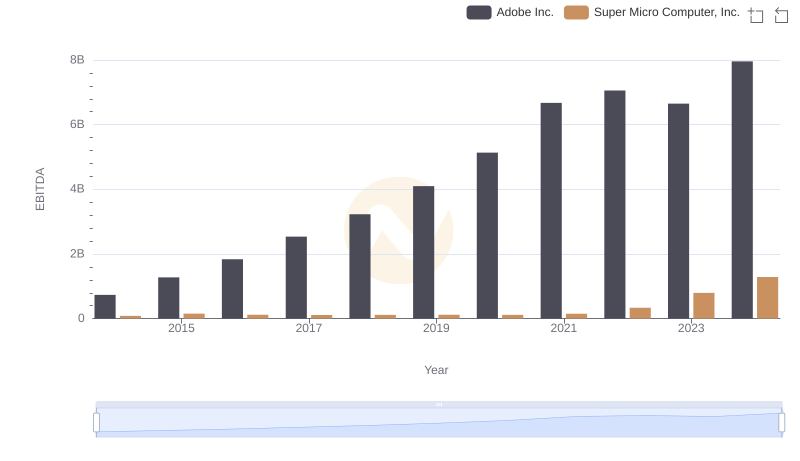

| __timestamp | Adobe Inc. | Super Micro Computer, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2215140000 | 61029000 |

| Thursday, January 1, 2015 | 2215161000 | 73228000 |

| Friday, January 1, 2016 | 2487907000 | 100681000 |

| Sunday, January 1, 2017 | 2822298000 | 115331000 |

| Monday, January 1, 2018 | 3365727000 | 170176000 |

| Tuesday, January 1, 2019 | 4124984000 | 218382000 |

| Wednesday, January 1, 2020 | 4559000000 | 219078000 |

| Friday, January 1, 2021 | 5406000000 | 186222000 |

| Saturday, January 1, 2022 | 6187000000 | 192561000 |

| Sunday, January 1, 2023 | 6764000000 | 214610000 |

| Monday, January 1, 2024 | 7293000000 | 383111000 |

Igniting the spark of knowledge

In the competitive world of technology, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Adobe Inc. and Super Micro Computer, Inc. offer a fascinating study in contrasts. Over the past decade, Adobe's SG&A expenses have surged by approximately 230%, reflecting its expansive growth strategy. In 2014, Adobe's SG&A costs were around 2.2 billion, climbing to an estimated 7.3 billion by 2024. Meanwhile, Super Micro Computer, Inc. has maintained a more conservative approach, with SG&A expenses increasing by about 530% from 61 million in 2014 to 383 million in 2024. This stark difference highlights Adobe's aggressive market expansion compared to Super Micro's more measured growth. As businesses navigate the post-pandemic economy, these strategies offer valuable insights into balancing growth with cost efficiency.

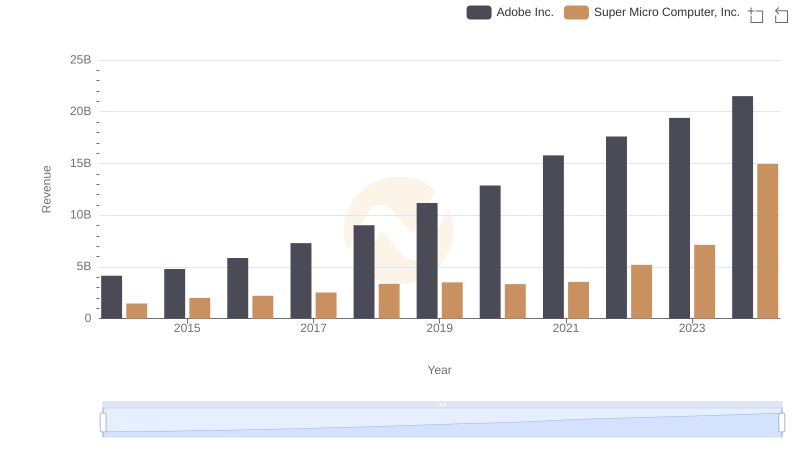

Comparing Revenue Performance: Adobe Inc. or Super Micro Computer, Inc.?

