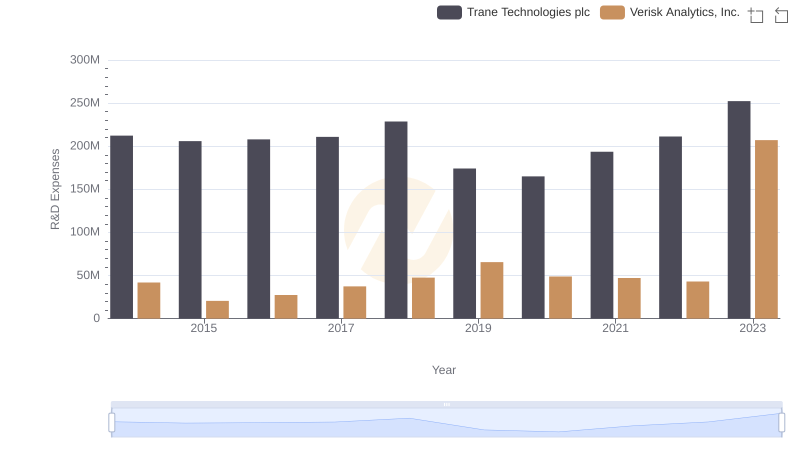

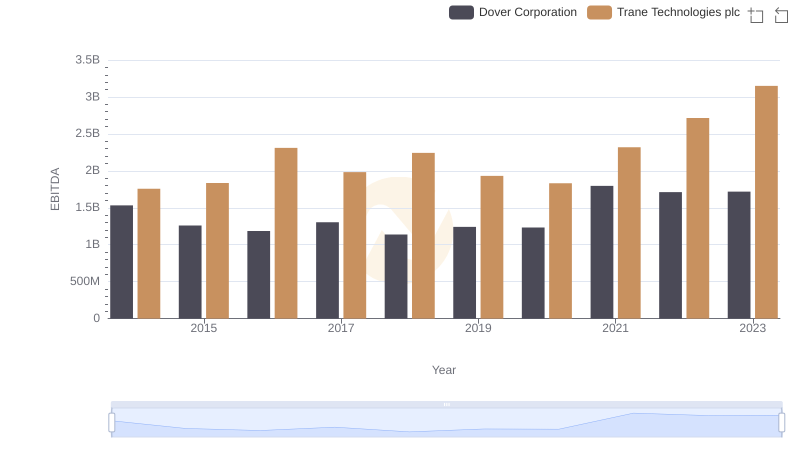

| __timestamp | Dover Corporation | Trane Technologies plc |

|---|---|---|

| Wednesday, January 1, 2014 | 118411000 | 212300000 |

| Thursday, January 1, 2015 | 115037000 | 205900000 |

| Friday, January 1, 2016 | 104479000 | 207900000 |

| Sunday, January 1, 2017 | 130536000 | 210800000 |

| Monday, January 1, 2018 | 143033000 | 228700000 |

| Tuesday, January 1, 2019 | 140957000 | 174200000 |

| Wednesday, January 1, 2020 | 142101000 | 165000000 |

| Friday, January 1, 2021 | 157826000 | 193500000 |

| Saturday, January 1, 2022 | 163300000 | 211200000 |

| Sunday, January 1, 2023 | 153111000 | 252300000 |

| Monday, January 1, 2024 | 0 | 0 |

Unleashing insights

In the competitive landscape of industrial innovation, Trane Technologies plc and Dover Corporation have consistently demonstrated their commitment to research and development (R&D). Over the past decade, Trane Technologies has outpaced Dover Corporation in R&D spending, with an average annual investment of approximately 50% more than its counterpart. This strategic focus is evident in 2023, where Trane Technologies allocated 2.52 times more resources to R&D compared to 2014, marking a significant growth trajectory.

Dover Corporation, while trailing, has shown a steady increase in its R&D investments, peaking in 2022 with a 38% rise from 2014. This upward trend underscores the importance both companies place on innovation to maintain their competitive edge. As the industrial sector evolves, these investments are crucial for driving technological advancements and sustaining market leadership.

