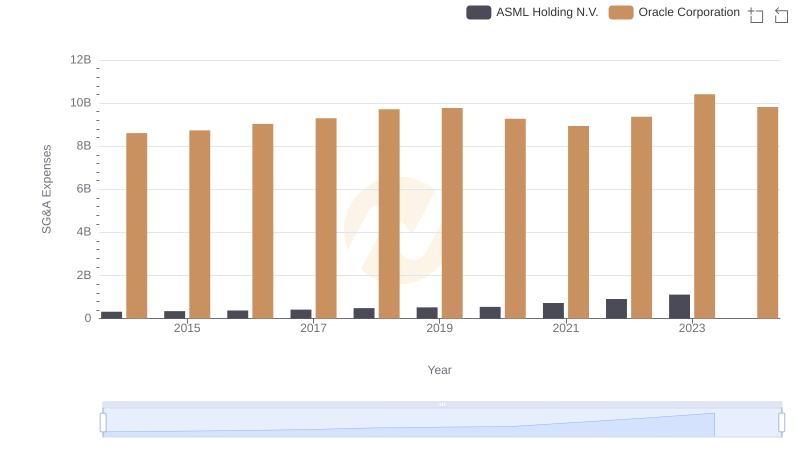

SG&A Efficiency Analysis: Comparing Oracle Corporation and ASML Holding N.V.

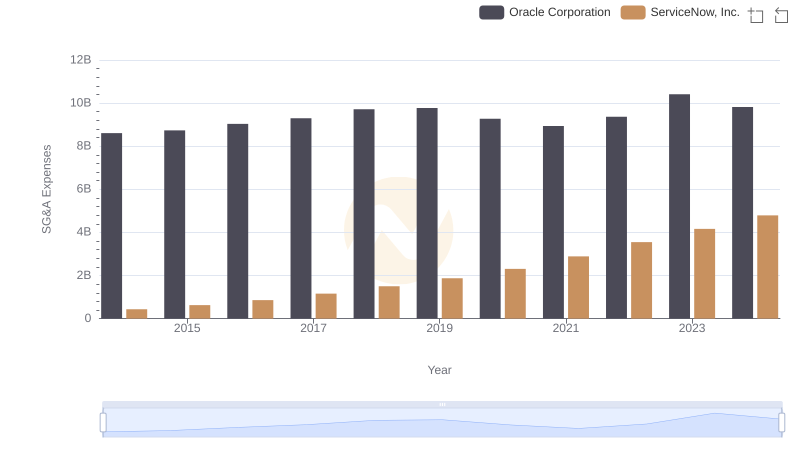

Operational Costs Compared: SG&A Analysis of Oracle Corporation and ServiceNow, Inc.

Comparative EBITDA Analysis: Oracle Corporation vs Accenture plc

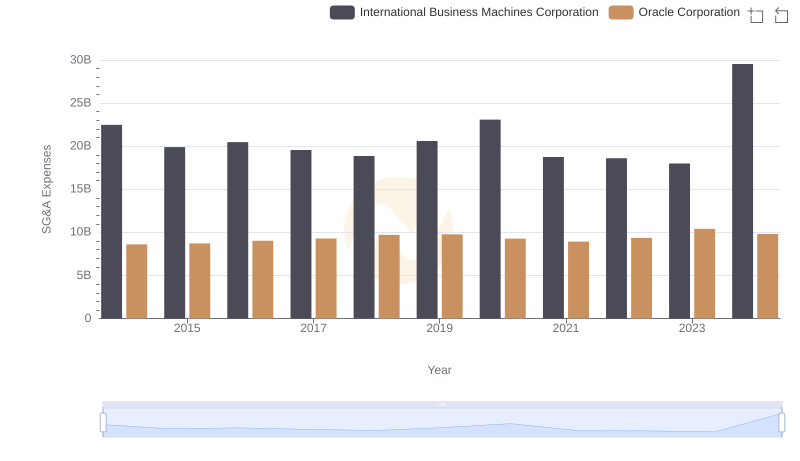

Oracle Corporation or International Business Machines Corporation: Who Manages SG&A Costs Better?

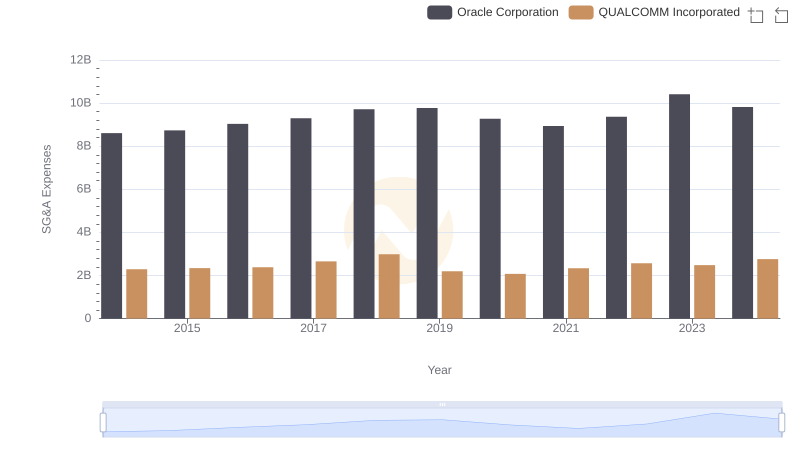

Comparing SG&A Expenses: Oracle Corporation vs QUALCOMM Incorporated Trends and Insights