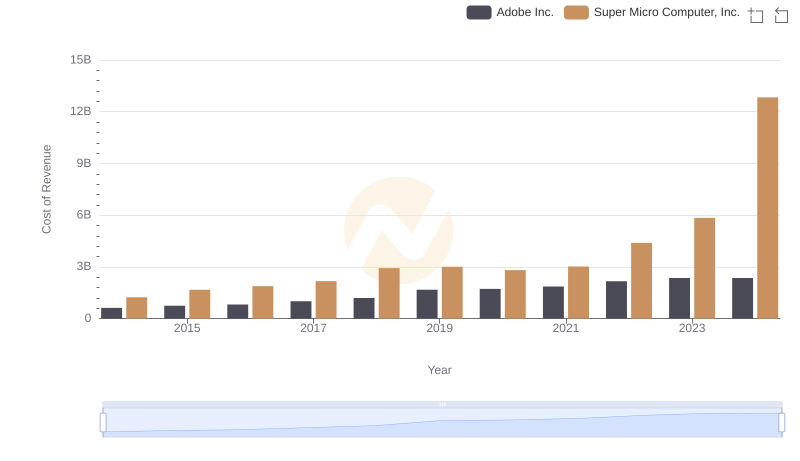

Cost Insights: Breaking Down Adobe Inc. and Super Micro Computer, Inc.'s Expenses

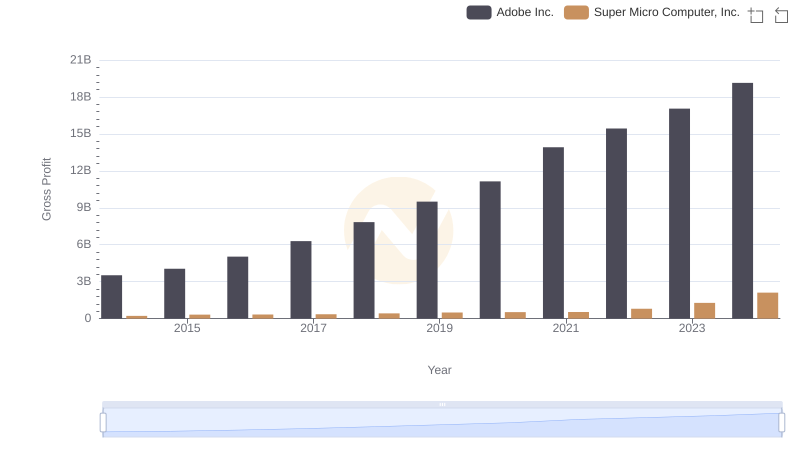

Adobe Inc. and Super Micro Computer, Inc.: A Detailed Gross Profit Analysis

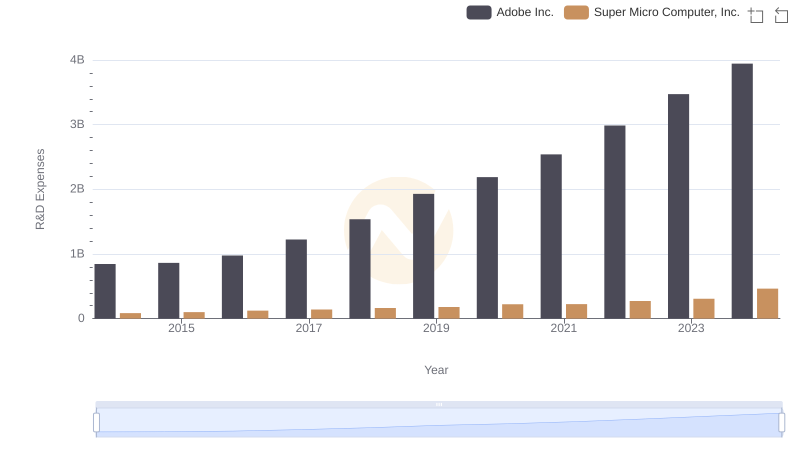

Research and Development Expenses Breakdown: Adobe Inc. vs Super Micro Computer, Inc.