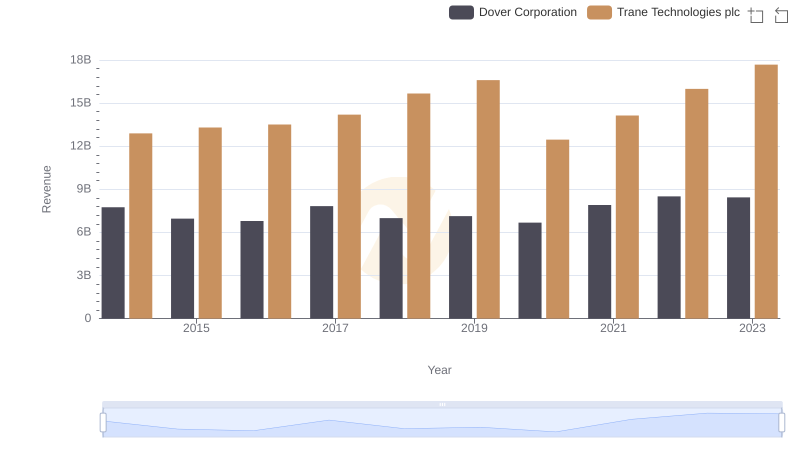

Annual Revenue Comparison: Trane Technologies plc vs Dover Corporation

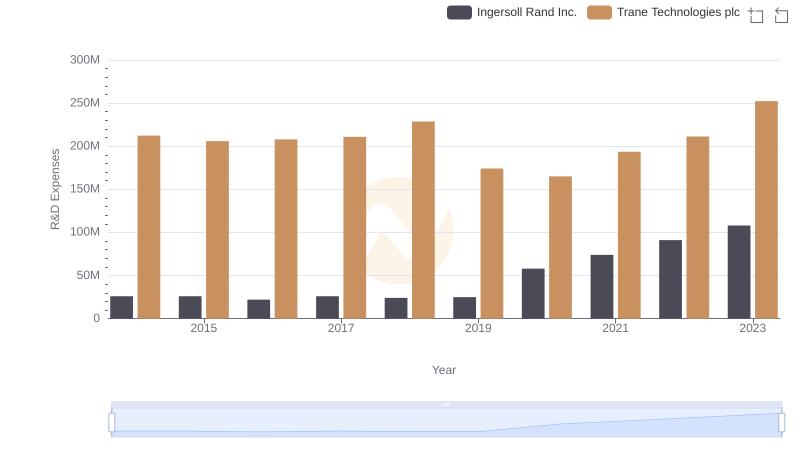

Analyzing R&D Budgets: Trane Technologies plc vs Ingersoll Rand Inc.

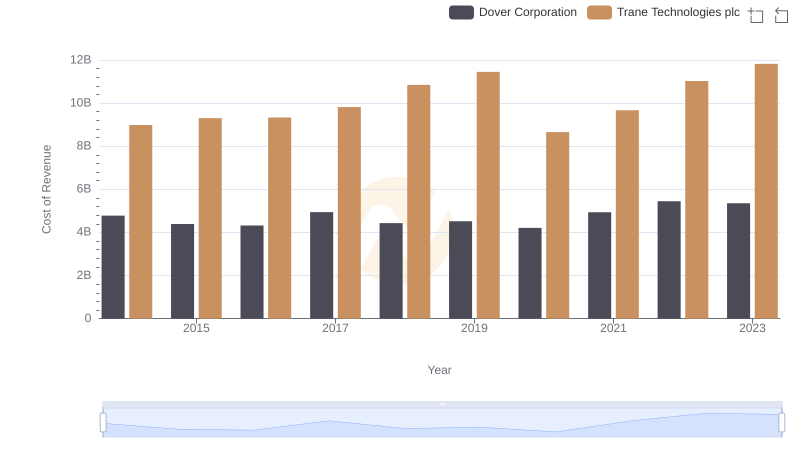

Cost of Revenue: Key Insights for Trane Technologies plc and Dover Corporation

Trane Technologies plc vs Verisk Analytics, Inc.: Strategic Focus on R&D Spending

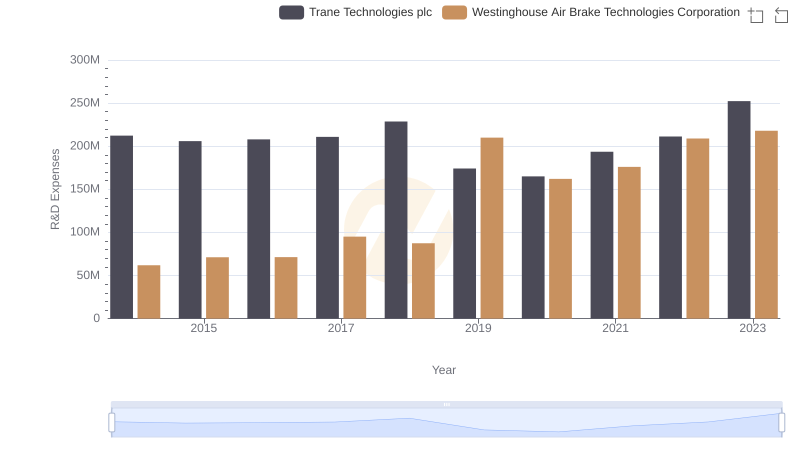

Who Prioritizes Innovation? R&D Spending Compared for Trane Technologies plc and Westinghouse Air Brake Technologies Corporation