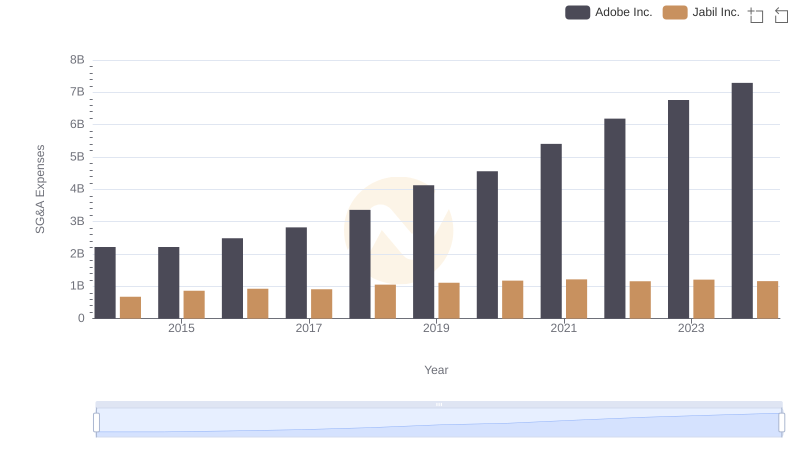

Breaking Down SG&A Expenses: Adobe Inc. vs Jabil Inc.

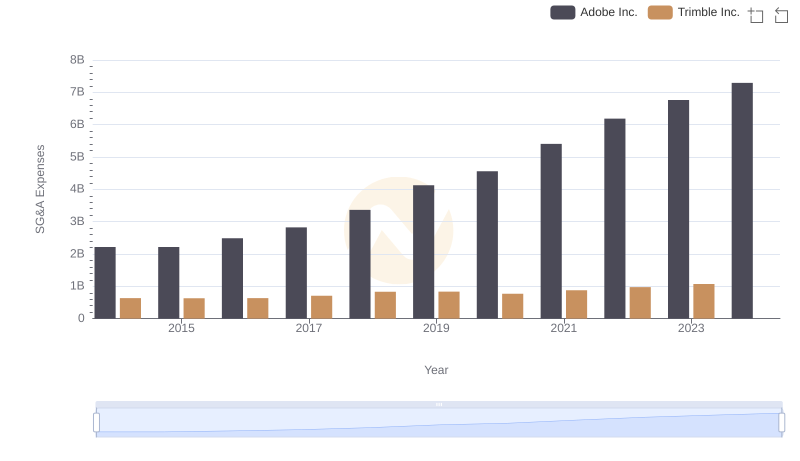

SG&A Efficiency Analysis: Comparing Adobe Inc. and Trimble Inc.

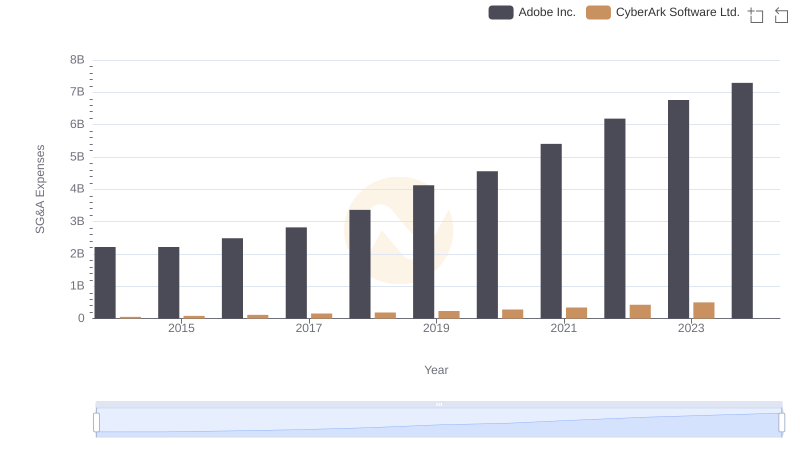

Adobe Inc. or CyberArk Software Ltd.: Who Manages SG&A Costs Better?

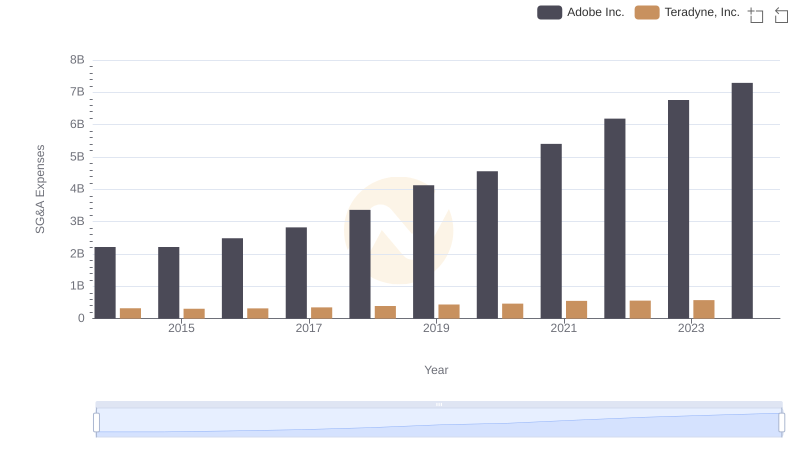

Breaking Down SG&A Expenses: Adobe Inc. vs Teradyne, Inc.