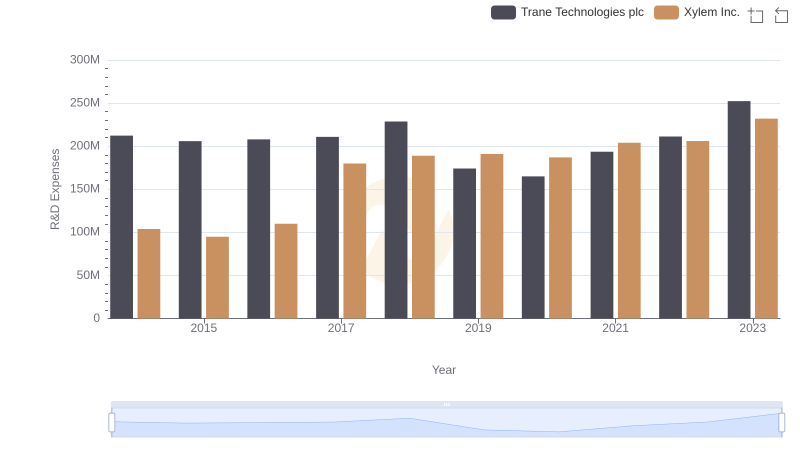

Research and Development Expenses Breakdown: Trane Technologies plc vs Xylem Inc.

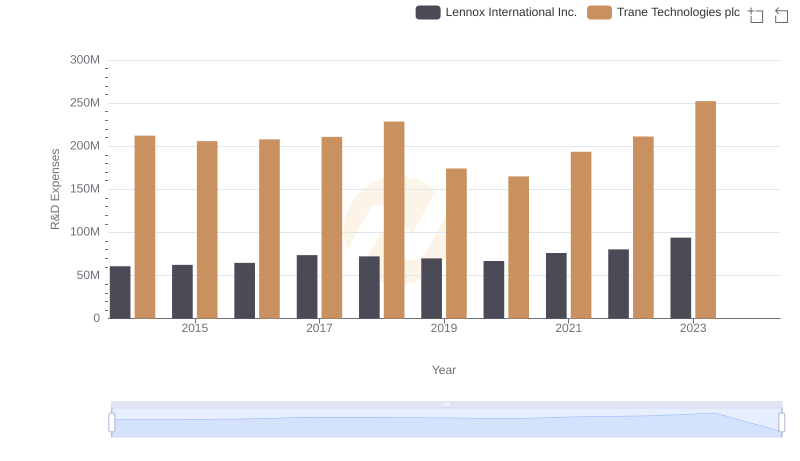

R&D Spending Showdown: Trane Technologies plc vs Lennox International Inc.

A Side-by-Side Analysis of EBITDA: Trane Technologies plc and Dover Corporation

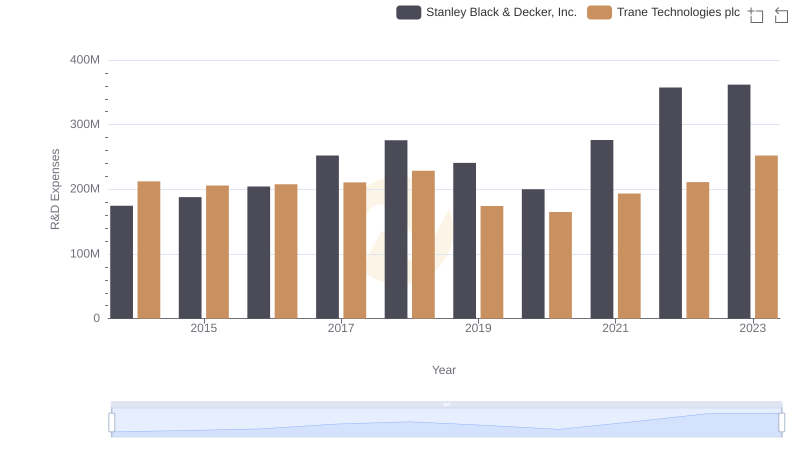

Who Prioritizes Innovation? R&D Spending Compared for Trane Technologies plc and Stanley Black & Decker, Inc.