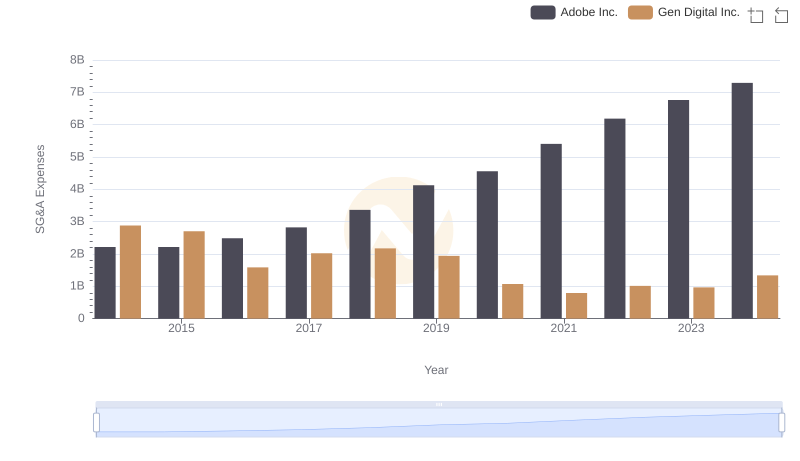

Cost Management Insights: SG&A Expenses for Adobe Inc. and Gen Digital Inc.

EBITDA Performance Review: Adobe Inc. vs Super Micro Computer, Inc.

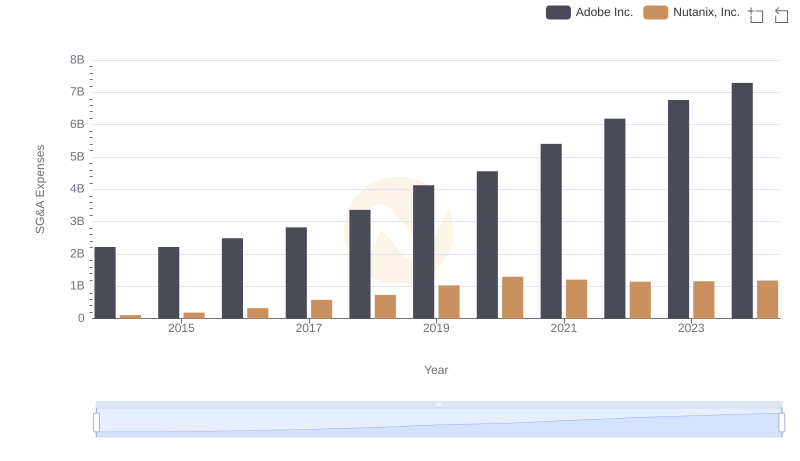

Cost Management Insights: SG&A Expenses for Adobe Inc. and Nutanix, Inc.

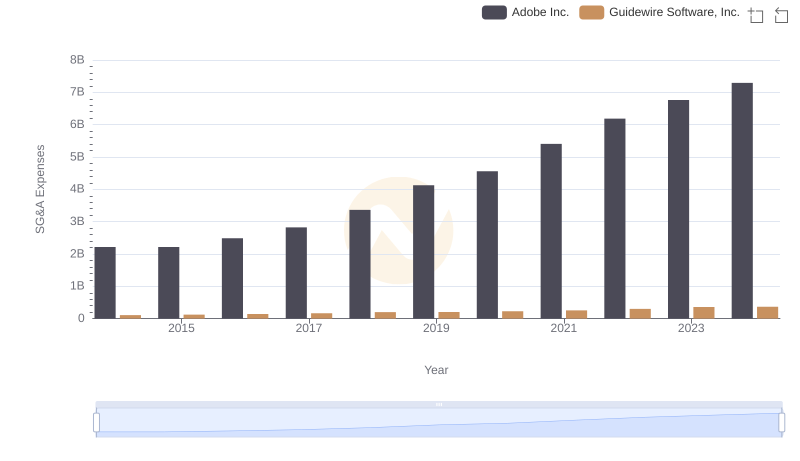

Adobe Inc. and Guidewire Software, Inc.: SG&A Spending Patterns Compared